Restructuring of services and partnering with OEM

The amalgamation of Rolls-Royce JVs Singapore Aero Engine Services Pte Ltd (SAESL) and International Engine Component Overhaul Pte Ltd (IECO) was completed on 2 October 2016. The intent of the amalgamation is to derive better efficiencies, scale and synergies.

Heavy Maintenance Singapore Services Pte Ltd (HMS Services) had received regulatory approval on 28 October 2016. The JV with Airbus combines SIA Engineering Company’s (SIAEC’s) maintenance experience with the technical expertise of the airframe original equipment manufacturer (OEM) to provide airframe maintenance, cabin upgrade and modification services for Airbus A380, A350 and A330 aircraft.

The operations of Pratt & Whitney (P&W) JVs Component Aerospace Singapore Pte Ltd (CAS) and International Aerospace Tubes-Asia Pte Ltd (IAT-A) will be integrated. The integrated entity is expected to generate better efficiencies, scale and synergies.

Lower interim dividend declared; lowered our full year forecast by 0.5 cent

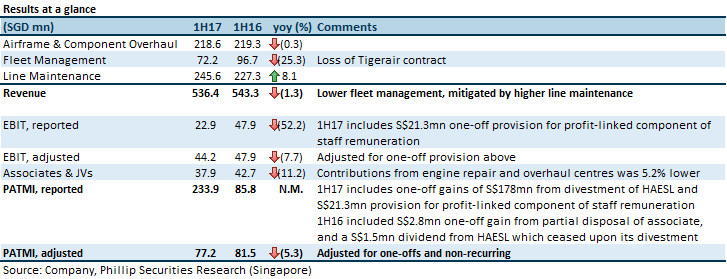

Interim dividend of 4.0 cents is 58.1% of 1H FY17 6.88 cents recurring EPS. This is lower than 1H FY16 interim dividend of 6.0 cents at 78.5% of 7.64 cents recurring EPS. We lowered our full year dividend assumption to 13.5 cents from 14.0 cents (due to lower revised net profit); our dividend payout assumption remains unchanged at 89%. Management remains committed to keep payout to 80%~90%, as per historical.

Divestment gains not likely to translate fully to a special dividend

While no firm decision has been made on the use of the S$178mn gain from divestment in 1Q FY17, Management has the intent to reinvest in technology and build up capabilities. Going by past momentum and capital outlay for new ventures, we think that up to only half of the divestment gains would be paid out as special dividend, amounting to approximately 7.9 cents/share. We believe that Management would adopt a conservative approach and distribute any special dividend over more than one FY.

Maintain “Reduce” rating with lower target price of S$3.28 (previous: S$3.39)

While work volume is expected to pick up in 2017, we believe work content will be lower compared to historical. This is due to better technology, which has led to better airframe and engine reliability. We have lowered our FY17/FY18 recurring PATMI by 5.1%/5.9%.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Richard covers the Transport Sector and Industrial REITs. He graduated with a Master of Science in Applied Finance from the Singapore Management University. He holds the CFTe and FRM certifications and is a CFA charterholder.

He was ranked #2 Top Stock Picker (Asia) for Real Estate Investment Trusts in the 2018 Thomson Reuters Analyst Awards, and ranked #2 Top Stock Picker (Singapore) for Resources & Infrastructure in the 2016 Thomson Reuters Analyst Awards.