Investment Merits

We favour UOL Group Limited (UOL) for its nimble and well-executed strategy especially in the current market environment where demand is curbed by a series of property cooling measures in Singapore. The result of the Group’s strategy mitigates its risk of facing potential charges or fines from clawback of additional buyers’ stamp duty (ABSD) should there be an overhang of unsold properties in a development.

The take up rate of Principal Garden has been encouraging as compared to two adjacent projects, The Crest and Mon Jervois. UOL still has plenty of time to clear the remaining units as the deadline for ABSD clawback is in April 2019. We project a development margin of 21% for Principal Gardens which is healthy compared to the other two developments.

Rental income from investment properties made up of at least 50% of the Group’s total operating profits in the past three years between FY13 and FY15. UOL owns a mixture of investment properties ranging from serviced suite, office and retail properties where majority of these assets are in Singapore.

UOL owns five office properties, yielding 100,000 square metres of net lettable area where they are mostly located in the fringe of the CBD area. As at 3Q16, the Group’s portfolio of Singapore office properties is standing at a healthy occupancy rate of 94% which is higher than the average occupancy rate of fringe offices (92%).

The boost in international tourist arrivals was led by a 36.1% and 5.9% growth in visitors from China and Indonesia respectively. We believe the depreciation in the SGD against the RMB and IDR was one of the main factors that led to an increase in tourist arrivals from these two countries. We view that a continued depreciation in SGD, translating into lower price points for goods and services in relative terms, will benefit domestic hoteliers.

Initiating coverage with “ACCUMULATE” rating and target price of S$7.05

We favour UOL for its consistency in operating performance since at least 68% of its operating profits are contributed from recurring income. As the local property development market extends a decline, the Group is well-buffered by its stability in earnings. On the property development front, UOL is nimble and sits on a relatively comfortable position as most projects are either close to being completely sold, or sitting on strong development margins according to our projections.

Company Background

UOL Group Limited (UOL) has four primary business segments, namely property development, hotel operations, property investments and investment in securities. Under UOL’s hotel subsidiary, Pan Pacific Hotels Group, the company owns the two brands, Pan Pacific and PARKROYAL. UOL has a 44.3% stake in listed property developer, United Industrial Corporation (UIC).

Property Development

Nimble and well-executed development strategy; Only two launched projects remaining with more than 10% unsold units in Singapore portfolio

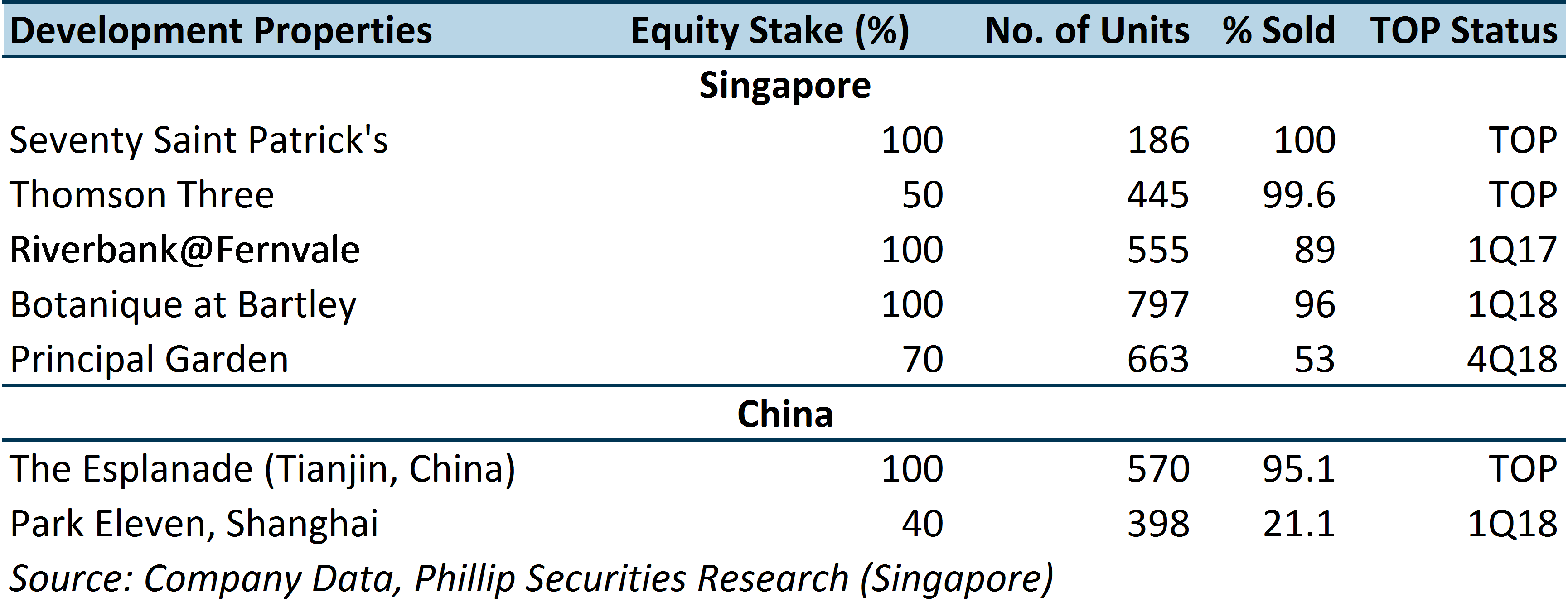

Apart from two out of five ongoing development projects, namely Principal Garden and Riverbank@Fernvale, the other projects under the Group’s Singapore portfolio are at least 96% sold as at 3Q16. UOL adopts a laser-focused strategy in its property development operations where it refrains from participating in multiple development projects each time. UOL launched two development projects in 2015, Botanique at Bartley and Principal Gardens which are 96% and 53% sold as at December 2016. We favour the Group’s nimble and well-executed strategy especially in the current market environment where demand is curbed by a series of property cooling measures in Singapore. The result of the Group’s strategy mitigates its risk of facing potential charges or fines from clawback of additional buyers’ stamp duty (ABSD) should there be an overhang of unsold properties in a development.

Figure 1. Details of launched development properties as at 3Q16

Ample time to sell remaining units in Principal Garden coupled with strong development margins

UOL’s 70% owned 663-unit residential condominium project, Principal Garden was launched for sale in October 2015, and is 47.1% sold (inclusive of 263 unlaunched units) as at 3Q16. The take up rate of Principal Garden has been encouraging as compared to two adjacent projects, The Crest and Mon Jervois. UOL still has plenty of time to clear the remaining units as the deadline for ABSD clawback is in April 2019.

We project a development margin of 21% for Principal Gardens and is healthy compared to the other two developments. Unlike Principal Garden, The Crest is a 469-unit residential development which has 70% unsold units (328/469) in the development and is likely to face the clawback of (ABSD) amounting to S$51.6 million (S$96 PSF) as the developer is required to the remaining unsold units by September 2017. Similarly, Mon Jervois which has 43% unsold units (47/109) that remained unsold is most likely to face ABSD clawback in February 2017.

While the general belief is there may be near term price pressures as developers race to clear these remaining units, we view that this is unlikely as prices at The Crest and Mon Jervois would have been cut earlier if the respective developers had the intention to do so. We believe that developers of The Crest and Mon Jervois have considered that a price cut spree would be disadvantageous to them since Principal Garden has the lowest land acquisition cost out of the three developments (Principal Garden: S$820 PSF, Mon Jervois: S$862 PSF, The Crest: S$960 PSF).

Weaker development margin for Riverbank@Fernvale led by surmounting supply in OCR; 89% of development sold as at 3Q16

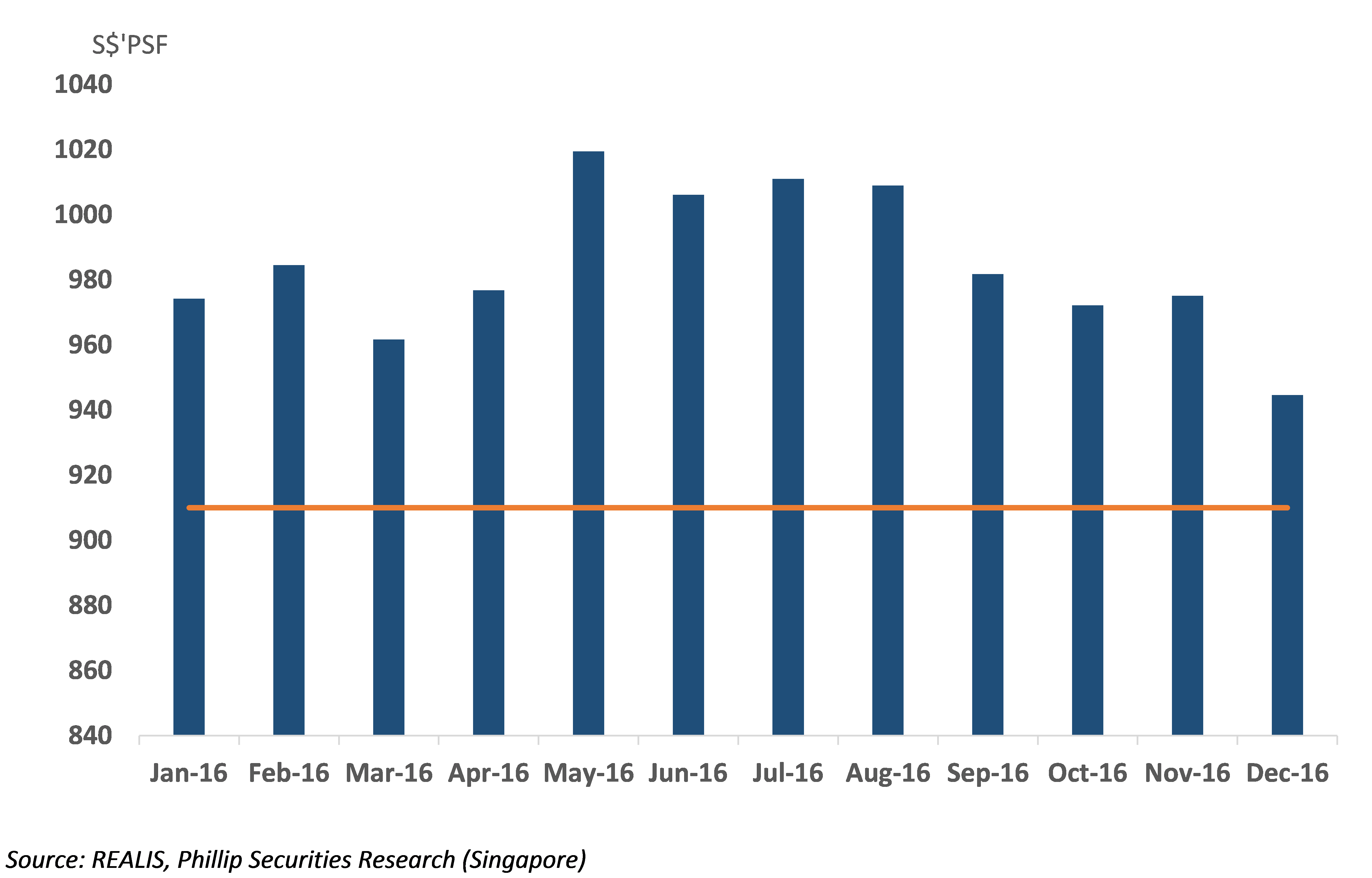

We expect UOL to book in the remaining profits in Riverbank@Fernvale, a 555-unit condominium project in the Sengkang district, in the next few months, as the development is expected to obtain its Temporary Occupancy Period (TOP) status by 1Q17. As at Dec 2016, 89% units in the development have been sold where the Group has another 15 months to clear the remaining unsold units before facing the clawback of ABSD. Although we are expecting weaker development margin of 8% from the development (compared to other development projects on hand), however, we view that the large number of unsold units and slowing demand in the Outside Central Region (OCR) may create price pressures for developments in the area. We noted that sales momentum in Riverbank@Fernvale decelerated due to the launch of High Park Residences in July 2015 which has a relatively lower land acquisition cost (S$443 PSF) compared to Riverbank@Fernvale (S$489 PSF). We are optimistic that the remaining 11% of unsold units in Riverbank@Fernvale can be sold before the ABSD clawback deadline and maintain the current development margin as the land acquisition cost at the development is the lowest among other development projects in the vicinity (Rivertrees Residences: S$533 PSF, Recent GLS at Fernvale Road: S$517 PSF). ASP in December 2016 was the lowest in 2016 at S$910 PSF versus the highest of S$1020 in the year. Even if ASP maintains at the current level, we are of the view that there will be limited impact on the development margin on the entire project, considering that there remains only a small proportion of unsold units in the development.

Figure 2. Transacted prices and breakeven cost (orange line) for Riverbank@Fernvale

Please sign in to read the full report.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: