Report type: Weekly Strategy

“Information Banks”, the New Business in the Age of Data Capitalism

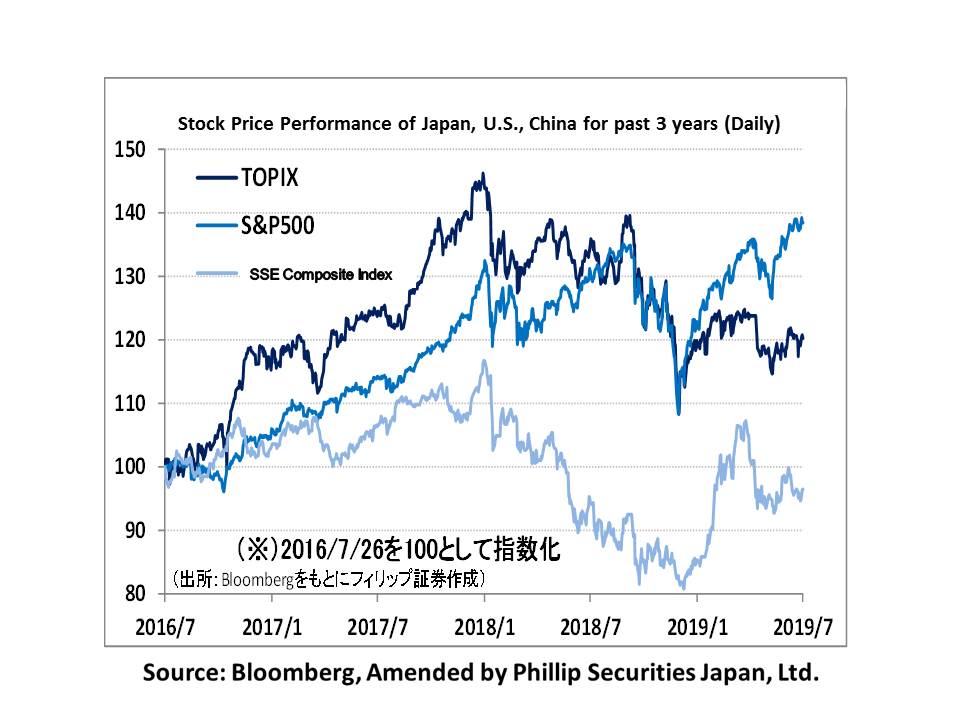

In the House of Councilors election on 21/7, the coalition ruling party comprising the LDP and Komeito won 71 seats, more than the required majority of 63 seats. With results as expected, the focus of the market shifted to monetary policies in each country and trade friction issues. After the elections on 22/7, and following a report from WSJ that President Bullard of the Federal Reserve Bank of St. Louis had stated that there was no need to cut the interest rate by more than 25bp at the next FOMC, TOPIX reacted by falling 0.49% compared to the previous weekend. After that, with expectations that the US might be easing sanctions against Huawei, the resumption of the US-China trade talks and strong corporate results such as those from Coca-Cola (KO), TOPIX rose for three continuous days. However, TOPIX ended the week with a drop on 26/7, as a result of subdued expectations of an interest rate hike arising from strong orders for US durable goods, and also because President Draghi of the ECB did not provide dovish views as was expected.

Data is now seen as the “Oil of the 21st Century”, and companies are using networks to acquire all types of data related to users, and using them for their own service provision. With the advance of IoT, all kinds of data are being freely distributed. As with people, goods and money, the age of “data capitalism”, whereby data is the basis of management resources, is coming. However, following the problem of personal information leakage at Facebook (FB), it has become clear that one is now not certain how one’s personal information is being used. In exchange for convenience, the usage of personal information, without any consideration whatsoever, collected by platform providers, such as “GAFA” (Google, Apple, Facebook, Amazon) in the US, and “BAT” (Baidu, Alibaba, Tencent) in China, is now viewed as a problem, and currently, an international debate is being carried out on the introduction of regulations.

Under such circumstances, the growth strategy of the government’s Council on Investments for the Future is now focusing on “development of rules for the digital market”. On 26/6, the Japan Federation of IT Associations designated Sumitomo Mitsui Trust Bank and FeliCa Pocket Marketing as the first domestic information banks. An information bank provides a service that collects personal information, such as purchase history and age, with the consent of the user, and provides these information to other companies. In return, users enjoy discounts and receive services that take into account their respective attributes and preferences. In addition, on 16/5, NTT Data (9613) also announced plans to put into practical use within FY2019 an information foundation. As the information bank business handles personal information, from a sense of security, traditional companies such as megabanks will dominate this sector. If that happens, it will be an opportunity to revitalize the sluggish stock market.

In the 29/7 issue, we will be covering Gunze (3002), Shin-Etsu Chemical (4063), Chugai Pharmaceutical (4519), OBIC (4684), Cyber Agent (4751) and Giken (6289).

・Established in 1896. In addition to the Apparel Business consisting of apparel and textile materials, other main business also includes the Function Solutions Business for functional materials, mechatronics and medical materials, and the Lifestyle Comfort Business managing real estate and sports clubs.

・For FY2019/3 results announced on 14/5, net sales increased by 0.1% to 140.706 billion yen compared to the same period the previous year, and operating income increased by 7.2% to 6.69 billion yen. The plastic film and engineering plastics sectors in the Functional Solutions Business had performed well, with net sales increasing by 4.7% over the previous year, and operating income increasing by 14.5%, contributing to the increase in sales and profits.

・For FY2020/3 plan, net sales is expected to increase by 4.5% to 147.0 billion yen compared to the previous year, and operating income to increase by 4.6% to 7.0 billion yen. “in.T”, an inner wear for T-shirts released on 2019/3, has been selling well, with good news that there is a continuing shortage of the product. In the medical sector, suture reinforcements and collagen-based artificial skins are also selling well. With the acquisition of Medical U&A, Inc., company is aiming to expand its bone bonding materials business. We can therefore look forward to further growth for this company.

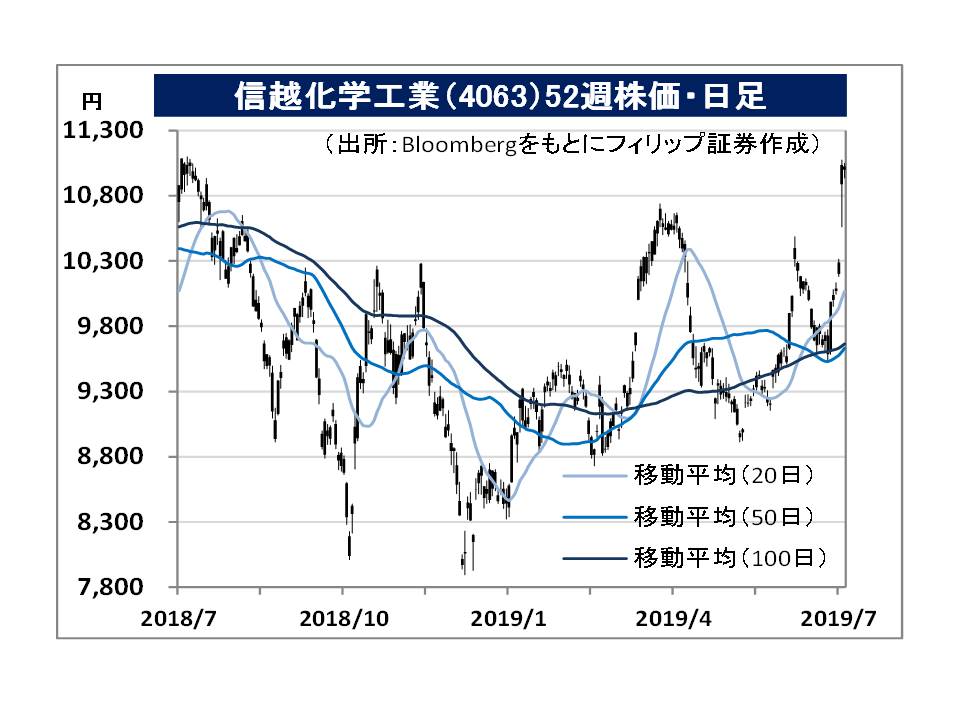

・Founded in 1926. Manufactures and sells vinyl chloride, caustic soda, silicones, functional chemicals, semiconductor silicon and electronics / functional materials. PVC production capacity of US subsidiary Shintech is the largest in the world. Has top share in the world for PVC, silicon wafers, synthetic quartz products, advanced photomask blanks and synthetic pheromones.

・For 1Q (Apr-June) results of FY2020/3 announced on 24/7, net sales increased by 0.7% to 386.211 billion yen compared to the same period the previous year, operating income increased by 12.7% to 107.502 billion yen, and net income increased by 14.0% to 84.028 billion yen. In the silicones sector, despite the decline in general-purpose product prices, company’s effort in expanding sales of functional products had resulted in strong sales. Semiconductor silicones also maintained high levels of shipments.

・Company has also announced its FY2020/3 plans during its 1Q results announcement. Net sales is expected to decrease by 2.8% to 1.55 trillion yen compared to the previous year, operating income to increase by 0.3% to 405.0 billion yen, and net income to increase by 1.6% to 314.0 billion yen. Although sales are expected to decrease due to market conditions, etc., company aims to secure profitability by strengthening cost competitiveness. Annual dividend forecast is 220 yen, up by 20 yen over the previous year.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: