Investment Merits

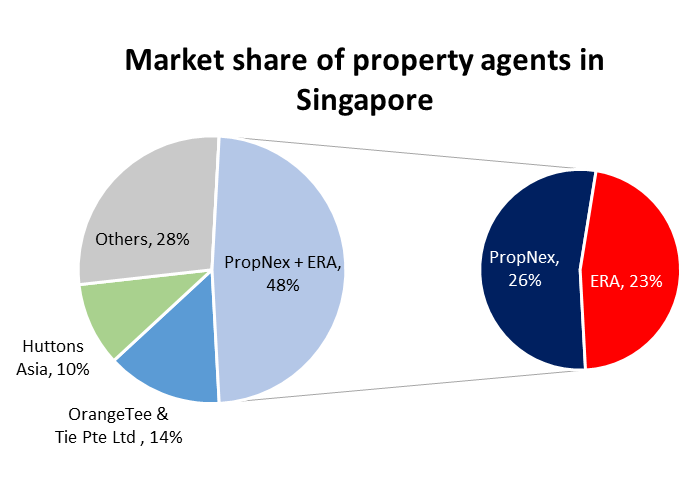

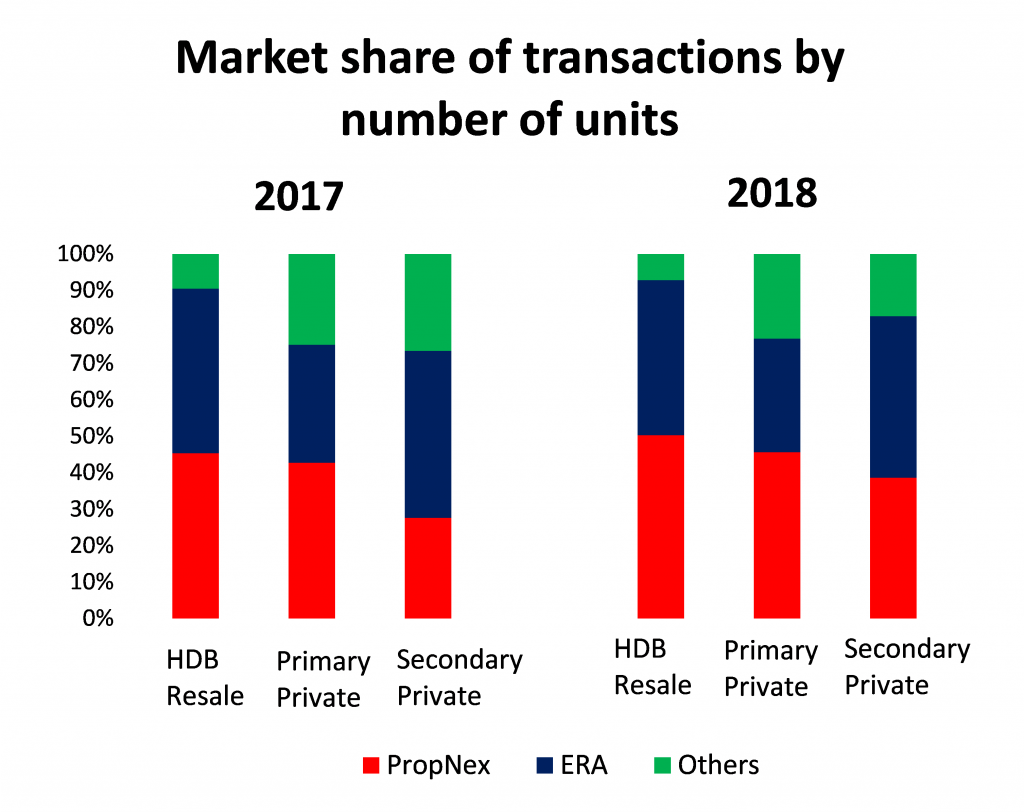

PropNex and ERA comprise c.48% of the property agents in Singapore (Figure 1). In 2018, these two brokerages made up for 93% / 77% / 83% of HDB resale / primary residential / secondary residential transactions (by no. of units) (Figure 2). Industry consolidation in the past has seen PropNex and ERA gain market share over the years, from 13% and 15% of total property agents in Singapore in 2012 to 26% and 23% in 2019, respectively. The dominance of these two market players within the real estate brokerage market in Singapore allowed them to capture a substantial amount of transactions, be it in a buyers’ market or sellers’ market.

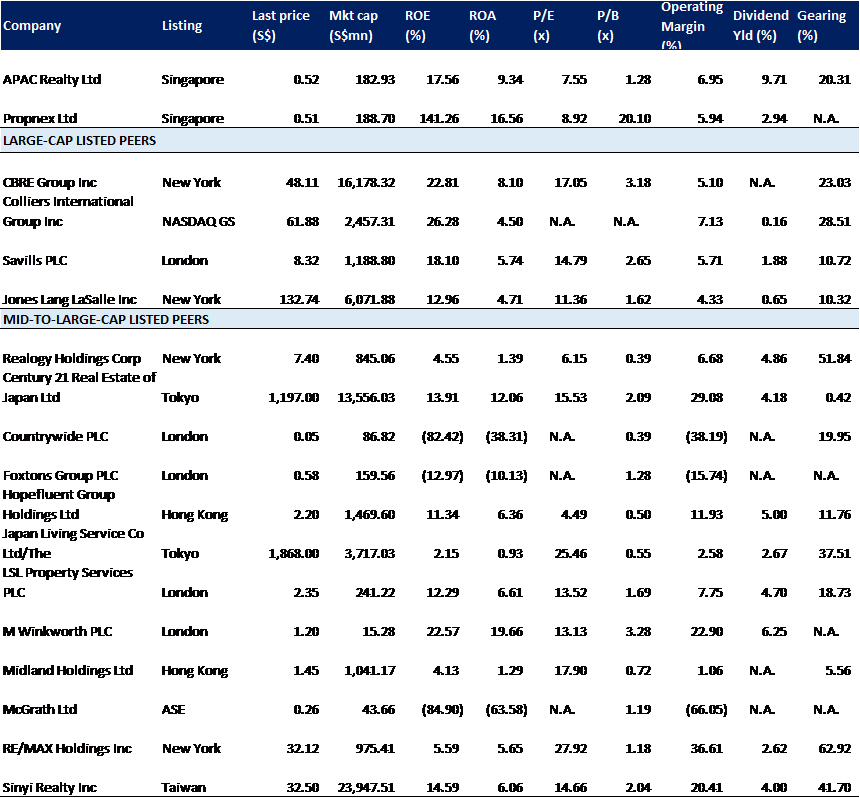

Both companies clocked in high double-digit ROEs over the years – PropNex 31% and APAC Realty 17%, for FY2018 – with little to no leverage (the debt presently held under APAC Realty relates to a mortgage over its single investment property). The brokerage business is asset-light, with most of the salesforce being paid on a variable basis, allowing both companies to easily maintain or grow their high ROE.

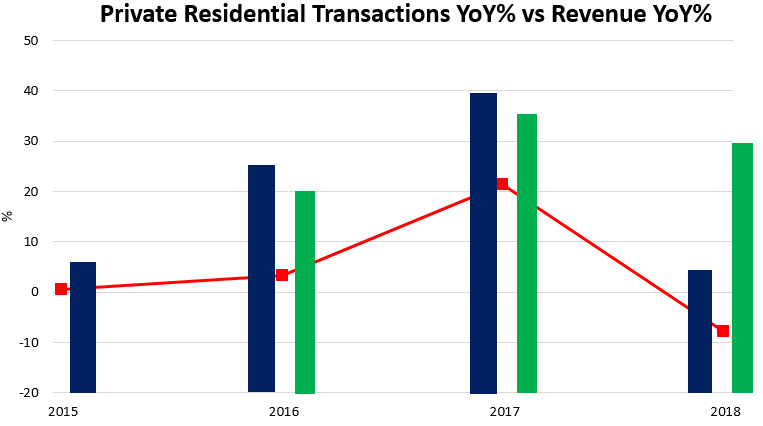

Both PropNex and APAC Realty were able to match or beat the movements of the property market each time, with their revenue YoY change overlapping that of the private residential transactions YoY change (Figure 20). In 2018 for example, PropNex and APAC Realty recorded a +6% and +30% increase in revenue, respectively, in spite of the -8% decline in private residential transactions. On the flip side, in 2017, PropNex and APAC Realty recorded a +39% and +35% increase in revenue, respectively, outstripping the +21% growth in private residential transactions.

Outlook

The real estate agencies’ model is highly scalable and resilient, especially with both APAC Realty and PropNex capturing an average c.85% of total market transactions. Aside from gaining market share and being a proxy to the Singapore residential market when volumes pick up, a key upside would be the pivoting towards overseas markets – by eventually owning and consolidating said operations, thus also diversifying the earnings base out of Singapore.

Investment Actions

Initiate on the Real Estate Agencies sector:

Real estate agencies landscape in Singapore

The real estate agency industry in Singapore is dominated by a handful of players (c.72% market share of agents belonging to just four players – see Figure 1) with the remaining market share spread over a thousand agencies.

The industry has gone through multiple consolidation exercises in the past (Figure 22), as a result of heightened compliance requirements and competition. This is also driven by the need to consolidate the smaller brokerages, as the natural attrition rate eats into the agent count of these brokerages – particularly so for agents that are not within the top few agencies.

PropNex Realty (PropNex) and APAC Realty (operating under the ERA brand), the only two listed real estate agencies in Singapore, have consistently held the top two positions in terms of market share of agents and currently hold close to half of the entire market share of property agents in Singapore. The bulk of these agencies’ earnings are generated via brokerage income, which is a function of transaction volume and prices, market share and commission rates. Other income is earned from – among other items – royalties by sub-franchisees, property valuation and management, training and auction.

Figure 1: PropNex and ERA Realty comprise close to half of the entire market share of property agents in Singapore

Source: CEA, PSR

Figure 2: Agency count among the biggest real estate agencies in Singapore. Currently, only PropNex and APAC Realty (operating under the ERA brand) are listed

|

Estate Agent |

No. of agents |

|

PropNex Realty Pte Ltd |

7,837 |

|

ERA Realty Network Pte Ltd |

6,839 |

|

OrangeTee & Tie Pte Ltd |

4,247 |

|

Huttons Asia Pte Ltd |

3,072 |

|

Others (c.1.2k agencies) |

8,399 |

|

TOTAL |

30,394 |

Source: CEA, PSR

Figure 3: Correspondingly, PropNex and ERA Realty both have 80-90% share of transactions across the private residential (primary and secondary) and HDB resale markets

Source: APAC Realty, PropNex, PSR

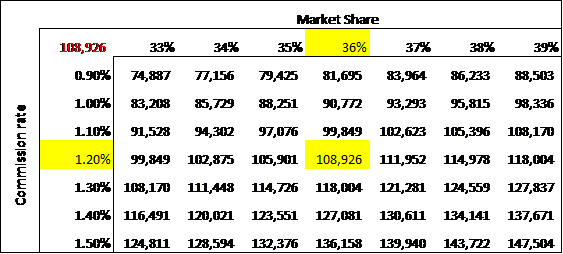

Commission structure for private residential sales (primary sales and resale)

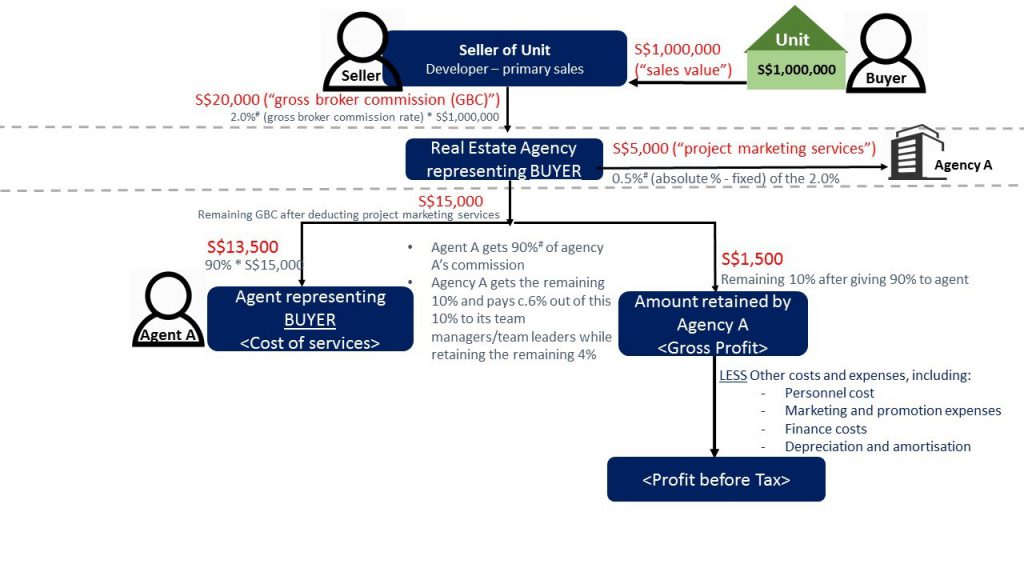

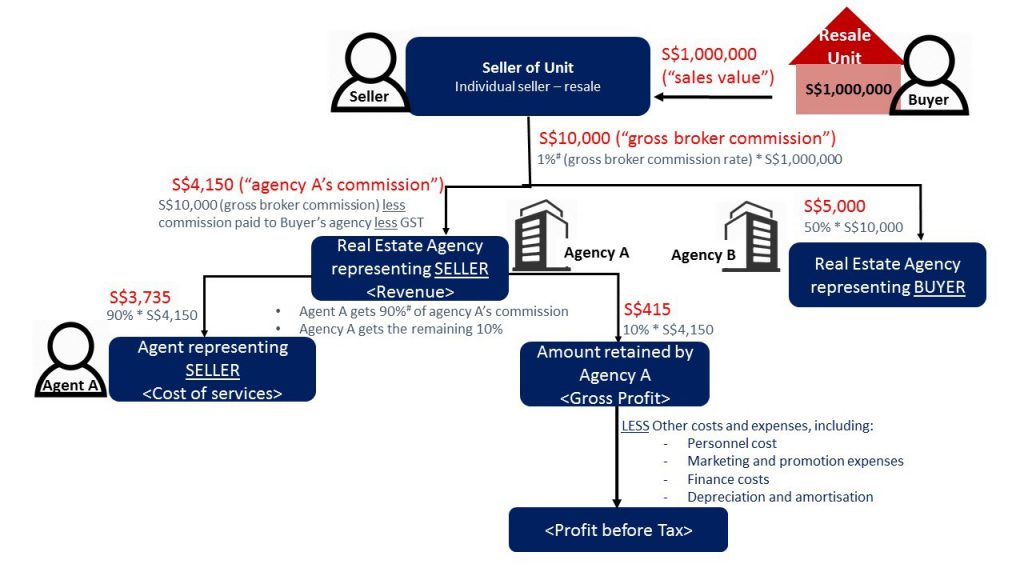

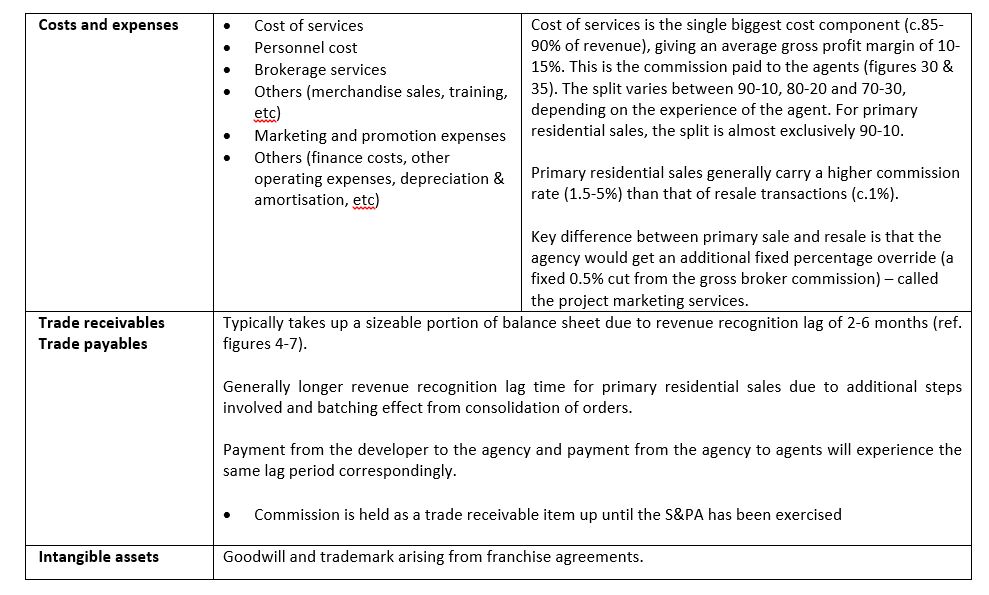

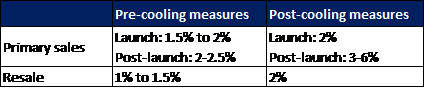

Key difference between primary sale and resale is that the agency would get an additional fixed percentage override (a fixed 0.5% cut from the gross broker commission) – called the project marketing services. The gross broker commission rate is a negotiated rate between Seller and Agencies – up to 5% for primary sales and typically 1-2% for secondary sales (figures 26-29, 34).

Figure 4: Example of a primary sale (private residential)

Source: PSR

Figure 5: Example of a resale (private residential)

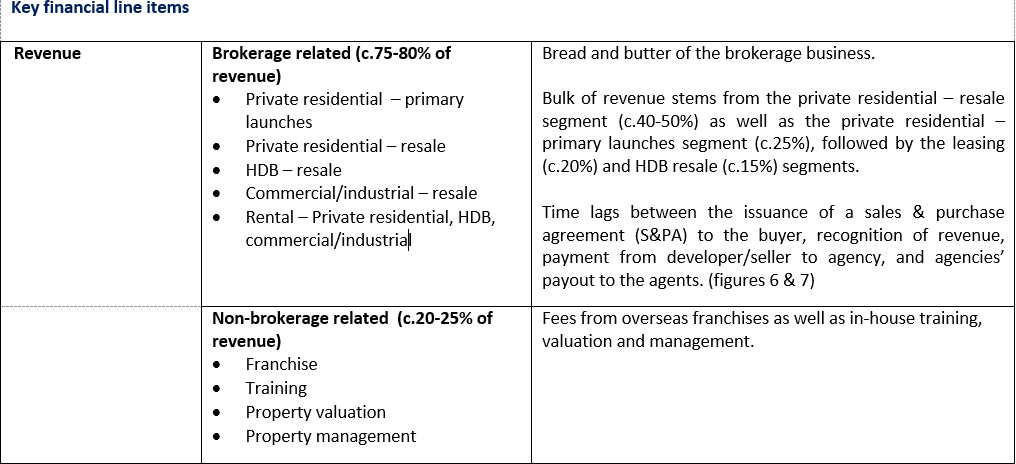

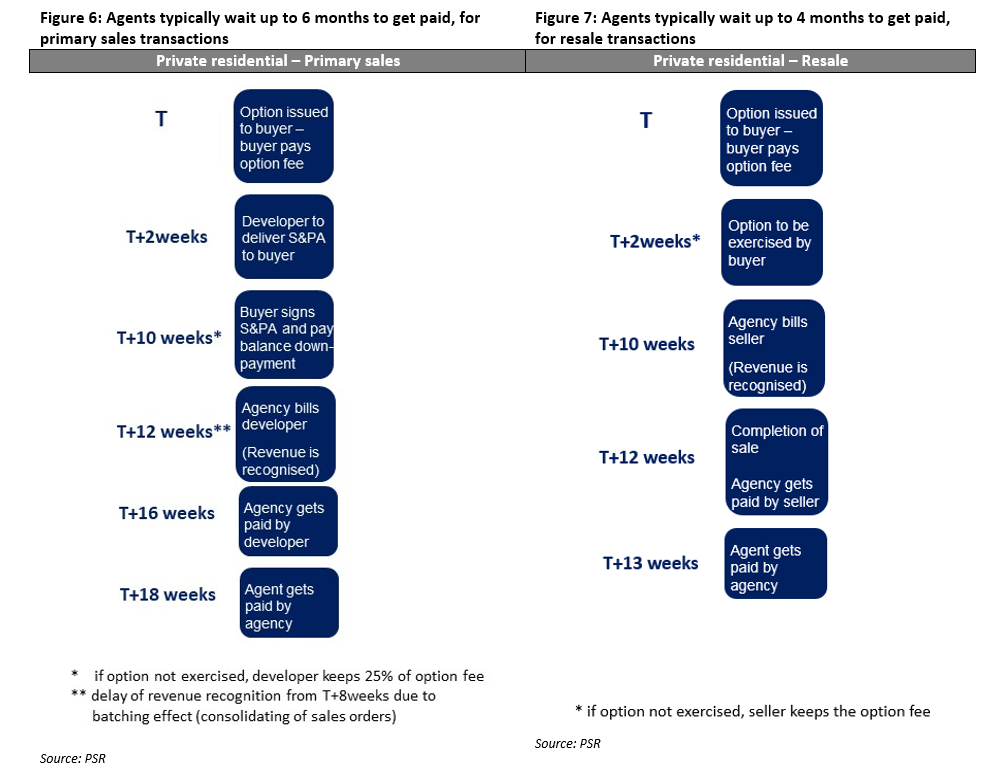

Figure 8: General seasonality effect observed for the resale and leasing segments, compared to the other segments. Given the time lag between the commencement of transactions and eventual revenue recognition, the lower rental and resale income in the first half of the year could be attributed to typically lower transaction volumes at year-end as well as the Chinese New Year.

Source: APAC Realty, PSR

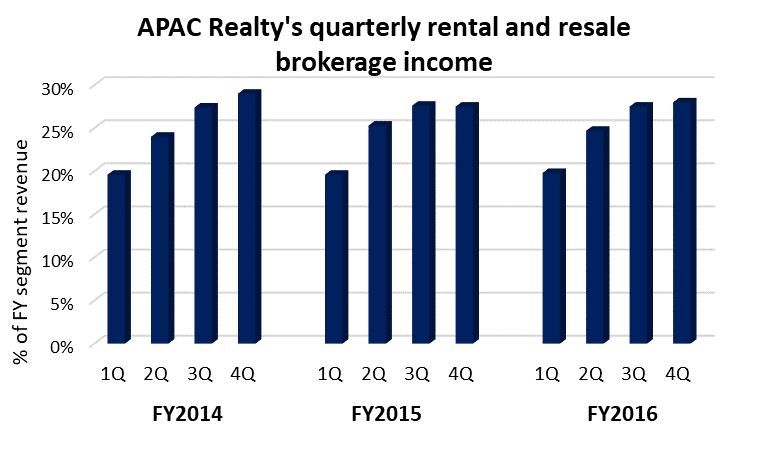

Figure 9: Sensitivity analysis between the commission rates and market share on revenue. For primary sales transactions, the margin may seem compressed as the project marketing fees are a fixed cut regardless of the level of commission rates paid out by the developer to the agency.

Source: PSR

Key risks

Risk of losing market share of number of agents to other agencies. While the number of agents do not directly correlate to the market share of transactions, the loss of key performing agents can result in a more-than-proportionate shift in market share of transactions.

In addition, the consolidation of agencies do not necessarily result in a sustained increased agent count, as there could be fallout due to a clash of company culture, among other things.

Risk from companies offering online platforms or solutions that ultimately reduce the need for an agent and that would render the brokerage business non-competitive.

While we believe a wholesale displacement of real estate agents by technology platforms is unlikely in the near-term, there is a risk of certain market share migrating to these online platforms.

What does it take to be a property agent?

Requirements to be a property agent in Singapore:

Outlook for Singapore property market

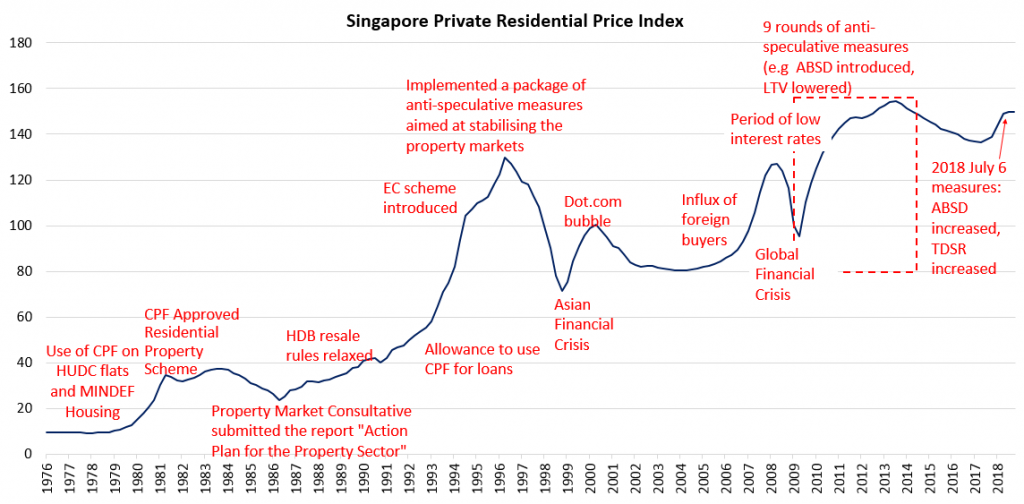

Figure 10: Major property events through the decades

Source: CEIC, PSR

Demand – muted in the near term

Supply – possible adjustment in upcoming supply

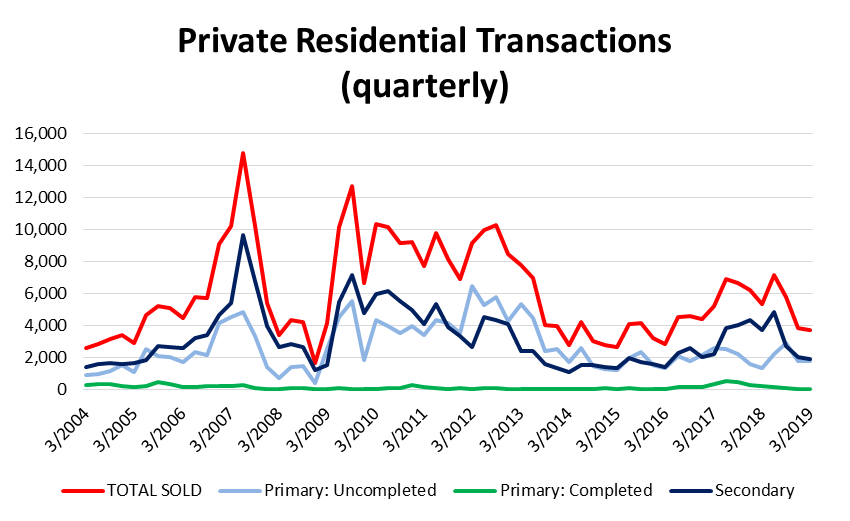

Figure 11: Uncompleted primary transactions held up better than that of the secondary market, both QoQ and YoY

Source: CEIC, PSR

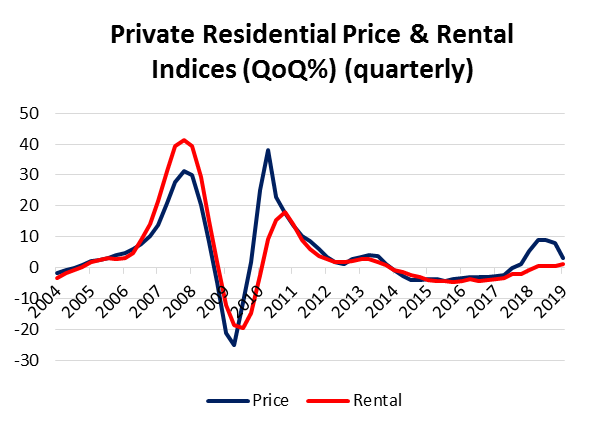

Figure 12: Prices took a dip QoQ in 1Q19, while rents held steady

Source: CEIC, PSR

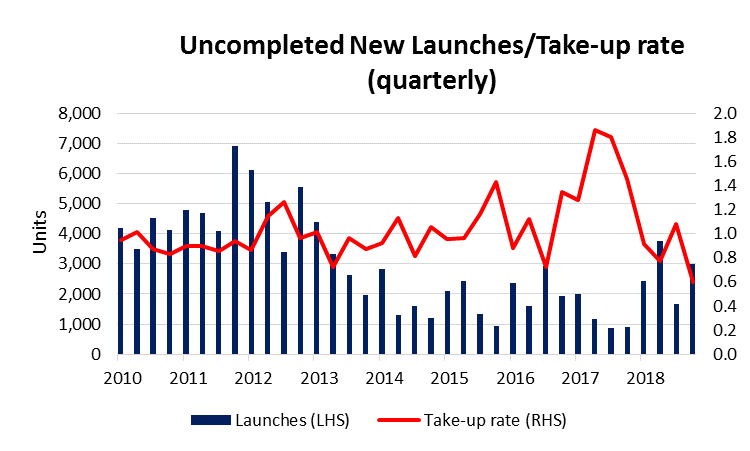

Figure 13: Take-up rate of uncompleted new launches declined to 0.6x in 1Q19 (2018 average: 1.1x)

Source: CEIC, PSR

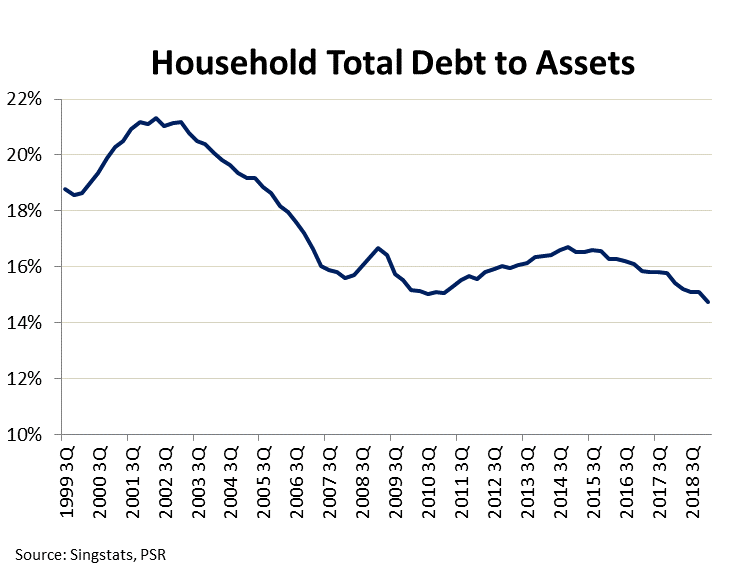

Figure 14: Household balance sheet has been healthier over the years

Source: Singstat, PSR

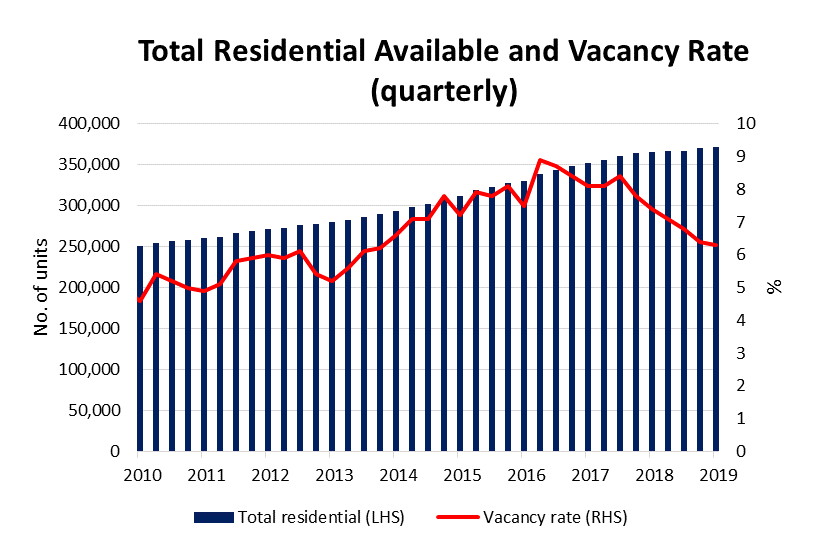

Figure 15: Vacancy rate had been declining since late 2017

Source: CEIC, PSR

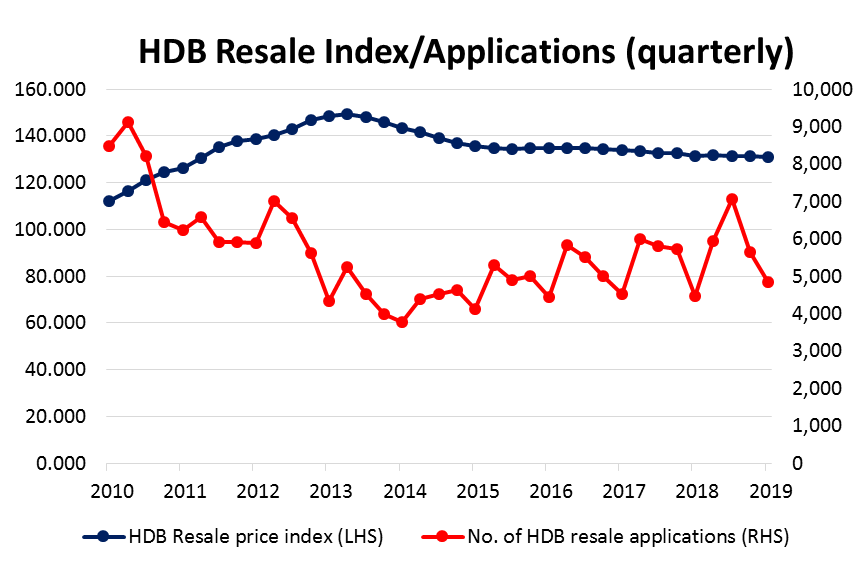

Figure 16: Excluding one quarter (3Q16), 1Q19 would have been the 22nd consecutive YoY dip in the HDB resale price index

Source: CEIC, PSR

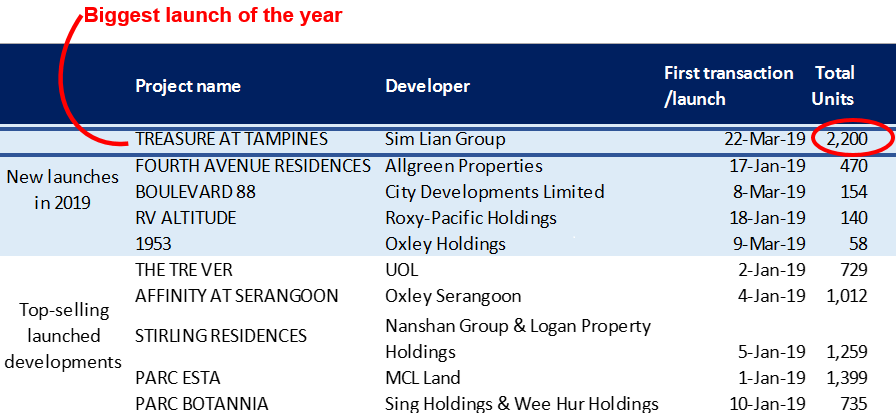

Figure 17: Anticipated line-up of 69 projects (>25k units) in 2019. Below are some of the new launches and top-selling launched developments in 1Q19

Source: CEIC, PSR

Figure 18: Developers have thrown in a “sweetener” in the form of higher commissions to agents post-cooling measures, which also underscores the significance of the agencies’ roles during these new property launches

Source: PSR

Figure 19: How the two listed Singapore property agencies stack against its global and regional listed peers. PropNex Ltd has the highest ROE and P/B ratio amongst all counters

INVESTMENT MERITS

PropNex and ERA comprise c.48% of the entire market share of property agents in Singapore. In 2018, these two brokerages made up for 93% / 77% / 83% of HDB resale / primary residential / secondary residential transactions (by no. of units). Industry consolidation in the past has seen PropNex and ERA gain market share over the years, from 13% and 15% of total property agents in Singapore in 2012 to 26% and 23% in 2019, respectively. The dominance of these two market players within the real estate brokerage market in Singapore undeniably allow them to capture a substantial amount of transactions, be it a buyers’ market or sellers’ market.

Both companies clocked in high double-digit ROEs over the years – PropNex 31% and APAC Realty 17%, for FY2018 – with little to no leverage (the debt presently held under APAC Realty relates to a mortgage over its single investment property). The brokerage business is asset-light, with most of the salesforce being paid on a variable basis, allowing both companies to easily maintain or grow their high ROE.

Both PropNex and APAC Realty were able to match or beat the movements of the property market each time, with their revenue YoY change overlapping that of the private residential transactions YoY change (Figure 20). In 2018 for example, PropNex and APAC Realty recorded a +6% and +30% increase in revenue, respectively, in spite of the -8% decline in private residential transactions. On the flip side, in 2017, PropNex and APAC Realty recorded a +39% and +35% increase in revenue, respectively, outstripping the +21% growth in private residential transactions.

Figure 20: Both PropNex and APAC Realty were able to match or beat their revenue movements against the movements in the property market transactions each time

Source: URA REALIS, PSR, APAC Realty, PropNex

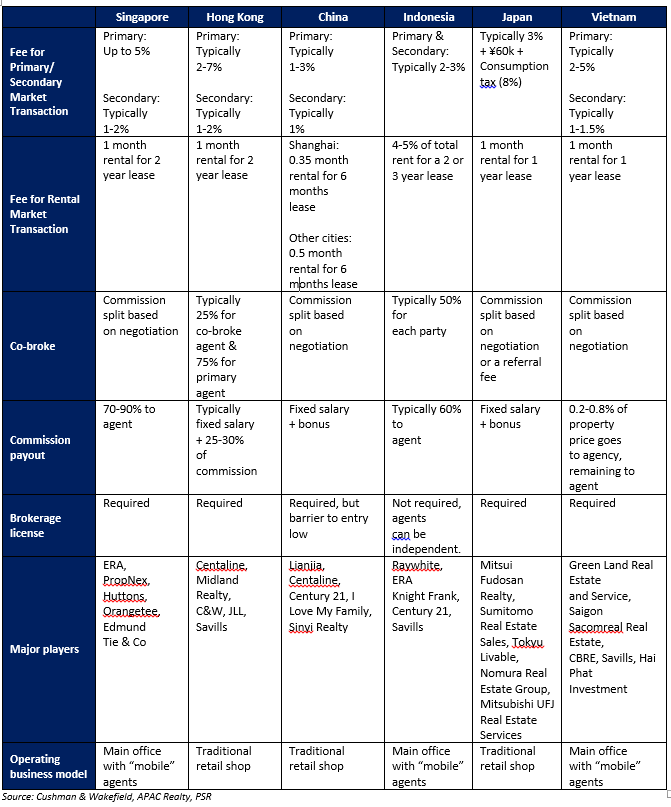

Figure 21: Agency practices across countries – the 70-90% commission payout is unique to Singapore

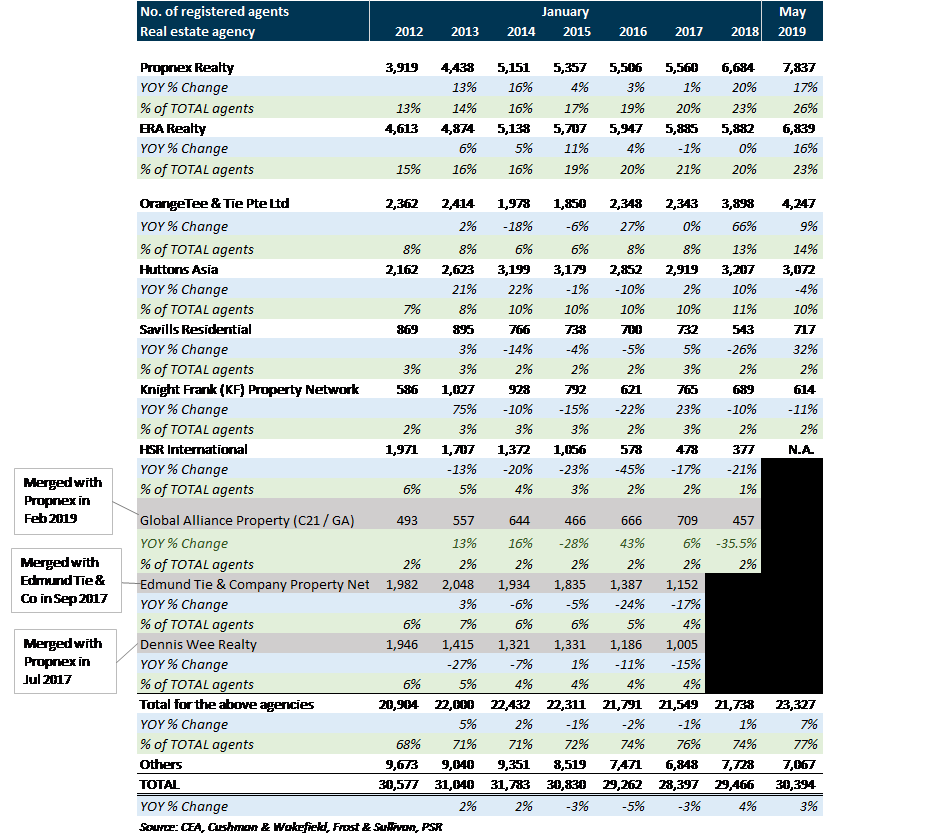

Figure 22: PropNex and ERA have consistently been the top two in terms of market share of number of agents, closely followed by Orange Tee & Tie Pte Ltd and Huttons Asia. PropNex had done two consolidation exercises in the past, of Dennis Wee Realty in Jul 2017 and Global Alliance Property (operating under the Century 21 franchise) in Feb 2019.

Source: CEA, Cushman & Wakefield, Frost & Sullivan, PSR

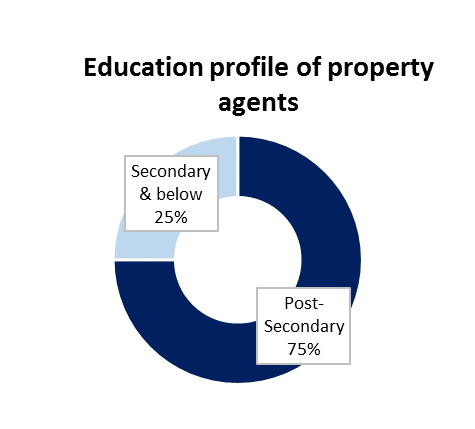

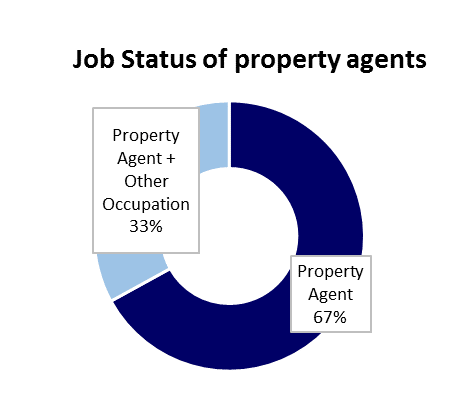

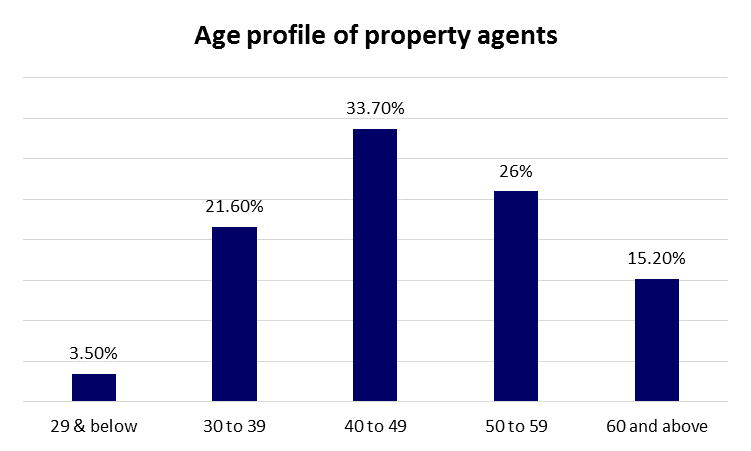

Figure 23: Demographics of property agents in Singapore

Most are exclusively property agents and do not hold any other occupation.

Majority of the registered property agents in Singapore are above 40 years of age.

Source: CEA, PSR

Read the full report for insights on APAC Realty Limited and Propnex Limited.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: