Beginning with the bursting of the US housing bubble in 2007, the problem of non-performing subprime mortgage loans began to surface. Many financial institutions and investors held large amounts of debt as a result of complex financial products such as mortgage-backed securities (MBS, etc) and collateralized debt obligations (CDO) that had lost creditworthiness. Bear Stearns, a leading major securities firm, went bankrupt in March, 2007 (bought over by JP Morgan Chase), and in August, 2007, a mutual fund under BNP Paribas began freezing contract cancellations from investors. For a while, world financial markets began to panic (Paribas shock). And it was the collapse of Lehman Brothers on 15th September, 2008, that caused the most symbolic and globally inter-linked credit contraction of the financial crisis from 2007 to 2008.

Ten years after the “Lehman crisis”, much debate is surfacing on the market, such as “No mistakes will be repeated”, “The crisis is approaching again, but in a different shape”. In fact, the tough US trade policy is pushing down the world economy, with possibilities of negative chain-reactions spreading, including fiscal deterioration, currency declines in some emerging markets and inflation.

President Trump had stated that he would activate an additional tariff of 200 billion dollars on China immediately after the hearings from private enterprises, etc, had finished, but as of this moment, that threat is yet to be executed. According to the WSJ, on 9/12, Treasury Secretary Mnuchin had sent a letter to the negotiators led by Vice Premier Liu He of China, proposing a new meeting to discuss bilateral trade. At a press conference on 9/13, a spokesman from the Chinese Ministry of Commerce confirmed that there had been a proposal to reopen ministerial- level discussions, and said the Chinese side “welcomed it”. Perhaps the US government officials are recalling the once-in-100 years crisis that happened 10 years ago.

It is not surprising that the Trump administration has the mentality that their achievements including the historical economic boom and high stock prices created by them “should not be laid to waste” before the mid-term elections. On 9/13 the Central Bank of Turkey raised the policy interest rate (one-week repo rate) by 625 points to 24%, and the Turkish Lira rose strongly against the dollar as a result of the interest rate increase which was much higher than market expectation. The Nikkei average closing price on 9/14 was 23,094.67 points, breaching the 23,000 points barrier for the first time since 5/21. However, the US is expected to make severe demands during the Japan-US trade negotiations (FFR) planned for 9/21, and the Japan-US summit expected within this month. Therefore, for the foreseeable future, we expect upper limits of stock prices to be suppressed.

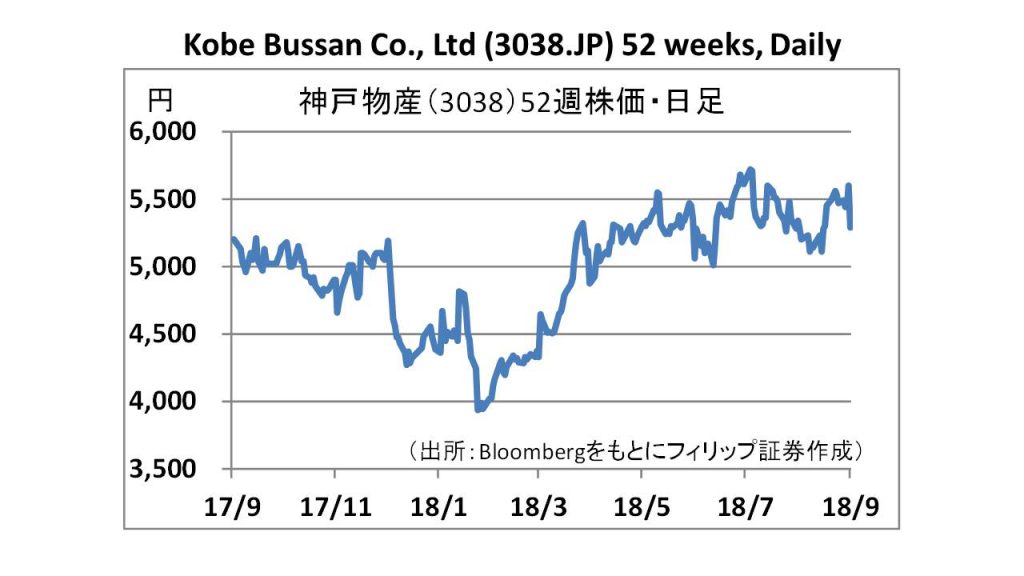

In the 9/18 issue, we will be covering Kobe Bussan (3038), Rohto Pharmaceutical (4527), Japan Post (6178), Chiyoda Corp (6366), Yamaha Motor (7272) and Daiwa Securities Group (8601). Kobe Bussan Co., Ltd (3038)

Kobe Bussan Co., Ltd (3038)

・Established in 1981. Manufacture, wholesale and retail of commercial ingredients. Pushing food supermarket business, namely “Business Supermarket” business targeting business users through the FC method. Also involved with ready-made meals chains and dining-out chains such as “Kobe Cook World Buffet”, “Green’s K” and “Green’s K Teppan Buffet”, and renewable energy business.

・For 3Q (2017/11-2018/7) of FY2018/10, net sales increased by 5.9% to 198.364 billion yen compared to the same period the previous year, operating income increased by 5.6% to 11.783 billion yen, and net income increased by 23.4% to 7.941 billion yen. New stores have been pushed out mainly in the Kanto region, and relocation of obsolete stores is also in progress. Company is focusing on developing PB products, reinforcing its own factories and strengthening own imported products.

・For FY2018/10 plan, net sales is expected to increase by 5.4% to 265.0 billion yen compared to the previous year, operating income to increase by 2.7% to 15.0 billion yen, and net income to increase by 15.0% to 9.6 billion yen. Company’s subsidiary, G.Taste Co., Ltd., has absorbed Kabenoana Co., Ltd. which is developing spaghetti specialty stores, Italian restaurants and udon specialty stores, as a wholly-owned subsidiary. Further synergies can be expected with this acquisition.

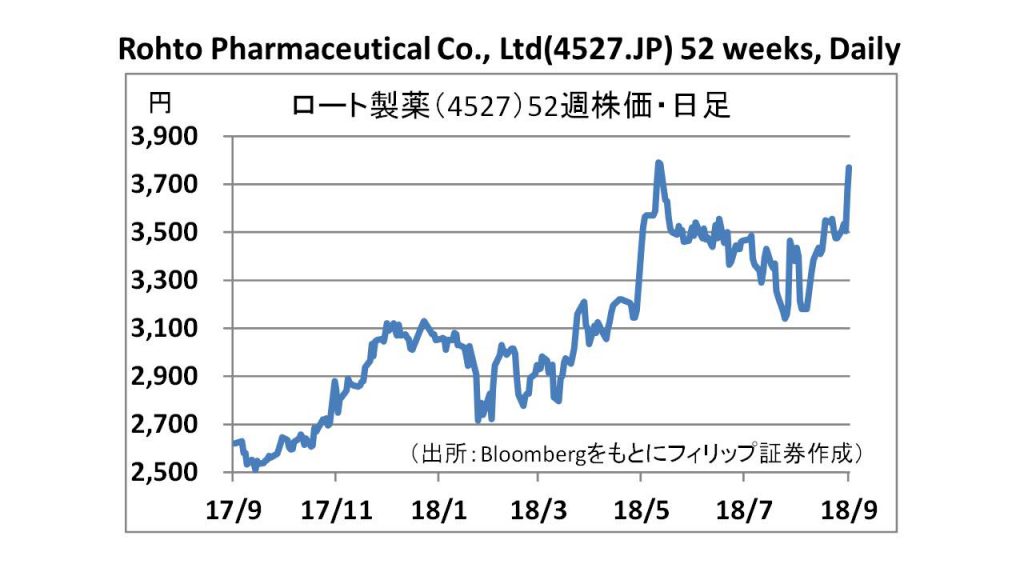

Rohto Pharmaceutical Co., Ltd (4527)

Rohto Pharmaceutical Co., Ltd (4527)

・Founded in 1899 as Shintendo Yamada Anmin Pharmacy. In the Health & Beauty Care sector, company manufactures and sells eye care products (eye drops, eye washes, etc), and skin care products (skin medicine, lip cream, sunscreen, functional cosmetics, etc), , internal medicine / food products (gastrointestinal medicine, herbal medicine, supplements, etc), and others (in vitro test drugs etc).

・For 1Q (Apr-June) of FY2019/3, net sales increased by 13.4% to 40.638 billion yen compared to the same period the previous year, operating income increased by 47.4% to 5.061 billion yen, and net income increased by 51.2% to 3.44 billion yen. In Japan, sales of high value-added products were strong, and new products such as “Skin Aqua Tone Up UV Essence” continued to perform well. Overseas, recovery in Asia is continuing.

・For FY2019/3 plan, net sales is expected to increase by 2.5% to 176.0 billion yen compared to the previous year, operating income to increase by 2.2% to 19.5 billion yen, and net income to increase by 28.1% to 11.9 billion yen. Company and Shionogi have signed a license agreement for the domestic exclusive development and sale of “ADR-001”, a regenerative medicine candidate which the company has been developing for liver cirrhosis treatment.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: