2Q21 likely to be washed out by political instability and Covid-19

Since the coup on 1 February, peaceful protests have swiftly escalated into violent protests. The military has opened fire on demonstrators and conducted overnight raids to arrest residents. As of date, more than 50 people have been killed, which is more deadly than the Saffron Revolution in 2007. The 2007 protests were triggered by a decision of the military government to remove price subsidies for fuel. The number of casualties in that crisis was estimated at 13-31.

The situation is also not yet as bad as 1988 when over 3,000 people were killed across Burma, as Myanmar was then known. Before the crisis, Burma had been ruled by the repressive and isolated regime of General Ne Win since 1962. The 8888 uprising was triggered by the announcement of withdrawal of newly-replaced currency notes, which wiped out citizens’ savings instantly.

Over the past month, state telecommunication services have been disabled intermittently. All major construction work has ceased. On 8 March 2021, Myanmar’s biggest trade unions began widespread strikes in their latest attempt to force the country’s generals to step down. At least 18 labour organisations representing industries such as construction, agriculture and manufacturing called on workers to stop work to restore Aung San Suu Kyi’s elected government to power. The impact has been felt at every level of the national infrastructure, with hospitals, ministry offices and banks all unable to operate. Major shopping centres have also been closed and factories are not operating.

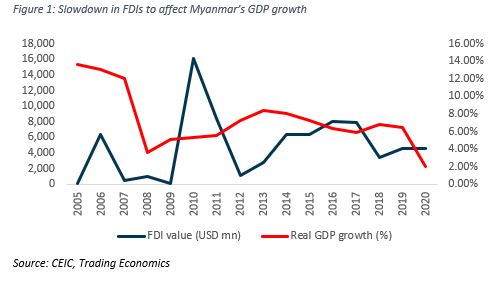

Apart from US sanctions against the top military brass, Britain has frozen the assets of a few military generals and imposed travel bans on them. Canada is imposing sanctions against nine military officials. The EU will press ahead with sanctions this month and withhold some development aid. Political instability is expected to damage investment sentiment and hurt economic growth in the country.

We are anticipating major business disruptions to affect at least a quarter of Yoma’s FY21 revenue. There could be fewer Wave Money transactions as consumers conserve cash. F&B and Motors sales are also likely to be lacklustre. Given the pause in construction work, Yoma may not be able to recognise revenue from the completion of its property-development projects in the next 3-6 months. Yoma Land has US$45mn worth of revenue yet to be recognised from City Loft @ Star City, The Peninsula Residences and Star Villas.

Downgrade to Neutral with a revised TP of S$0.156, from S$0.340. We change our valuation from SOTP to P/B, using its average historical price tanks during major conflicts, political upheavals and natural disasters. Before the 2010 general election, Myanmar was under military rule. Given that the current state of emergency in Myanmar is expected to last a year and violent protests are not likely to cease in the near term, we believe a P/B discount of the similar magnitude as in 2007-2010 is warranted. Excluding 2007 when Yoma traded at its low of 1.45x P/B, its historical 2007-2010 had averaged lows of 0.41x P/B.

Our 0.45x P/B TP is slightly above its 2007-2010 low of 0.41x, given that Yoma is now a bigger conglomerate with more resilient businesses such as Financial Services. Our FY21e book value is US$0.257. We believe Ayala will proceed with its second tranche US$46mn investment in Yoma. At US$/S$ rates of 1.35, our valuation translates to a TP of S$0.156.

Re-rating catalysts could come from significant improvements in the political situation, a sanctions uplift and a return to normalcy.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: