Report type: Weekly Strategy

Now Is the Time to Gauge the Potential of Japanese Companies

The Japanese stock market from 29/7 began with movements following the financial policies of the US and Japan central banks. On 25/7, the European Central Bank had already indicated a possibility of conducting policy interest rate cuts by the first half of 2020, which led to growing expectations of additional monetary easing at the Bank of Japan and interest rate cuts at the US FRB. However, the Bank of Japan’s Monetary Policy Meeting remained at the status quo, and despite the decision of the interest rate cut of 0.25% points by the US FOMC, as it “did not prove to be the beginning of a series of long-term interest rate cuts”, it failed to meet market expectations. Despite the NY Dow falling significantly on 31/7 by 333 points compared to the previous day, due to receding expectations of the US FRB interest rate cuts, on one hand, it helped to support Japanese stocks due to the depreciation of the yen against the dollar, and on 1/8, the Nikkei average stood firm by increasing by 19 points compared to the previous day.

Whereas on 1/8, US President Trump announced on twitter the implementation of the 4th round of tariffs against China (10% per 300 billion dollars). In response, the NY Dow saw a consecutive significant fall of 280 points compared to the previous day. With the dollar-yen exchange rate abruptly turning towards the direction of the yen appreciating against the dollar by falling below 107 points from the high price of 109.30 points the previous day, on 2/8, the Nikkei average saw a significant fall to below 21,000 points. With the Apr-Jun term financial results announcements moving into full force, purchasing movements focusing on buybacks were observed due to financial results announcements for major stocks faring better than market expectations, however, this was more or less negated from risks of the US-China trade friction suddenly becoming apparent. The US-China trade friction is not an issue that will be agreed upon easily, and it seems that we have all been reminded that this will be a factor that will weigh heavily on the global economic structure in the future as well.

In the midst of growing uncertainty of our future footing, in this data-driven economy with data being coined as the “Oil of the 21st Century”, the future of Japanese companies, in particular those in the manufacturing industry, is far from grim. Japanese companies, despite possessing advanced technology, are often regarded as the textbook example of a “conglomerate discount”, where they take on various businesses and are unable to effectively utilise their assets or shareholders’ capital. However, in this 5G communication era where “ultra-high speed and ultra-low delay” data come and go, through IoT (Internet of Things) technology, the tie-up of data with various machines / equipment hides immense potential in its metamorphosis into “automated manufacturing platforms” via advanced 3D printing technology. Specifically, we can look forward to corporate groups with systems subsidiaries versed in software technology to become promising targets of investment by showcasing their strengths from effecting a corporate governance reform or business reorganisation.

In the 5/8 issue, we will be covering NS Solutions (2327), ZOZO (3092), Taiyo Nippon Sanso (4091), Fujitsu (6702), Nintendo (7974), and Yamato International (8127).

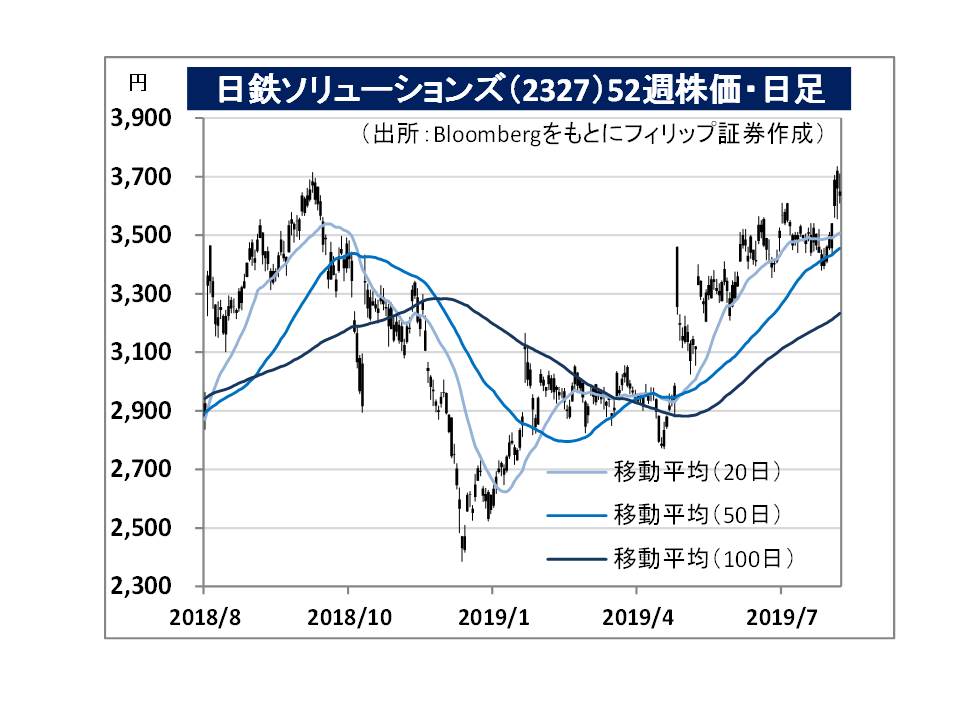

・Established in 1980 with Nippon Steel Corporation as their parent company. Although they are the systems integrator for the Nippon Steel (5401) group, approx. 80% of net sales is accounted by systems development / consulting for government offices and companies other than their parent company.

・For 1Q (Apr-Jun) results of FY2020/3 announced on 30/7, net sales increased by 39.8% to 81.664 billion yen compared to the same period the previous year, and operating income increased by 55.1% to 7.936 billion yen. The increase in the number of major product projects for central government agencies, the contribution from major foundation projects involving industrial / distribution / services, and the increase in service solutions for Nippon Steel, etc. have been the driving force for their business performance.

・For FY2020/3 plan, net sales is expected to increase by 7.8% to 286 billion yen compared to the previous year, and operating income to increase by 5.9% to 27.2 billion yen. In the 5G IoT generation which conducts large volumes of data transaction at real-time between things, as a core company supporting Nippon Steel group’s data distribution, we can foresee an increase in the importance of the company’s role. Attention will likely be focused on business reorganisation due to an increase in the corporate group’s ROE and a corporate governance reform involving parent-subsidiary listing.

・Established in 1998. Expands 2 main businesses which are the ZOZOTOWN business that operates the e-commerce (EC) site, ZOZOTOWN, and the BtoB business, which supports operations of the EC site. Also operates the fashion media, WEAR, which aims to contribute in revitalising the overall fashion market. ZOZOTOWN expands (as of 3/2019) 1,240 shops (excluding PB shops).

・For 1Q (Apr-Jun) results of FY2020/3 announced on 30/7, net sales increased by 6.2% to 28.197 billion yen compared to the same period the previous year, operating income increased by 32.6% to 7.786 billion yen, and net income increased by 27.9% to 5.326 billion yen. Due to contributions involving sales events such as ZOZOWEEK, etc., product transaction volume grew by a 12.5% increase to 79.237 billion yen. Due to a decrease in the distribution numbers for ZOZOSUIT, profit ratio has also improved.

・For its full year plan, net sales is expected to increase by 14.9% to 136 billion yen compared to the previous year, operating income to increase by 24.7% to 32 billion yen, and net income to increase by 40.8% to 22.5 billion yen. Began taking preorders for ZOZOMAT, which enables 3D data measurement of the shape of the foot. Plans to deliver them subsequently in FW2019. We can look forward to an increase in product transaction volume in the footwear category.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: