Interested to trade in the Japan market?

From 1 Jun – 31 Aug 2018, receive SGD38* when you start trading in the Japan market! Read on for more information!

*Terms & Conditions Apply.

The FRB, on 6/13, announced the decision to raise interest rates signaling 4 rate hikes (2 hikes to come for the rest of the year) this year compared to 3 rate hikes (1 more to come) that had been planned at the March FOMC. It is still uncertain whether rate hikes will be accelerated as 8 FRB board members (vs 7 the last time) forecast 4 rate hikes this year while 7 members (vs 8 the last time) forecast 3 rate hikes. We, therefore, expect the rise in interest rates to moderate.

It seems the FRB intends to normalize interest rates to a neutral level during the economic boom. As the US economic long-term expansion would have lasted 9 years by the end of June, it seems the FRB intends to create room for economic stimulus measures by monetary policy to counter any potential recession.

After the FOMC finished almost within the expectations, the dollar fell temporarily in forex markets and long-term interest rates declined. The next day on 6/14, the ECB announced that the Governing Council would end quantitative easing (QE) by the end of the year. Following the US, Europe has also decided to move towards the normalization of monetary policy. It is expected that the level of asset purchases will be maintained until September at EUR 30 billion a month, reduced to EUR 15 billion thereafter and end at the end of December. The ECB also indicated the inflation forecast for 2018 and 2019 was revised upwards to 1.7% from 1.4% while the economic growth rate for 2018 was revised downwards to 2.1% from 2.4%. The ECB said, in the announcement, that “they intend to keep interest rates steady at least until next summer”. The ECB President, Draghi, said “QE policy will not go away” and confirmed that the ECB would not accelerate monetary tightening.

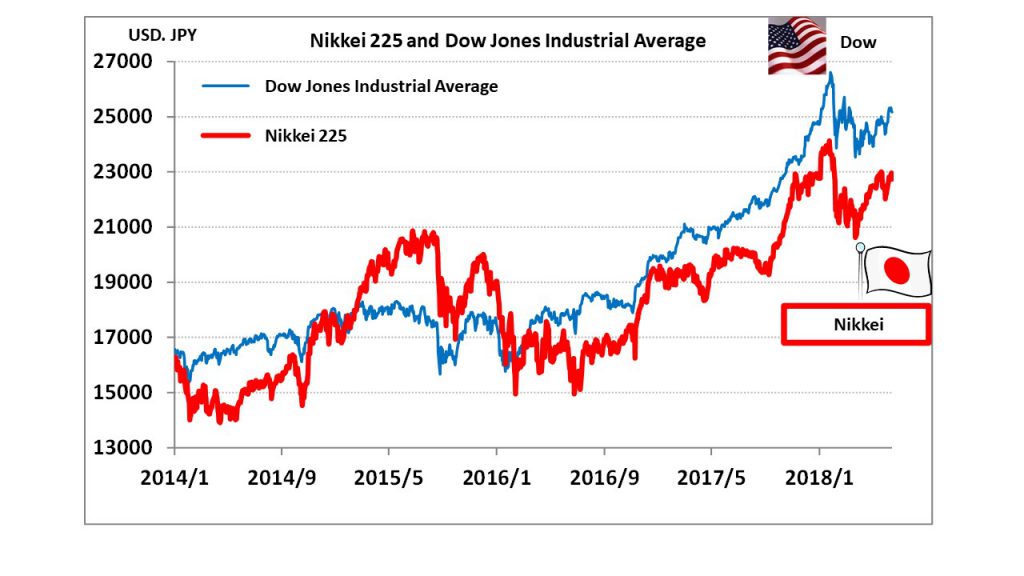

The euro temporarily rose to 1.185 USD/euro after receiving ECB’s decision to exit the assets purchase program by the end of the year, but then plummeted to 1.15 USD/euro. The dollar index temporarily dropped to 93.193 points and then jumped to 94.9. The Bank of Japan, at the Monetary Policy Meeting on 6/15, decided to maintain monetary easing measures to keep short-term interest rates at minus 0.1% and long-term interest rates at around 0%. If the strong dollar and weak yen policy continues, there is a possibility that the yen dollar rate would hit 111 yen/dollar again, since the last time on May. Although there are concerns on the US trade policy such as applying the additional tariff for the economic sanction on China by the Trump administration, the US stocks are expected to remain high due to the good economic and corporate performance. In Japanese domestic market, it is expected investor sentiments to improve due to the behavior of foreign investors, and the Japanese stocks to be steady. We see Hi-tech stocks and export related stocks are compelling investment targets in addition to domestic demand related stocks.

In the 18th of Jun issue, we will be covering Ateam (3662), Nippon Paper (3863), Macromill (3978), ORIENTAL LAND (4661), CyberAgent (4751), and OHARA (5218).

Selected Stocks

Ateam Inc(3662)

· Established in 2000. Ateam Inc is a comprehensive IT company that plans, develops and manages game contents mainly for smart devices such as smart phones and tablets; comparative sites and information sites; electronic commerce (EC) sites, among others. It also runs “Hikkoshi Samurai”, a website that provides house moving quotations for comparison and reservation as well as “cyma (CycleMarket)”, an online shopping site for ordering fully assembled bicycles.

· For 3Q (August 2017 – April 2018) of FY2018/7, sales were up 12.5% to 28.338 billion-yen, operating profit increased by 37.5% to 3.809 billion yen, and net income rose 44.2% to 2.650 billion yen as compared to the same quarter last year. Sales improved significantly due to a rise in relocation cost caused by a lack of manpower in the moving industry and a high demand for movers during the busy season in March. Bridal related business also contributed to the revenue growth.

· For 2018/7 full year forecasts, sales is expected to increase by 15.6% to 40 billion yen, operating income up by 15.3% to 4.7 billion yen, and net income to increase by 20.2% to 3.1 billion yen as compared to the previous year. With the release of a new game application “Mikuni BASSA !!” on May 21, fees collection started from May 25. “TOYOTA NEXT” a joint project in the lifestyle support business went into high gear.

Nippon Paper Industries Co Ltd(3863)

· Established in 1949. In addition to the manufacture and sale of paper and pulp, this company is also engaged in paper related business, timber, building materials, civil engineering business as well as leisure business. The company aims to transform itself into a comprehensive biomass enterprise by using technology to make efficient use of wood resources.

· For 2018/3, sales increased by 5.4% to 146.499 billion yen, operating income decreased by 25.9% to 17.613 billion yen, and net income declined 6.6% to 7.847 billion yen as compared to the same period the previous year. Demand for printing paper for advertising was sluggish against the backdrop of digitization while sales of office products grew. Declining profitability was caused by shrinking profit margin due to rising raw material cost such as waste paper.

· For 2019/3 full year forecasts, sales is expected to increase by 3.2% to 180 billion yen, operating income to increase by 41.9% to 25 billion yen, and net income to be in the deficit of 18 billion yen from 7.847 billion yen in the previous fiscal year. The company announced a price increases for wallpaper base paper. The price will increase by 15% or more from 7/21 shipment onwards to absorb rising raw material and logistics costs.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: