The 2019 European Parliament Elections is the 9th election since the first held in 1979. Citizens from the 28 member states get to vote for the 751 Members of the European Parliament (MEP).1 The members represent the interests of different countries and regions within the EU. They are also responsible for making laws and approving budgets, and also plays a role in the EU’s relations with other countries including those that wish to join the EU.

The European Elections takes place once every five years, with each country allocated a fixed number of seats. Back in February 2018, the European Parliament voted to decrease the number of MEPs from 751 to 705 if the UK were to withdraw from the EU on 29 March 2019. However, the Article 50 process of UK’s Brexit has been delayed till the end of October 2019. With this turn of events, the number of MEPs remained the same during the elections since UK had to take part in it.

Events such as the European elections may impact the European stock market if unexpected news arise from it. Beyond the internal impact of the elections on the European market, more importantly, investors should keep an eye on the ongoing US-China trade war which may spillover to the European countries.

So amidst the uncertainty in these events, opportunities still exist in the European Union. Furthermore, investors whom wish to further diversify their portfolio may consider stocks in Europe. This article will seek to introduce some European equities that investors may consider for their portfolio.

Table 1: List of European Equities

|

Company |

Ticker |

Market Capitalization (€Billion) |

Last Done Price |

Analyst Consensus Target Price |

Dividend Yield (Past 12 Months) |

P/E Ratio |

P/B Ratio |

|

Orange SA |

ORA.FP |

37.30 |

€13.82 |

€16.57 |

4.98% |

22.50 |

1.50 |

|

Airbus SE |

AIR.FP |

89.50 |

€123.40 |

€135.82 |

1.43% |

31.90 |

10.02 |

|

Siemens AG |

SIE.GY |

87.80 |

€103.30 |

€124.35 |

3.68% |

18.90 |

1.98 |

|

Volkswagen AG |

VOW.GY |

72.10 |

€145.90 |

€194.04 |

3.32% |

6.30 |

0.69 |

Telecommunications – Orange SA (Ticker: ORA.FP)

Retail investors who are risk averse can look into telecommunications stock Orange SA, listed in Euronext Paris. Orange SA provides telecommunications services, equipment sales and rental. The general markets that they serve are in Europe, which they have since expanded recently with their latest venture into Africa and the Middle East. The telecommunications sector belongs to the defensive sector, which means that the share performance does not fluctuate wildly as compared to growth stocks. This will therefore provide stability in an investor’s portfolio. Based on the figure below, the stock has been trading within a relatively small range. The annual results also shows that the objectives announced for 2018 were achieved, with revenue displaying signs of modest growth. These were supported by businesses conducted in Africa and the Middle East which accounted for almost half of the Group’s growth in 2018.

Figure 1: Price Chart of Orange SA

Source: Bloomberg

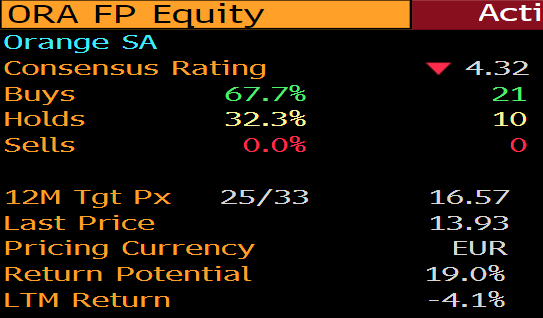

Being one of the largest operator in the telecommunications industry, Orange SA signed a network-sharing agreement with Vodafone in Spain. This will enhance existing coverage and generate savings on network expenditure, which will potentially strengthen Orange SA’s financial position in the long run. In fact, network-sharing will not only benefit them in terms of cost savings, it will also allow the company to roll out 5G services more efficiently, thereby enhancing user experience. Analysts’ consensus rating for Orange SA are also positive as shown in the figure below.

Figure 2: Orange SA Consensus Rating

Source: Bloomberg

In conclusion, investors looking for a stable investment that will unlikely be influenced by the political outcome of the European elections can consider this counter. With an attractive and stable dividend yield of approximately 5%, coupled with stable share price movements, investors can consider including this stock into their portfolio for diversification.

Aircraft Manufacturer – Airbus SE (Ticker: AIR.FP/AIR.GY)

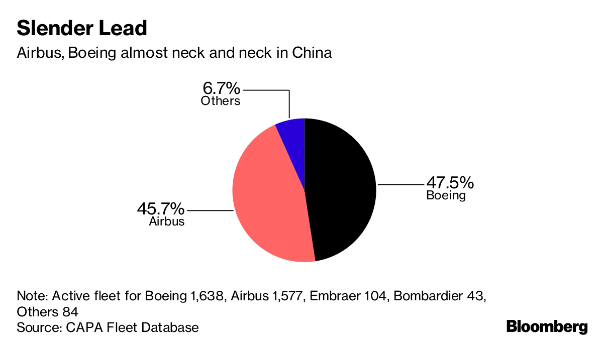

Airbus SE is a company that manufactures airplanes and military equipment. It is currently dual listed in both Germany’s FWB and EuroNext Paris exchange. It operates in a duopoly market, whereby both Airbus SE and Boeing are the main suppliers in this market. As seen from the figure below, we can see that the Chinese airlines mainly use Airbus SE and Boeing planes. Being in a duopoly market enables Airbus SE to be in a commanding position in terms of supplying new planes to its customers. Boeing’s recent 2 crashes has led to concerns on its safety, which has in turn damaged the brand. This may therefore benefit Airbus SE in the short term while the issue is still in the midst of being resolved by Boeing.

Figure 3: Airline Supply in China

Source: Bloomberg

The recent announcement of the cancellation of the A380 program2 has resulted in the net orders of aircraft for Q1 2019 to be -58. There were also new orders with a total backlog of 7,357 aircraft as seen in the figure below. The recently released results reported slightly better than expected core first quarter profits. Revenues have increased in Q1 2019 due to higher deliveries. Revenues from other sources have also been stable.3

Figure 4: Consolidated Airbus Order Book

Source: Airbus

On the technical perspective, Airbus SE has been on an uptrend since the end of 2016. Investors may consider entering at the bottom of the trend channel. Long term trend should continue as demand for planes will likely support the aircraft manufacturing business.

Figure 5: Price Chart of Airbus SE

Source: Bloomberg

In the long run, demand for new planes will continue to grow due to the demand for air travel in emerging markets. Airlines will look into purchasing from the 2 major suppliers as they have proven track record in terms of product and safety. As the industry has high barriers to entry due to high Research and Development (R&D) cost involved, Airbus SE is poised to maintain its position in the middle to long term prospect. The company will unlikely be affected by the upcoming elections due to the industry they operate in, which is that customers are diversified around the world. Also, the ongoing trade war concerns appears to benefit them as shown by China’s recent bulk purchase of Airbus planes.4 Therefore, investor may consider Airbus SE due to the potential long term returns and current macro factors such as the China-US trade concerns.

Engineering/Manufacturing – Siemens AG (Ticker: SIE.GY)

Siemens AG is an engineering and manufacturing company focusing on the areas of electrification, automation and digitalization. They are a leading supplier of systems for power generation and transmission. The company is also a geographically diversified business that produces energy efficient and resource saving technologies. The effects of global events such as the trade war and European elections will therefore be mitigated due to the company’s strong foothold in the global industrial industry.

Figure 6: Siemens AG Financials

Even though they operate in a cyclical industry, revenues collected from the wide geographical diversification means they are able to achieve stable revenues.5 Siemens AG is poised to gain an advantage as the world begins to shift towards digitalization and electrification. The increased focus on renewable energies such as solar and wind energy generation will likely be the main driving factor to its business model. From the figure below, we can see that the guidance set out for FY2018 was achieved. Revenues has been very consistent throughout the past 5 years.

Figure 7: Price Chart of Siemens AG

Source: Bloomberg

From the technical perspective, Siemens AG has been on a long term down trend from around mid-2017. The downtrend was mainly due to the ongoing problems at the power and gas division of the business. This, coupled with the fact that Siemens AG did not reveal the details about the cost and efficiency savings that their Vision 2020 would achieve, resulted in uncertainty in its business outlook. Due to the multiple businesses that Siemens AG conducts, investors might be afraid that the core business will be negatively affected. However, the order intake has significantly improved through Q3 of 2018.

In conclusion, Siemens AG has a highly diverse portfolio of leading global operations in industries with massive growth potential. The industry they operate in has strong barriers to entry due to the advanced technologies used, which requires high R&D cost. In the long run, the shift in trends towards higher sustainability will likely drive the company forward. Also, it is worth noting that the company provides an appealing dividend policy which will return cash to its shareholders over the long run. Therefore, investors may consider this as a long term investment proposition.

Automotive Manufacturer – Volkswagen AG (Ticker: VOW.GY)

Volkswagen AG is an automotive manufacturer which owns an extensive portfolio of vehicle brands ranging from economy to luxury. This includes brands such as Audi, SKODA, SEAT, Bentley and Porsche. The company holds a global market share of more than 12%, with the key markets including western Europe, China, US, Brazil and Mexico. The world’s biggest auto maker is still suffering from reputational and fiscal damage from the 2015 diesel emission scandal. The scandal has cost the share price to retrace nearly 40% from a high of 250 euros in early 2015 to approximately 150 euros in recent times. Coupled with the fact that global car-industry growth appears to be slowing down since last year, share performance for Volkswagen AG have not been fantastic.

Figure 8: Price Chart of Volkswagen AG

Source: Bloomberg

Despite all the issues facing the industry, Volkswagen AG still managed to report a slightly better operating profit in 2018.6 The valuations of the stock also looks attractive at the current price level. The stock currently trades at just about 5.5 times forward Price to Earnings. It is also worth noting that Volkswagen has a very strong global brand strength, as well as a higher cash flow as compared to its rivals in Europe. This allows them to better manage crisis such as the emissions scandal in 2015. Even though the damage was severe, we can see that the stock’s low price currently more than discounts its problems moving forward.7

The immediate risk posed to the stock is the ongoing trade war set out by the US rather than the European elections. The concern is that US could soon impose tariffs on EU cars, potentially impacting Volkswagen AG as US is one of the key markets to Volkswagen.8 However, the impact will definitely be mitigated with the fact that Volkswagen is the market leader in the automotive industry with a diverse global markets for its vehicles.

Figure 9: Volkswagen AG Consensus Rating

Source: Bloomberg

Volkswagen is also venturing into electric vehicles. They now plan to launch almost 70 new electric models by 2028 as compared to 50 from its earlier plan. This move will hopefully enable it to capture market share during the infancy stage of electric vehicles. In conclusion, Volkswagen AG is a worthy stock for investors to look into considering its recovery from the emission scandal crisis, as well as the fact that it is a market leader serving a diversified global market.

Information is accurate as of 13 June 2019

References

[1] https://www.nytimes.com/2019/05/21/world/europe/european-parliament-election.html

[2] http://fortune.com/2019/02/14/airbus-ends-production-a380/

[3] https://www.cnbc.com/2019/04/30/airbus-keeps-outlook-as-fuirst-quater-core-earnings-rise.html

[5] https://seekingalpha.com/article/4216962-siemens-unlocking-durable-long-term-growth-conviction-buy

[6] https://www.fool.com/investing/2019/02/25/volkswagens-profit-rose-in-2018-but-2019-could-be.aspx

[7] https://www.barrons.com/articles/volkswagen-stock-pick-1541553638

[8] https://www.cnbc.com/2019/05/02/volkswagen-earnings-q1-2019.html

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Ming Jun graduated from RMIT with a Bachelor’s Degree in Business Management. He joined Phillip Securities in 2016 as an Equity Dealer and is currently with the Global Markets Team, specialising in the UK and Europe markets as well as supporting the US and Canada markets. He has provided regular market commentaries across various media channels such as Morning Express Channel 8, 95.8FM Live Radio, 联合早报.