|

Report type: Weekly Strategy |

“The U.S. FRB in Overseas Factors and the Spread of Infection of the Omicron Variant in Domestic Factors”

For the Japanese stock market in the week of 11/1, it was shaken up by domestic factors such as the sharp increase in the spread of infection of the Omicron variant in addition to overseas factors such as the uncertainty surrounding the timing of the FRB balance sheet reduction (quantitative tightening) and the frequency of increased interest rates in the U.S.

For overseas factors, in response to indications of a tight labour market, such as the decline in the labour force participation rate, the increase in average hourly earnings and the decline in unemployment rate in the July U.S. employment statistics, investment bank Goldman Sachs announced their quarterly interest rate forecasts for March, June, September and December. While it was digesting materials one after another, such as the reappointment of FRB Chair Powell in November, the statement at the approval public hearing involving the appointment of the FRB governor Brainard as the Vice Chair of the FRB on the 13th as well as the U.S. Consumer Price Index for December announced on the 12th, which indicated high growth that was last seen 39.5 years ago with a 7.0% increase compared to the same month the previous year, the 10-year government bonds declined from over 1.8% last week to near to 1.7%. Due to indications of signs of subsiding supply constraints in the U.S. Manufacturing ISM Report on Business announced on the 4th, the excessive uneasiness on the increase in interest rates and quantitative tightening appears to have abated.

At the same time, in the foreign exchange market, a change was observed in the tone of the strong dollar, such as the dollar/yen exchange rate falling under 114 yen on the 14th after rising to 116.35 yen on the 4th. With the depreciation in the dollar accompanied by inflation concerns, there will likely be attention on future trends on whether it will be risk-on following the influx of funds to the commodity market in addition to precious metals, nonferrous metals and gold, or risk-off following an escape to safe currencies, such as Yen and Swiss franc buying.

Although the U.S. long term interest rates are gradually regaining stability, the U.S. Nasdaq Composite, which focuses on growth stocks regarded to have a tendency to increase from a decrease in interest rates, saw an increase in the range of decline between the 12th and 13th. As a result, the Nikkei average is also being pushed from the declining pressure from the fall of high price high-tech stocks that have high contribution to the index.

For domestic factors, there has been a sharp increase in the spread of the COVID-19 Omicron variant. On the 13th, there were 3,124 persons who newly tested positive in Tokyo and the rate of hospital bed usage reached 15%, nearing 20%, which is the standard for the call on measures to prevent the spread. If the rate of hospital bed usage reaches 50% in Tokyo, there will be a call on a state of emergency to be declared on the country, which will be a situation where there will be concerns of a slump in those related to leisure, retail and F&B outlets, where a recovery in customers was observed towards the end of the year.

For the time being, the tendency to lookout for value stocks will likely be the focus, such as Toyota Motor (7203) and its group enterprise, which has been favoured involving additional investment in electric vehicles (EV); iron and steel stocks, where its aspect as a low P/E ratio and high dividend yield value stock is being reviewed; nonferrous metals, which have had an inflation in the copper and nickel market; and trading company stocks, which are expected to benefit from the increase in energy prices.

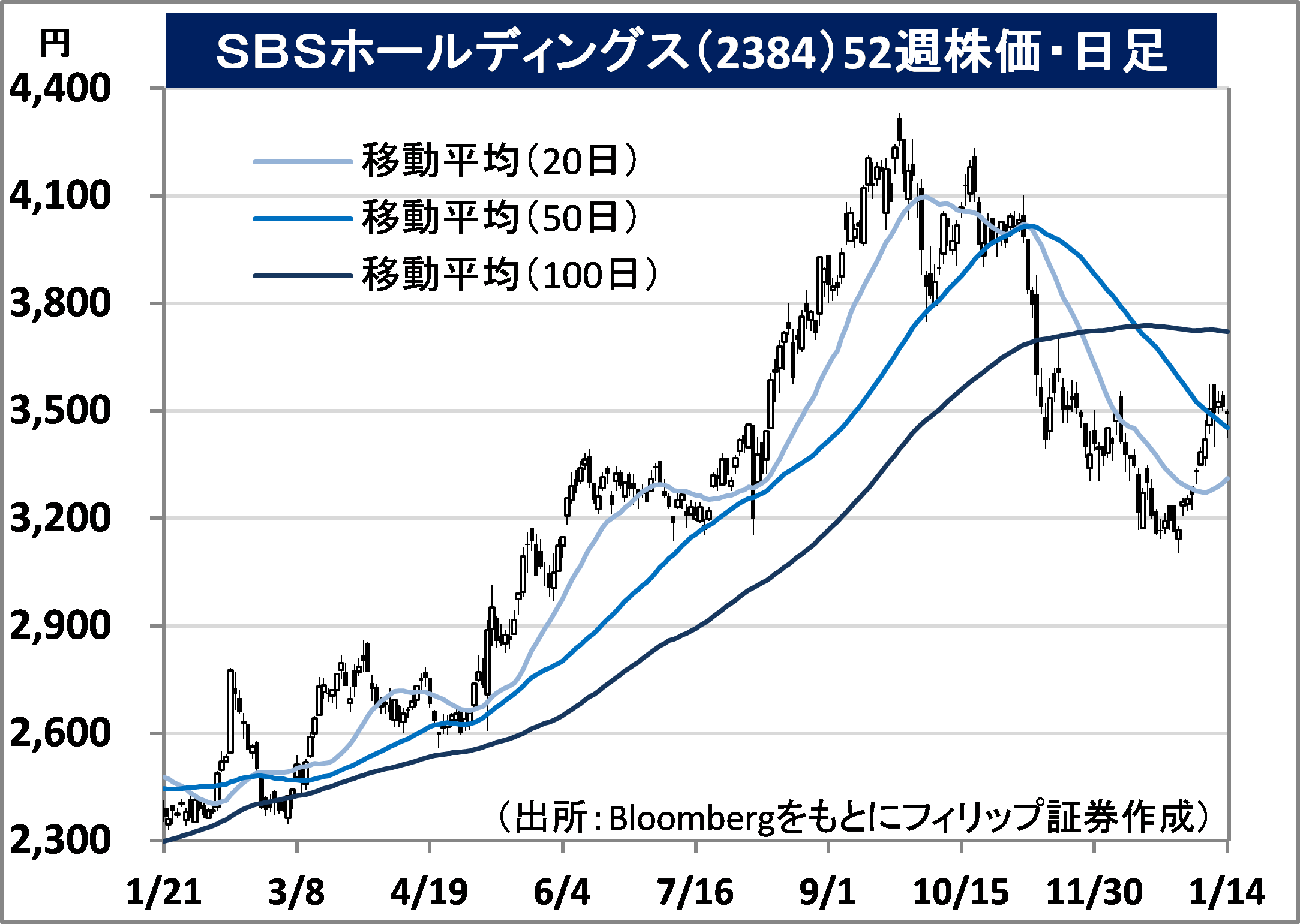

In the 17/1 issue, we will be covering SBS Holdings (2384), Ube Industries (4208), Yokogawa Electric (6841) and Toppan (7911).

Japan_Weekly_Strategy_Report_17012022 PDF

・A 3PL (total subcontracted distribution) that established in 1987. Operates a real estate business involving the sale and leasing of owned logistics facilities in addition to the distribution business, which includes 3PL services, frozen, chilled and shelf-stable foodstuff distribution and transporting/same-day delivery, etc.

・For 9M (Jan-Sep) results of FY2021/12 announced on 10/11, net sales increased by 58.4% to 299.761 billion yen compared to the same period the previous year and operating income increased by 2.1 times to 17.559 billion yen. In addition to benefitting from the expansion of the e-commerce (EC) market, such as online shopping and daily necessities, earnings from the securitisation of distribution real estate and the new consolidation of Toshiba Logistics and Toyo Warehouse & Transportation, etc. have contributed.

・For its full year plan, net sales is expected to increase by 55.5% to 400 billion yen compared to the previous year and operating income to increase by 82.5% to 20 billion yen. On 4/1, it was reported in The Nikkei that the company will officially enter home delivery distribution in addition to B2B regarding EC as well as invest approx. 160 billion yen by 2030 in constructing 15 new EC goods exclusive bases in the metropolitan area. They are attempting to incorporate demand for same-day delivery of small quantity goods. Also, the expansion of the frozen food market will likely benefit the company, which is strong in foodstuff transport.

・Started in coal mining in 1897 and established in 1942. Operates business segments, such as chemistry involving nylon resin and synthetic rubber, etc., construction materials involving cement and limestone, etc., as well as machines involving moulding machines, etc., and carries out the manufacture and retail of those involving them.

・For 1H (Apr-Sep) results of FY2022/3 announced on 2/11, net sales was 306.685 billion yen (280.013 billion yen the same period the previous year) and operating income increased by 5.6 times to 19.088 billion yen. The accounting standard involving revenue recognition was adopted from the current period onwards. In addition to an increase in retail units of products related to automobiles, such as nylon, synthetic rubber and battery materials, the increase in retail price of nylon, lactam and synthetic rubber have contributed.

・For its full year plan, net sales is expected to be 635 billion yen (last year’s results was 570 billion yen) and operating income to increase by 50.6% to 39 billion yen. With there being a statement last December on the joint start of consideration towards securing safety in “Clean Ammonia” by 4 chemical manufacturers including the company, the government decided to support Indonesia in the implementation of technology that mixes ammonia with coal fired power generation. Also, the company is likely to receive greater attention as a manufacturer of lithium-ion battery electrolytes.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: