Market: STI recovered in September with a modest 1.4% gain. YTD, it has returned a negative 4.3%. The rift between the U.S. and China is not limited to trade. It has spilled over to politics. Trump may realise it is not easy to pick a fight with someone your own size. Other pressure points are needed. To this end, the tone and rhetoric of the U.S. administration has intensified in recent weeks. The first salvo was fired by Vice President Mike Pence, accusing China of economic aggression, interference in US 2018 mid-term elections, stealing U.S. technology, intimidating neighbours, militarizing the South China Sea and religious persecution. In recent NAFTA (or USMCA) trade talks, a condition was also inserted that no member country can ink trade agreements with a non-market economy (we know who) without approval from the other member countries. More worrisome was an incident in the South China Sea in which a Chinese destroyer nearly clipped another U.S. Navy destroyer. Adding fuel to the fire were allegations by Bloomberg of Chinese spying from tiny microchips at data-centre equipment, based on their “anonymous” source(s).

Tensions with China are unlikely to abate anytime soon. China hawks Navarro (trade adviser) and Bolton (national security adviser) remain pivotal members of the Trump administration. But why all the hostility now? In part, we think Trump is seeking to beef up his credentials as a protector of jobs for Americans. Another more plausible reason is China’s “Made in China 2025” strategic plan. Unveiled in 2015, this is a 10-year strategy to escape the middle-income trap and emerge a powerful manufacturing country. China will raise domestic content to 70% in 10 targeted industries. It will manufacture its own semiconductors, medicines and planes. From a U.S. multinationals’ perspective, China has officially declared itself a competitor. It is no longer a customer or market for US products. Predictably, the multinationals will be more open to their governments’ attempts to slow down the progress of any competitor.

Recommendation: We have downgraded our STI target from 3700 to 3400. The backdrop for equities is not positive. Global economic growth has peaked, interest rates are inching higher and we have a new cold war. Furthermore, we expect caution as we head towards U.S. mid-term elections. A loss of the Lower House for the Republican Party would mean more investigations of the President. Despite their tacit support, Democrats are unlikely to approve an infrastructure spending bill that could boost Trump’s popularity. In Singapore, we still favour banks. Interest rates are rising and loan volumes, still healthy. A negative will be soft capital markets. This could hurt wealth-management income as risk-averse customers turn to lower-margin products. A stock that has become more appealing to us is SembCorp Industries. Almost all its businesses are perking up. India is enjoying a rebound in spot electricity prices. This augurs well for profits and increases the likelihood of securing long-term PPAs. Electricity demand in China is better than expected. Integrated energy operations in Jurong have shielded the company from depressing electricity spark spreads in spot markets. Expansion into renewables and rapid-response power plants should also fuel mid-term growth. As for its marine segment, it has been de-rated to fairly low expectations.

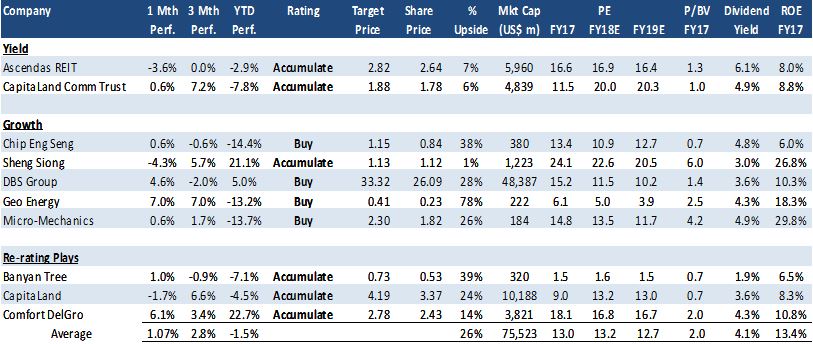

PHILLIP ABSOLUTE 10 – Our top 10 picks for absolute returns

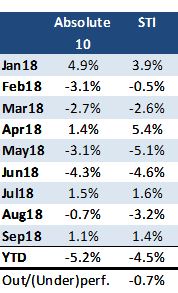

Source: Bloomberg, PSR. Phillip Absolute 10 performance assumes equal weight to every stock in the portfolio. Any change to Phillip portfolio is only conducted at month end. Performance of the portfolio and STI does not take into account gains from dividends.

HISTORICAL PERFORMANCE Portfolio Review:

Portfolio Review:

Our inaugural Phillip Absolute 10 Model portfolio began in January. It started well with a rise of 4.9% in January. Banyan Tree and CapitaLand led gains in January. DBS has been a significant contributor to our performance with a gain of 15% for the period of Jan-Feb18. We then switched to OCBC in March due to the higher upside to our target price and a beneficiary of higher interest rates (in particular through insurance business). In July we swapped out Asian PayTV, Dairy Farm and OCBC, with CapitaLand Commercial Trust, Sheng Siong and DBS.

In September, our gains could not match the STI. Our largest gainers were Geo Energy, ComfortDelgro and DBS Group. Transportation stats continue to support the reduced supply of private hire vehicles and the taxi fleet has started to recover, albeit modestly. Geo was helped by an announcement to dual list in Hong Kong. Weakness was in Sheng Siong, Ascendas REIT and CapitaLand.

We are still comfortable with our portfolio and no changes will be made. Sheng Siong is undergoing some profit taking after some stellar gains. We expect strong earnings from the company as gross margins pick up from higher contribution of fresh food and sales expands with new store openings Ascendas REIT share price was hurt by a share placement. We still like Ascendas for it diversified portfolio of more than 100 properties. It will also enjoy pick-up in rental for the business parks as office rentals in the core central region continue to climb. New investments into Singapore will favour their high-spec buildings. CapitaLand is pulled down by the expected weakness in property sales as new cooling measures were rolled-out. We like CapitaLand emphasis on building up its recurrent revenue base as it seek higher quality income with better ROEs from an asset-light model.

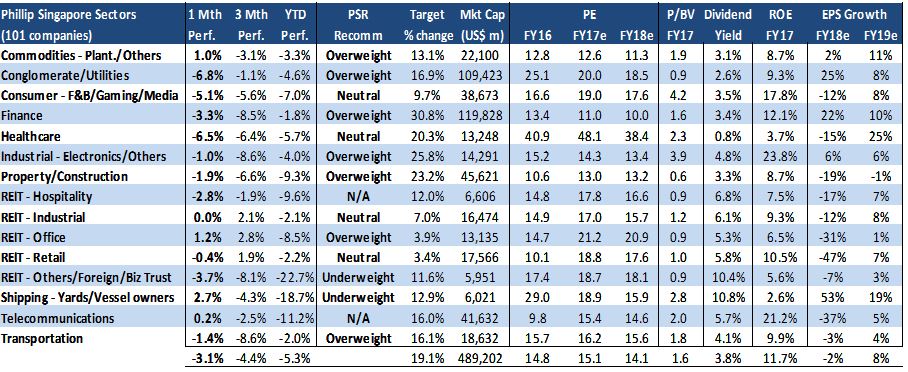

PHILLIP SINGAPORE SECTOR UNIVERSE

Best performing sectors in Sep18 were Shipping, Industrial and Consumer. Shipping benefited from 15.9% jump in Yangzijiang and 21% rally in Sembcorp Marine. In Industrial, 800 Super (+20.5%) and ST Engineering (+6.6%) took the lead in gainers. Consumer benefited from gains in Thai Beverage (+9.7%), Best World (+17.6%) and SPH (+2.5%).

Best performing sectors in Sep18 were Shipping, Industrial and Consumer. Shipping benefited from 15.9% jump in Yangzijiang and 21% rally in Sembcorp Marine. In Industrial, 800 Super (+20.5%) and ST Engineering (+6.6%) took the lead in gainers. Consumer benefited from gains in Thai Beverage (+9.7%), Best World (+17.6%) and SPH (+2.5%).

Worst performing sectors in Sep18 were REIT-Industrial, Property and REIT-Others. REIT-Industrial lost groud due to losses in Ascendas REIT and Mapletree Logistics. Property suffered from losses in Hong Kong Land, OUE and Guocoland. Weakness in REIT-Others was due to declines in Asian PayTV (-11%), Accordia Golf (-3.5%) and Manulife US (-4.2%).

SUMMARY OF SECTOR AND COMPANY VIEWS

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.