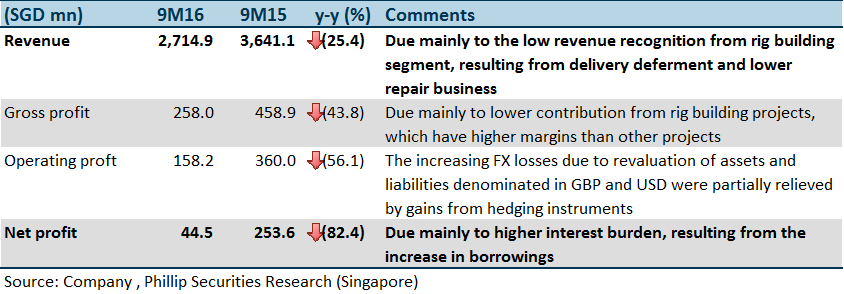

Results at a glance

Net order book drying up without new businesses

9M16 revenue plummeted 25% y-o-y to S$2,714mn, mainly attributed to lower revenue recognition due to slower progressive payment and delivery deferment requests from clients. During 3Q16, the group managed to deliver 3 offshore platforms (Wheatstone, Siemens Dudgeon, and Yamal PAU module), which matched management’s expectation. However, deliveries in the drilling segments (jack-ups, semi-subs, and drillships) were frozen over the last quarter.

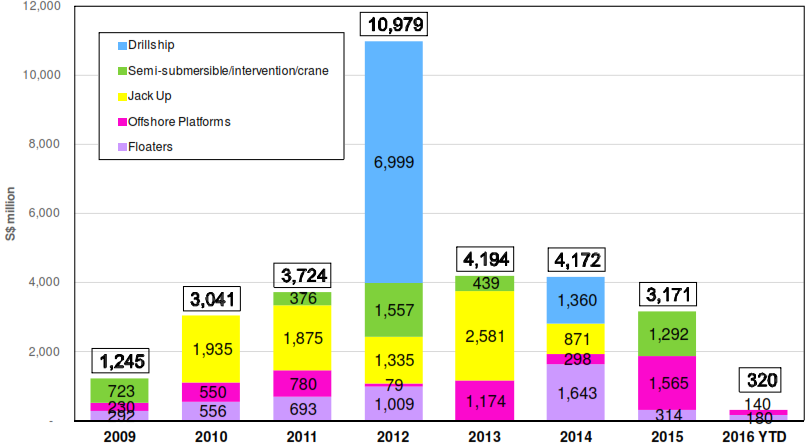

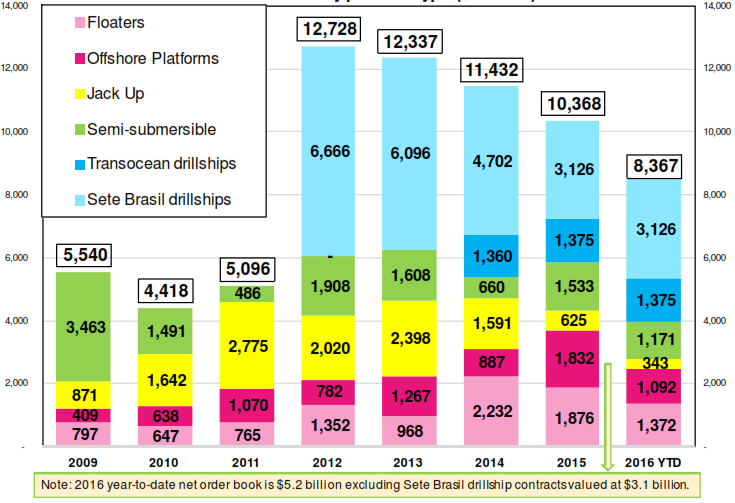

3Q16 was a quiet period for SMM to gain new business other than ship repairing, as there was zero growth of contracts q-o-q. As a result, the value of new contracts YTD remained unchanged from 1H16, at S$320m (see Figure 1). Comparatively, the Group won S$2.9bn worth of new contracts in 9M15. Meanwhile, the order backlog continued to fall amid smooth recognition of revenue. Referring to Figure 2, compared to backlog valued at S$10.4bn as of Dec-15, the amount was reported at S$8.4bn as of Sep-16, S$3.1bn out of which belonged to Sete Brasil drillships contracts. Sete Brasil has filed for judicial restructuring plan in Apr-16 and submitted it in Aug-16. Management has been active in following up with the arbitration proceedings, but we think that it could take a relatively long time to reach the final settlement. However the management believed the S$329mn of provision related to Sete Brasil’s projects made in FY15 was adequate. Moving forward, according to management’s guidance, SMM is facing more difficulties to achieve the scheduled deliveries in FY17 due to customer deferments, thus it is still struggling to monetise from the order book in the near term.

Figure 1. Contracts secured to date (excludes Repair)

Source: Company

Figure 2. Net Order book (by product type)

Sourece: Company

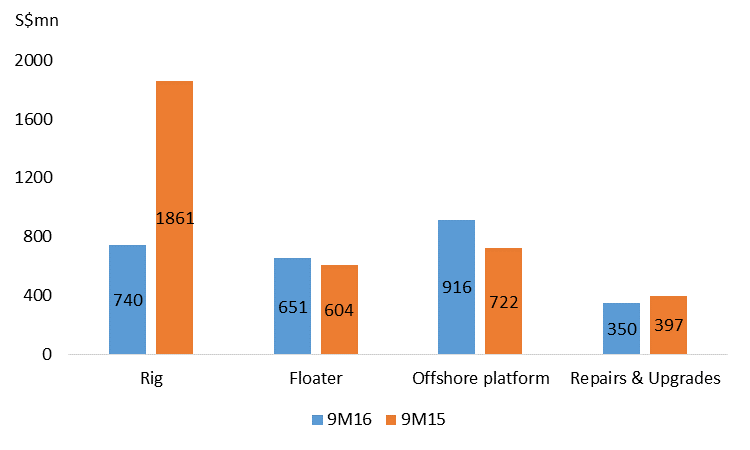

Leveraging on the upward momentum in non-drilling segments

As shown in Figure 3, owing to the success of securing substantial size of orders from floater and offshore platform projects, both segments slightly outperformed YTD in terms of y-o-y growth. In 3Q16, the group tried to maintain the positive momentum in these segments by making several acquisitions. In Aug-16, besides acquiring the remaining 15% stake in PPL Shipyard, it fully acquired LMG Marin AS, which specializes in ship design and engineering, especially of floaters and LNG vessels. These moves allowed the group to gain flexibility and efficiency when undertaking design and construction work for new orders, and more importantly, it will reduce cost without needing to outsource other 3rd party houses.

Figure 3. Core business revenue comparison

Source: Company, PSR

Ongoing cost reduction measures

Since FY15, SMM has laid off workforce of roughly 8,000 from the peak of 36,000 before FY14. On the other hand, the group also terminated several sub-contractors and reallocated manpower from the decreasing drilling activities to non-drilling ones. Through implementing salary freeze and adjustments of remuneration components for management team, SMM has been actively trying to optimize operating costs.

Relieving indebtedness, but still need more improvements.

As of 9M16, SMM reported S$4.1bn of total borrowings and bore a total S$62.9mn of interest expenses. Excluding cash on hand, net debt amounted to S$2.6bn, down 5% YTD, resulting in lower gearing (net debt-to-equity) at 1.03x, a slight improvement from 1.1x as of 1H16. Solvency weakened substantially though with interest coverage (EBITDA/interest expenses) at 4.2x in 9M16, compared to 4.8x in 1H16. The higher interest burden further suppressed the declining net profits over the 9 months this year. We believe that the management has been actively trying to reduce the debt level.

Missing the target

9M16 results missed our previous target substantially, because the group reported S$22mn of net loss mainly due to S$28mn of loss from associates as well as S$20mn of FX loss in 3Q16. Comparatively, the losses from associates was S$24mn, and FX gain was S$35 in 3Q15. Furthermore, without new contracts to replenish the order books, together with deferments and defaults on existing orders, the performance going forward is expected to be under downward pressure.

Investment Action

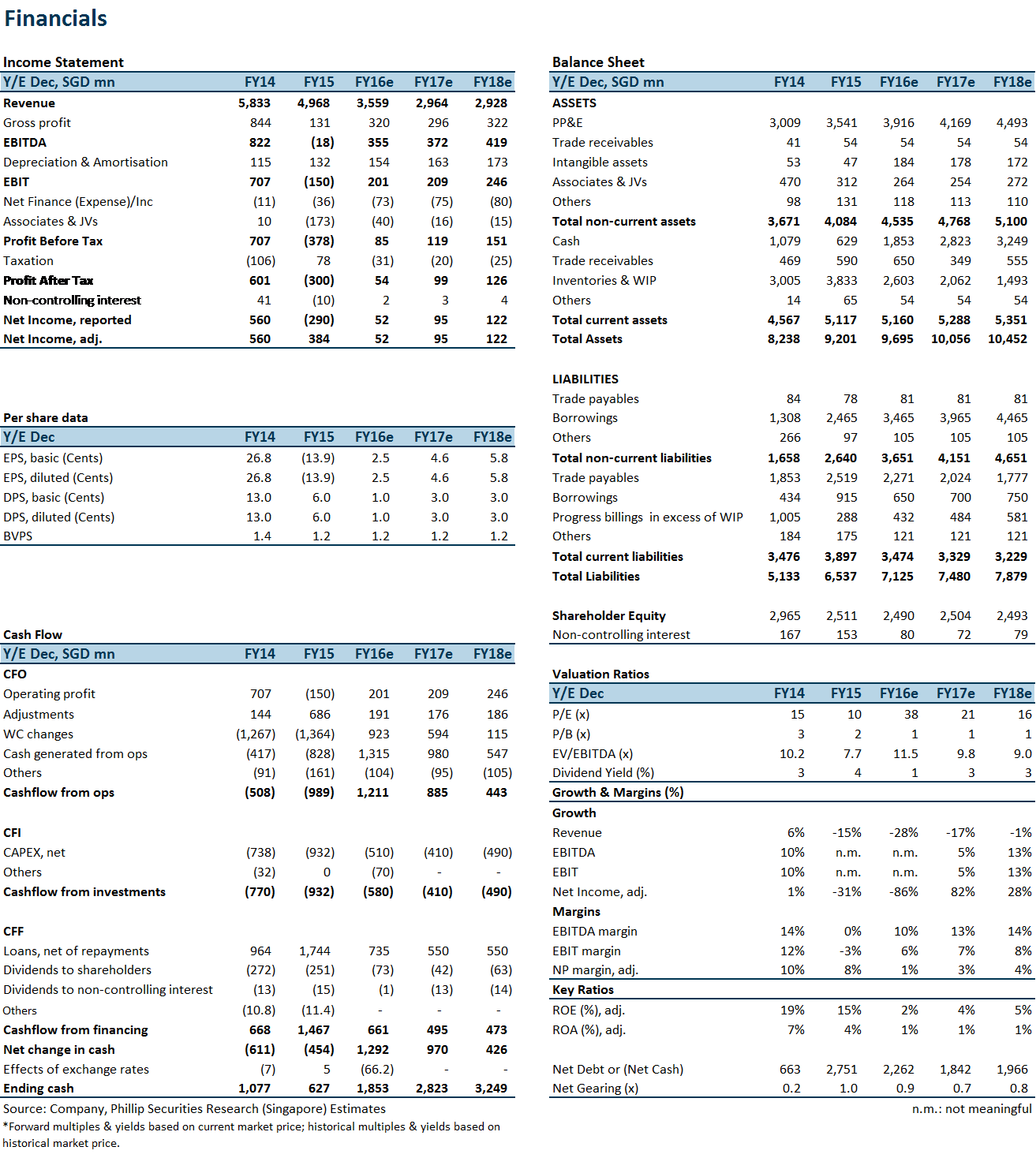

We revised our forecasts to account for weaker than expected performance YTD, higher finance expenses and expected losses in associates and joint ventures, which led to a lower net income of S$95mn and EPS of 4.6 SG cents in FY17e. Our FY17e and FY18e net income/EPS are adjusted downwards 55% and 43% respectively from previous forecast. Currently, SMM is trading at a 12-month forward PE of 19.0x.

We downgrade our call to Sell with a lowered TP of S$0.87 (from S$1.14), based on a PER of 19.0x. This implies a downside of 31.8% from the last close price.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Guangzhi graduated from Singapore Management University with a Master degree in Applied Finance and from South China University of Technology with a Bachelor degree in Electronic Commerce.

The current sector coverages include Energy, Utilities, and Mining sectors. He has 3 years experience in equity research in both Hong Kong and Singapore market. He is the mandarin spokesperson for Phillip Securities Research in relation to China-related projects and all mandarin seminars and client events.