Civil Engineering Sector

Company Specifics

Initiating coverage with “Reduce” rating

Hock Lian Seng Holdings (HLSH) is expected to face challenges in operating performance as competition intensifies in the civil engineering sector amid the ongoing slowdown in private sector construction demand. Coupled with the absence of revenue contribution from property development, we expect both earnings and dividends to decline over the next few years till 2018 when the development of the group’s industrial property is completed. We have initiated coverage on HLSH with a “Reduce” rating based on a SOTP valuation of S$0.31.

Company background

Hock Lian Seng Holdings (HLSH) was first established in 1969, and have since completed a wide range of civil engineering projects for both the public and private sectors in Singapore. Since its listing on the Singapore Exchange Mainboard in December 2009 at S$0.25 per share, the group’s business activities have transitioned into two primary segments, namely civil engineering and property development.

Civil Engineering Segment

HLSH has been a main contractor for civil engineering projects in Singapore and major customers of the Group, including government and government-related bodies of Singapore, such as the Land Transport Authority, the Housing & Development Board, PSA Singapore Terminals, Public Utility Board and Civil Aviation Authority of Singapore (CAAS).

The Group is a Grade A1 contractor in the Building and Construction Authority of Singapore’s (BCA) Civil Engineering (CW02) category. Grade A1 is the highest grade to be registered under the BCA, and allows a contractor to tender for Singapore public sector civil engineering construction works of unlimited contract value.

Property Development

The group ventured into the property development business at the end of 2012 and has since developed two industrial properties within the Group and one residential property via a joint venture (JV). The development of the residential property, The Skywoods, is a JV between HLSH (50%) and two other JV partners, King Wan Corporation (25%) and TA Corporation (25%). The Group is currently developing an industrial property, Shine@Tuas South, which is expected to be completed in 2018.

Civil Engineering Sector

Public sector construction demand in 2016 is expected to be the highest since 2002 as private sector construction demand weakens

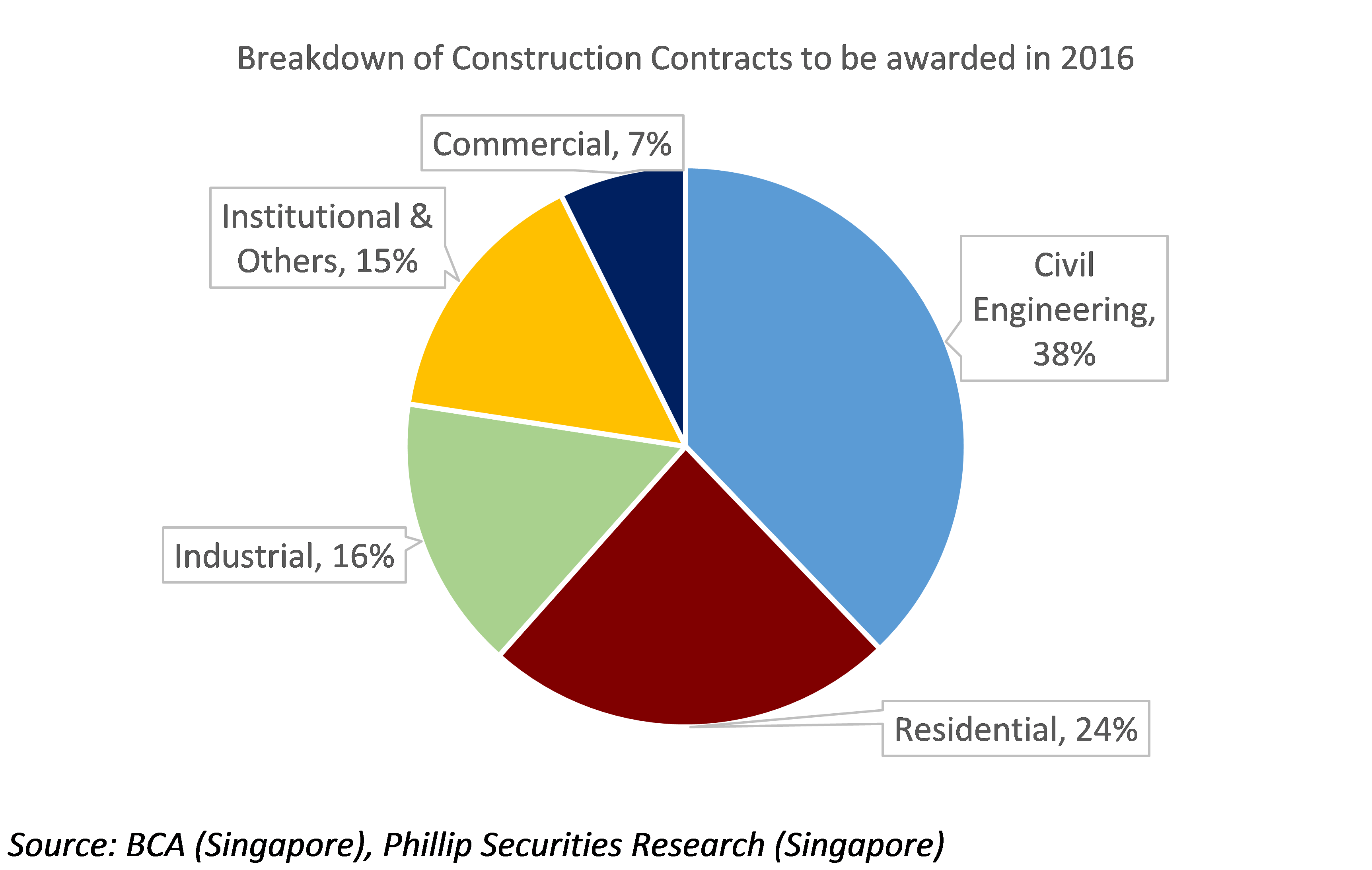

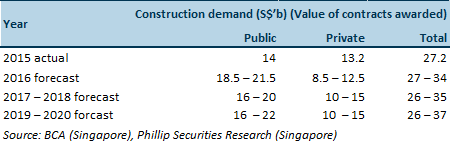

The Building and Construction Authority (BCA) projected that the total value of construction contracts to be awarded in 2016 would be in the range of $27b to $34b. This value is at least equivalent to or higher than that of 2015 ($27.2b). Out of the total construction contracts to be awarded in 2016, 37.9% is expected to be civil engineering projects. The lower construction demand in 2015 stemmed from the rescheduling of project tenders for a few major infrastructure projects to 2016, in particular, certain MRT stations and the North South Corridor. Furthermore, should the forecasted estimates be met this year, the proportion of construction demand from the public sector will be the highest in 14 years since 2002, where public sector contracts accounted for 66.6% of the total contracts awarded in that year. On top of the rescheduling of public projects to 2016, construction demand is waning from the private sector (2015a: $13.2b, 2016f: $8.5b – $12.5b) as a result of weakness in the current economic climate, an oversupply of unsold private housing units, as well as a softening demand for office and industrial spaces.

According to BCA’s projections, out of the total construction contracts ($27b-$34.1b) to be awarded in 2016, civil engineering (38%) is expected to be the largest segment.

According to BCA’s projections, out of the total construction contracts ($27b-$34.1b) to be awarded in 2016, civil engineering (38%) is expected to be the largest segment.

