Report type: Weekly Strategy

What Aspect Should We Focus

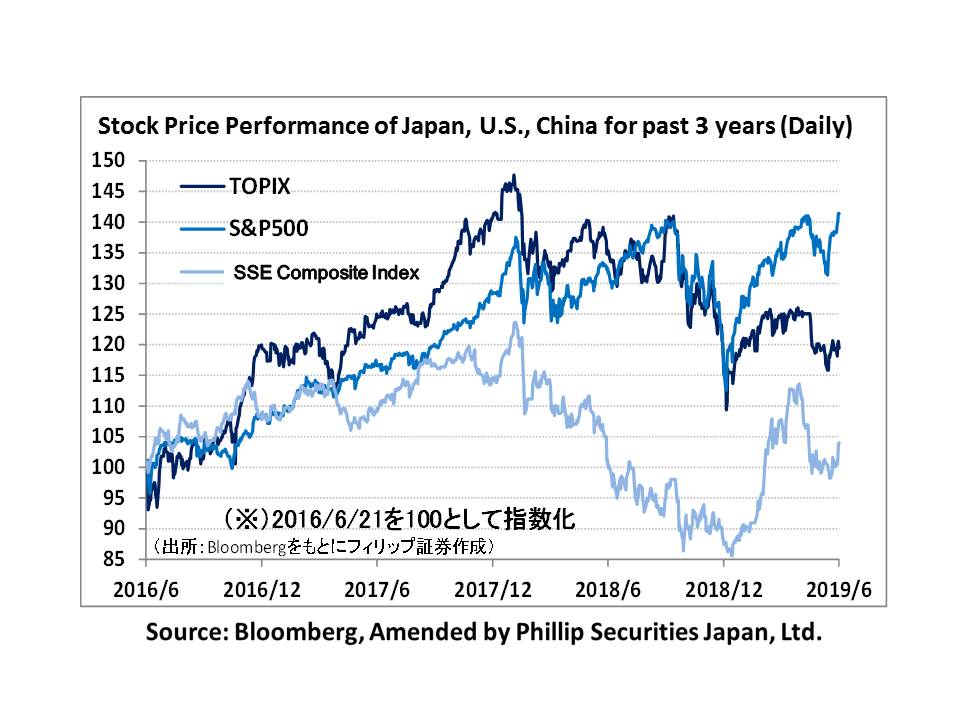

The period between 17-21/6 can be regarded as a week where the governors of the central banks of Japan, the US, and Europe played a vital role in global financial markets. On 18/6, ECB President Draghi took the lead by expressing “the possible need for additional stimuli (if there is an absence of improvement in outlook and inflationary pressure does not rise)”, which caused Germany’s 10-year government bonds to mark a record low of -0.3%. Following which, at the press conference after the FOMC with US FRB Chief Powell on 19/6, he stated “we will consider appropriate policies in order to sustain economic expansion”, which also saw a situation of the US 10-year government bonds falling below 2%. Based on these events, although there had been greater expectations of additional easing from the market regarding the Bank of Japan’s policy meeting on 20/6, due to the decision to maintain a status quo, it saw an instant turn of events with the yen appreciating against the dollar, and the dollar/yen exchange rate falling up to below 107.50 points.

Although the Nikkei average fell below 21,000 points on 18/6, it remained stable due to expectations of FOMC interest rate cuts. Although there were concerns of a decline if the yen continued to appreciate against the dollar due to the decision to maintain a status quo at the Bank of Japan’s policy meeting, being supported by steady Asian stocks, it turned out to be stable by approaching 21,500 points on 20/6. Although a strong yen and US long-term interest rate cuts are disadvantageous to financial stocks and those related to export, we can also perceive this as a change taking place towards the trend in greater purchases of domestic demand-related stocks, which are easily influenced by the benefits of a strong yen.

There are 3 factors we want to address regarding the focus points for future Japanese stock investments. ① A reform in corporate governance. Instead of limiting to share buybacks and increased dividends to strengthen shareholder returns, from the viewpoint of business restructuring to increase ROE and ROIC, and to eliminate risks of a conflict in interest for listed subsidiaries and their parent companies, it would be easy to focus on corporate groups that own many listed subsidiaries. ②Public investment for disaster prevention / mitigation. There is marked deterioration of the social capital infrastructure built during the time of the previous Tokyo Olympics. Even if natural disasters cannot be avoided, further efforts in works to prevent / mitigate disasters are necessary regardless of economic and financial trends. At the same time, there is a need to keep an eye on movements involving Japan’s redevelopment after the 2020 Tokyo Olympics. ③ Bearers of the new generation’s finance industry. Facebook announced their cryptocurrency (Libra) on 18/6, and with the change in the times, we are faced with the possibility of the leading role of the bearers supporting finance in Japan also shifting from the existing mega banks / local banks and major securities companies, etc. to fintech companies who are advanced in IT technology. This aspect would also serve as an investment chance.

In the 24/6 issue, we will be covering Inpex (1605), Raito Kogyo (1926), Adastria (2685), PeptiDream (4587), Anicom Holdings (8715) and NTT Data (9613).

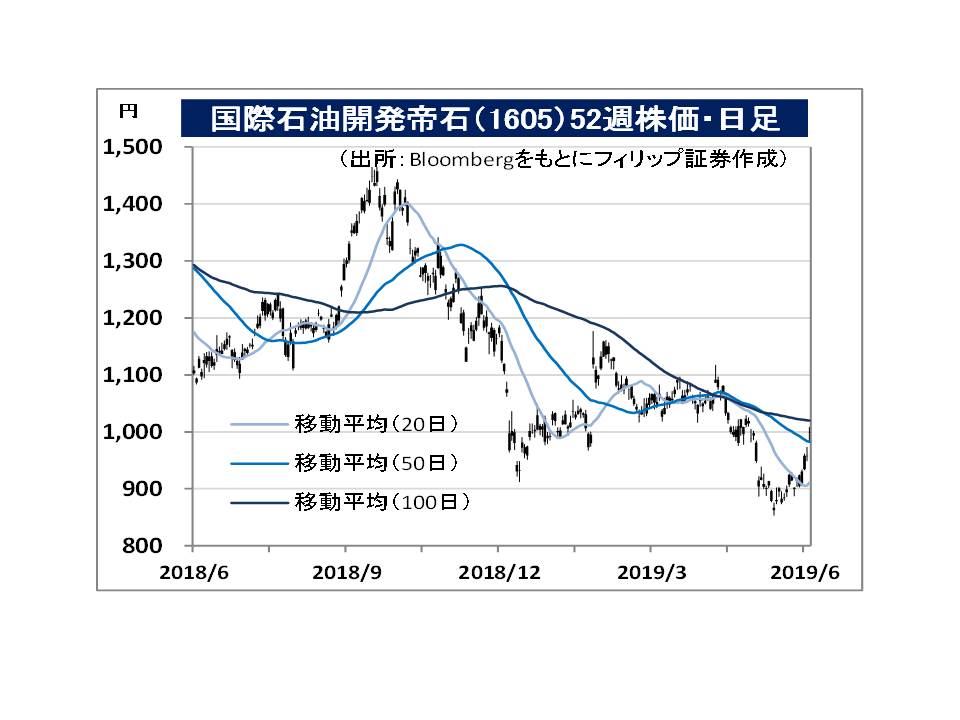

・Established in 2006 following a management integration between Inpex and Teikoku Oil. Carries out the exploration, development, manufacture, retail of petroleum / natural gas, and the investment and loan to companies engaging in them. Has expanded approx. 70 projects across 20 countries.

・For FY2019/3 results announced on 13/5, net sales increased by 4.0% to 971.388 billion yen compared to the previous period, operating income increased by 32.7% to 474.281 billion yen, and net income increased by 2.4 times to 96.106 billion yen. Although there has been a decrease in retail units, there has been a revenue increase due to a rise in retail prices of crude oil. Cost prices involving the offshore Mahakam Block have also begun to decrease. Company managed to recover part of their project impairment loss.

・For FY2019/12 plan(*), net sales is expected to increase by 19.7% to 958 billion yen compared to the previous year, operating income to increase by 6.9% to 442 billion yen, and net income to increase by 72.1% to 90 billion yen. On 20/6, company announced the signing of a basic agreement with local authorities on a development plan regarding the Abadi LNG project in the Masela Block of the Arafura Sea in Indonesia.

(*) Due to a change in the settlement period, an irregular settlement period of 9 months between 1/4 until 31/12 is scheduled. The rate of change compared to the previous period is the value compared to the results after adjustment from same period in 2018.

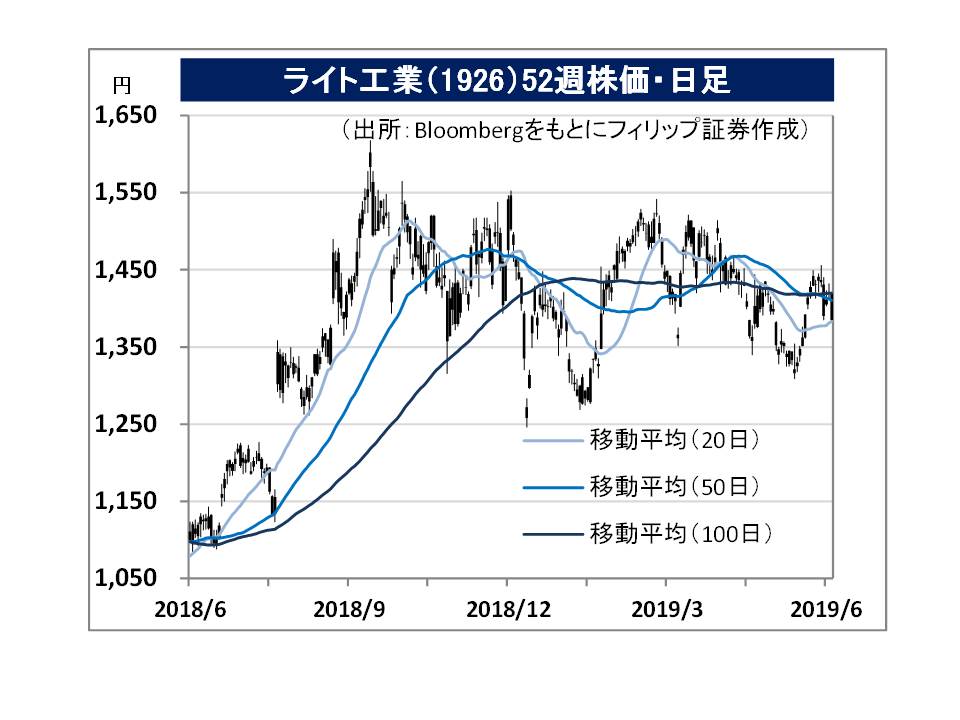

・Established in 1948 in Sendai City. Engages in their specialty of civil engineering work (countermeasures for slope / slope surface works, foundation / ground improvement works, mending / reinforcement works, environmental restoration works), where they are recognised for their technological capabilities, general civil engineering, and construction / other works.

・For FY2019/3 results announced on 10/5, net sales increased by 2.7% to 102.825 billion yen compared to the previous period, and operating income increased by 8.4% to 9.702 billion yen. Supported by a high level of public investment, an increase in orders received in their specialty, the civil engineering field, have proved to be successful. Amount of orders received increased by 7.4% to 104.886 billion yen. Countermeasures for slope / slope surface works increased by 15.0%, and foundation / ground improvement works increased by 15.7%.

・For FY2020/3 plan, net sales is expected to increase by 0.2% to 103 billion yen compared to the previous year, operating income to increase by 0.3% to 9.8 billion yen and net income to increase by 0.6% to 6.8 billion yen. Although an earthquake with a maximum magnitude of 6 occurred off the coast of Yamagata prefecture, as a countermeasure for frequent occurrences of natural disasters, demand is likely to increase for the company’s specialty in civil engineering technology. The period between 2018-2020 also corresponds to the “Triennial Urgent Measures for National Resilience, Disaster Prevention and Mitigation”, and we can expect a continuous, high level of orders received.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: