As planned, from midnight 00.01 am US Eastern time on 7/6 (Japan time 1.01pm on 7/6), the US started imposing 25% additional tariffs as sanctions on China on 818 products, equivalent to 34 billion US dollars, including automotive, semiconductors and industrial machinery, etc. The spokesman from the Ministry of Commerce, China, said that they had verified the impact of these additional tariffs on Chinese companies, and stated that they would be forced to retaliate. On 7/6, China imposed 25% additional tariffs on 545 products such as soybeans and automotive etc, equivalent to 34 billion US dollars.

We need to see how the US will respond to China’s triggering of these retaliatory tariffs. President Trump had stated that if China were to take any countermeasure, the US would impose additional tariffs on 200 billion US dollars worth of Chinese products. This is expected to take effect after August. The US Department of Commerce has also started considering strengthening regulations on the export of high-tech products to China.

With the imposition of additional tariffs by both the US and China, products from both countries are expected to flow to other countries and regions. There is therefore concern that this may disrupt the global supply and demand situation. In response to additional tariffs imposed by the US, there is a possibility that the EU may impose emergency import restrictions (safeguards) on steel products provisionally from mid-July. We are concerned that this may have global effects, including for Japan. OECD has estimated that, if the cost in the US, Europe and China increases by 10% as a result of these tariff increases, then global GDP will decrease by 1.4%.

However, on 7/6, major Asian stock markets including Japan and China etc, responded strongly. Against the background of the escalating trade friction between the US and China, the Shanghai Composite Index fell to 2,690 points on 7/6 from its recent high of 3,100 points on 6/7. Japanese stocks also continued to decline owing to increasing linkage to Chinese stocks. There is growing concern that domestic global enterprises that have built supply chains around the world may suffer directly or indirectly through the economic damage that China will sustain. However, with the start of additional tariffs between the US and China on 7/6, the market appears to accept that the worst is over for the time being, and increased buyback activities could be seen. The future of trade problems between the US and China is still uncertain. We expect President Trump’s hardline stance to continue towards midterm elections. However, we anticipate that stocks which had been oversold in the short-term due to the declining market since the middle of June will experience some degree of buybacks. We should pick up stocks that have confirmed good results and which are resilient against the effects of trade friction.

In the 7/9 issue, we will be covering Seven & I HD (3382), Nippon Carbon (5302), TOTO (5332), United Arrows (7606), MANI (7730) and SCREEN HD (7735).

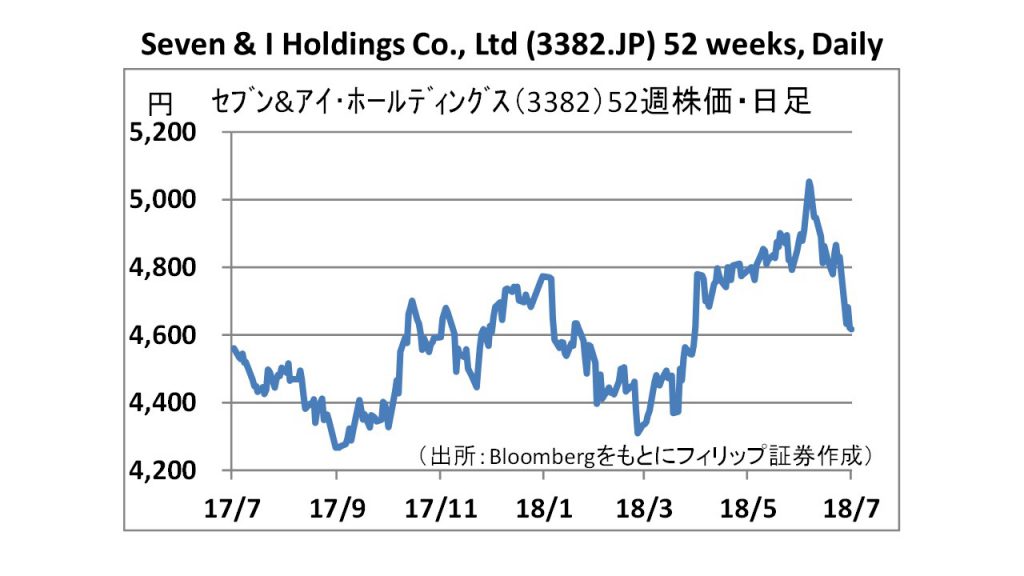

Seven & I Holdings Co., Ltd (3382)

Seven & I Holdings Co., Ltd (3382)

・Established in 2005. Planning, management and operation of Group companies centering on convenience stores, hypermarkets, food supermarkets, department stores, specialty stores, food services, financial services and IT services, etc.

・For 1Q (Mar-May) of FY2019/2, revenue from operations increased by 8.9% to 1.599 trillion yen compared to the same period the previous year, operating income increased by 5.7% to 86.376 billion yen, and net income increased by 27.5% to 42.887 billion yen. Overseas convenience store business and financial-related business are doing well. Hypermarket Ito-Yakodo improved its profitability through structural reforms such as strengthening food sales.

・For FY2019/2 plan, revenue from operations is expected to increase by 10.7% to 6.683 trillion yen compared to the previous year, operating income to increase by 6.0% to 415 billion yen, and net income to increase by 15.9% to 210 billion yen. The company will be partnering with Zoshinkai Holdings which is developing correspondence courses “Z-Kai”. It is aiming to create new services by combining stores, classroom network, membership base and product capabilities, etc.

Nippon Carbon Co., Ltd (5302)

・Founded in 1915. A pioneer in the carbon industry. Manufactures and sells carbon products. Engaged in Japan’s first artificial graphite electrode for electric furnace for steelmaking. Also handles special carbon products, carbon fiber products, silicon carbide continuous fiber, graphite materials for lithium ion batteries and high purity graphite used for manufacturing crystalline silicon etc.

・For 1Q (Jan-Mar) of FY2018/12, net sales increased by 48.2% to 8.489 billion yen compared to the previous year, operating income was 1.897 billion yen, and net income was 1.218 billion yen, with both turning positive. In addition to growth in carbon fiber and specialty carbon products owing to favorable semiconductor market conditions, lithium ion battery negative electrode materials for automotive also maintained steady growth. Selling price corrections of electrodes also contributed.

・Company has revised its FY2018/12 full year performance upwards as a result of price correction of graphite electrodes, and expansion in the fine carbon and lithium ion battery negative electrode material sectors. Net sales is expected to increase by 48.4% to 41.5 billion yen (original plan 37.5 billion yen) compared to the previous year, operating income to increase by 4.3 times to 11.0 billion yen (original plan 7.0 billion yen), and net income to increase by 2.5 times to 7.4 billion yen (original plan 4.6 billion yen).

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: