Report type: Weekly Strategy

A Japan Stock Market with Corporate Governance Reform Holding the Key

During the week of 24/6, the Japanese stock market adopted a wait-and-see attitude in view of the upcoming G20 Osaka Summit. As a result, trading volume on TSE Section 1 until 26/6 had remained thin just short of two trillion yen. We had been mentioning in this Weekly Report before that a Nikkei average of 21,000 points is an important milestone for the market in the medium to long term. As the saying, “No sales during a period of inactivity”, goes, the Nikkei average fell to 21,035 points on 26/6, but rebounded thereafter.

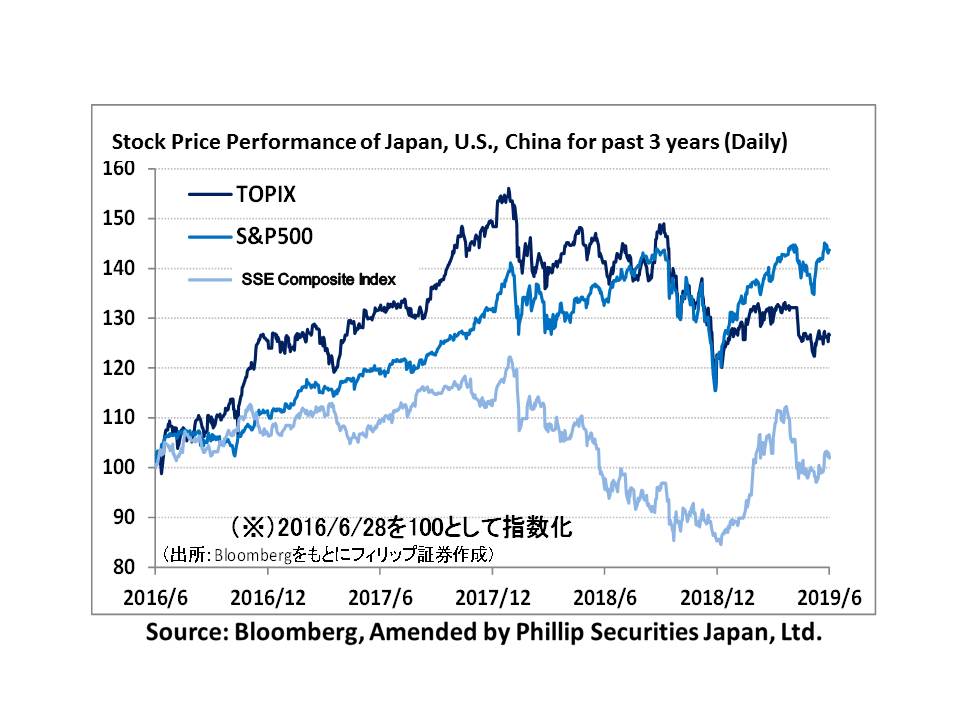

Let’s recall that the amount of Japanese stocks sold by foreign investors reached 5.6 trillion yen in 2018, surpassing that in 2008, the year of the Lehman Shock, and reaching a record since 1987. Sales by foreign investors accelerated during the 2019/1-3 period, reaching 2.3 trillion yen within three months. Despite support on the demand-side through buying entities such as the BOJ’s ETF purchases and companies’ share buybacks, and support through fundamentals where the weighted average based PER is 11 times and the PBR is 1.1 times or less, the fact that the Nikkei average is hovering around 21,000 points after absorbing huge amounts of sales by foreign investors is a testimony of the resilience of Japanese stocks.

However, the fact that prices are cheap with firm low prices does not necessarily lead to rising stock prices. I would like to point out that corporate governance, especially “parent-subsidiary listing”, is one of the keys to the shift towards rising stock prices. With regard to parent-subsidiary listing, in addition to the risk of conflicts of interest between the shareholders of the parent and subsidiary companies, the fact that both the parent and subsidiary can gain from new releases is regarded as a problem. From the perspective of the shareholders of the parent company, shareholders’ equity becomes excessive, and this may be a factor that leads to a lower ROE (Return on Equity). At the same time, the fact that a part of the profits earned by a subsidiary is leaked out as minority interests is also seen as a problem.

Looking at the ROEs in the most recent full-year results of three companies with the most listed subsidiaries, that of AEON (8267) is 2.1%, LIZAP Group (2928) is ▲54.9% and GMO Internet (9449) is ▲43.1%. From the shareholders’ perspective, it is desirable to improve their ROEs. In the midst of this, Nomura Holdings (8604) announced on 18/6 that it would sell the shares of Nomura Research Institute (4307) through TOB, and thereafter conduct a share buyback of its own shares after lowering its shareholding in NRI. We believe this is an attempt to increase ROE after enhancing the management independence of group companies. From the point of view of NRI shareholders, share buyback via TOB raises EPS, and capital efficiency like ROE is also expected to rise. Let’s look forward to more of such activities related to the issue of parent-subsidiary listing.

In the 1/7 issue, we will be covering Kyocera (6971), Matsuda Sangyo (7456), Ichibanya (7630), Parco (8251), AEON Financial Service (8570) and Kamigumi (9364).

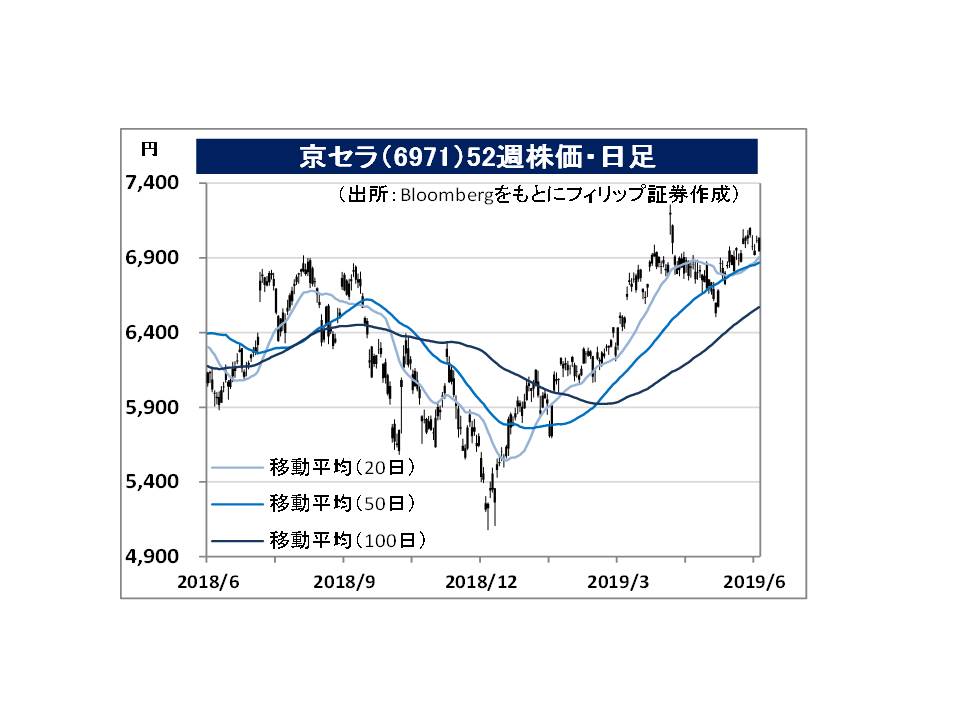

・Founded in 1959 as Kyoto Ceramic. Provides products in the fields of industrial / automotive parts, semiconductor-related components, electronic devices (electronic components, printing devices), communication (smartphones, tablets), document solutions, life and environment, etc. Had produced the “Kyocera Philosophy” and “Amoeba Management”.

・For FY2019/3 results announced on 25/4, net sales increased by 3.0% to 1.62371 trillion yen compared to the same period the previous year, operating income increased by 4.5% to 94.8232 billion yen, and current income increased by 30.4% to 103.21 billion yen. Sales of ceramic capacitors for smartphone, as well as printing devices for industrial equipment had increased, with contribution also from M&A. There was also a contribution from a temporary tax charge.

・For FY2020/3 plan, net sales is expected to increase by 4.7% to 1.7 trillion yen compared to the previous year, operating income to increase by 47.6% to 140.0 billion yen, and current income to increase by 21.1% to 125.0 billion yen. According to newspaper reports, company has developed a next-generation lithium-ion battery that reduces raw material costs by 30%. Mass production is expected to start within FY2021/3 earliest.

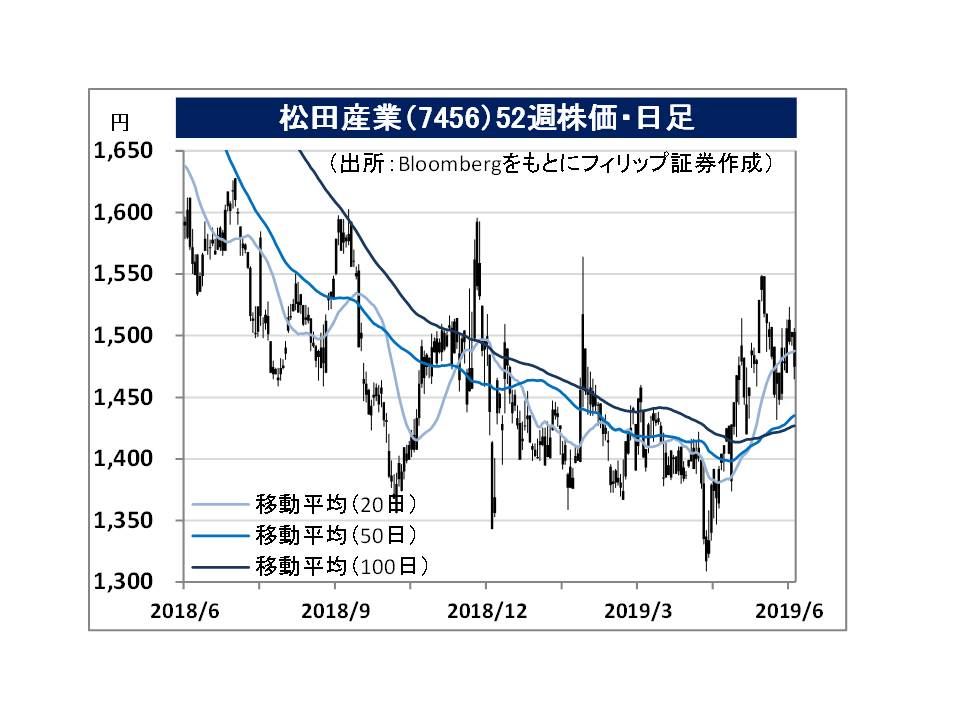

・Established in 1951. Operates the Precious Metals-related Business handling precious metal recovery and refining, sale of precious metal and electronic materials, and collection and treatment of industrial waste, and the Foodstuff-related Business selling food processing raw materials. The precious metals of the company, namely gold, silver, platinum and palladium have been designated as deliverable grade metals by TOCOM. These ingots have also been registered at LBMA and LPPM.

・For FY2019/3 results announced on 13/5, net sales increased by 9.5% to 208.338 billion yen compared to the same period the previous year, operating income increased by 1.4% to 4.948 billion yen, and current income decreased by 2.0% to 3.391 billion yen. Sales volume of precious metal products and volume of industrial waste treatment handled had increased. Price increase of palladium had also contributed. Final profit decreased due to decrease in investment income according to the equity method.

・For FY2020/3 plan, net sales is expected to decrease by 4.0% to 200.0 billion yen compared to the previous year, operating income to increase by 1.0% to 5.0 billion yen, and current income to increase by 1.7% to 3.45 billion yen. Maintaining and expanding business by strengthening bases both in and out of Japan, improving efficiency, and cultivating new demands. CMX Gold Futures had risen to a level attained 5 years and 9 months ago, and this is expected to be a push factor.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: