Report type: Weekly Strategy

Time to Keep a Close Watch on Structural Changes Surrounding Japan

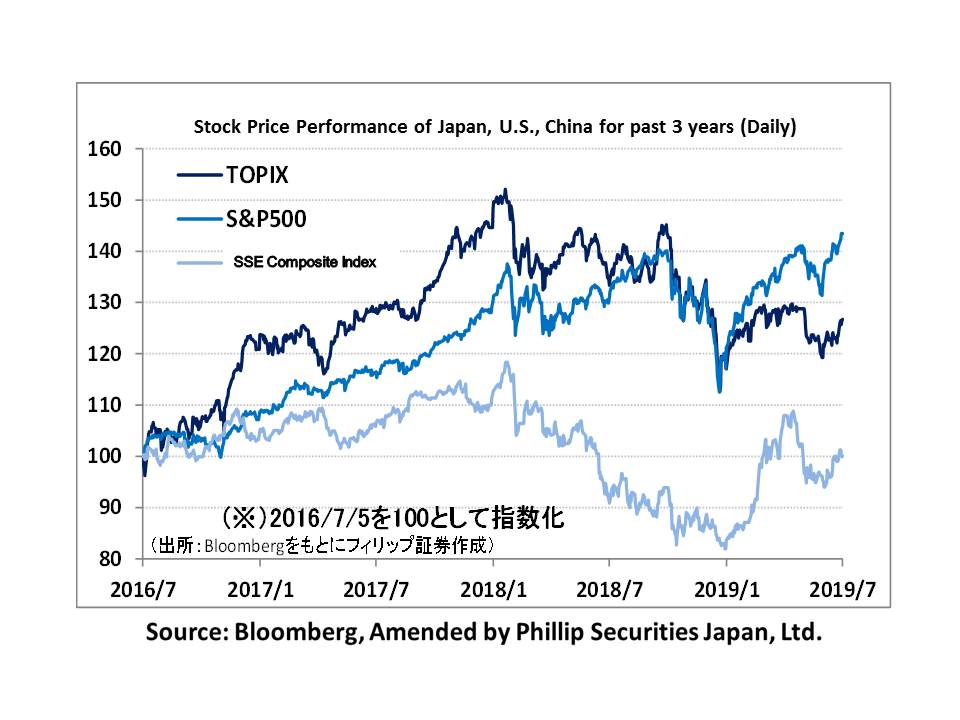

In the Japanese stock market from 1/7 onwards, the US-China summit talks on 29/6 saw a decision to call off the invocation of the 4th round of tariffs, along with the agreement to approve the supply of components to Huawei proved to be favourable as the Nikkei average began to exceed 21,500 points, which saw a move towards a high price. Although the rise in price was hindered when it was found out that the supply to Huawei was only limited to generic goods that pose no threat to national security, the NY Dow also appeared strong by renewing their highest ever record high.

From a mid and long-term perspective, we want to keep our eyes on the following 2 points. First is the US-North Korea summit talks, which immediately took place after President Trump’s call via twitter. He mentioned “the need for the international community to stand together to show a firm stance towards the denuclearisation of North Korea”, and for that purpose, “close cooperation between Japan, the US and North Korea is essential”, however, between the US and Japan, President Trump expressed discontent stating that the Japan-US security treaty was “a one-sided and an unfair agreement”. Between Japan and North Korea, from 4/7, a reinforcement of regulations was implemented for stricter procedures to approve the export of 3 products, which include semiconductors from Japan to North Korea. The US-North Korea summit talks taking place this time round also clearly show that the balance of international relations surrounding Japan, which centre on and has been comprised of the North Korea issue, has fundamentally changed. This means that there will also be a reason to consider the possibility of the US increasing their demands for a revision of Japan-US security, and in such case, the significant increase in burden of defence expenses may also result in concerns of an issue of Japan’s public finances in the red coming to the fore.

Next, on 24/5, the Ministry of Finance announced that Japan’s net foreign assets at the end of 2018 reached 341.55 trillion yen from 12.25 trillion yen compared to the previous year, which saw the 2nd largest ever scale of net assets. Although at a glance, this may seem that it is due to yen appreciation, however, looking at the breakdown, we can see that the difference in the amount between assets and liabilities due to the investment of overseas securities have decreased, and the difference in the amount between assets and liabilities due to foreign direct investment is expanding. For foreign securities investment, although “buying yen to avoid risk” due to yen conversion after selling can easily occur, in the case of direct investment of foreign corporate acquisition, etc., it is not as easy to be able to sell them off as in securities investment. We can consider the above 2 points as aspects that will serve as factors towards yen depreciation in foreign exchange rates, which will greatly influence the Japanese stock market.

In terms of investment strategy, in contrast with the objective to increase ROE (Return on Equity) and ROIC (Return on Invested Capital), from the viewpoint of group business selection and focus, we want to continue to keep a close watch on mid and long-term movements that attempt to resolve the distortion of capital relationship due to “parent-subsidiary listing”.

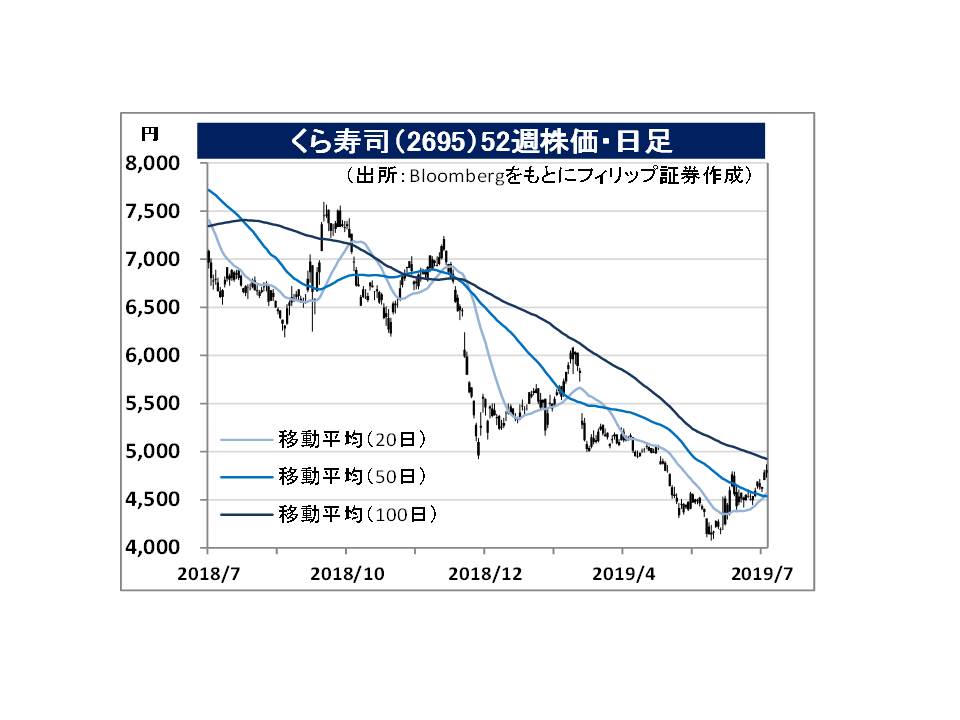

In the 8/7 issue, we will be covering Kura Sushi (2695), Trend Micro (4704), Takara Printing (7921), Canon Marketing Japan (8060), AEON Mall (8905) and Nitori Holdings (9843).

・Founded in 1977, and company established in 1995 as Kura Corporation. Changed its company name in 5/2019. Expands a conveyor belt sushi chain under the brand of “Additive-free Kura Sushi”, etc. Under the corporate philosophy of “returning to food before the wars”, company develops and offers products which eliminate the use of “four major food additives” (chemical seasoning, artificial sweeteners, artificial colourings, and artificial preservatives).

・For 1H (2018/11-2019/4) results of FY2019/10 announced on 7/6, net sales increased by 1.8% to 66.392 billion yen compared to the same period the previous year, operating income decreased by 37.5% to 2.359 billion yen, and net income decreased by 36.2% to 1.713 billion yen. Due to repercussions from part-time job terrorism, net sales in existing stores have decreased by 4.0%. In 1H, company opened a total of 14 stores in Japan / overseas, bringing the total number of stores to 467.

・For company’s full year plan, net sales is expected to increase by 4.0% to 137.813 billion yen compared to the previous year, operating income to increase by 3.8% to 7.133 billion yen, and net sales to increase by 1.2% to 5.19 billion yen. On 7/4, the company’s subsidiary, Kura Sushi USA, announced that they had submitted a registration statement for the US IPO to the US Securities and Exchange Commission. Company aims to be listed on NASDAQ.

・Established in 1989 as a subsidiary of a UK corporation, and changed its company name to the current name in 1997. Develops and retails “Virus Buster”, along with other computer security countermeasures products, and expands them to Japan, North America, Europe, Asia Pacific, and Latin America.

・For 1Q (Jan-Mar) results of FY2019/12 announced on 9/5, net sales increased by 3.9% to 39.472 billion yen compared to the same period the previous year, operating income remained unchanged at 9.308 billion yen, and net income increased by 4.8% to 6.899 billion yen. Although there has been a decrease in revenue for North America, there has been an increase in revenue for the areas aimed at corporations, which are Japan, Europe, Asia Pacific, and Latin America, which absorbed the increase in upfront investment cost such as labour costs, etc.

・For FY2019/12 plan, net sales is expected to increase by 5.1% to 168.6 billion yen compared to the previous year, and operating income to increase by 6.0% to 38 billion yen. As a security solution for the 5G era, on 26/3, the “docomo cloud-based network security service” which safeguards IoT devices, began offering its services in collaboration with NTT Docomo (9437), which will benefit from the popularisation of 5G in the future. The monthly chargeable subscription-type business is also an area to keep an eye on.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: