Clinics and Distribution businesses expansion as expected. Dental outlets in Singapore and China increased by 7 and 4 outlets, respectively, compared to 30 June 2015. Meanwhile, dental outlets in Malaysia remain unchanged. As at 30 June 2016, the Group has a total of 68 dental outlets, 4 medical outlets and 1 aesthetic centre in Singapore; a total of 8 dental outlets in Malaysia; and 3 dental hospitals and 8 dental outlets in China.

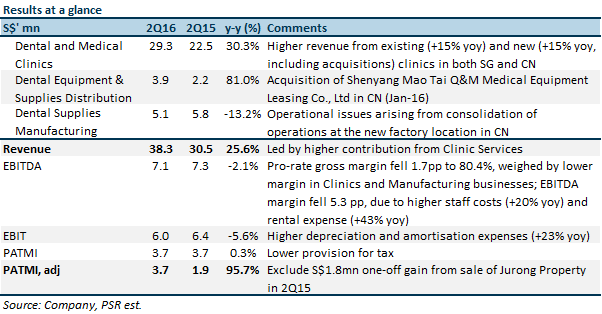

Higher turnover from its Clinics businesses, coupled with contribution from the newly acquired dental equipment and supplies distribution company in China, offset the slowdown in Manufacturing business due to Aidite’s relocation.

Manufacturing business to turnaround in 2H16. The Group noted that Operations have since stabilised and sales in June 2016 was higher than June 2015. With capacity doubling to five lines, we expect higher contribution as well as better margin due to economies of scale, from its China Manufacturing business.

Last call to shareholders to spin-off listing of Aidite. An extraordinary general meeting (EGM) will be convened to seek approval of shareholders for the Proposed Spin-off and the Restructuring Exercise on 26 August 2016. Should shareholders vote in favour, the effective interest of the Group in Aidite post Spin-off shall be 38.17%, and the earliest timeline of Aidite’s listing could be by end-2016.

Cash piling up, awaiting deployment. In net debt position of S$23.6mn, the Group’s sat on S$65.5mn war chest as at 30 June 2016. Based on historical deals, the amount could fund acquisitions for at least 20 outlets. We expect the Group to continue its roll-up strategy and some add-on acquisitions in Singapore while expanding its footprints in China. The Group stepping up its pace of acquisitions or picking up favourable deals, could lead to rerating.

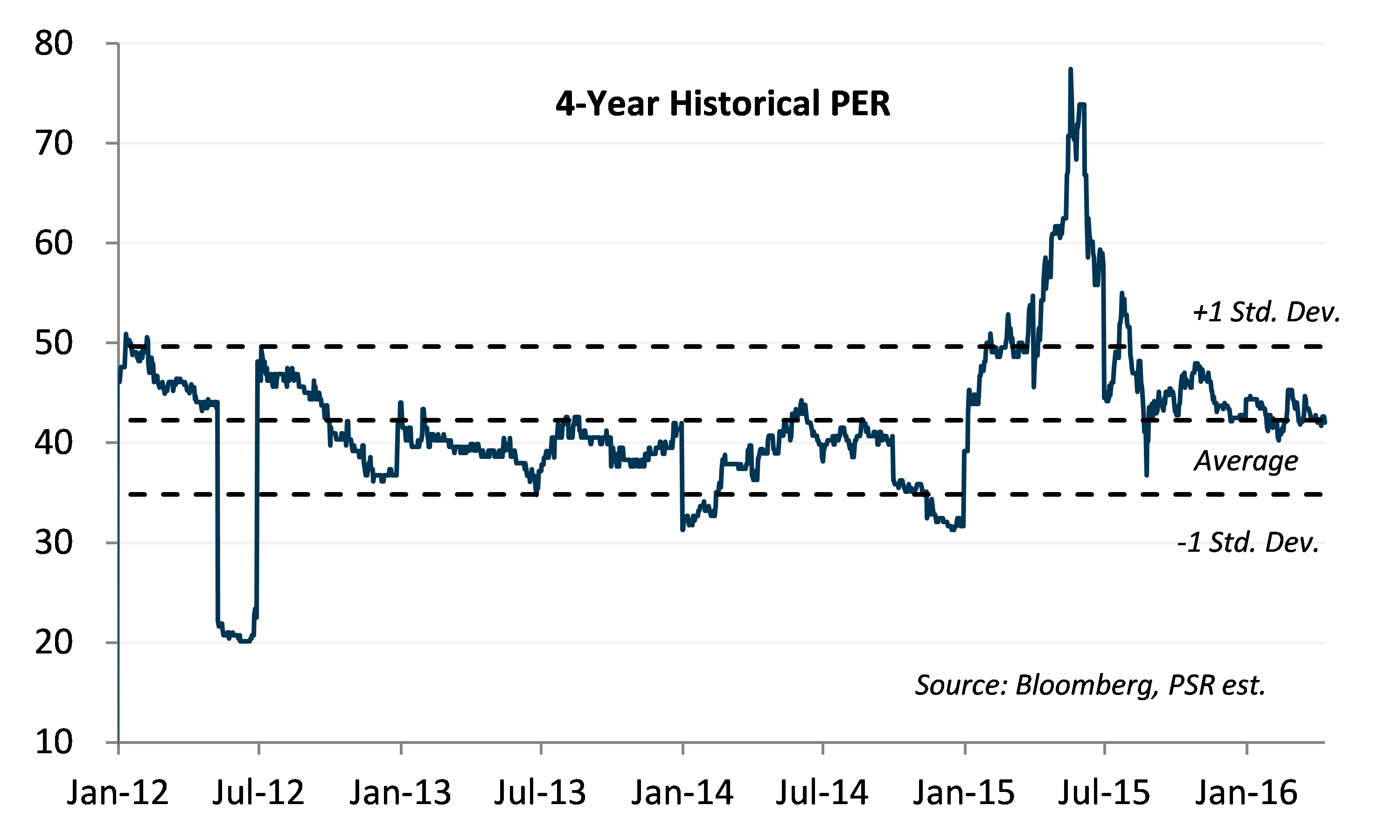

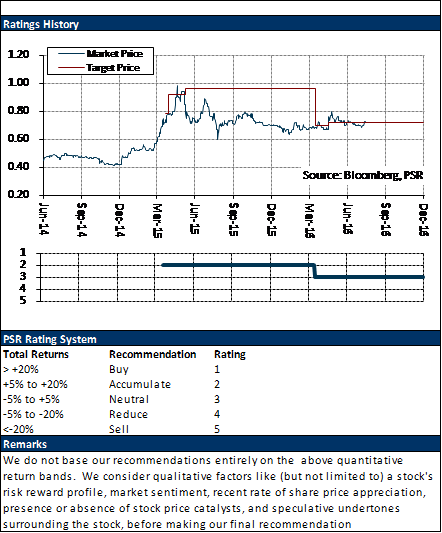

We maintain Neutral rating and TP of $0.72, based on unchanged estimated 1.89 Singapore cents FY16 EPS and 38.2x FY16F PER.

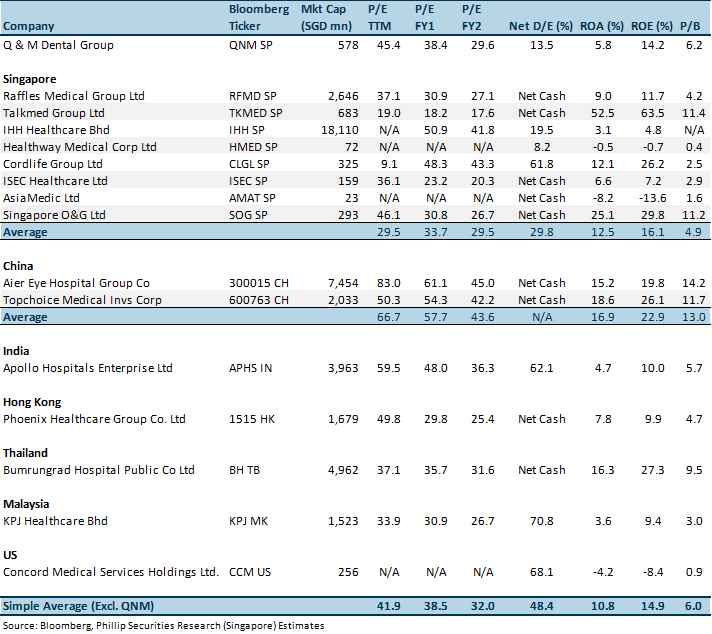

Q&M Dental Group is currently trading above the average Price/Earnings and in line with the peer average return on equity (ROE).

Figure 2: Peers Comparison

Figure 3: Historical PER

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Lin Sin has been an investment analyst in Phillip Securities Research since June 2014, where she started as an economist, focusing on China and ASEAN macroeconomics. Currently, she covers primarily the Consumers and Healthcare sectors in Singapore equities market.

She graduated with a Bachelor of Science in Mathematics and Economics from NTU.