| Executive Summary

i. Tsai Ing-wen made history as the first elected female president when she won the general election for presidency with 56.12% of the votes. She assumed office in 20 May 2016, succeeding Ma Ying-jeou from Kuomintang (KMT). ii. Democratic Progressive Party (DPP) won 68 seats in the 113 Legislative Yuan (Taiwan’s Parliament) thus displacing the incumbent KMT, which ruled Taiwan for a period of 8 years since 2008. iii. Sovereignty identity is much stronger with the pro-democracy DPP and this will definitely affect the relationship with China. iv. GDP growth in Q2 2016 brings Taiwan out of a technical recession. Export, industrial production and manufacturing PMI seems to be indicating a turning point. v. Taiwan saw a pick-up in foreign direct Investment as investors turn to emerging markets in search of growth. vi. Attractive valuations as the discount for political uncertainties has yet to be lifted and the market has not price in the recent economic recovery.

Investment Merits

Investment Risk

|

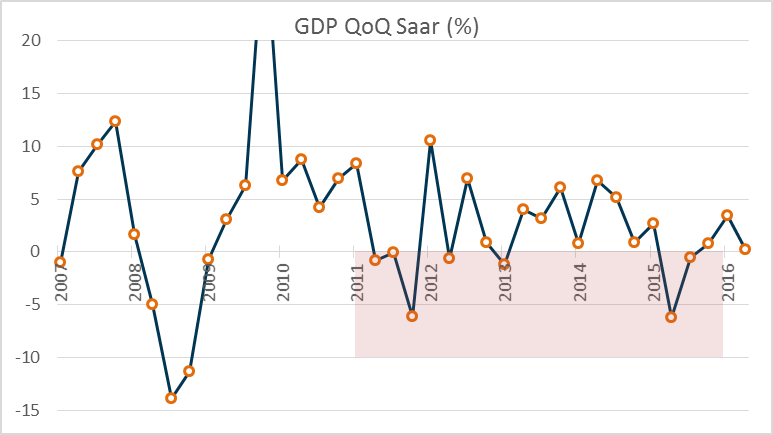

Politics The General Election held in January this year saw a switch of sentiment for the people of Taiwan as the incumbent party, Kuomintang (KMT) lost the election to the Democratic Progressive Party (DPP) for the second time since the country’s democracy. DPP, led by Tsai Ing-wen, won the election comfortable by winning 56% of the votes. The result of this election was not only a reflection of their sovereignty but the outcome highlighted the dismay towards the economic recovery since the global finance crisis in 2008. Weak economic growth raised question on Kuomintang leadership Since 2011, Taiwan’s economic growth has been weak and inconsistent. The economy recorded negative growth on several occasion as seen in Figure 1. The start-stop to the economic growth casted doubt on KMT’s ability to improve the economy and affected the popularity of Ma Ying-jeou and his party. Figure 1: GDP QoQ Seasonally-Adjusted Annual Rate |

Source: Taiwan Directorate-General of Budget, Accounting & Statistics, CEIC, Phillip Securities Research (Singapore)

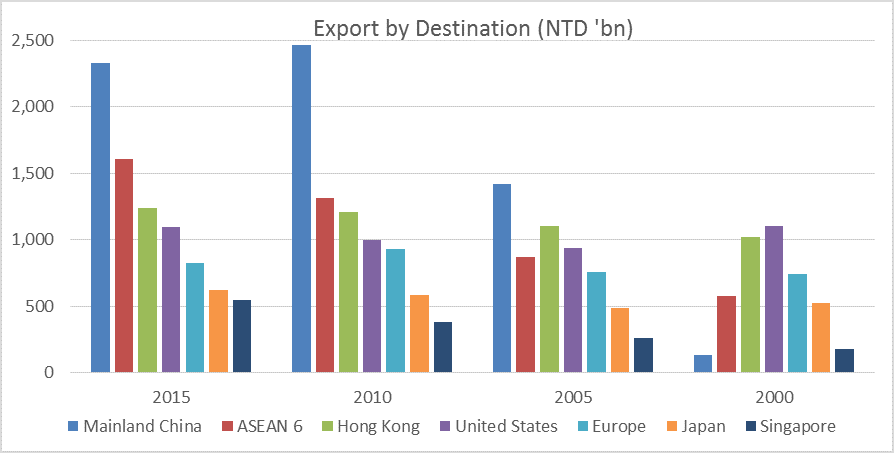

Furthermore, under Ma Ying-jeou stewardship, KMT expanded Taiwan cross-strait trades with China. During its 8 years tenure, the Ma Administration worked hard to repair the relationship with Beijing and made China his focal point for Taiwan’s recovery. The strategy then, was to ride on the tailwind of China’s enormous growth. This ultimately led Taiwan to an unhealthy dependence on a single market. Figure 2 showed the exponential growth of China as an export destination for Taiwan products.

Figure 2: Export by destination

Source: Taiwan Ministry of Finance, CEIC, Phillip Securities Research (Singapore)

| Sunflower Student Movement and the diminishing popularity of Kuomintang

As the economical tie with mainland China improves, so did the cross-strait politics. The people of Taiwan are wary of the close relationship between KMT and the Communist Party of China (CPC). Political tension between the Taiwan government and its people heightened when KMT infuriated its citizens by acknowledging the ‘1992 consensus’. (The ‘1992 consensus’ was for both Taiwan and mainland China to interpret the meaning of ‘One China’ according to their own definitions). This tension reached its peak in 2014 with the ‘Sunflower Student Movement’. In a demonstration to oppose the Cross-Strait Service Trade Agreement (CSSTA), a group of student-led protestors occupied the Taiwan’s Legislative Yuan thus starting the movement known as ‘Sunflower Student Movement’. Various services and goods sectors across the straits would be liberalised under CCSTA, harming small and medium-sized enterprises in Taiwan. The protester believed that the trade-pact will harm Taiwan’s economy and leave it vulnerable to political pressure from China. The rise of DPP economic leadership DPP had been very critical of how Ma Administration has handled Taiwan’s economic affair. The New Frontier Foundation, an economic think tank incubated within DPP, has suggested that Ma Administration have failed to identify and developed new economic engine for growth. Ma Administration sole focused on improvement free trade with China has led Taiwan into an economic stagnation. The New Frontier Foundation which featured many prominent economic policymakers are now top advisers to Tsai Administration and will take the lead in forming Taiwan’s new economic policies. In general, they have advocated for a more comprehensive growth through innovation, financial sector reform and improving international trades with other countries. In her 2015 speech, addressed to a group of political academics, President Tsai has stated her vision of a better economic relationship with the U.S. Her DPP administration will improve collaboration on the next generation infrastructure on the Internet of Things (IoT), cloud, big-data and ICT-based industries. She further emphasised the need for Taiwan to expand trade relations with more countries and it is crucial for Taiwan to participate in the Trans-Pacific Partnership (TPP) negotiation as well. |

We have a positive view on the change in the political landscape. Political change are usually accompanied by economic reform. It is paramount that Taiwan retains its economic independence and reduce its risk to a single market. This will boost Taiwan effort in maintaining its sovereignty.

| Economy

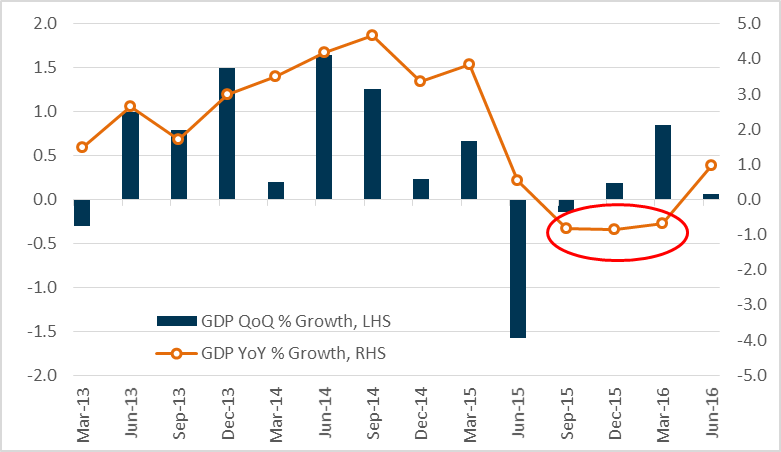

Taiwan economy registered its first positive YoY GDP growth in Q2 2016. This marked the end of a technical recession for Taiwan which lasted 3Q quarters. We believed that the economy has bottomed out as the initial uncertainty accompanied with the change in leadership subside. |

Figure 3: GDP YoY & QoQ percentage growth

Source: Taiwan Directorate-General of Budget, Accounting & Statistics, CEIC, Phillip Securities Research (Singapore)

| What drives Taiwan’s GDP? |

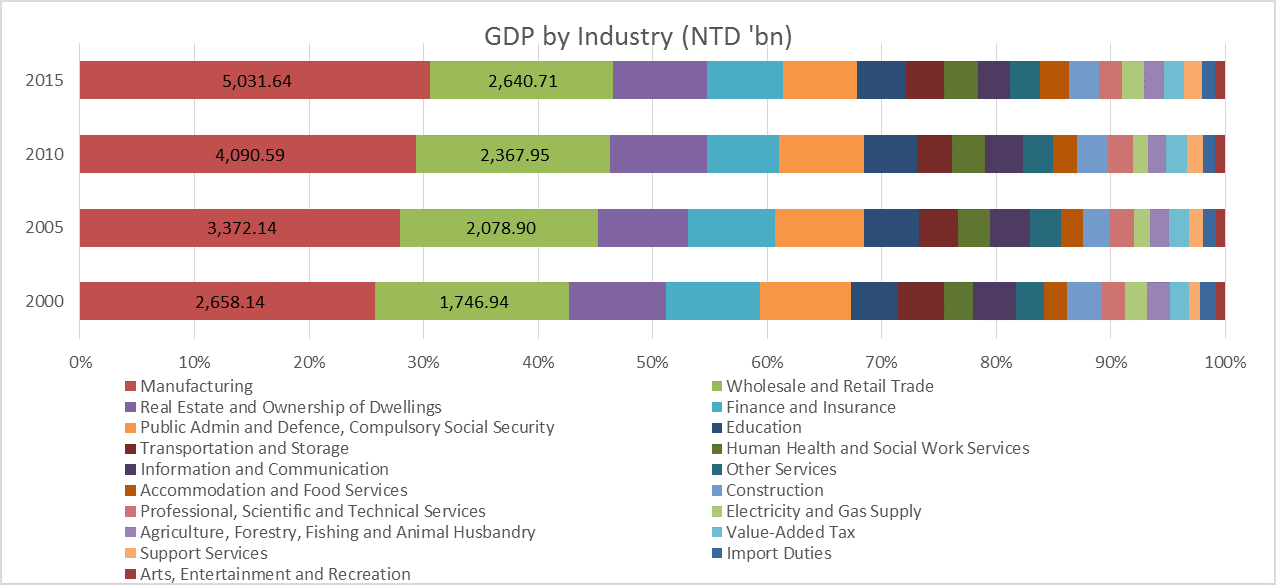

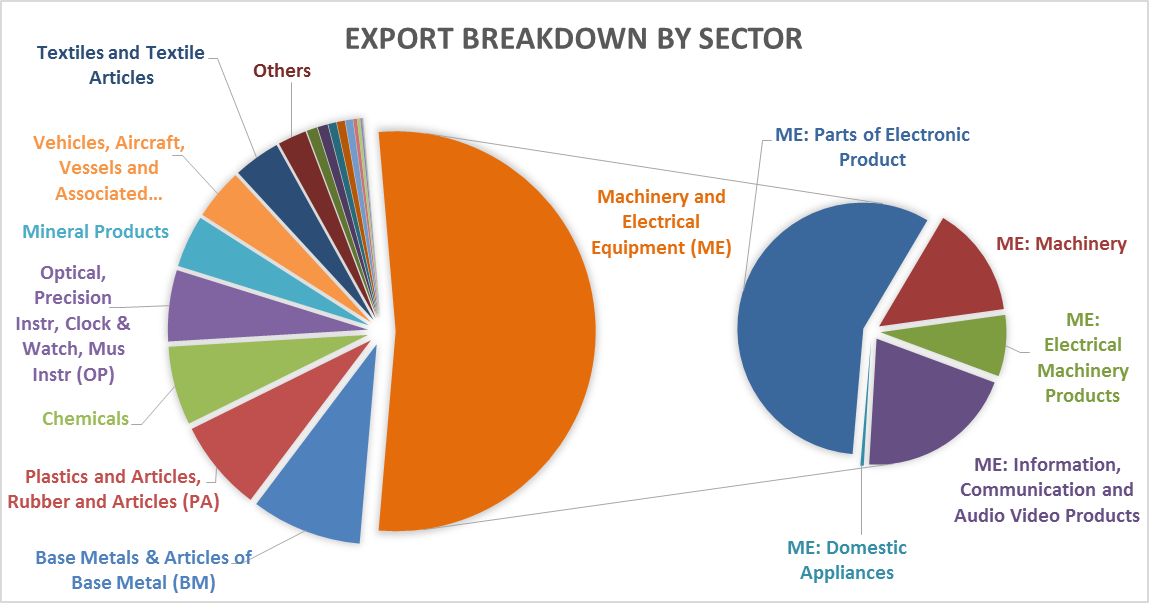

Taiwan, as with other East Asia economies, is still very dependent on its exports to spur growth. However, unlike the Southeast Asia economies, Taiwan has position itself at the higher value-added manufacturing supply chain. The bedrock of Taiwan’s economy lies in its manufacturing and exporting of electronic products.

Figure 4: GDP by Industry

Source: Taiwan Directorate-General of Budget, Accounting & Statistics, CEIC, Phillip Securities Research (Singapore)

| As at end of 2015, Manufacturing represented more than 31% of the GDP output. As such, manufacturing also accounts for the largest component of the nation’s total industrial production. Therefore if manufacturing does well, industrial production is expected to increase, lifting Taiwan’s overall economy.

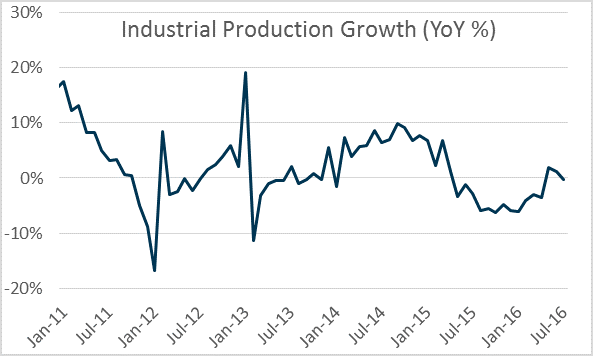

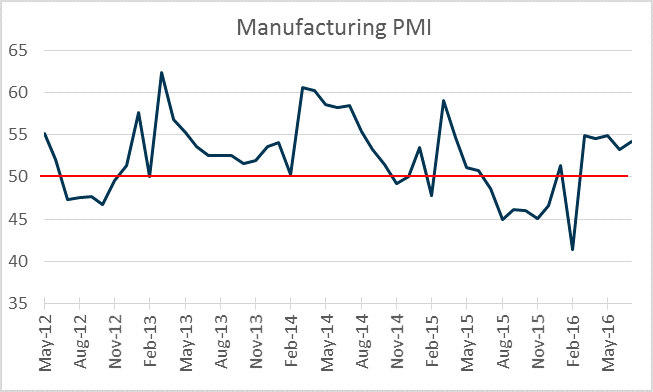

The industrial production index at the end of July was -0.31% YoY. However this small blip will not affect our view that the industrial production has taken a turn for the better after a year of downward cycle. The forward looking manufacturing PMI has remain positive, entering the fifth straight month of expansion. |

Figure 5: Industrial Production YoY Growth

Source: Taiwan Directorate-General of Budget, Accounting & Statistics, CEIC, Phillip Securities Research (Singapore)

