Report type: Weekly Strategy

What the Trends Involving Cross-Shareholding Mean

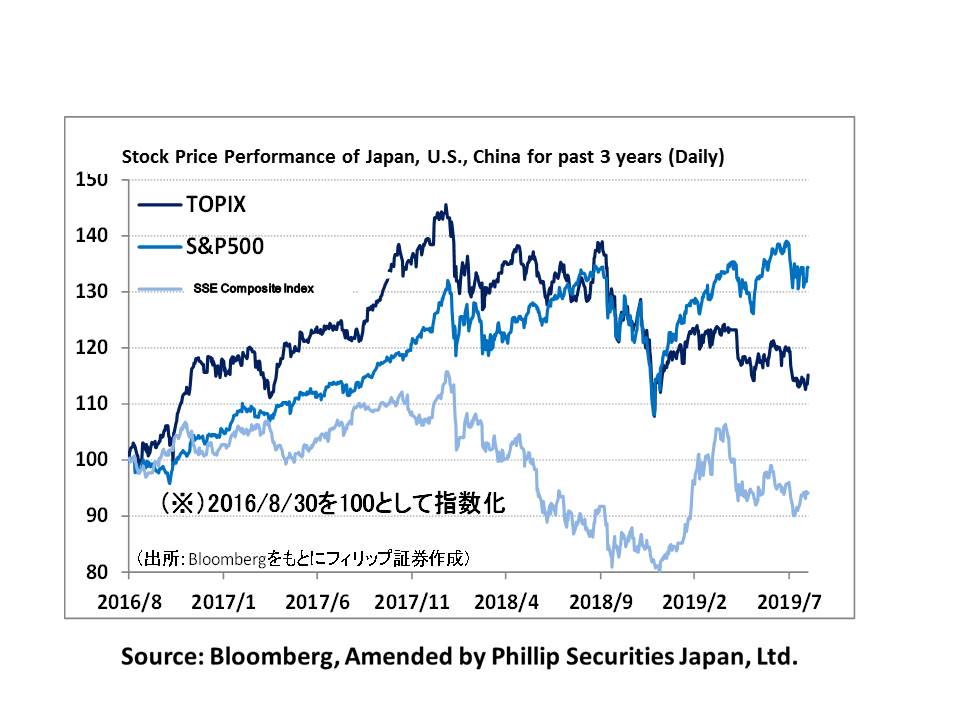

For the Japanese stock market in the week of 26/8, despite growing concerns of the Nikkei average falling below 20,000 points as a result of the “Trump Shock” on 23/8, after the opening on 26/8 and marking the low of 20,173 points, it showed stable movements in the slight fluctuations around 20,500 points. President Trump’s announcement on 23/8 of additional tariffs on China saw 250 billion dollars equivalent of Chinese products that have already been imposed with tariffs being raised from 25% to 30% at the moment, and there was also the announcement of raising the tax rate by an additional 5% as a countermeasure in the “4th round of tariffs”, where 300 billion dollars equivalent of Chinese products are scheduled to be newly imposed on 1/9 and 15/12 separately. In addition, there was the hardline content such as the demand for U.S. companies to withdraw their businesses from China, etc.

Not only was there a sense of low stock prices seen from fundamentals with the Nikkei average’s weighted average PBR (price-to-book ratio) around under 1.0 times, due to factors such as the month end for the demand for portfolio rebalancing of pension funds, etc., the Japanese stock market also proved to be strong. Due to an easing of the stance of the US-China opposition on 30/8, it also saw the Nikkei average increasing up to around 20,750 points. Also, in terms of days for supply and demand, for the 79 trading days between 26/12 last year that marked the low price of 2018 to the high price of 24/4 this year, there were also 79 trading days between the following day of 25/4 to 26/8. The time could be approaching as the situation switches from strong selling.

Conflicting movements were also seen in cross-shareholding involving Japanese stocks. Firstly, there was the announcement on 28/8 of a capital tie-up involving crossholding of shares between Toyota Motor (7203) and Suzuki Motor (7269) to promote “cooperation in new fields including the field of automated driving”. Following Daihatsu Motor, SUBARU (7270) and Mazda Motor (7261), this is the 4th company to invest in the domestic passenger car manufacturer Toyota, and by gradually incorporating a wide range of fields and companies in the period of revolution for “CASE”, this could also be a move by Toyota to target “major platform providers” in the data-driven economy.

On the other hand, on 28/8, there was the announcement by Recruit Holdings (6089) to put on sale the 121.5 million shares of 13 companies held (approx. 7% of the number of issued shares). From the aspect of corporate governance and ROE, we can expect this to lead to a resolution of the issue of cross-shareholding. Companies who sell off their crossholding of shares may also be pressed to return to shareholders via share buyback using funds from the sale, etc. In addition, Recruit themselves have also announced a share buyback. Attention will likely be on companies with a high percentage of cross-shareholding.

In the 2/9 issue, we will be covering Meiho Facility Works (1717), DIC (4631), Being (4734), Japan Medical Dynamic Marketing (7600), Toyota Tsusho (8015) and Tokyo Dome (9681).

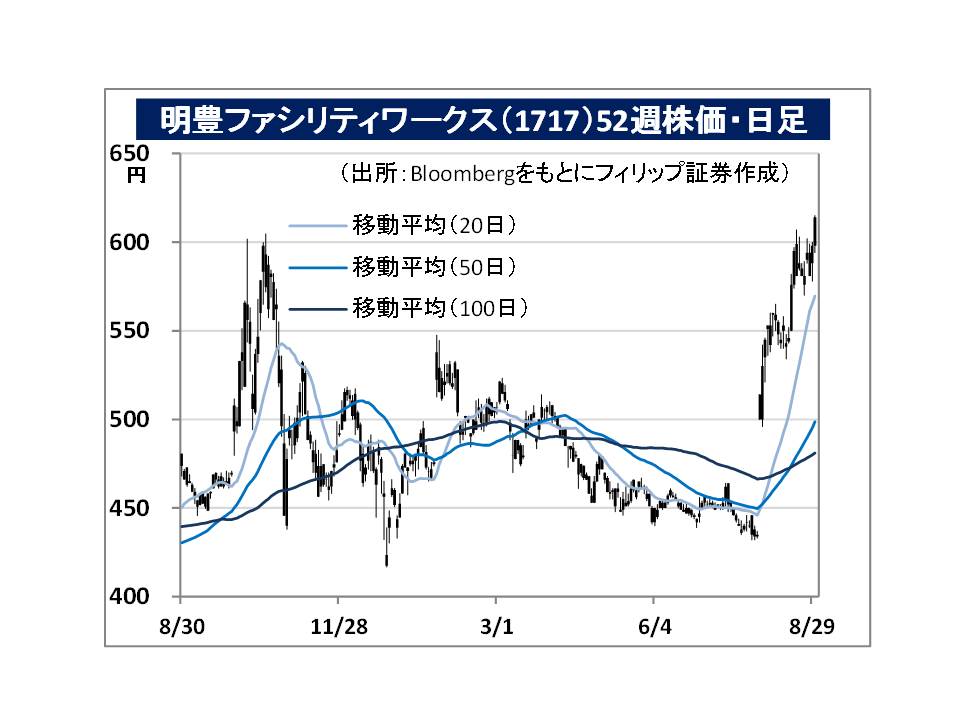

・Established in 1980. Supports clients employing a CM (construction management) approach involving various facilities and offices. Deals with the office business, CM business and CREM (corporate real estate management) business.

・For 1Q (Apr-Jun) results of FY2020/3 announced on 5/8, net sales decreased by 2.4% to 1.021 billion yen compared to the same period the previous year, and operating income increased by 89.3% to 174 million yen. The decrease in revenue is due to the increase in “Pure CM”, which does not include construction costs, and essentially has seen an increase in revenue. There has been an increase in inquiries to implement the CM method due to a deterioration of public facilities and heatstroke countermeasures by local governments.

・For FY2020/3 plan, net sales is expected to decrease by 23.6% to 4.28 billion yen compared to the previous year, and operating income to increase by 2.0% to 790 million yen. A decrease in “At Risk CM”, which includes construction costs in the sales, and a continuous increase in “Pure CM” are expected, but the plan is for an essential increase in revenue and profit. If there is a future increase in societal recognition of the CM business, which “supports the client” as its core, we can also expect the company’s value to increase. There is also a need to keep an eye on the point where it surpasses 1 year from the switch from JASDAQ to the Second Section of the TSE.

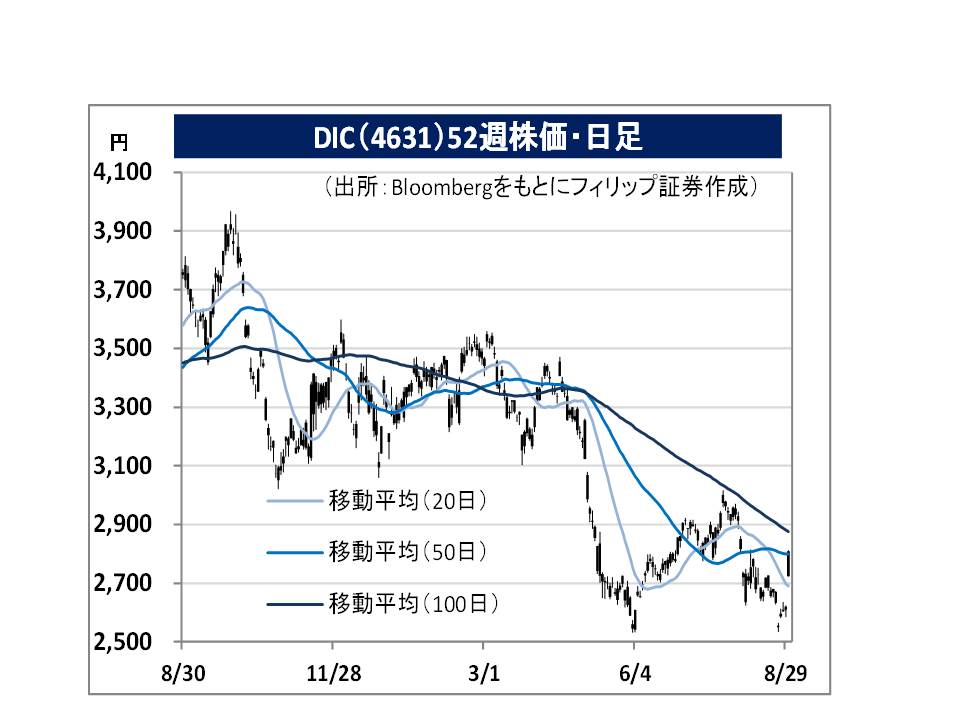

・Founded in 1908 as a chemical manufacturer that manufactures and sells printing inks. Expands their range of businesses based on the fundamental materials of organic pigments and synthetic resins, and offers a wide product lineup from raw materials to processing. Holds the top shares globally for printing inks, organic pigments, and PPS compounds. Has expanded to over 60 countries and regions worldwide.

・For 1H (Jan-Jun) results of FY2019/12 announced on 8/8, net sales decreased by 3.5% to 385.014 billion yen compared to the same period the previous year, operating income decreased by 24.4% to 18.392 billion yen, and net sales decreased by 11.9% to 13.13 billion yen. Due to the global economic slowdown, there has been a decrease in shipments throughout a wide range of fields such as materials for automobiles, electric, and electronic. Effects from a decrease in conversion for foreign businesses due to the appreciation of the yen have also shown.

・For its full year plan, net sales is expected to decrease by 1.9% to 790 billion yen compared to the previous year, operating income to decrease by 11.1% to 43 billion yen, and net income to decrease by 6.3% to 30 billion yen. On 29/8, the purchase of Europe’s largest BASF chemical pigment business, the German BASF Colors & Effects, was announced. Their product portfolio appears to have low redundancy and high subsidiarity.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: