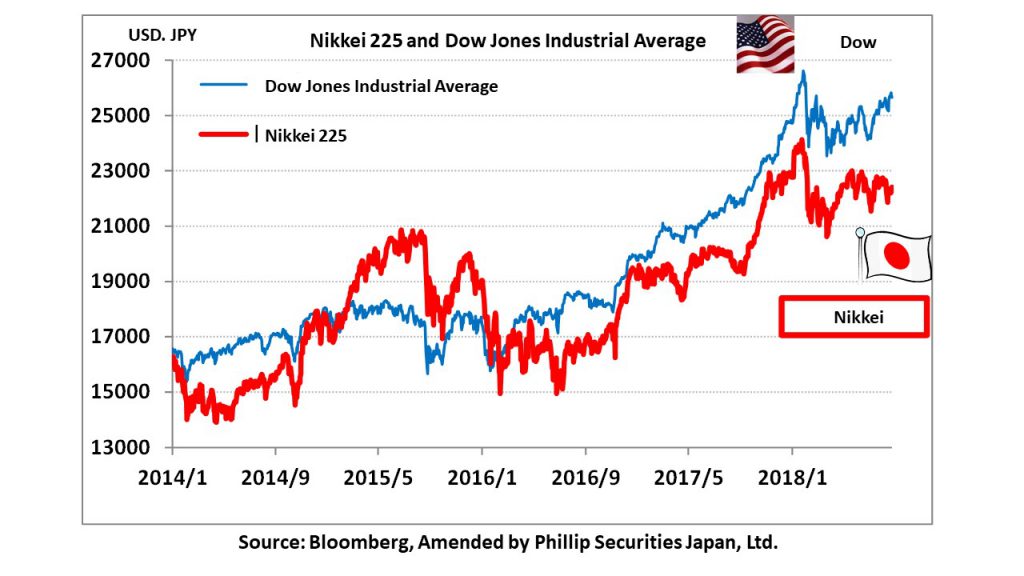

It looks like small and medium-sized Japanese stocks have bottomed out and are recovering steadily. Although uncertainty arising from external factors still remains, US stocks have been rising and the yen is depreciating again, with the dollar/yen exchange rate reaching 111 yen to the dollar. As a result, as of 8/24, the Nikkei average had risen 1.49% in the past five business days. Of the constituent stocks, Tokai Carbon (5301) rose 8.13%, Showa Shell Sekiyu (5002) rose 8.08% and Fast Retailing (9983) rose 7.93%, showing that investors are revising performance expectations and valuing good stocks.

It looks like small and medium-sized Japanese stocks have bottomed out and are recovering steadily. Although uncertainty arising from external factors still remains, US stocks have been rising and the yen is depreciating again, with the dollar/yen exchange rate reaching 111 yen to the dollar. As a result, as of 8/24, the Nikkei average had risen 1.49% in the past five business days. Of the constituent stocks, Tokai Carbon (5301) rose 8.13%, Showa Shell Sekiyu (5002) rose 8.08% and Fast Retailing (9983) rose 7.93%, showing that investors are revising performance expectations and valuing good stocks.

At the same time, the Mothers Index rose 3.73% during the same period, with Mobcast (3664), Mediaseek (4824) and Datasection (3905) all having huge increases of 39.47%, 34.22% and 26.19% respectively. Meanwhile, projections by Applied Materials (AMAT) and NVIDIA (NVDA) during their earnings announcements were below market expectations, causing overall selloff of semiconductor stocks. As a result, the SOX index declined, but recovered and rose subsequently. This was a factor supporting Japanese stocks.

Amongst the 33 industries in TOPIX, petroleum / coal products rose by 4.27%, other products rose by 4.03% and pulp /paper industry rose by 3.15%. On 8/13 OPEC cut demand forecast for crude oil for 2019, and the price of crude oil plummeted as a result. However, crude oil price bottomed out after that and staged a steady recovery. While we need to pay attention to supply and demand trends, the world economy is nevertheless expanding. Phillip Capital is of the opinion that demand will continue to grow. We expect WTI crude oil futures price to be around 65-70 dollars for the time being. Meanwhile, performance of Tencent, a major Chinese internet service provider, worsened due to slow growth in game revenue. There was also a report that regulators in China were freezing game distribution licenses as part of public opinion control. As a result, Nintendo’s (7974) stock was largely sold, but subsequently rose for four continuous days.

Both the US and China imposed the second round of additional tariffs on imports equivalent to 16 billion dollars. It seems that trade negotiations by vice-ministerial level staff of both countries have ended without much progress. Besides the possibility of further US sanctions on Turkey and Iran, uncertainties surrounding the market, such as suspicion of President Trump’s involvement with Russia, still remain. There are indeed still a lot of investors adopting a wait-and-see attitude. Domestically, with revaluation of stock prices of good-performing companies going on, risks due to wrong timing of market entrance are emerging. Indeed, investors may be close to reversing their current stance.

In the 8/27 issue, we will be covering ADEKA (4401), Eisai (4523), Artra (6029), ULVAC (6728), Mitsubishi Estate (8802) and Kyoritsu Maintenance (9616).

Selected Stocks

・Established in 1917 as Asahi Denka Co., Ltd. Operates chemical and food products businesses. In the chemical product sector, company provides various inorganic and organic intermediate products, additives for plastics and fine chemical products such as high performance materials for semiconductors and digital home appliances. In the food product sector, company offers margarine, shortening, oil and fat for chocolates, etc.

・For 1Q (Apr-June) of FY2019/3, net sales increased by 7.5% to 61.779 billion yen compared to the same period the previous year, operating income increased by 3.2% to 5.384 billion yen, and net income increased by 6.0% to 4.09 billion yen. Strong sales of information and electronic chemical products such as photo-curing resins as a result of strong demand in the semiconductor market. Resin additives such as antioxidants, and the food product business had also performed well.

・For FY2019/3 plan, net sales is expected to increase by 8.1% to 259.0 billion yen compared to the previous year, operating income to increase by 3.6% to 22.1 billion yen, and net income to decrease by 2.2% to 7.1 billion yen. Company has announced the conversion of Nippon Nohyaku, an affiliate, into a subsidiary. Pursuing synergy in R&D and sales in the newly-identified life science sector.

Eisai Co., Ltd (4523)

・Established in 1941. Develops, manufactures and sells medical-use drugs, generic drugs and general use drugs. Positions “oncology” and “neurology” as two strategically important areas. Products include anti-epileptic drug “Fycompa”, obesity treatment agent “BELVIQ”, new combination tyrosine kinase inhibitor “Lenvima”, and anticancer drug “Halaven”, etc.

・For 1Q (Apr-June) of FY2019/3, revenue increased by 8.1% to 153.304 billion yen compared to the same period the previous year, operating income increased by 36.0% to 20.58 billion yen, and net income increased by 79.0% to 27.243 billion yen. “Lenvima” sales grew strongly after gaining approval for use in treatment of hepatocellular carcinoma in Japan. Sales of “Fycompa” and “Humira”, an anti-rheumatic drug, had also increased.

・For FY2019/3 plan, revenue is expected to increase by 5.3% to 632.0 billion yen compared to the previous year, operating income to increase by 11.4% to 86.0 billion yen, and net income to increase by 10.9% to 57.5 billion yen. “Lenvima” has been approved by the European Commission as a monotherapy for adult patients with advanced or unresectable hepatocellular carcinoma without history of chemotherapy.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: