Report type: Weekly Strategy

“MSCI Rebalancing, Legal Reforms & System Changes and Aircraft Demand”

On 27/5, the trading value of the First Section of the Tokyo Stock Exchange became approx. 5.6 trillion yen, a high level since February 2018. With the international investment index, MSCI, having announced the regular switching of indexes on 12th May, since that switch was to be implemented after the end of trading on 27/5, attention was on the movements of related stocks throughout the closing. There are 3 aspects in the MSCI index maintenance, which are as follows. ① the “Semi-Annual Index Review (SAIR)” in May and November, where a full-scale review is carried out on size and segments as well as value/growth, ② the “Quarterly Index Review (QIR)” in February and August, which reflects important changes before the next SAIR which were not reflected in the market at the point of them actually occurring, and ③ “ad hoc changes” when there is an occurrence of a corporate event, such as a merger, acquisition or spinoff, etc. The period of implementation for SAIR and QIR is after the end of the business day, which is the final day of the handover in that corresponding month, and is usually announced at least 10 business days before the implementation. There may also be a need to note that there are stocks where a buying and selling demand occurs from changes in the incorporation of market capitalisation or the ratio of floating stocks that enable foreign investment (FIF).

Following the conclusion of the Amended Banking Act on 19/5 which newly recognises staff dispatch, system sales, data analysis and advertisements, etc. in banks, on 26/5, the Amended Copyright Act, which simplifies procedures for processing rights in “simulcast” which runs TV programmes on the internet at the same time as their broadcast, as well as the Amended Act on the Promotion of Global Warming Countermeasures, which constitutes climate change countermeasures that ought to be tackled by the country, local governments and corporations, were passed and concluded by the House of Councillors. Amongst local banks, there will likely be attention on financial groups, such as Fukuoka Financial Group (8354), which pioneers efforts in digital businesses, such as Japan’s first digital bank, “Minna no Ginko”, and “iBank Marketing”, which expands Fintech businesses. Also, the lowering of barriers between terrestrial and online will likely benefit television stations burdened by the drop in revenue of terrestrial advertisements as a result of being dominated by online advertisements. Furthermore, from 1/6, management of hygiene control in accordance with HACCP will become mandatory across Japan for business establishments handling foodstuff. It is believed that it will be a business opportunity such as for the temperature control measuring apparatus manufacturer, Chino (6850), as well as Shinto Kogyo (6339), which handles metal detectors responsible for preventing contamination especially in metals.

As mentioned in the 1st March 2021 issue of our weekly report, it appears that the stock market has begun focusing on the rise in aircraft demand, such as the plan for increased production of the European Airbus and the increase in orders in the U.S. Boeing (BA). It looks like we can say that the time is gradually coming for a shift to an increase in demand for aircraft components in “Boeing-related” companies, such as Mitsubishi Heavy Industries (7011), Kawasaki Heavy Industries (7012), Subaru (7270), Toray (3402) and ShinMaywa (7224), etc.

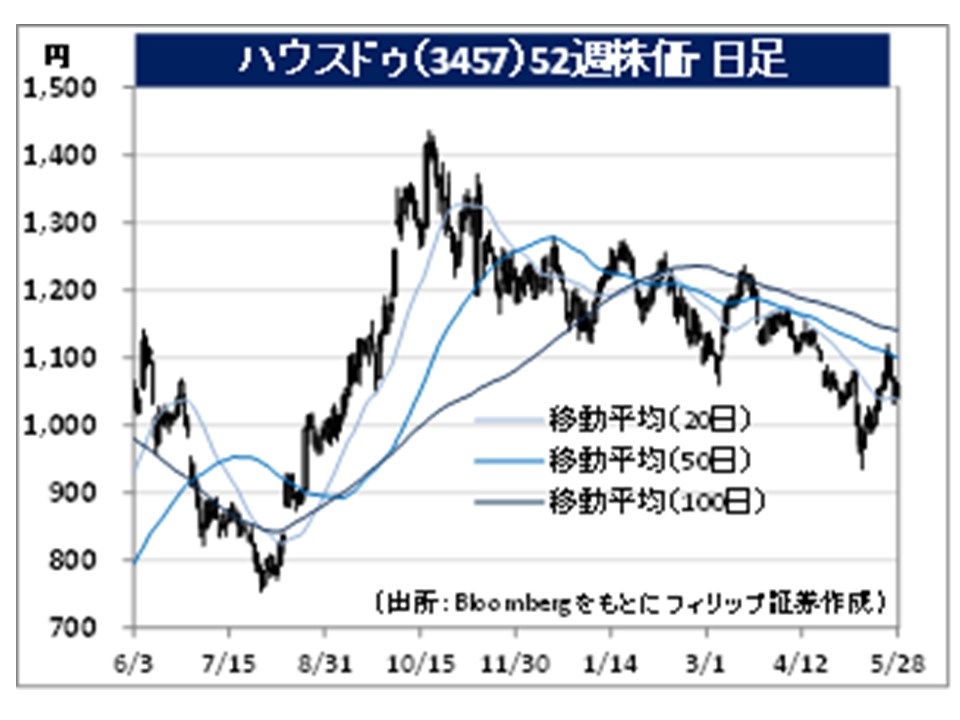

In the 31/5 issue, we will be covering HOUSE DO (3457), Ube Industries (4208), Weathernews (4825), and TOTO (5332).

Japan_Weekly_Strategy_Report20 PDF

・Established in 2009. In addition to the real estate buying and selling and leasing franchise business, the company manages the house leaseback business which enables the sale of the house while living in it, the finance business such as reverse mortgage, etc., the real estate buying and selling and brokerage business, as well as the renovation business, etc.

・For 9M (2020/7-2021/3) results of FY2021/6 announced on 11/5, net sales increased by 10.4% to 25.351 billion yen compared to the same period the previous year and operating income increased by 10.9% to 1.266 billion yen. The increase in the number of new member stores in the franchise business, the acquisition of capital gain from the sale to real estate funds, etc., and the reverse mortgage guarantee due to cooperation with financial institutions, etc. contributed to business performance.

・For its full year plan, net sales is expected to increase by 3.3-14.2% to 33.976-37.532 billion yen compared to the previous year and operating income to increase by 43.3-85.5% to 2.713-3.512 billion yen. The transfer to funds of held real estate for leasing in the house leaseback business is expected to contribute to their full year business performance. As a result of cooperation with regional financial institutions, the total number of contracts in the reverse mortgage guarantee business increased by 39% to 502 as of end April this year compared to end June last year. As of 12/4, the number of partner financial institutions has expanded to 24.

・Established in 1942 with its beginnings in coal mining in 1897. Manages business segments, such as chemistry which involves nylon resin and synthetic rubber, etc., construction materials such as cement and limestone, etc., and machines such as moulding machines, etc., and carries out the manufacture and retail of those involving them.

・For FY2021/3 results announced on 12/5, net sales decreased by 8.1% to 613.889 billion yen compared to the previous year and operating income decreased by 23.9% to 25.902 billion yen. The decline in demand in the chemistry segment and machines segment in the first half as well as a worsening in the market condition of chemicals influenced the decrease in revenue. In addition, regular repair conducted in ammonia factories influenced the decrease in profit.

・For FY2022/3 plan, after adjustment of the accounting standard for revenue recognition, net sales is expected to increase by 5.9% to 570 billion yen compared to the previous year and operating income to increase by 42.8% to 37 billion yen. A recovery is predicted in the chemistry and machines segments. It was announced that a segment business would be integrated with Mitsubishi Materials (5711) in April next year. Also, an agreement was formed with Itochu (8001), etc. involving the joint development of supply bases and the supply of ammonia fuel for ships in a bid to utilise their expertise as Japan’s largest ammonia producer.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: