Report type: Weekly Strategy

Raw Materials for 5G Communication; the Solar Minimum Period

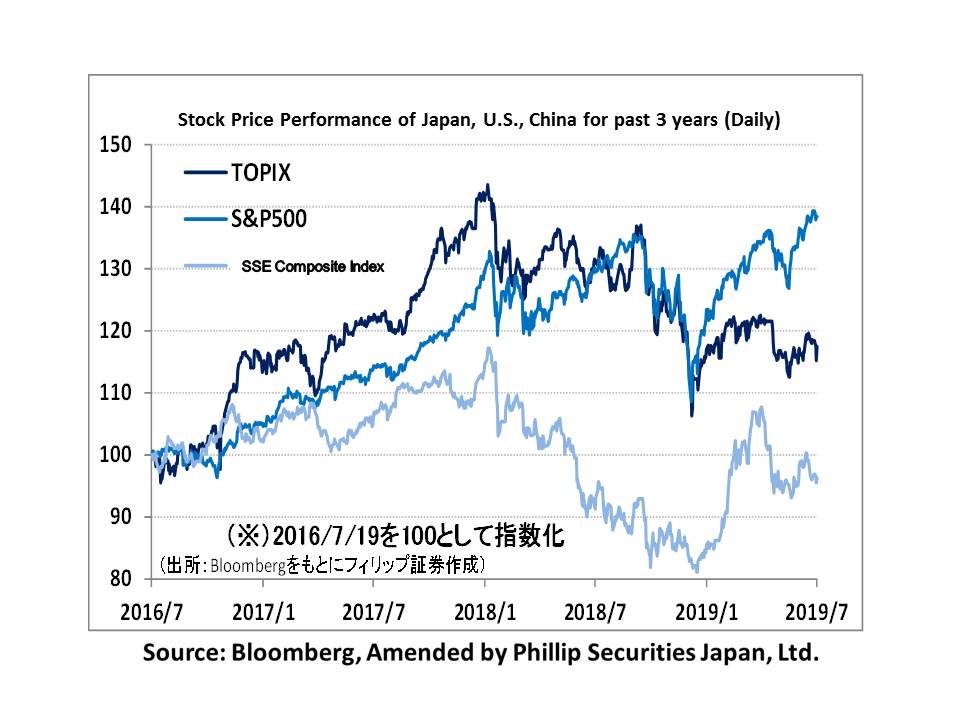

The Japanese stock market from 16/7 onwards contrasted with the steady US stock market with the Nikkei average falling below 21,500 points on 17/7, and then falling below the low of 21,000 points on 18/7, which saw a significant drop. With growing expectations of US interest rate cuts leading to an appreciation of the yen, which held back the rise in Japanese stock prices, along with a 70% year-over-year drop in net income in the Mar-May term’s financial results at Yaskawa Electric (6506), followed by the reported forecast of a downward revision of a 40% year-over-year decrease in operating income in the Jan-Jun term’s financial results at Canon (7751), which is scheduled to be announced on 24/7, it appears that there were concerns of consecutive forecasts of worsening business performance in the Apr-Jun term’s financial results, which will be shifting into high gear.

On the following day of 19/7, in addition to the factor of demand in easier repurchases due to a high short selling ratio, in overseas markets, a positive forecast indicated at the financial results announcement of Taiwan Semiconductor Manufacturing Company (TSMC) and the announcement of the Dutch ASML’s EPS exceeding market predictions, saw it active with repurchasing movements focusing on semiconductor-related stocks, which resulted in a significant high. The investment in new premium smartphone models, an acceleration in 5G compatibility, and logic semiconductors, etc. in the TSMC and ASML financial results announcements seemed to act as a strong prospective driving force. Also, within the “semiconductor-related”, it would be vital to continue monitoring from the viewpoint of mostly the relation between compatibility with 5G communication, etc. As of now, apart from Huawei, suppliers for 5G communication semiconductors are only limited to the US Qualcomm (QCOM), and it is likely that trends involving Qualcomm will prove to be crucial.

Aside from semiconductors, as 5G utilises higher frequency radio waves than the existing, they require the use of raw materials that enable easy transmission of radio waves, and glass is regarded as promising. Although the US Corning (GLW)’s “Gorilla glass” is gathering attention, AGC (5201) is also developing an integrated antenna glass for 5G, while

Teijin (3401) has also developed a reinforced plastic back panel for smartphones that use “aramid fibres”, which allow easy transmission of radio waves. In terms of 5G-related “raw materials”, there may be a chance at winning for Japanese companies as well.

The rainy season’s cold this summer has lasted longer than expected, and the US National Oceanic and Atmospheric Administration (NOAA) announced a forecast on 5/4 of “the solar activity approaching a solar minimum period between the latter half of 2019 and the beginning of 2020”. This points to the increase or decrease in the number of sunspots in a fixed cycle, which is said to last for an average of 11 years. Although it would be very intriguing to consider its correlation with the cycle of economic activities, perhaps it would be difficult to disregard its effects on the aspect of physical health, etc. We want to ensure that we keep our health in tip-top condition.

In the 22/7 issue, we will be covering Japan Tobacco (2914), Kushikatsu Tanaka Holdings (3547), TerraSky (3915), Information Services International-Dentsu (4812), Weathernews (4825) and Nissha (7915).

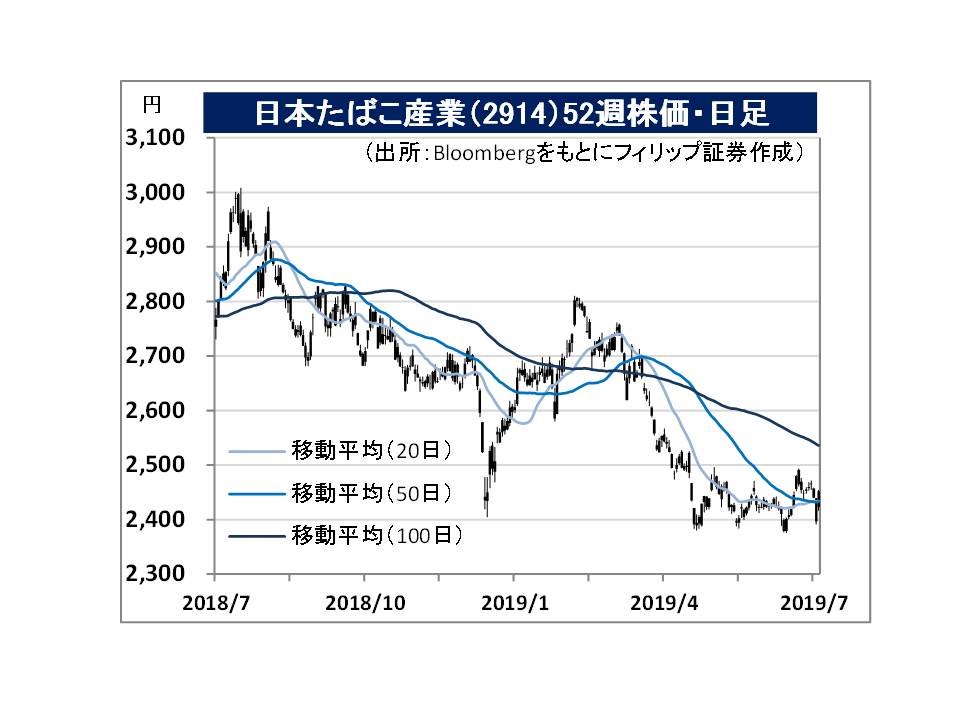

・Established in 1985. Its predecessor was Japan Tobacco and Salt Public Corporation. In addition to their mainstay domestic / overseas tobacco business, company actively expands a diverse range such as the medical business / processed food business, etc. Focuses their efforts on their unique low temperature heating type tobacco, “Ploom TECH”.

・For 1Q (Jan-Mar) results of FY2019/12 announced on 26/4, sales revenue decreased by 1.9% to 505.422 billion yen compared to the same period the previous year, and operating income increased by 24.4% to 182.593 billion yen. Operating income after fixed adjustment to the exchange rate also increased by 7.2%. A rise in price in the domestic / overseas tobacco business along with the increase in sales of RRP (products that may reduce health risks) have contributed.

・For FY2019/12 plan, sales revenue is expected to decrease by 0.7% to 2.2 trillion yen compared to the previous year, and operating income to decrease by 4.4% to 540 billion yen. Phillip Morris International (PM) announced their 2019/2Q (Apr-Jun) financial results on 18/7 and revised their full year plan upwards due to good sales of their heated type tobacco, “IQOS” in Japan, etc. Although it has a lighter tobacco flavor than IQOS, due to sales expansion of “Ploom TECH”, which has less smoke smell, we can look forward to its good effect on business performance.

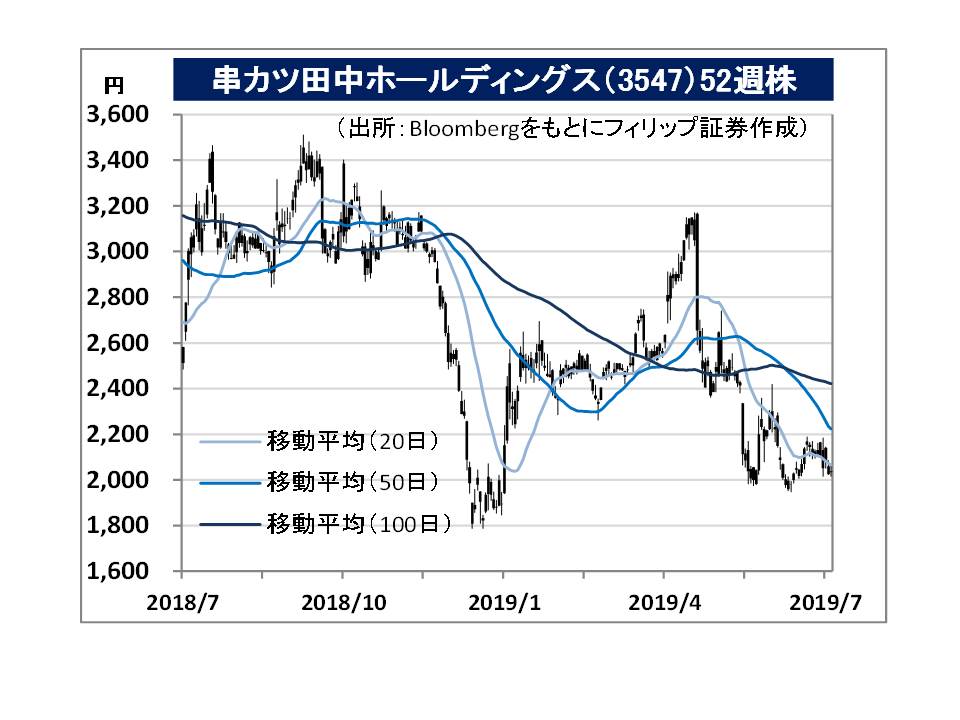

・Founded in 2002. Based on their aim of “making Osaka’s traditional tasting kushikatsu a representative of Japanese food culture”, company expands directly managed and franchise chain restaurants focusing in the Kanto area. Began implementing all non-smoking seats / floor-separated smoking from 6/2018.

・For IH (2018/12-2019/5) results of FY2019/11 announced on 12/7, net sales increased by 39.8% to 4.682 billion yen compared to the same period the previous year, operating income increased by 41.3% to 303 million yen, and net income increased by 21.0% to 217 million yen. Due to an implementation of non-smoking, although customer transactions in the office worker category decreased, an increase in the number of customers in the family category has secured a 0.5% increase in net sales of their existing stores.

・For FY2019/11 plan, net sales is expected to increase by 26.5% to 9.7 billion yen compared to the previous year, operating income to increase by 5.4% to 590 million yen, and net income to decrease by 6.4% to 440 million yen. Increase in investment costs for growth are predicted from directly managed store openings and a renovation of deteriorating stores, etc. Company is narrowing down their target to the family category, and in addition to the change to non-smoking, company has opened a new business category store, which is a family restaurant-type roadside outlet. They will likely garner attention for their various initiatives in managing both non-smoking and an increase in sales.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: