Company description

Nam Lee Pressed Metal Industries (Nam Lee) is an established metal fabricator dealing in aluminium and steel products. Nam Lee remains the only worldwide third-party manufacturer of aluminium frames for container refrigeration units in the world for a major customer.

Nam Lee’s range of other aluminium and steel products includes gates, door frames, staircase nosing and hand-railings, sliding windows, grilles, laundry racks and letter boxes for flats and houses.

Nam Lee was listed on the Singapore Exchange on 26 October 1999 through 12,000,000 Offer Shares at S$0.42 each, and 35,500,000 Placement Shares also at S$0.42 each.

Investment Highlights

Nam Lee is currently trading at 0.71x trailing price-to-book (P/B) multiple and we estimate rolling next-twelve-months (NTM) forward price-to-earnings (P/E) multiple to be only 6.9x, versus peer trailing average of 13.1x.

As of end-June 2016, net current asset (NCAV) per share of Nam Lee was 36.2 cents. Net current asset value is defined as total current assets, less total liabilities. It conservatively assumes that non-current assets do not have any salvage value, and only current assets are used to pay off both current and non-current liabilities. At its last close price of 37.0 cents, the stock price is just 2.2% above its NCAV.

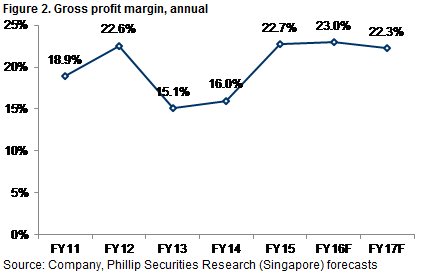

While year-to-date (YTD) 9MFY16 revenue is 14.7% lower year-on-year (yoy), profit after tax and minority interests (PATMI) has grown 14.6% yoy. Nam Lee had renewed its contract with its major customer two years ago at better pricing, which led to the expansion in gross margin. The benefits have largely been able to flow through to the bottom line. 3QFY16 was particularly weak in terms of yoy revenue growth, and we are erring on the side of conservatism to forecast a weaker 4QFY16 as well. This results in a weaker FY16F PATMI being 4.1% lower yoy, but with better margins mitigating the 12.7% lower yoy revenue.

We see Nam Lee’s cash hoard growing in FY16F due to the higher free cash flow. The higher free cash flow arises from three factors: higher profit (compared to historical average), better working capital management and lower capital expenditure (CapEx). We expect positive net change in cash of about S$12mn from S$38.4mn at the start of FY16F.

2.5 cents dividend was declared for FY15, equivalent to S$6.0mn cash paid as dividends. We see Nam Lee generating positive net cash flow from operations in the mid-teens range, under normalised conditions.

We estimate 5.14 cents EPS for FY16F and 3.5 cents dividends per share (DPS) (1.0 cent ordinary and 2.5 cents special) to be declared. This translates to an implied forward dividend yield of 9.5%, based on last closing price.

Initiating coverage with “BUY” rating and target price of S$0.69

We opine that Nam Lee has been neglected by the market and is currently trading at a significant discount to what it is truly worth. It is currently priced just 2.2% above its NCAV and this will serve as a price floor for investors, limiting adverse downside price movement. Notwithstanding the potential 86% capital gains, we view the DPS of 3.5 cents as sustainable, and the dividend yield of 9.5% is highly attractive. High-conviction “BUY”.

Investment Thesis – High yield stock, offering a compelling risk-to-reward proposition

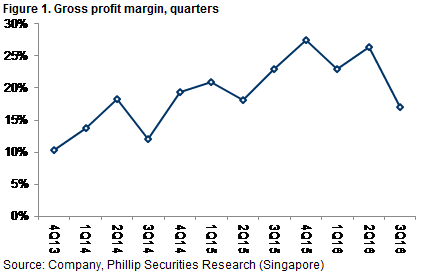

Unbeknown to the broader general market, there has been a re-rating catalyst for the stock. Nam Lee had successfully re-negotiated its contract with its major customer (Carrier Refrigeration Singapore Pte Ltd) for another five years at better margins. We believe that the previous contract had expired around end-2013 and was renewed in 1H-2014. Consequently, gross margin has been on an improving trend since 3QFY14 (fiscal year-end September). Our channel checks suggest that Nam Lee is able to pass on the raw material cost (aluminium) to its customer. Hence, Nam Lee is not exposed to fluctuation in aluminium price.

Nam Lee’s gross profit margin does not hold steady quarter-on-quarter (qoq) due to the nature of the contribution from project-based products. On a full year basis, we are forecasting gross profit margin to sustain at low-twenties.

Nam Lee’s speciality product is aluminium frames used for container refrigeration units, which are more commonly known as “reefers”. Reefers are used to transport perishable food. Demand for reefers and trade routes are non-cyclical with the underlying demand drivers of population growth and desire for fresh food. Detailed and accurate information on global reefer trade volumes is not available because only the carriers themselves have the data for their own operations and do not share it. However, according to a leading maritime research house, the main trade routes are bananas and pineapples shipped out of Latin-America, meat and dairy shipped out from Australasia, and intra-Asia movement of seafood, dragon fruit, garlic, durians, apples and pears. The next growth market for reefer could be the shipping of pharmaceuticals.

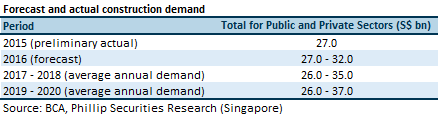

Nam Lee’s involvement in construction projects spans across both the public and private sectors. According to data from the Building & Construction Authority (BCA) of Singapore, there is a steady pipeline for construction demand all the way to 2020.

Net current asset value (NCAV) is one method of ascribing a liquidation value to a company. The NCAV of a company is the value of its total current assets, less its total liabilities. It conservatively assumes that all non-current assets are impaired to zero value, and total liabilities are paid from only the current assets. Looking at the NCAV of a company is a more conservative metric than the net asset value (NAV).

We believe that market concerns over Nam Lee’s customer concentration risk (from the contract for aluminium frames for container refrigeration units) have been an overhang for the share price. While the market concerns are valid, they are overblown, in our view. Nam Lee has a long standing relationship with its customer and Nam Lee’s economic moat stems from the switching cost for its customer. We opine that it is irrational for the stock to trade at a distressed level that is below its NCAV. With us highlighting Nam Lee’s NCAV, we believe that that there will now be a price floor at that level.

Going forward, we expect Nam Lee to consistently report at least a low double-digit full year PATMI. With the higher PATMI (compared to historical average) coupled with the lower CapEx, we see sustainable growth in cash on the balance sheet. We think that higher dividends should be sustainable.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Richard covers the Transport Sector and Industrial REITs. He graduated with a Master of Science in Applied Finance from the Singapore Management University. He holds the CFTe and FRM certifications and is a CFA charterholder.

He was ranked #2 Top Stock Picker (Asia) for Real Estate Investment Trusts in the 2018 Thomson Reuters Analyst Awards, and ranked #2 Top Stock Picker (Singapore) for Resources & Infrastructure in the 2016 Thomson Reuters Analyst Awards.