We attended United Overseas Bank Limited’s (UOB) Corporate Day 2019. Theme: Focus on fundamentals and not lose sight of UOB’s primary objective of achieving sustained long term growth balanced with stability in three ways.

Customers

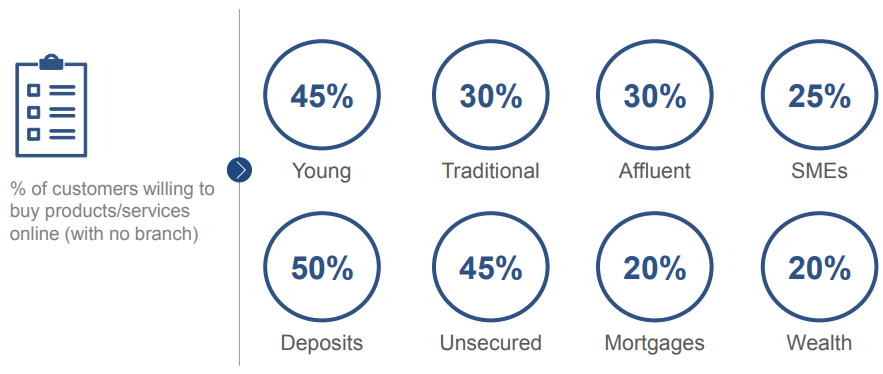

UOB visualises its future customers to come from its ASEAN franchise, which has a rising young population. Around 60% of the ASEAN population is under 35 years old, and 52% of the population owns a smartphone. As customers’ needs evolve, there’s a need for both digital services as well as physical branches. When it comes to higher value transactions such as mortgage loans, wealth management and SME transactions, less than 25% (Figure 1) of UOB’s customers are willing to transact online because of the sense of security of having someone to talk to before making a decision.

Figure 1: Who wants to buy financial products/service online?

Source: UOB

Omni-Channel Experience

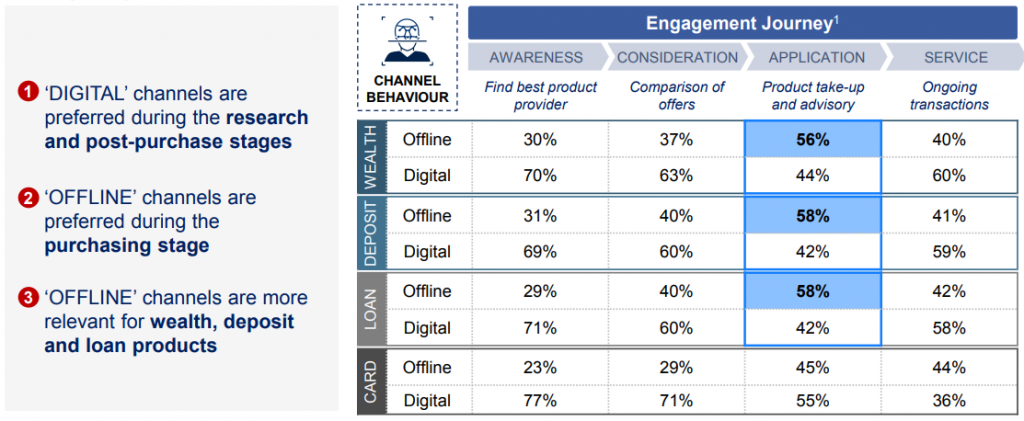

Despite intensive digitalisation efforts, offline channels remain crucial in UOB’s customer engagement journey. Digitally is not the only way customers want to be served, more than 56% of UOB’s customers prefer physical interaction for wealth, deposit and loans transactions (Figure 2) when making purchasing decisions. Online channels are preferred in gathering information during the run-up before the actual application stage.

Figure 2: Channel Preferences Vary across Engagement Journey and Products

Source: UOB

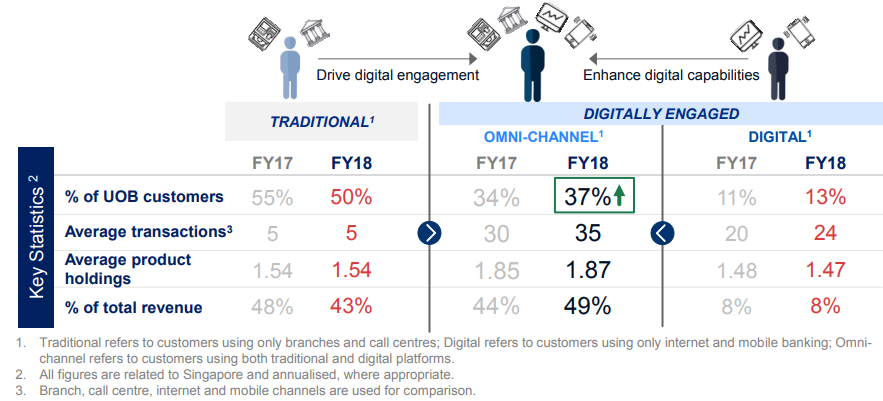

As per Figure 3, the percentage of UOB’s customers using both traditional and digital platforms increased the fastest. These customers are called Omni-channel customers. Omni-channel customers became the most significant contributor in FY18 at 49% of total revenue as compared to 44% in FY17, when traditional customers were still the major contributor at 48% (Figure 3).

Figure 3: Omni-channel is rising in customer engagement and revenues

Source: UOB

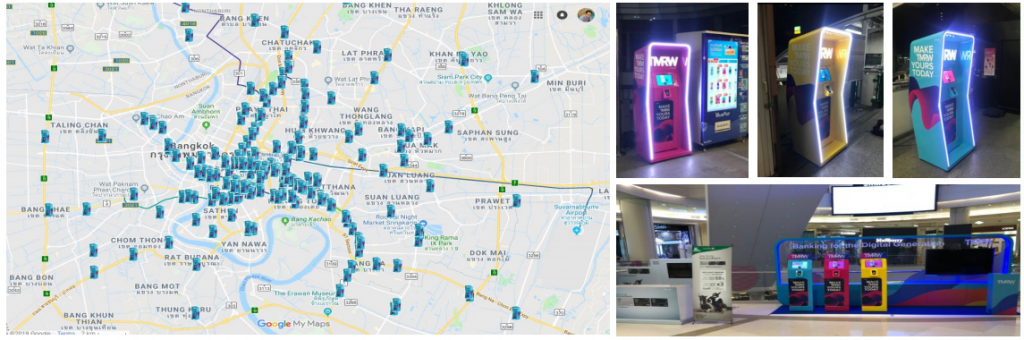

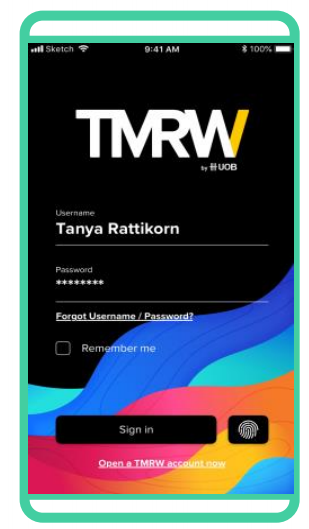

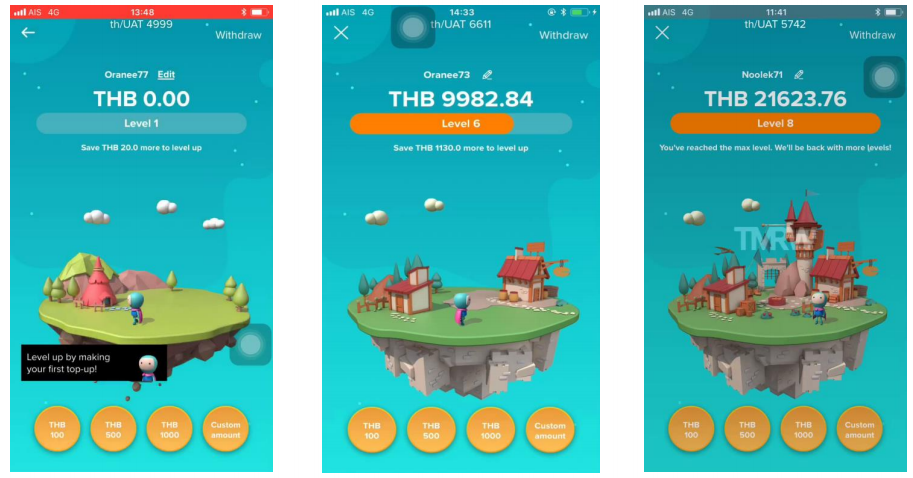

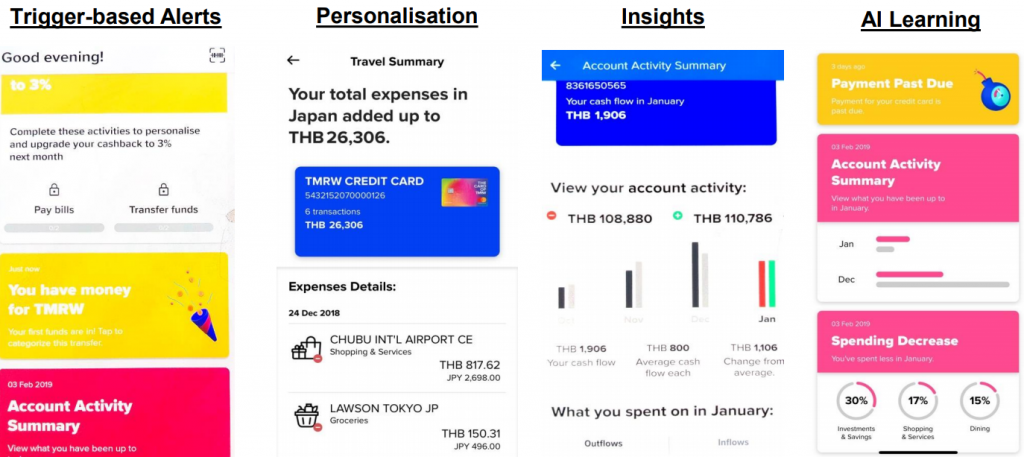

Digitalisation – “TMRW”: ASEAN’s first mobile-only Digital Bank

UOB shared its designs for customer-centric solutions by making banking simpler with digitalisation. The newly launched digital bank called “TMRW” in Thailand targets the middle-affluent, mobile-savvy millennials who want to be continuously engaged. Products offered at the moment consists of payments, deposits and unsecured credit. Authentication can be completed within 10 seconds with a match of chip to government data. The steady CIR of TMRW is approximately 35%.

Figure 4: First Bank with 500 Kiosks in Bangkok

Source: UOB

Figure 5: TMRW App

Source: UOB

Figure 6: Making Savings as Fun as Playing Mobile Game

Source: UOB

Figure 7: Using Insights to Engage Customers – Examples

Source: UOB

Ecosystem Partnerships

Examples of ecosystem partnerships include bancassurance with Prudential, strategic alliance with Grab and partnerships in property and car ecosystems. M1 is the first telco in Singapore to offer paynow as a mode of payment. PayNow allows people to transfer money through their bank’s mobile or Internet banking service to a registered recipient with just their mobile phone number, NRIC or FIN. Scoot will also be the first airline in Singapore to provide paynow as a mode of payment, which means lower booking fees for customers.

Target

Revenue mix outside Singapore to increase to close to 50%. As of 1Q19, the proportion of UOB’s profit before tax from outside Singapore stands at 40.8%.

Cost-to-income ratio to decline close to 42% in 3 years. UOB’s CIR as of 1Q19 was at 44.6%. Improvement of productivity will start from Singapore where processes can be improved easily by reducing costs to acquire, serve and engage with digitalisation, before rolling out in the region.

ROE targeted to reach closer to 13%, depending on how fast UOB scales up its regional operations.

Market volatility in 2019

The main contributors to market volatility in 2019 will likely come from geopolitics, global trade tensions and a synchronised global slowdown in sentiments.

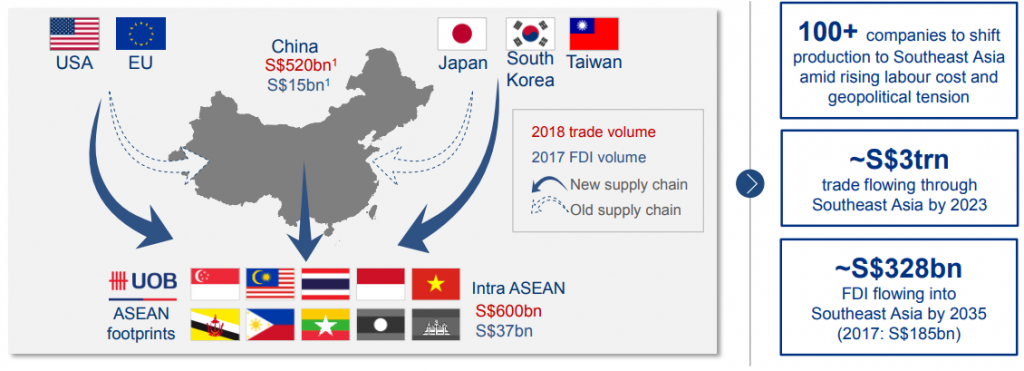

Trade war – With the resurgence of trade war concerns, there seems to be a growing sentiment amongst corporates (with business in technology and electronics) to shift their supply chain out of China into ASEAN (Figure 8). A shift in the supply chain does not happen overnight, and many corporations are exploring the idea for now. A natural consideration would be countries such as Vietnam, Thailand and Indonesia where labour is cheap. UOB is well positioned with a wide SEA footprint to serve both suppliers and distributors.

Figure 8: Shifting Investments and Supply Chain to Southeast Asia

Source: UOB

Key market – South-east Asia (SEA)

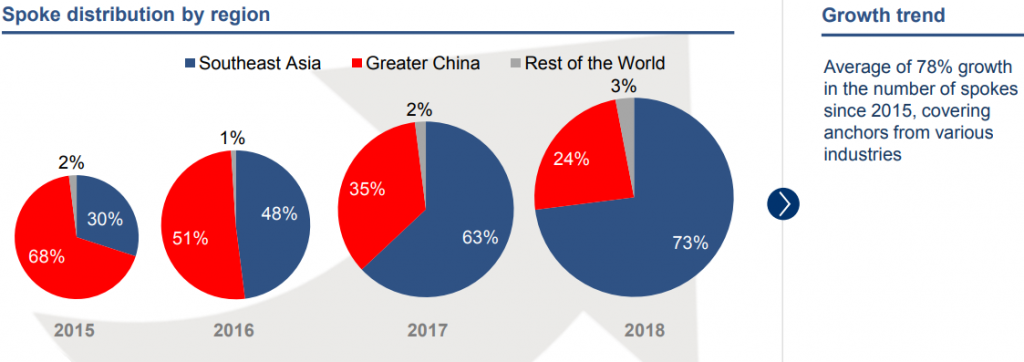

SEA is the third largest population globally after China and India with a young demographic (384mn people below 35 years old). Indonesia, Thailand and Malaysia are UOB’s key markets. UOB’s Greater China proportion of spoke distribution reduced over the years with a broader focus on SEA (Figure 9).

Figure 9: Diversifying from Greater China into Southeast Asia

Investment Actions

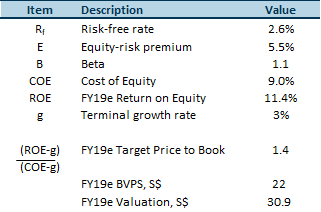

Maintain ACCUMULATE with an unchanged target price of S$30.90 based on the Gordon Growth Model. We maintain our existing earnings forecasts.

Valuation: Gordon Growth Model

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Min Ying covers the Banking and Finance sectors. She has experience in external audit and corporate tax roles.

She graduated with a Bachelor of Accountancy with a major in Finance from SMU.