| Election Season

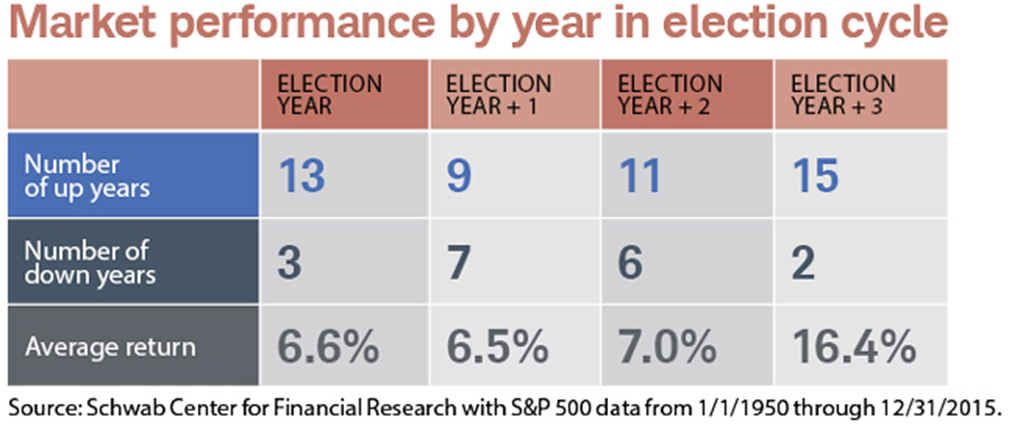

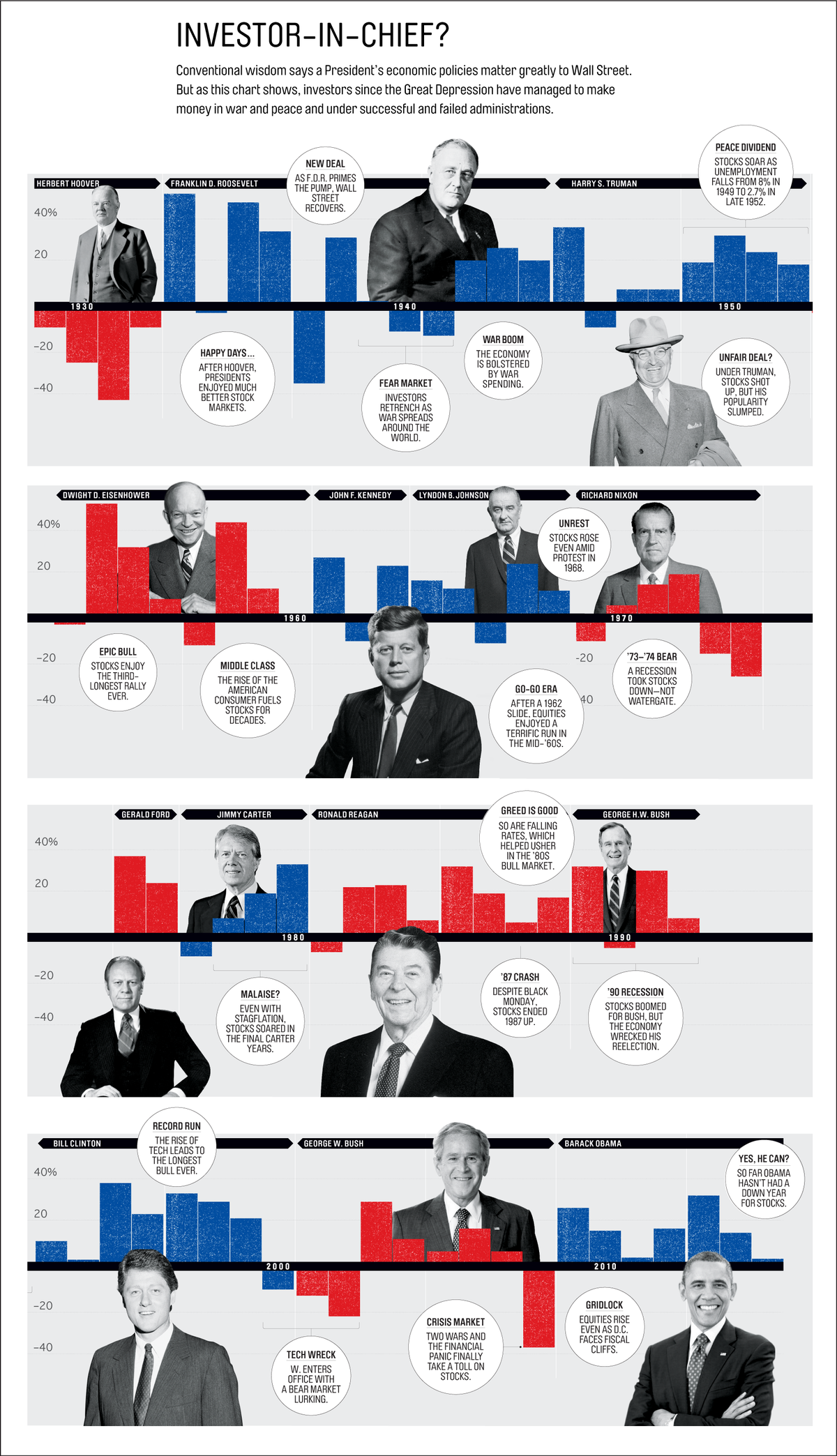

USA election season is upon us and 2016 has been a truly interesting year. The candidates this year are the most disliked candidates in history. On one hand, you have the Republican candidate, Donald Trump, whose campaign can be described, at best, as anti- politically correct, and, at worst, as racist and bigoted. On the other hand, you have Hillary Clinton, who has been marred with scandal after scandal and the electorate in general just does not see as particularly trustworthy. With barely more than a month to go, one of these two people will be the new president of the USA. Investment Action? With each party having their own agenda and points of view when it comes to driving policy, it can be natural to assume that the presidency, being able to affect policy decisions, would also be able to affect the stock market. However, history shows that the S&P 500 has risen an average of 6.5% in the first year of the presidential term, regardless of a sitting Democrat or Republican. Despite the general held belief that a Republican, with their Big Business approach, being good for the market, there is no evidence of a Republican president being better for the stock market. In fact, Democrat presidents seem to have a slight edge over their counter parts, although other macro events would do better to explain the rise and fall of the stock markets. Historically, during an election year, the S&P 500 has risen 81% of the time. |

Source: Time

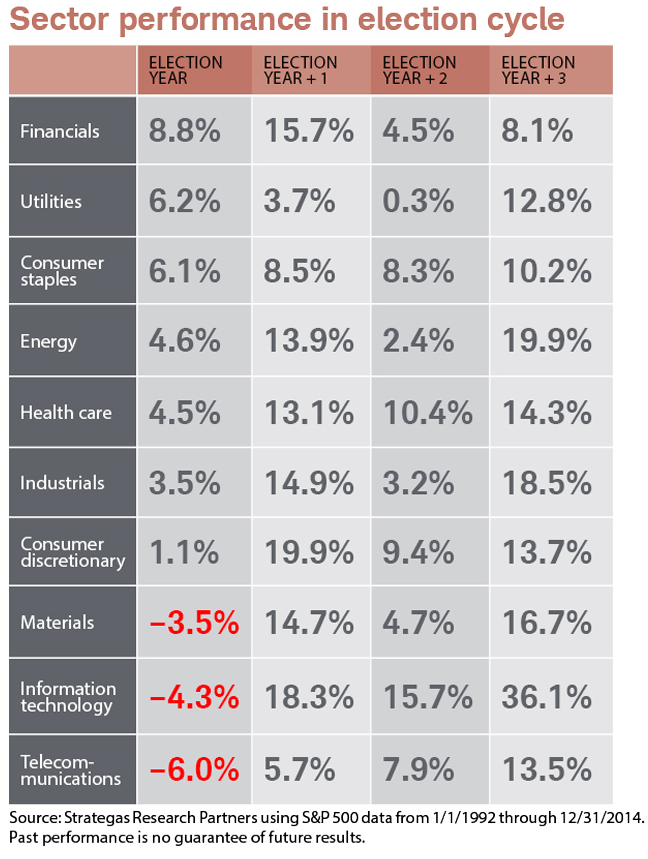

Sector Performance

| During the election year itself, the highly regulated industries like Financials and Utilities seem to perform best, which is not surprising, as the election year is typically a lame duck session, with the current government unable to pass many new regulations.

The year after the election year, Consumer Discretionary, IT, Industrials, Energy and Healthcare does tend to perform, as the market recovers from the uncertainty of which party will be in power. Chances of winning? |

Currently, Fivethirtyeight, a poll aggregation website, puts the chances of Hillary winning at 57.6% and Donald Trump at 42.4%, a little better than a coin toss for either party. The past few weeks have not been good for Hillary and if the current momentum continues, her chances to win might equal Trump’s by November. There will be three presidential debates and one vice presidential debates in the next few weeks and the performance of the candidates at each might help determine who ends up winning the presidency.

Source: Fivethirtyeight

| Candidates’ platform

The party platforms are in general proposals for how the candidate intends to run the country. While it is not a guarantee that the proposals in the platforms will eventually materialize, it does give a general sense of the direction the candidate will want to take the country. In this note, we will focus on Energy and Healthcare, as these are the sectors where the candidates differ greatly and are likely to have market impacts. In terms of Energy, Donald Trump favours more traditional energy sources, and advocates a rescinding of the Climate action plan and Waters of the US rule, effectively allowing the drilling for oil and other fossil fuels in currently protected areas. He has also promised to invest heavily in the coal industry. In contrast, Clinton has pledged to expand investments in renewable energy, proposing that over half a billion solar panels to be installed by the end of her first term, a nearly 700% increase in solar capacity by 2020. For Healthcare, Clinton proposed to increase the Affordable Care Act (ACA), also colloquially known as Obamacare, promising to reduce out of pocket cost ( deductibles) for citizens. Trump however, has promised to repeal the ACA, proposing a state level Medicaid for citizens instead. Both parties do agree that rising drug cost is an issue and have promised to fight to keep drug cost down. Clinton will legislate to keep excessing cost down, while Trump says he will negotiate aggressively with drug companies and remove barriers to entry for generic, non-patent alternative products. Both parties’ platforms can be found respectively: https://www.hillaryclinton.com/issues/ https://www.donaldjtrump.com/positions

With the platform of each candidate in mind, we have tried to identify some companies that would likely benefit from a Trump or Clinton presidency and the list is as follows: 1. Energy – Exxon Mobil (NYSE:XOM) & First Solar (NASDAQ:FSLR) |

| Exxon Mobil Corporation is one of the world’s largest oil producers and refiners. A Trump presidency will likely be good for the fossil fuel industry and we believe that XOM will be able to benefit from it as well as a number of other factors. XOM is currently trading at USD 83.54 per share, with a PER of 33.19 and a Dividend yield of 3.59%. |

Oil Price mild recovery – Since hitting a low of USD 28.50 in January 2016, WTI Crude oil prices have rebounded above the USD 40 per barrel mark and is trading at USD 46.46. The US Energy Information Administration estimates that production and consumption will level out in Q1 2017. Further reduction in Capex for the sector seems to point to a likely slowdown in supply.

| XOM Low development cost and High Inventory – XOM has been focusing on low cost production during this period of low oil prices, being able to cut the development cost from above USD 20 per barrel to below USD 10 per barrel. It also has an estimated 9 years of inventory sustainable at the WTI USD 40 per barrel.

First Solar is producer of photovoltaic (PV) solar energy solutions. The company designs, manufactures and sells PV solar modules and if Clinton wins and goes ahead with her plan to expand solar capacity in the USA, we believe that FSLR will greatly benefit from that. Of all the USA listed solar panel producers, we believe FSLR to be the most financially sound, being able to generate a profit and also having more cash equivalent than debt. FSLR is currently trading at USD 35.42 with a PER of 5.20. It is not currently paying out a dividend. The sector has been beaten down significantly recently due to supply of cheap solar panels from China. We believe that FSLR is undervalued as a result of the following factors: Trading below book value – FSLR’s book value per share is USD 56.71, its tangible book value is 52.61. While FSLR’s PPE is highly specialized and there might be some difficulty in the event of liquidation, FSLR’s current trading price implies a 40% discount to book value. |

Competitive CdTe Tech – The solar panel industry is primarily manufacturing and selling the same technology; Crystalline Silicone(C-Si). However, C-Si wafers are relatively expensive to produce due to raw material costs. FSLR on the other hand, manufactures and sells what is known as thin film solar cells, based on cadmium telluride (CdTe) technology. CdTe panels are cheaper to produce compared to C-Si. FSLR currently produces panels at USD 0.40 per watt, while China’s Trina Solar’s (currently the world’s top solar panel maker) average production cost is USD 0.46 per watt. FSLR’s panels are theoretically 5% more efficient as well, under the right conditions. Given the oversupply, it is unsustainable without government intervention for Trina Solar to keep supplying at current prices. If FSLR is able to ride out the current over supply, it could be in a good position to rebound.

| 2. Healthcare – HCA Holdings (NYSE:HCA) & Unitedhealth Group Inc (NYSE:UNH)

Regardless of candidate, we believe that pharmaceuticals are likely to be beaten down due to the spotlight on high drug cost. As such, we believe that hospitals or private insurance companies would be more likely to be impacted positively depending on the candidate. HCA Holdings is a healthcare services company, they operate hospitals and related healthcare entities. Expansion of the ACA under Clinton might generate more traffic to hospitals. HCA is currently trading at USD 76.38 with a PER of 13.18. The company currently does not pay a dividend. We feel that the stock is undervalued based on: · Aging Demographic – HCA has been able to select key geographic markets with aging populations, which led to about a 2% growth in same facility equivalent admissions · Expansion of ACA – since the introduction of the ACA, the percentage of uninsured in America has fallen drastically. This is significant because uninsured people do not typically pay their medical bills, leading to high doubtful revenue. If Clinton is able to expand the ACA further, Healthcare providers may be able to collect more revenue for the services they provide.

UnitedHealth Group Inc is a diversified healthcare company. UNH’s private insurance business is its biggest source of value. UNH is currently trading at USD 141.04 with a PER of 22.07. The company has a dividend yield of 1.77%. While the ACA has expanded the number of people with insurance, it has also forced UNH to take on unprofitable business. Under a Trump presidency, if the ACA is repealed, UNH might be able to be more discerning and pick more profitable clients. |

USA’s market leader – UNH is the market leader in private health insurance. If Trump becomes president, it is highly unlikely a Public Option will become available as an option. As such, UNH should maintain its position as the market leader.

Withdrawing from ACA – UNH announced that it was withdrawing from most of the ACA state exchanges by 2017. 2015 ACA related losses came up to USD475 mn and 2016 is estimated at USD 650 mn. UNH is looking to reduce ACA related businesses from 1,200 counties to 156. With the reduction in unprofitable business, UNH should be able to increase its margins.

Please download the full report to read further.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Ho Kang Wei graduated with a Bachelor of Commerce, majoring in Accounting and Finance, from Monash University.

He started analysing and investing in US equity markets since 2008. Joining Phillip Securities Research in 2015, he is the analyst in charge of US markets.