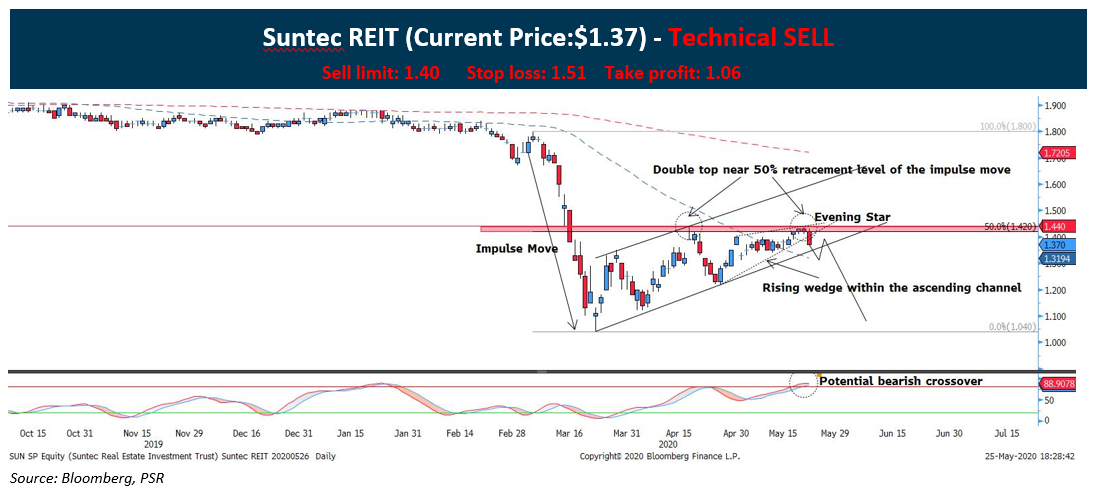

Suntec REIT (SGX: T82U) impulse down move on mid-March 2020 was expected given the weak consolidation between January to February 2020. Although the stock did make a decent rebound, edging above 1.40 from 1.04, the rebound is more of a corrective move rather than recovery and based on the technical, Suntec Reit will resume its downtrend:

- Although the REIT made a higher high and higher low, the ascending channel indicates that the REIT’s upside momentum is limited due to the size and the gradient slope is less than 45 degrees. Hence, the REIT’s upside is more of a corrective flag rather than a bullish channel.

- The rising wedge within the ascending channel gave another signal that a bearish reversal is coming.

- Double top formation rejecting 50% Fibonacci level of the whole impulse wave indicates that the bull lacks the strength to push the price to a new high.

- On the second top, the Evening star formation signals that the REIT is entering into a bear reversal.

- Although prices have broken above the 50 moving average lines, the momentum is slowing as suggested by the cluster of small body of candles and it does not give a strong sign of an impending up move. Also, price is still trending below the major 200 Moving Average line.

- Stochastic oscillator shows a potential oversold cross.

*Timeline of the trade should be between 1-3 weeks from the date issued.