Figure 6: Manufacturing PMI

Source: Chung-Hua Institution for Economic Research, CEIC, Phillip Securities Research (Singapore)

| Exporting Growth

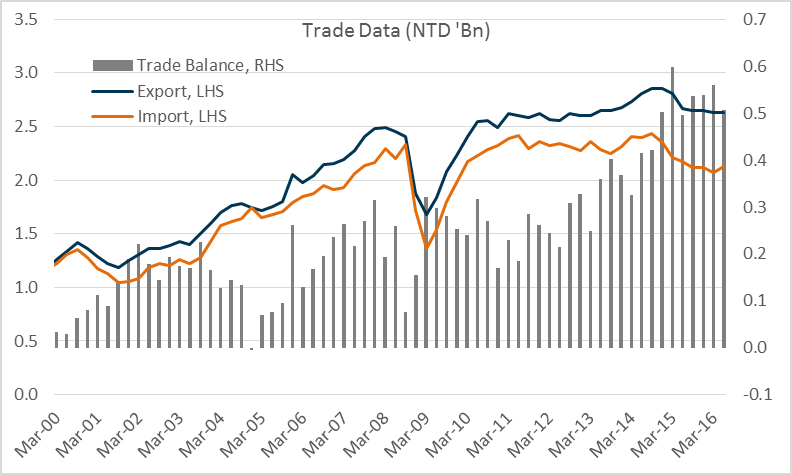

The dynamics of Taiwan’s economy had changed drastically in the past decades. Starting out as a textile and agricultural exporter, Taiwan industrialisation has allow them to be the world’s largest exporter of electronic goods. During their early stages of industrialisation, it has acquired technology from overseas and invested heavily in R&D to keep themselves at the forefront of the information, communication and technology (ICT) sector. This has allowed Taiwan to maintain a sizable trade surplus through the years. |

Figure 7: Export by Sector

Source: Taiwan Ministry of Finance, CEIC, Phillip Securities Research (Singapore)

Figure 8: Trade Balance, Export & Import

Source: Taiwan Directorate-General of Budget, Accounting & Statistics, CEIC, Phillip Securities Research (Singapore)

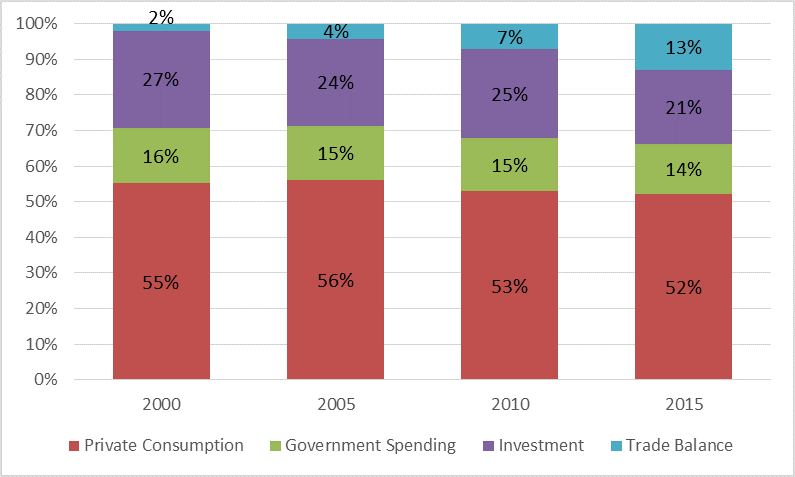

| However this has created an over-reliance on export for growth and puts Taiwan at a precautious state. Trade balance as a percentage of GDP have increased and accelerated in recent years due to the rise of China and Taiwan’s focus on cross-strait trade relation. In the past 15 years, growth in net exports has outpaced private consumption and investment resulting in a larger trade balance as percentage to the GDP. |

Figure 9: Percentage of GDP by Expenditure

Source: Taiwan Directorate-General of Budget, Accounting & Statistics, CEIC, Phillip Securities Research (Singapore)

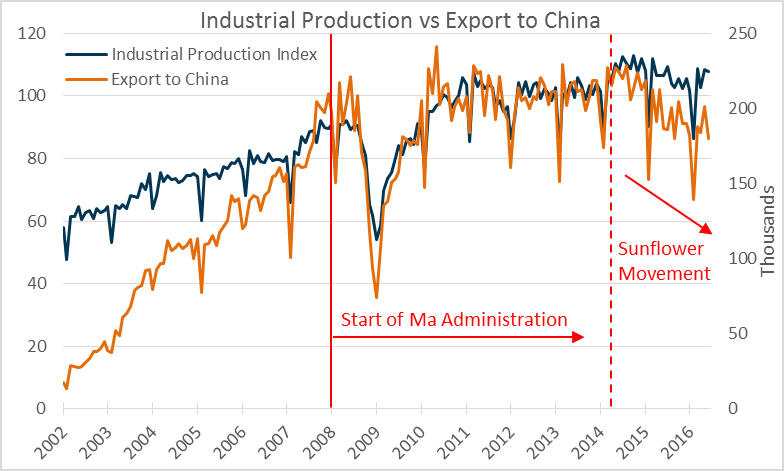

The risk of being too dependent on a single market can be identified when we overlay the industry production to Taiwan’s export to China. The strong correlation between the 2 data showed an overwhelming evidence of Taiwan’s vulnerability to any shock in the global demand.

Figure 10: Industrial Production vs Export to China

Source: Taiwan Ministry of Economic Affairs, CEIC, Phillip Securities Research (Singapore)

Export will remain crucial to Taiwan’s economy in the coming year. However the urgency to restructure its economy beyond just an export-driven country has never stronger. With DPP holding the majority seats in the Legislative Yuan, we expect DPP to layout a more comprehensive growth strategy as they search for growth engine within their shores. We believe with the help of government support and the entrepreneurial spirit of the Taiwan people, they will be able to build reputable firms which can compete in the ever demanding global landscape.

