Company Background

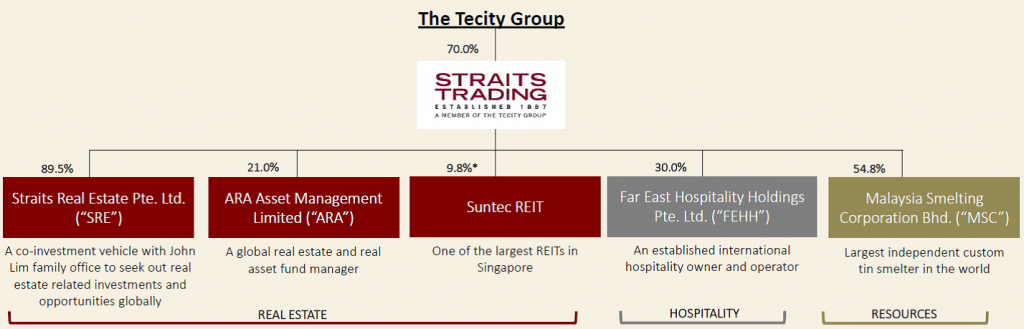

The Straits Trading Company (STC) has a history dating back to 1887 when it started out as a tin smelter. In the 1960s, it began developing and constructing multiple prestigious property projects around Singapore. 2008 was a major turning point when privately held investment group, Tecity, acquired a controlling stake in the company. This began STC’s journey of transformation from a mere passive owner of low-yielding assets into an active financial investor and developer of real estate.

STC had since successfully divested S$1bn of non-core assets, refocusing on its resource business and restructured its hospitality operations. It now has three core businesses:

Outlook

BACKGROUND

The Straits Trading Company has a history dating back to 1887 when it started out a tin smelter. Straits Trading formed its property division in 1960. It developed and constructed many prestigious projects around Singapore, including the first iconic 21-storey Straits Trading Building (1972), Great Eastern Centre and China Square Central (2002), and good class bungalows at Cable Road and Nathan Road (2006). 2008 was a major turning point when privately held investment group, Tecity, acquired a controlling stake in the company. This began STC’s journey of transformation from a mere passive owner of low-yielding assets into an active financial investor and developer of real estate.

Figure 1: STC’s three core pillars are real estate, hospitality and resources

Source: Company. * Aggregate interest in Suntec REIT held by STC Group of companies

REAL ESTATE

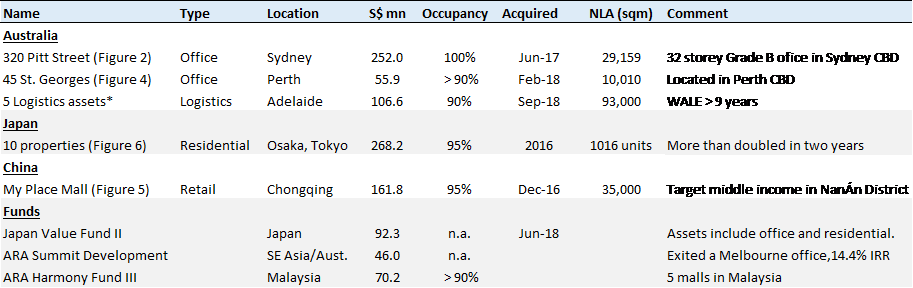

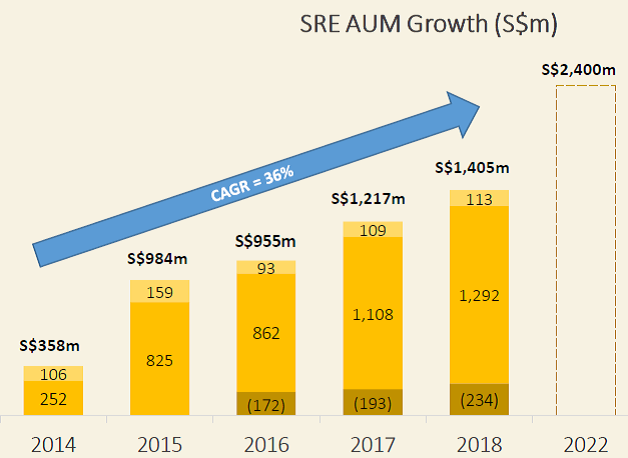

1. Straits Real Estate (89.5%): This is STC’s in-house real estate investment business. The remaining 10.5% is owned by the John Lim Family Office. The objective of SRE is to build a geographically diversified portfolio of property assets that will generate attractive recurrent earnings or returns and capital upside. It may invest directly in real estate or via real estate funds. SRE’s modus operandi is to invest in projects with value-add opportunity and manage them to drive capital upside. Operating since 2014, SRE has been building its scale and track record. Assets under management have grown at a 36% CAGR from S$358mn in 2014 to S$1.4bn in 2018 (Figure 8). 114 William Street (Melbourne) is an example of a property that SRE invested in and enhanced, eventually increasing its occupancy and WALE, repositioning it as an institutional-grade asset for sale. SRE later successfully monetised it for a profit of A$21.7, at an IRR of 25%. Another successful investment was the divestment of the Greater Tokyo Office Fund, with its four office buildings, for an IRR of 19%. The direct real estate portfolio of SRE is now spread across three key geographies – namely, Australia, Japan and China. There are also three property funds under SRE that invest in Japan, Malaysia and Australia.

Figure 2: 320 Pitt Street, Sydney

Source: Company

Figure 3: SRE portfolio of direct investments and funds

Source: Company *SRE ha 80% stake in five assets. Tenants include Coca-Cola Amatil, Incitec Pivot Centre and Siemens

Private Equity Funds

ARA Harmony Fund III (40%): owns a portfolio of five commercial properties in Malaysia. The income-generating properties include Ipoh Parade Mall in Perak, Klang Parade Mall and Citta Mall in Selangor, 1 Mont Kiara Retail Mall and Office Tower in Kuala Lumpur, and AEON Bandaraya in Malacca.

Japan Value Fund II (40.82%): the objective is to acquire assets in the Greater Tokyo area and other cities in Japan. The fund is managed by Savills Investment Management.

ARA Summit Development Fund (89%) (substantially exited in end 2018): co-invest with developers in projects in South East Asia and Australia. The fund may invest as an equity partner to share a project’s development risk and returns, or participate in a project as a mezzanine loan lender for lower risk.

