New outlets and new products lifted demand; Three new outlets by FY18

Sales from retail outlets increased 5.9% YoY in FY17, mainly driven by (i) Six new stores; and (ii) New flavours of puffs (sales for puffs increased 6.7% YoY). Puffs remain the major contributor to revenue, accounting for 31.8% to its total revenue in FY17.

Total number of outlets in Singapore increased to 89 as at end-FY17 from 83 a year ago. The Group has three new outlets in the pipeline. This will bring the total number of outlets to 91 by end-FY18, including the closure of Golden Shoes outlet in end-July 2017. Expansion in distribution channel and product range will continue to boost FY18e top line.

Gross margin continues to improve; Further margin expansion post-integration

FY17 gross margin improved further by 2 bps yoy to 63.3%, benefiting from the enlarged new factory facilities and and machineries in 4 Woodlands Terrace and Iskandar Malaysia. The reconstruction work in 2 Woodlands Terrace is on track to complete by 1QFY18. Management expects full integration with the adjacent factory and operations by 3QFY18.

The integrated factory facilities, which are equipped with advanced machinery and c.60% additional production area, would improve OCK’s productivity and operating efficiency. We expect better earnings in 4QFY18, on the back enhanced manufacturing efficiencies, and introduction of new product offerings with better margins.

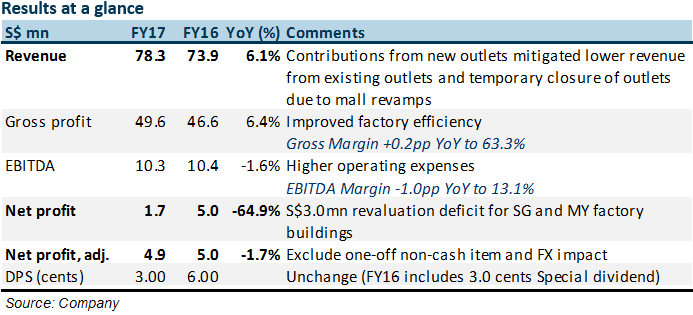

FY17 earnings was hit by S$3mn one-off non-cash item

OCK recorded a revaluation deficit of c.S$3mn for the Group’s Singapore and Malaysia factory buildings. The revaluation exercise was conducted by an independent valuer. Nonetheless, the two factories assessed (in 4 Woodlands Terrace and Iskandar Malaysia) have just been renovated with brand new cold rooms, lifts and M&E works. Management shared that these were excluded from the assessment, leading to the revaluation deficit. Excluding the revaluation deficit and FX impacts, net profit was maginally down by 1.7%.

Revenue from Malaysia grew by 7.5 times on product innovations and growing B2B sales

OCK’s Malaysia business has turned profitable for the first time since its inception six years ago, thanks to the new factory in Iskandar Malaysia. As mentioned in our intiation report, OCK intends to expand its B2B business in Malaysia. Management shared that it has engaged some hotel chains in Malaysia for puff sales.

While recording an encouraging 32.2% operating profit margin in Malaysia, it registered a S$511,000 pre-tax loss, dragged by two non-cash items, i.e. S$333,000 revaluation deficit and S$266,000 depreciation expenses. Nonetheless, we are optimitic that the new products innovation (supported by the Iskandar factory facility) and the growing B2B sales will continue to boost the topline of its Malaysia operations.

First foray outside Asia Pacific region – an outlet in central London by this year

The outlet is part of the expansion plan from its 60:40 Joint Venture with 13 Wonders. It will be funded from OCK’s initial paid-up share capital of GBP500,000 (S$873,000).

Despite the competitive food and beverage business in London, management noted that there are no direct competitor in the United Kingdom for such fried snack food. While there are other delicacies which offer curry dishes (e.g. in Indian, Thai and Japanese eateries), OCK wil positioned itself as a curry puff specialist, with Hainanese touch. Its key target market will be the affluent hip and young working adults in London. It has tested water with a pop-up event in London, which was well recieved with primary customers being overseas based Singaporeans.

Despite operating in a niche market, we expect the gross margin from its London business should be somewhat similar to its Singapore’s, i.e. at c.63%. The London outlet will operate as per its foreign outlets in Australia and Malaysia. The curry pastes and key dough ingredients will be controlled from Singapore to ensure consistency in quality and tastes. OCK envisage to replicate the model across London should the pilot project succeed.

Maintained Buy rating and DCF-derived TP of S$0.98

The completion of its reconstruction work in 2 Woodlands Terrace and integration with the adjacent new factory would be the inflection point for OCK.

We remain upbeat that its new factory facilities in Singapore and Malaysia would bode well with its expansion strategy to grow domestically and regionally.

Lin Sin has been an investment analyst in Phillip Securities Research since June 2014, where she started as an economist, focusing on China and ASEAN macroeconomics. Currently, she covers primarily the Consumers and Healthcare sectors in Singapore equities market.

She graduated with a Bachelor of Science in Mathematics and Economics from NTU.