| Markets

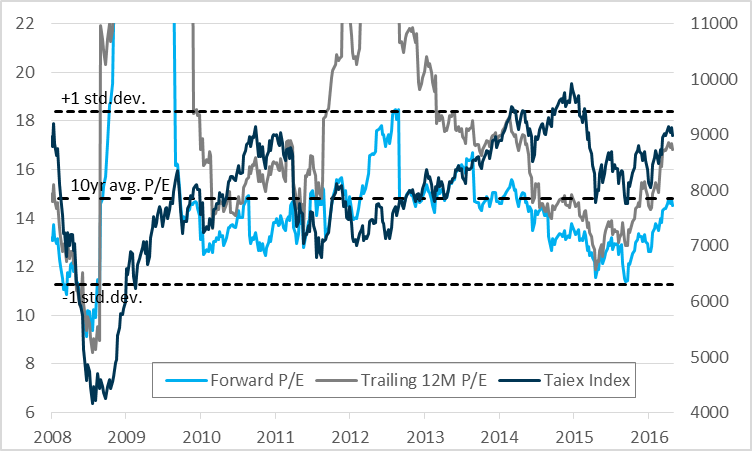

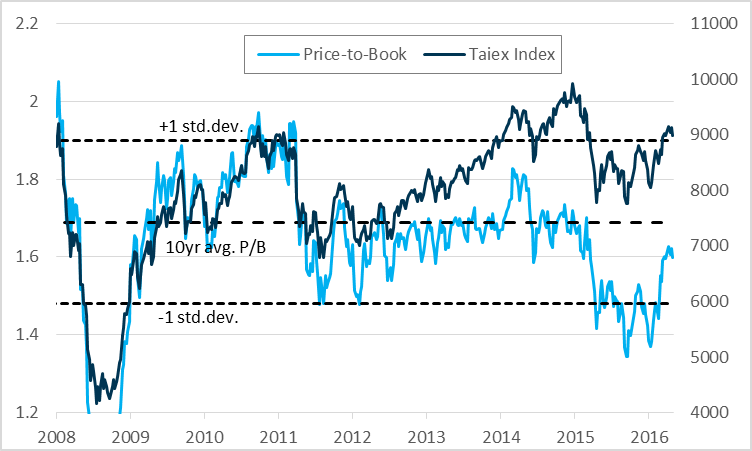

It is not surprising that the Taiex Index which is a proxy for the Taiwan market has c.47% of its weightage in the Information Technology sector. Taiwan Semiconductor Manufacturing Company (TSMC) is the single most heavily-weighted company in the index. It has a c.17% weightage out of the 856 companies in the Taiex Index. Therefore, manufacturing PMI and industrial production suffice to be leading indicators for its economy and thus its stock market. Valuations As Taiwan market recovers from its recent low in January 2016, valuations have been attractive as both its forward and trailing Price-to-Earnings ratio (P/E) did not spike up much. Forward P/E are currently at the 10 year average level. Price-to-book ratio (PB) is now at the lower end of the 10 year average. Price was moving in tandem with the PB ratio until 2012, where price and the PB ratio started to diverge. |

Both forward P/E and PB ratio are suggesting further upside for the Taiex Index as both ratios have reversed and is trending higher.

Figure 11: T12M & Forward Price/Earnings Ratio vs TAIEX Index

Figure 10: Price-to-Book Ratio vs TAIEX Index

Source: Bloomberg, Phillip Securities Research (Singapore)

| Market supported by foreign investment

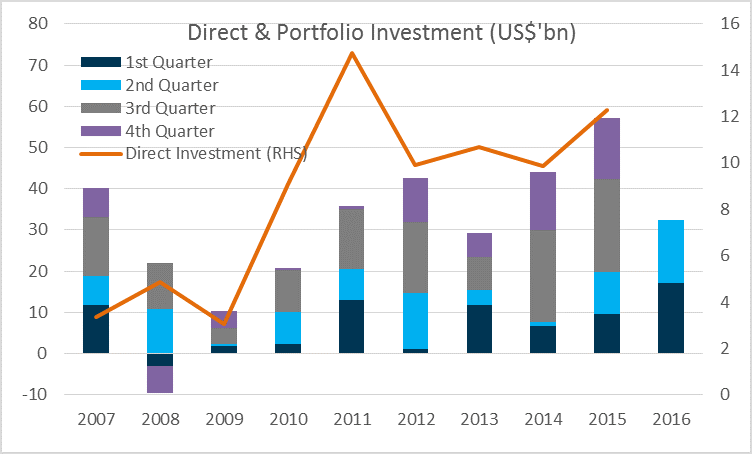

We are now seeing an unprecedented amount of foreign funds investing into the Taiwan capital market. At the end of 2015, there were a total of US$57.2 billion recorded portfolio investment. 2016 is set to break the previous high set in 2015 as there is already US$32.3 billion of portfolio investment made in 1H 2016, as compared to the US$19.7 billion in 1H 2015. Foreign direct investment which represent funds with a longer commitment has also increased steadily through since 2012. |

Figure 11: Foreign Direct Investment & Portfolio Investment

Source: Central Bank of the Republic of China, CEIC, Phillip Securities Research (Singapore)

| Conclusion

The economy of Taiwan is in a better shape than most of its emerging market peers. Through its initial export-driven model, Taiwan has accumulated a large balance surplus and foreign reserve capital. This will provide Taiwan with a strong fundamental economy to weather any unforeseen exogenous shocks. The strong fundamental will also create some buffer for the new Taiwan government as they transit to a new economic growth model. As DPP assume its role as the new government of Taiwan, there will be a lot of uncertainties. However we believe that it is also the main catalyst of growth. We are positive on the new government and their policies for economic reform. There is also further evidence from the market to suggest that investors are welcoming of the changes. This is reflected in the stock market price action and increasing foreign portfolio investments. “Growth demands a temporary surrender of security.” – Gail Sheehy |

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Sai Teng covers the global macro research. He has more than 6 years investment experience primarily in portfolio construction and asset allocation. He graduated with Bachelor of Science in Banking and Finance from University of London.