Figure 4: 45 St Georges Terrace, Perth

Figure 5: My Place Mall, Chongqing

Source: Company, PSR

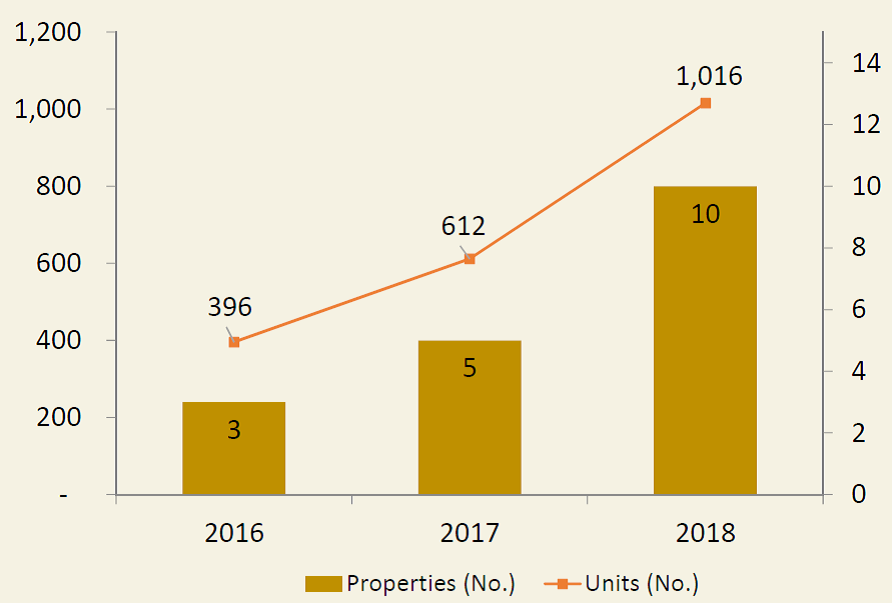

Figure 6: Residential properties in Japan expanded to 1,016 units

Source: Company

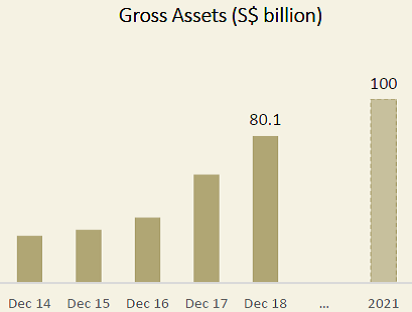

Figure 7: To hit S$100bn AUM by 2021

Source: Company

Figure 8: SRE’s target is to expand AUM by another S$1bn within 4 years

Source: Company

2. ARA Asset Management (20.95%): In October 2013, STC acquired a 20% stake in ARA from Cheung Kong for S$294.4mn. Established in 2002, ARA is one of the largest real estate fund managers in the region with assets under management of S$80bn. ARA was established in 2002 and listed on the SGX in 2007. In November 2016, together with a consortium that included STC, ARA was privatised for S$1.8bn (of 5% equity value to AUM).

Gross assets managed by the ARA Group is currently c.S$80.1bn across over 100 cities in 23 countries. ARA plans to grow gross assets by another S$20bn in the next three years (Figure 7). ARA is focused on the management of REITs, private real estate funds, infrastructure funds and operates country desks in China, Korea, Japan, Malaysia, Australia, Europe and the United States. ARA manages 20 REITs, six of which are listed – these are Fortune REIT, Suntec REIT, Cache Logistics Trust, Prosperity REIT, Hui Xuan REIT and ARA US Hospitality Trust.

3. Suntec REIT (9.8%): STC first acquired a stake in Suntec REIT in 2014. Suntec owns seven assets, four of which are in Singapore, one in Sydney and two in Melbourne. Assets under management is S$9.9bn. STC’s stake in SGX-listed Suntec REIT is recorded as investment securities. STC recognises dividend income from this REIT.

4. Singapore and Malaysia properties available for sale (100%): A S$317mn portfolio of legacy investment properties in Singapore and Malaysia is available to be monetised and for capital to be redeployed towards. These include (i) apartments/ townhouses in Gallop Green development; (ii) good class bungalows in Cable and Nathan road; (iii) several parcels of land and shophouses in Malaysia.

HOSPITALITY

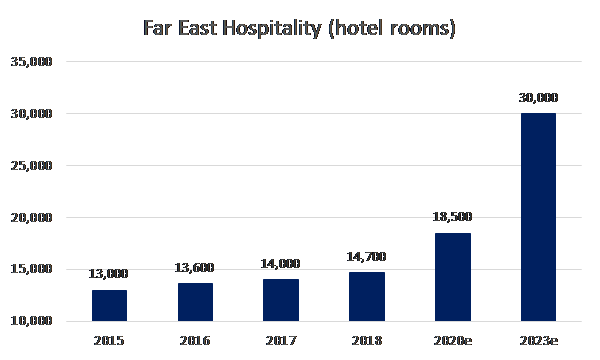

Far East Hospitality Holdings (FEHH) (30%): In November 2013, STC formed a 30:70 joint venture, FEHH, with SGX-listed Far East Orchard. STC injected three hotel properties and 13 management contracts into this joint venture. FEHH currently owns and operates a combined portfolio of 94 properties with over 14,700 rooms across seven countries and 25 cities. FEHH also operates nine hotel brands such as Rendezvous, Oasia, Quincy, Village, Far East Collection, Adina Apartment Hotels and Adina Serviced Apartments, Vibe Hotels, Travelodge Hotels and TFE Hotels Collection. Targets to double the rooms under management from 14,700 to 30,000 in 2023.

Figure 9: Far East room count target is to double in five years

Source: Company, PSR

RESOURCES

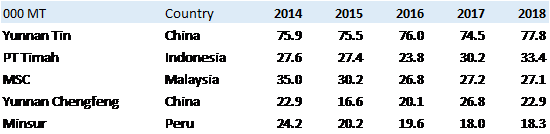

Malaysia Smelting Corporation (MSC) (54.8%): MSC is the largest tin mining company in Malaysia and the third largest globally, in terms of output (Figure 10). The company is listed on both Bursa Malaysia and SGX.

MSC’s end-product is refined tin bars. It has a tin mine in Perak – Rahman Hydraulic – with an annual production of around 2,300MT per annum. It is considered the largest operating open-pit hard rock tin mine in Malaysia (Figure 14). Tin ore extracted from this mine is processed into tin-in-concentrates which are then converted into refined tin metal products at the smelter in Butterworth, Penang. The mine meets 10% of MSC requirements, with the remaining raw materials sourced locally or overseas.

Figure 10: Top 5 largest tin producers in the world

Source: International Tin Association, PT Timah, PSR

Figure 11: The nine brands under Far East Hospitality Holdings

Source: Company

Figure 12: The newly opened 606 room Village hotel at Sentosa

Source: Company

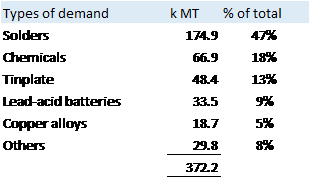

Figure 13: Types of demand for tin (2018)

Source: ITA, PT Timah, PSR

Figure 14: Rahman Hydraulic operates largest open pit tin min in Malaysia

Source: Company

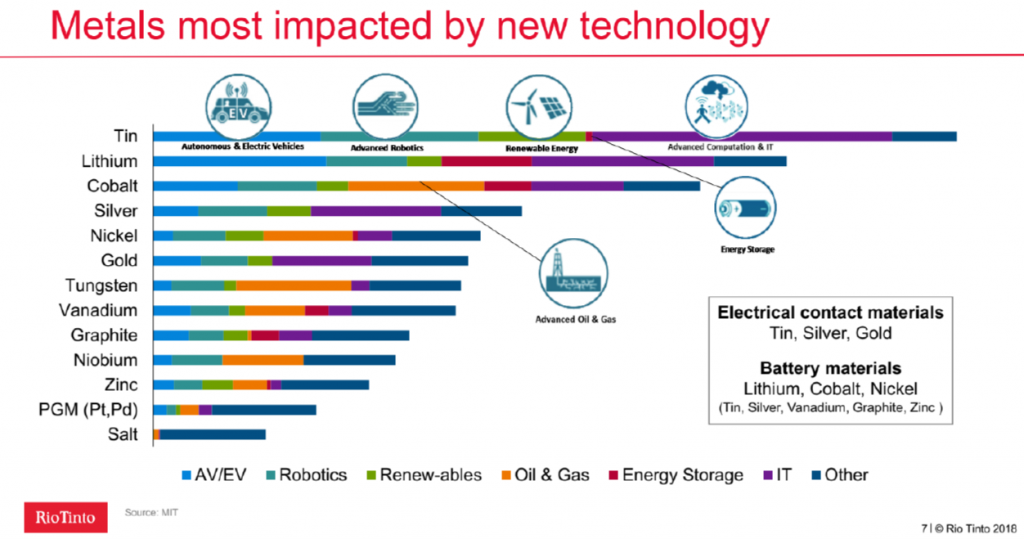

Figure 15: Tin would be the most positively impacted metal by new technologies

Source: Rio Tinto

MSC will be relocating from its current plant in Butterworth (operational since 1902) to a new smelter in Pulau Indah, Port Klang. The new facility will be using a more efficient smelting process – Top Submerged Lance furnace. The new plant will boost maximum production capacity by 50% or up to 60,000 tonnes p.a.

In view of the relocation, MSC and STC signed a Memorandum of Understanding (MOU) to jointly redevelop a 40.1 acre land site comprising the current factory land (13.9 acres) and adjacent land (26.2 acres) into a integrated waterfront development. The site is freehold and is near the new Penang Sentral, which will be the new transport hub of Penang (Figure 16).

Figure 16: The upcoming mixed-development (~RM3bn GDV) is near the new Penang Sentral transport hub

Source: Company

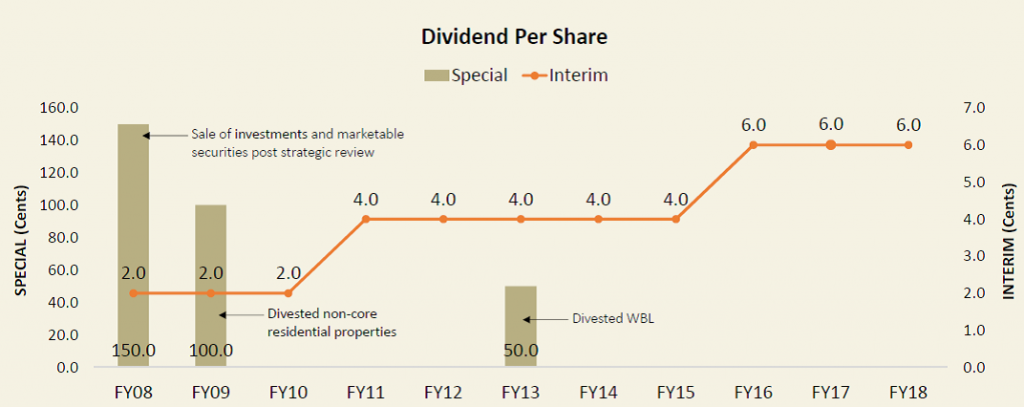

Figure 17: Dividend per share has tripled since 2008

Source: Company

RNAV

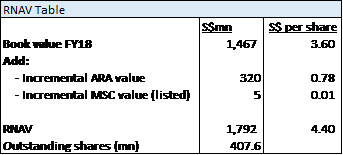

Our RNAV of STC is S$4.40 (Figure 18).

Figure 18: STC RNAV Estimates

Source: Company, PSR

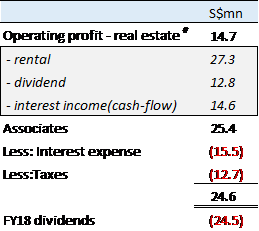

Figure 19: FY18 recurrent income of around S$25mn from the real estate

Source: Company, PSR

#Excludes income from resources business where net profit was S$6.7mn.

Our estimate of real estate operating profit is S$46mn less implied fair value gain within interest income of S$31.3mn.

*Based on data provided in 22Mar19 Circular on Capitaland acquisition of Ascendas and Singbridge. Some of the equity to AUM valuations used were Blackstone 4.8% and Cohen and Steers 3.2%. Incidentally, ARA was privatised at 5% equity to AUM or PE of 17.9x.

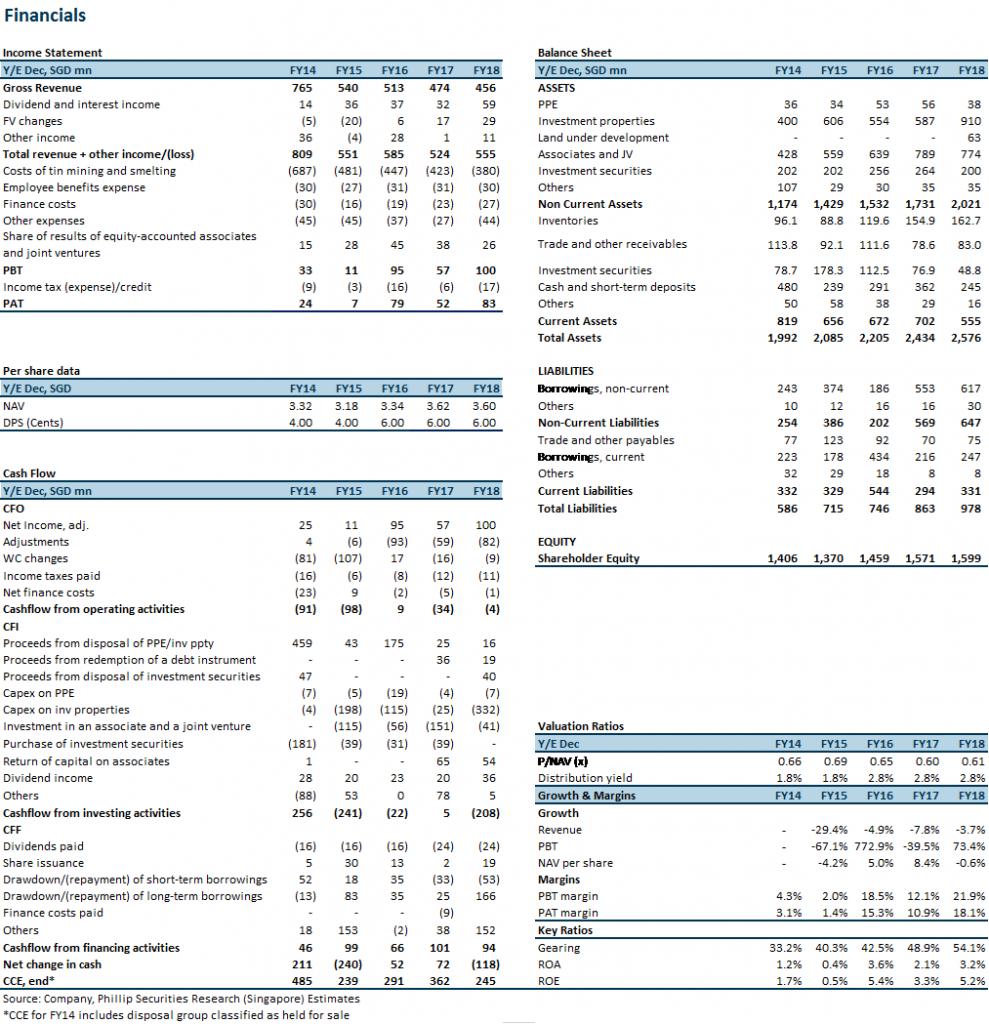

APPENDIX 1: Understanding the financials

Revenue

STC has multiple sources of revenue and income.

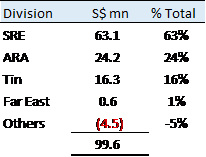

Figure 20: PBT break-down (2018)

Source: Company, PSR

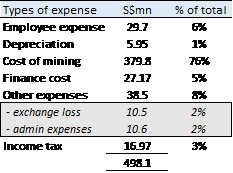

Cost

Biggest component of operating cost relates to the tin mining operations. Excluding mining cost, the largest expense are employee and finance costs (Figure 21).

Figure 21: Expense breakdown (2018)

Source: Company, PSR

Balance Sheet

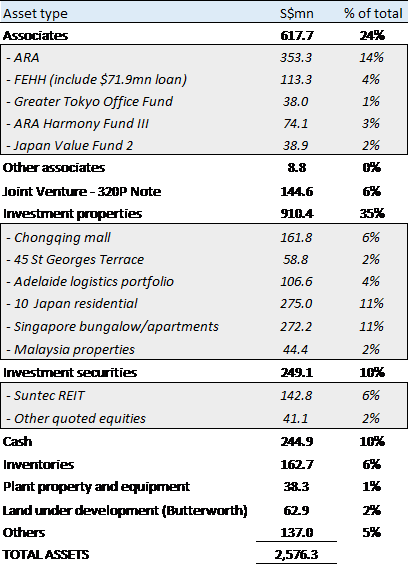

Assets: Around one-third of STC’s assets are investment properties. The largest investment properties are the Singapore bungalows and apartments, and the 10 Japan residential apartment blocks, followed by the associates -the single largest asset being the 21% stake in ARA (Figure 22).

Figure 22: Break-down of total assets

Source: Company, PSR

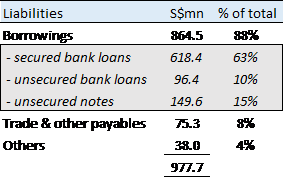

Liabilities: STC’s gross debt is around S$864.5mn. Bulk of the debt is secured bank loans. The interest rates are 0.5% to 5.2% for floating rate debt and 3.7% for fixed rate notes.

Figure 23: Bulk of the liabilities are secured bank loans (as at FY18)

Source: Company, PSR

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: