Description

Microsoft Corporation (MSFT) develops, manufactures, licenses, sells, and supports software products. The Company offers operating system software, server application software, business and consumer applications software, software development tools, and Internet and intranet software. Microsoft also develops video game consoles and digital music entertainment devices.1

Investment Rationale

There is further upside for MSFT due to 1) ongoing mega-trend of enterprises shifting to cloud; 2) Azure as the leading cloud service provider; 3) Customers upgrading to newer products. We believe MSFT will have faster organic growth due to its focus on digital transformation and innovation for its cloud platform.

Benefit from the ongoing enterprise shift to the cloud. MSFT reported 68% YoY growth for Azure in 2CQ19. Commercial Cloud revenue grew 39% YoY while gross margins increased ~600bps YoY due to Azure. We expect the momentum for cloud solutions to continue for the next two calendar quarters as MSFT continues to expand its cloud offerings and obtain large commercial deals (such as the AT&T deal). The ongoing mega-trend of enterprises migrating their data to hybrid cloud would accelerate MSFT’s organic growth for cloud.

Office products to accelerate due to migration to premium offerings. Office Commercial grew 16% YoY constant currency (CC) in 2CQ19, up from 14% last quarter. Office 365 decelerated slightly to 23% YoY as compared to 27% last quarter. MSFT commented that there is continued ARPU expansion from customer migration to premium Office E3 and E5 products.

Tailwind from 3 product cycles. We expect MSFT to benefit from customers switching to new versions of products as the current product cycles end, namely Windows (to Windows 10), Office (to Office 365) and Server (from Server 2008 to newer versions). There would be a short-term revenue boost for the next few quarters as customers expand their usage due to greater functionality form the newer versions.

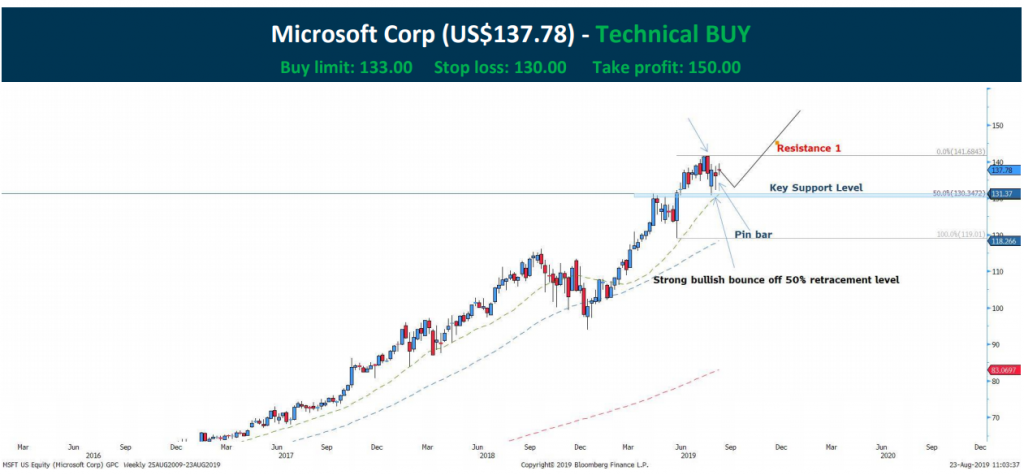

RECOMMENDATION

We have a TECHNICAL BUY rating for MSFT. MSFT is currently trading at a P/E ratio of 29.0, which is above its one standard deviation. However, we think MSFT’s PE multiple is justified given its strong position as the leading vendor in the cloud category and robust organic growth.

[1] Source: Bloomberg

Support 1: 131.37 Resistance 1:141.68

MSFT’s strong bullish momentum shows no signs of slowing down despite the recent trade war spats. Based on the weekly technical charts, there is further upside potential.

CHART LEGENDS

——– 200 periods MA

——– 50 periods MA

——– 22 periods MA