After more than four years of negotiations, the transition for SMRT to the New Rail Financing Framework (NRFF) was announced by the Land Transport Authority (LTA) on 15 July. Trading of SMRT shares was halted just before noon, pending the release of the announcement. The transfer of assets will put the onus on LTA to invest in new assets to meet capacity and demand, as well as replacing aged assets. Meanwhile, SMRT will take on its new role as an operator, being responsible for maintenance of the rail network and consequently delivering a reliable rail service.

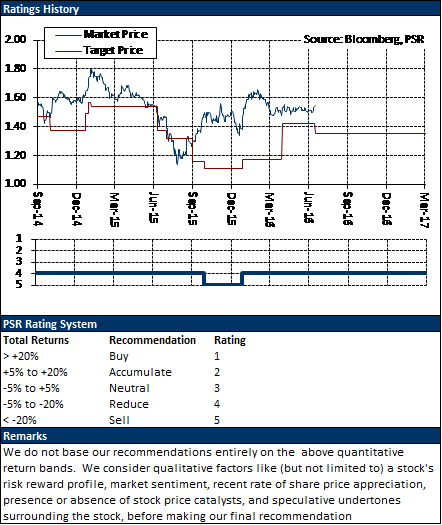

Maintain at “Reduce” rating with new lower target price of S$1.35 (previous S$1.42)

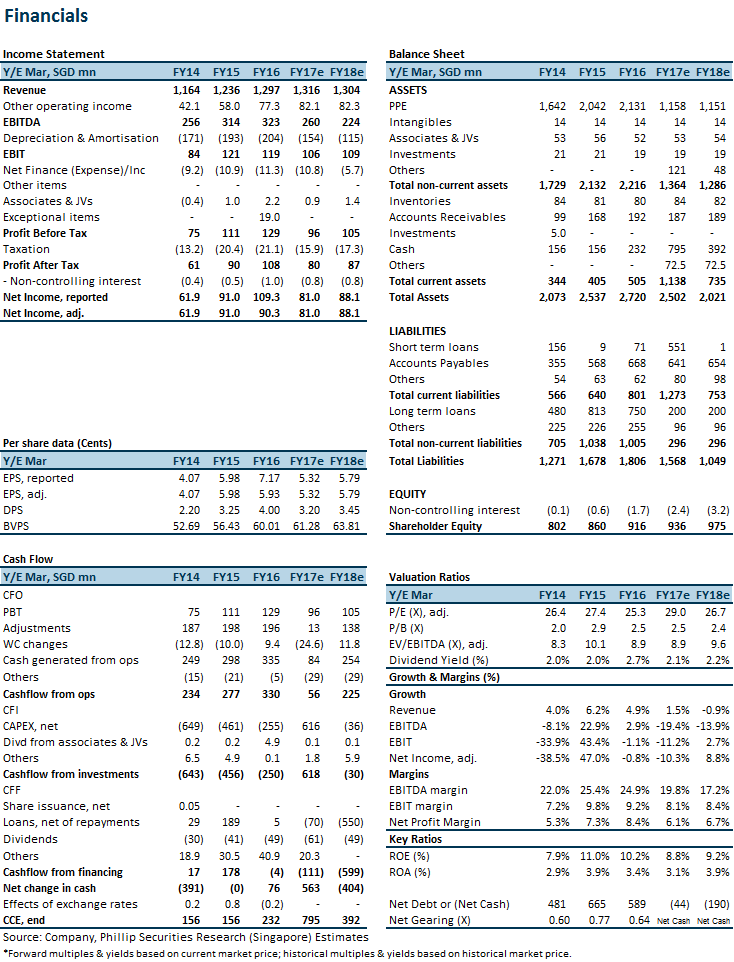

The transition to the NRFF will improve the free cash flow profile for SMRT, but does nothing to improve profitability. We continue to see earnings being depressed, due to stricter Regulatory requirements through Operating Performance Standards (OPS) for the Lines, Maintenance Performance Standards (MPS) and Key Performance Indicators (KPIs) for the operating assets of the Lines.

We raise our WACC to 7% from 6.8%, in view of the change in capital structure (retiring of debt) and the heightened business risk going forward. WACC should converge towards cost of equity as debt is being gradually retired.

Our target price of S$1.35 implies a forward P/E multiple of 25.4x FY17 earnings.

How do we differ from consensus?

We find ourselves at the lower end of consensus expectations in terms of future earnings and consequently valuation as well. We highlight that the bullish camp on The Street has previously assumed NRFF EBIT-margin of 5% to 15% being applied to the Rail business, and possibly a nominal Licence Charge being applied. We now know with certainty that the NRFF will adopt a 5% composite (Fare & Non-Fare) EBIT-margin on SMRT Trains with a Licence Charge and Profit Cap and Collar. With these material differences, we opine that the bullish camp on The Street has grossly overstated future earnings.

What is the news?

This will include items such as trains (rolling stock), permanent way vehicles, signalling and communication system, power supply, supervisory control system, escalators and lifts, platform screen doors, the environmental control system and automatic fare collection system, which are required for the operation of the North-South and East-West Lines (NSEWL), Circle Line (CCL) and Bukit Panjang LRT (BPLRT).

The first payment will be on the date of transition (1 October 2016), with subsequent payments on the next three anniversaries of the transition. Payment in the four tranches will be S$797 million, S$72.5 million, S$72.5 million and finally S$48 million. The sale proceeds of the first tranche will be used to pay down existing debt and invest in strengthening rail competencies; SMRT does not intend to pay a special dividend to Shareholders.

The intent is to improve maintenance performance and reliability of the rail system. In order to comply with the new MPS, SMRT intends to increase its maintenance staff by 20% over the next three years.

Upon commencement of the NRFF on 1 October 2016, SMRT Trains, will pay a Licence Charge to operate all three lines (NSEWL, CCL and BPLRT) under a single new licence. The new shorter operating licence of 15 years is to allow LTA to re-tender the operation of rail lines more often, thus making the industry more contestable. The Licence Charge will be paid into the Railway Sinking Fund, which will help pay for the building-up, replacement and upgrading of operating assets.

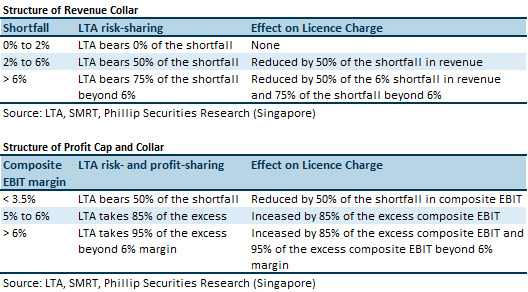

The Licence Charge that SMRT will have to pay, has been structured by LTA to allow SMRT Trains to earn a composite (Fare and Non-Fare) EBIT-margin of c.5%. The Licence Charge structure will provide a revenue shortfall sharing, and a risk- and profit-sharing mechanism.

How does the Licence Charge work in conjunction with the risk- and profit-sharing structure?

What is the composite EBIT-margin in the NRFF, and why does it matter?

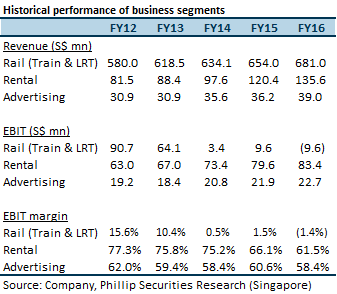

Among the various business segments reported by SMRT, the NRFF affects four of them: Train, LRT (collectively referred to as Rail or Fare), Rental and Advertising (collectively referred to as Non-Fare). SMRT derives Non-Fare revenue and EBIT through its Rail network, by leasing out commercial space within the MRT stations, and selling advertising space within the MRT stations and on the trains.

In FY16, SMRT generated revenue of S$681 million, S$135.6 million and $37.5 million for the Rail, Rental and Advertising business segments respectively. Of the total FY16 Rental and Advertising revenue, S$134 million of it was derived from within the Rail network. Management shared during the FY16 results briefing earlier this year that the Rail network contributed c.S$100 million and c.S$20 million to the Rental and Advertising segments respectively.

The Rental segment has historically delivered an EBIT-margin in the mid-70s, but this has come down in recent years due to the introduction of Kallang Wave Mall into the Group. Advertising has consistently delivered an average EBIT-margin of c.60%, but with a downward trend.

A significant amount of profits is derived from Rental and Advertising within the Rail network. Under the NRFF, these profits will be included into the composite EBIT, and consequently and composite EBIT-margin.

What has changed?

What remains the same?

How much will the Licence Charge be?

The quantum for the baseline Licence Charge was not disclosed. We examine SMRT’s FY16 financial results to get a sense of where the final Licence Charge could be priced at.

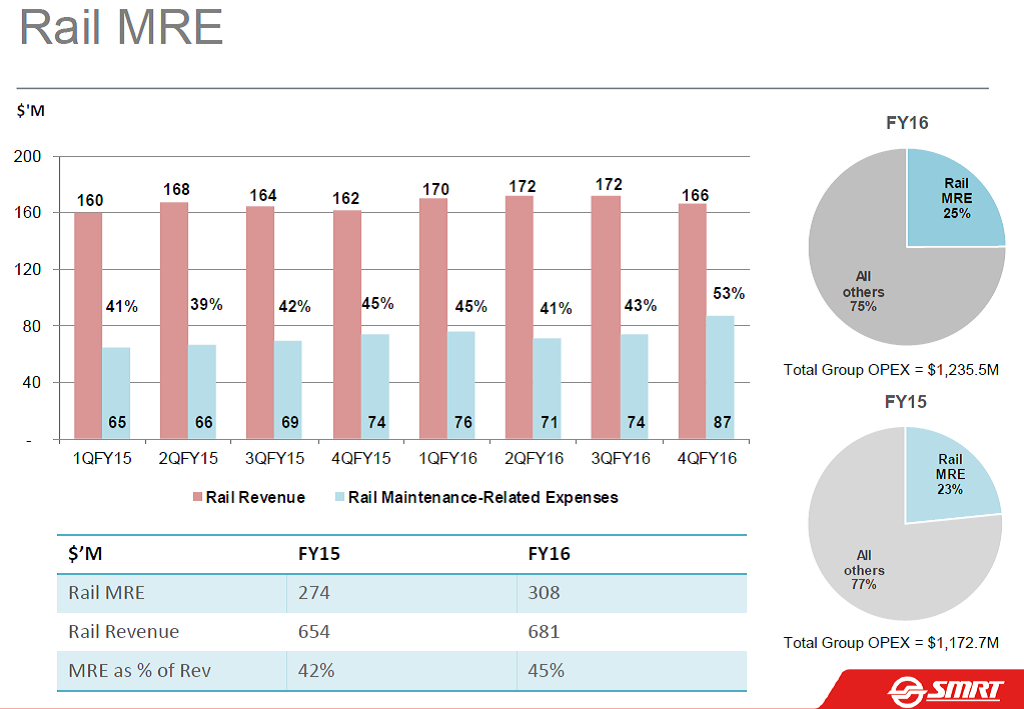

FY16 Rail Maintenance Related Expenses (MRE) was 45% of Rail Revenue. Management had previously guided that Rail MRE would trend towards 50% of Rail Revenue. We adjust FY16 composite EBIT downwards by S$34 million (5% of S$681 million) to S$44 million.

Under an asset-light model, there will not be any depreciation expense. Consequently, we believe that the final Licence Charge has been re-calibrated close to the existing Rail-related depreciation expense of S$100 million~S$110 million, in order to arrive at the target 5% composite EBIT-margin.

Going forward, we believe that baseline Licence Charge will be pegged to the Target Revenue, and then subject to further adjustment in accordance with the risk- and profit-sharing structure of the NRFF. We do not think that the baseline Licence Charge will be revised upwards in line with the growth in operating assets.

Source: Company FY16 Financial Results Presentation, 29 April 2016

Source: Company New Rail Financing Framework Presentation, 15 July 2016

How do we view this?

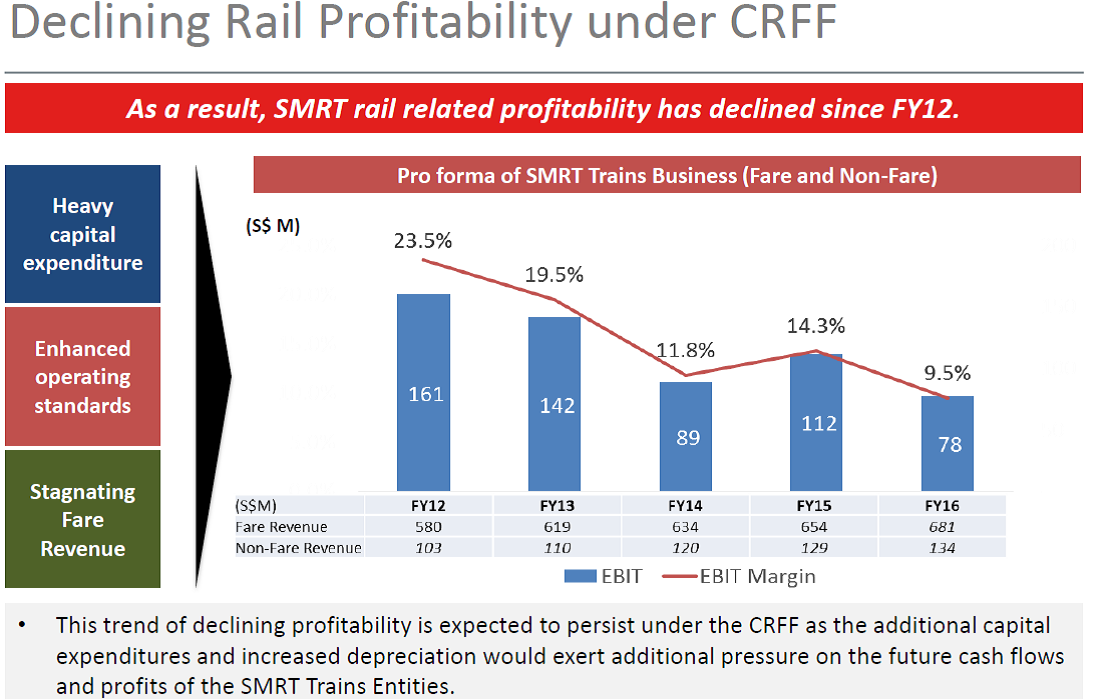

SMRT estimates its capital expenditure (CapEx) obligation to grow over the next five years to c.S$2.8 billion in aggregate. With fares being set by the Public Transport Council (PTC) under a fare adjustment formula, SMRT is not able to control its Fare revenue. The cost of higher ridership demand, higher performance and reliability standards and maintenance of an aging rail network had outpaced revenue growth; thus making the Current Rail Financing Framework (CRFF) unsustainable. With the implementation of the NRFF, SMRT will now be able to concentrate on its role as an operator and provide a level of service that is expected of it.

The shorter licence is intended to increase contestability in the industry, so that LTA can replace an under-performing operator sooner rather than later. We believe that there are no longer any sacred cows when it comes to public transport, and LTA would have the gumption to replace any incumbent operator. We draw a parallel to the recent transition of the Bulim Bus Package (the first package under the new Government Contracting Model for public bus services in Singapore), which has been smooth and successful. Thus illustrating that no incumbent operator is indispensable.

Without any operating assets, SMRT loses any bargaining power previously accorded with ownership. Making it even more so easier to be replaced by another operator. Recall that in a speech last year on 4 December (Paragraph 18), the Transport Minister had set a goal for LTA to build up its engineering capabilities and “establish a team that is able to take on operations and maintenance, should we decide to move in that direction”.

In lieu of SMRT’s future Rail CapEx obligations, LTA will impose an enhanced MPS under the NRFF. This is in line with SMRT’s role as an operator, and SMRT’s Management has guided that Rail MRE will trend towards 50% of Rail revenue.

With all three lines tied to the same operating licence, SMRT could be left with only its Bus and Taxi business, if it were to lose the right to operate the Rail network at the end of 15 years. However, this should not be a concern for shareholders today, since that event is beyond the typical investment horizon. However, it could pose an overhang on the share price as that date approaches, as uncertainty surrounds the renewal of the licence.

The Profit Cap and Collar structure affords little upside for SMRT, as LTA will take up to 95% of the profits that are in excess of the 5% composite EBIT-margin. At the same time, LTA’s downside is limited to the Licence Charge, as it will not share in any further risk if the Licence Charge payable is zero.

We view that the NRFF does not have any immediate impact on profitability and we have largely retained our earnings forecast. Without a depreciation expense but same level of profitability, the cash flow from operating activities will now be lower than before, since there is no reversal in the non-cash charge in the cash flow statement. This is offset by the reduction in CapEx requirements. Going forward, we see a more sustainable cash flow profile. Excess cash will be used to retire debt, thus lowering interest expense. SMRT has S$550 million of fixed rate notes maturing in October 2017. We have modelled their repayment in FY18. Overall, SMRT should be in better financial health going forward, but with the additional business risk outlined above.

Both the Fare and Non-Fare revenues and EBIT are used in determining the composite EBIT-margin for the Profit Cap and Collar. We have held the view that the Trains business cannot be view independently from the associated Advertising and Rental businesses. In our Land Transport Sector report, dated 8 December 2015, we had opined that “the Rail businesses should be viewed in totality with the Advertising and Rental businesses associated with it.”

We had long expressed our scepticism over any cash proceeds from the transfer of operating assets to LTA being disbursed to shareholders. We first stated more than two years ago on Page 5 of our re-initiation report on SMRT, dated 29 April 2014, that “we think it is unlikely that the cash would be returned directly to shareholders”.

Maintain at “Reduce” rating with new lower target price of S$1.35 (previous S$1.42)

Our target price of S$1.35 implies a forward P/E multiple of 25.4x FY17 earnings.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Richard covers the Transport Sector and Industrial REITs. He graduated with a Master of Science in Applied Finance from the Singapore Management University. He holds the CFTe and FRM certifications and is a CFA charterholder.

He was ranked #2 Top Stock Picker (Asia) for Real Estate Investment Trusts in the 2018 Thomson Reuters Analyst Awards, and ranked #2 Top Stock Picker (Singapore) for Resources & Infrastructure in the 2016 Thomson Reuters Analyst Awards.