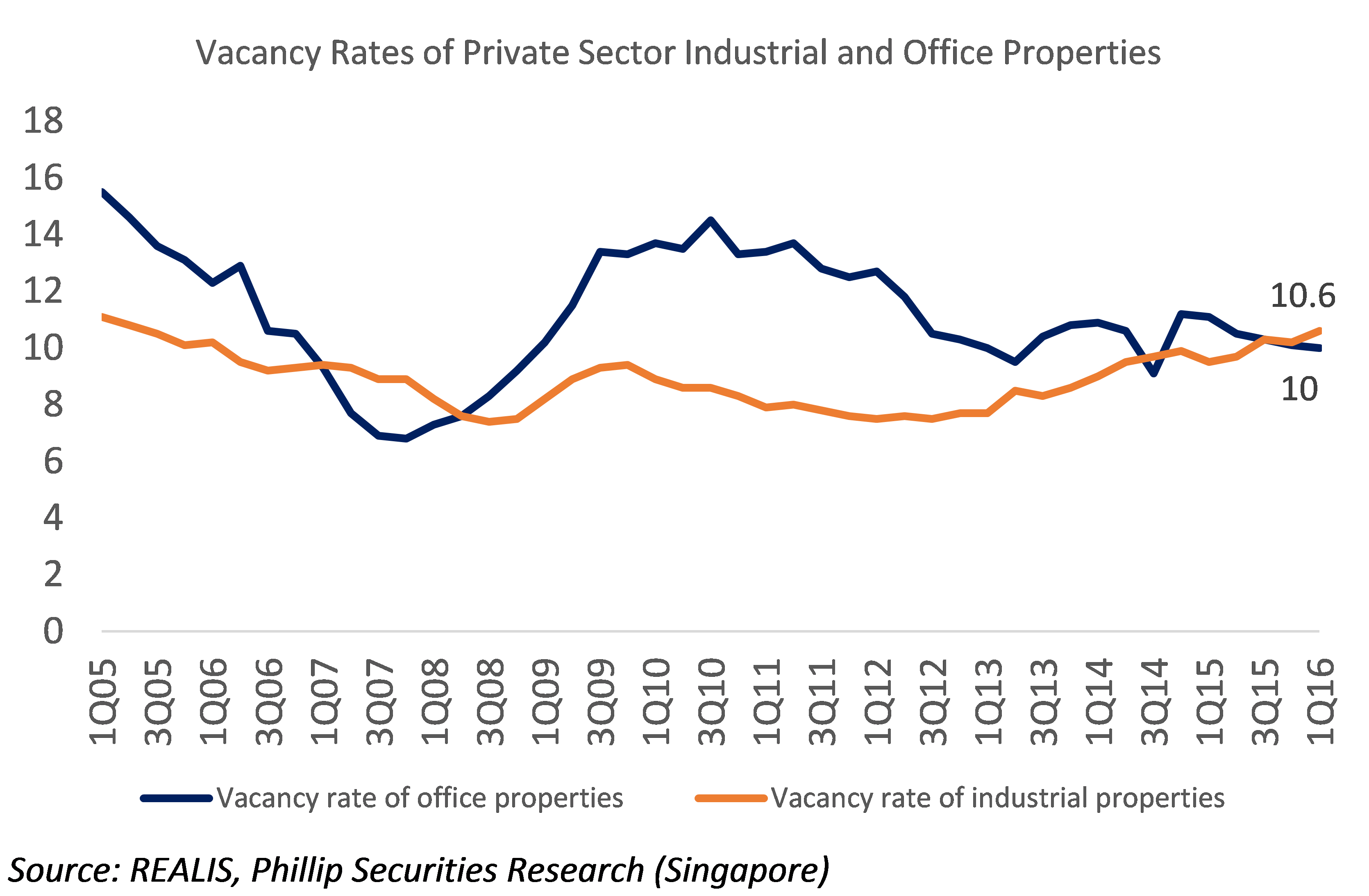

The 10 year average vacancy rates for private sector office and industrial properties are 10.9% and 8.7% respectively. The current vacancy rate for private sector office properties as at 1Q16 is 10% which is close to the 10 year average. The current vacancy rate for private sector industrial properties as at 1Q16 is 10.6%, and is 1.9 ppts higher than the 10 year average.

Civil engineering construction demand is expected to accelerate in 2016 and poised to stay strong at least till 2020

Civil engineering construction demand is expected to stay strong beyond 2016, driven by more major public infrastructure works including the construction of new MRT lines, North-South Corridor, associated works in Changi Airport Terminal 5, and phase 2 of the Deep Tunnel Sewerage System. BCA forecasts that 40% of construction demand between 2017 and 2020 will come from civil engineering projects, or c.$8b worth of contracts to be rolled out each year in the same time period.

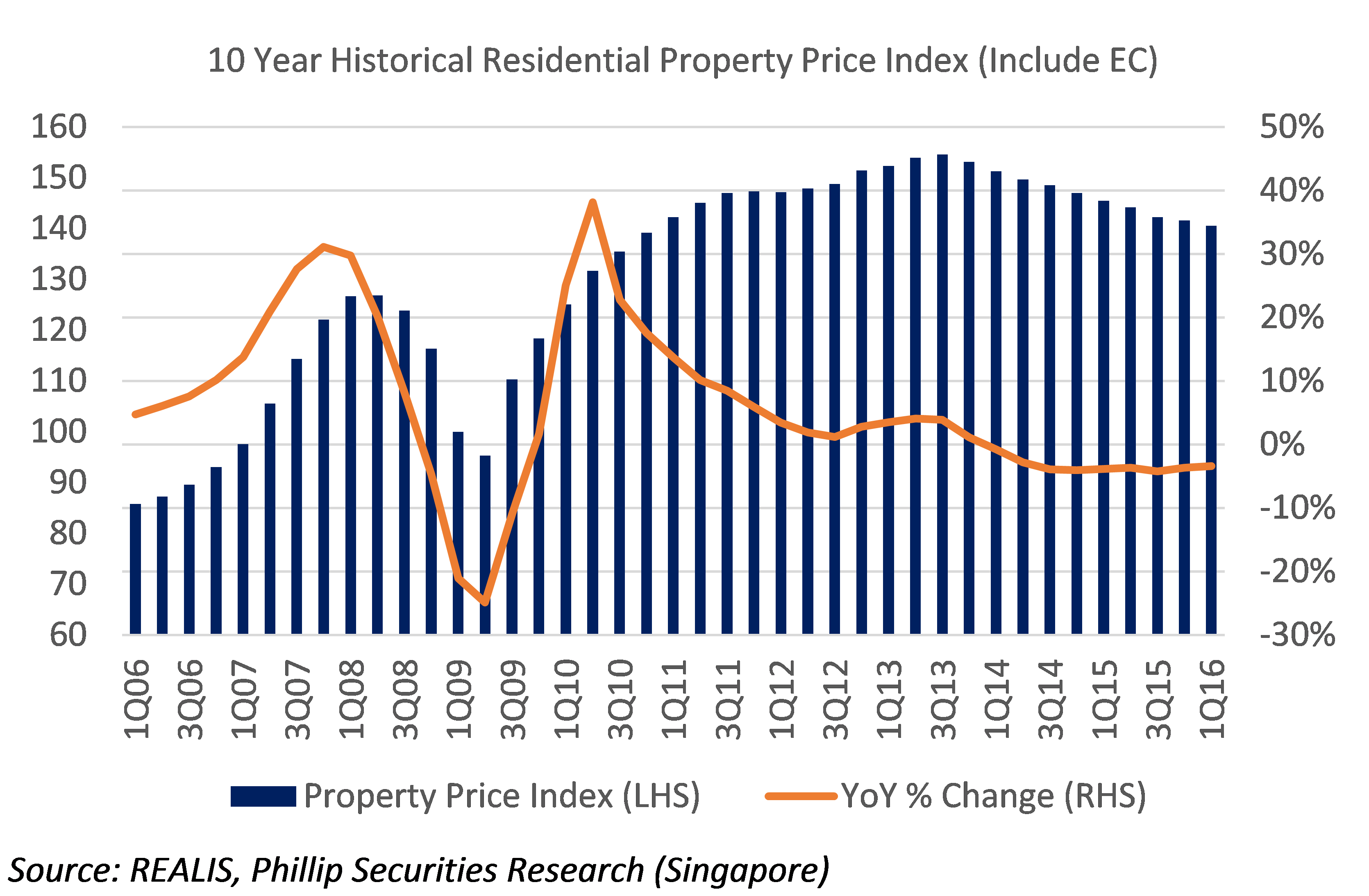

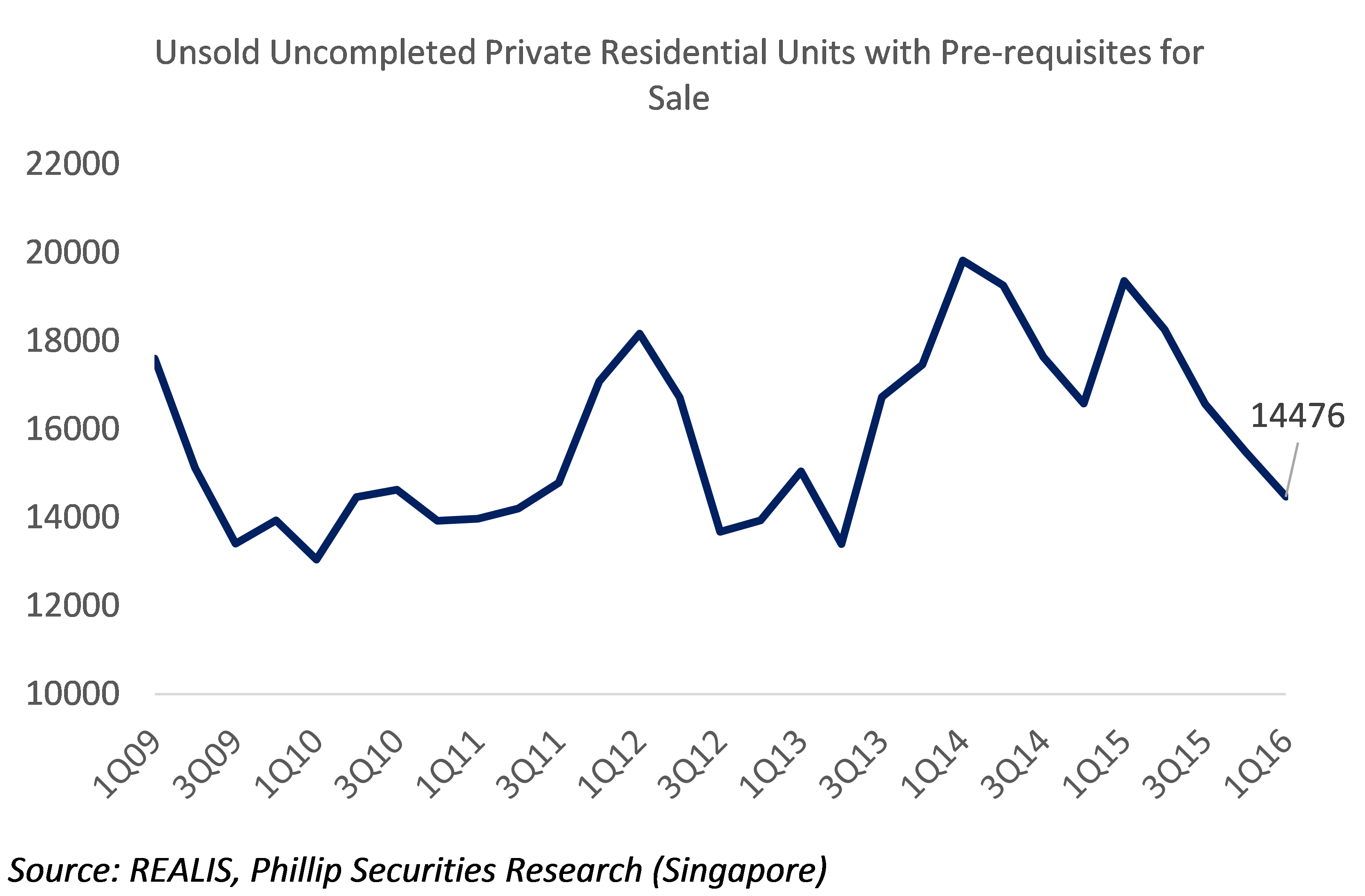

Real estate construction activities are slowing down from excess supply of unsold residential units in the market

The slowdown in the property market was mainly attributed to the several rounds of cooling measures that were put in place by the Singapore government in order to curb the rapid increase in property prices. While the number of unsold residential units with pre-requisites for sale (excluding executive condominium) has been steadily declining for the past five quarters, more time is required before the excess supply of unsold residential units can be completely absorbed. Having observed that the number of new units are being absorbed at a rate of c.1200 units per quarter for the past four quarters between 2Q15 and 1Q16, and if this number is extrapolated, it will take at least another 12 quarters before these excess residential units can be totally absorbed. In response to the current oversupply situation, real estate developers have adopted a cautious stance and have been significantly reducing the launch of new private property project that has led to a reduction in construction activities in the private sector. However, the absorption rate is likely to accelerate should the Singapore government decide to unwind the cooling measures in the market.

The residential property price index peaked in 3Q13 as a result of the nine rounds of property cooling measures that were introduced by the Singapore government, before steadily declining into 1Q16.

The number of unsold private residential property units have been declining at an average rate of around 1,200 units for the past three quarters since 2Q15, and there were 14,476 unsold units by the end of 1Q16.

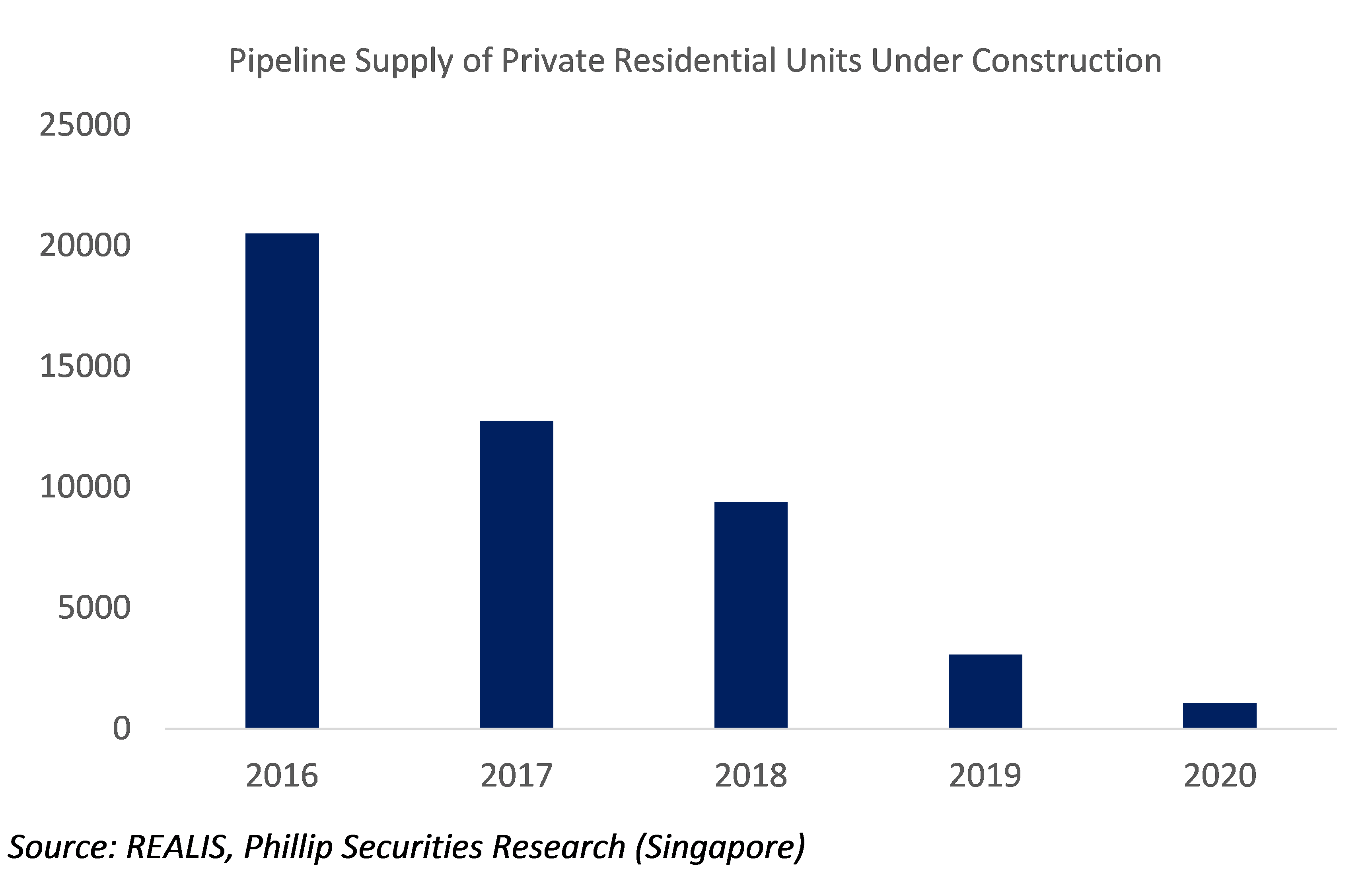

The pipeline of private residential units under construction is dropping significantly, as the private residential market continues to face slowing demand and an oversupply situation.

Grade A1 contractors are able to participate in project tenders of higher contract value where contractors with lower BCA grades are not eligible for

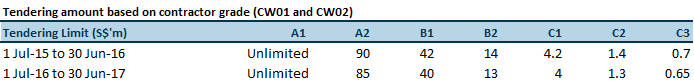

As at 19 Jun-16, out of the 969 companies registered under the BCA Contractors Registration System, only 48 contractors are registered as Grade A1 contractors. As civil engineering projects are generally higher in contract value, a lower tendering limit not only puts a constraint on the size but also the kind of project tenders which a contractor is eligible to participate in. For instance, larger scale infrastructure projects such as the construction of MRT stations, expressways and airport related works typically command contract values in excess of $100m. As such, contractors of Grade A2 and below are unable to participate in such tenders since the value of contract to be tendered cannot exceed $85m.

The BCA revises project tender limits for contractors on an annual basis.

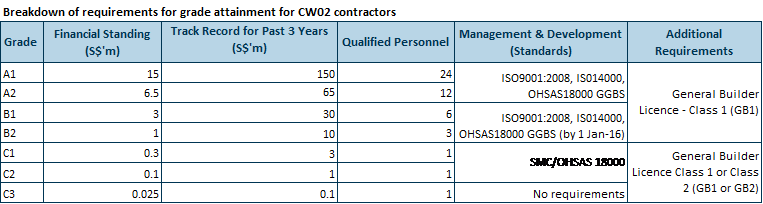

Contractors registered under BCA have to meet ongoing requirements in order to maintain their respective grades

The requirements for a contractor to attain each grade are set out by the BCA and classified into five main categories, namely financial standing, track record of project completions carried out in the past three years, number of qualified personnel to handle the project, management and development (ISO standards) as well as other additional requirements. Contractors are required to fulfil ongoing requirements in order to maintain their respective grades. For instance, an A1 contractor will be downgraded to A2 should the track record of project completions in the past three years decline to $100m. This means that the downgraded contractor will have to re-attain the requirements for a Grade A1 contractor before its grade can be restored.

Source: BCA Singapore, Phillip Securities Research (Singapore)

Competition is heating up as more contractors are increasingly hungry for project and returning to public sector projects

As mentioned above, construction activities in the private sector are projected to be weak in 2016, as well as for the next few years until at least the excess supply of residential units are completely absorbed. Contractors who were previously involved in private sector construction projects, are observed to be increasingly returning to participate in public sector project tenders, thereby intensifying competition among contractors. In addition, contractors are increasingly hungry for projects as they have to meet ongoing requirements in order to maintain their grades. For instance, to meet the qualified personnel requirement, contractors are required to incur overheads and upkeep a pool of qualified personnel in order to maintain their grades.

Margins in the sector are expected to reduce further as labour costs continue to expand, and uncertainties from costs of construction materials

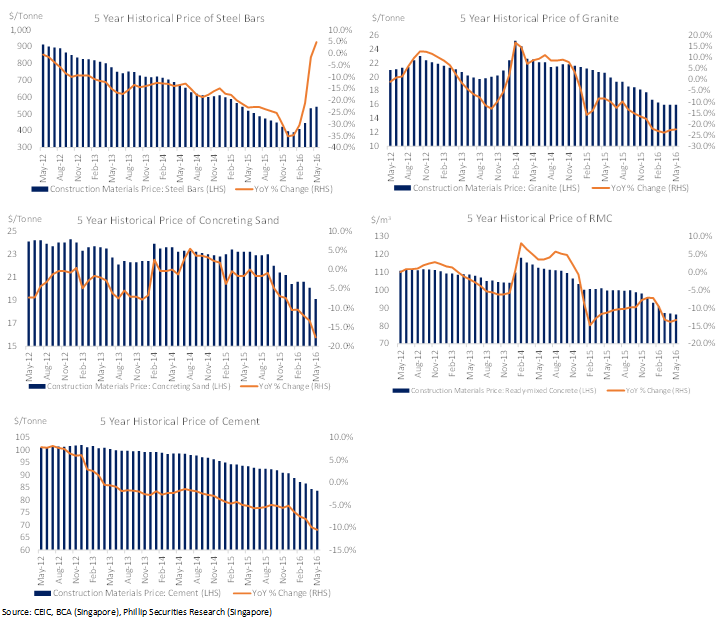

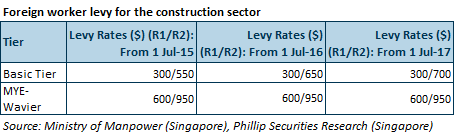

The two major components of costs in a construction project are material prices and labour costs. Construction materials have been on a price decline since 2012 as construction activities weakened mainly due to a softer real estate market as well as contraction in oil prices from an oil glut in 2014. However, price reversals in certain construction materials such as steel bars especially, are beginning to develop during the recent months as oil prices saw a significant rebound. The probability of a contractor overbidding for a project tender grows in a scenario of rapidly expanding material prices can negatively impact on profitability. Next, labour costs have been rising as a result of rising foreign worker levy on the construction sector in a bid by the Singapore’s Government to reduce on manpower usage and boost productivity. Typically, 40% of construction costs are attributable to labour costs. However, the mix is more likely to shift as labour costs continue to creep higher over time. As labour costs continue to grow, the gross margin of construction companies is expected to thin further even if material prices are to remain at a historical low.

Company Specifics

Strong and proven track record helps the group to secure repeated tenders of similar projects in the past

HLSH has undertaken and completed a wide range of civil engineering projects for both the public and private sectors in Singapore. These civil engineering projects involve works for roads, bridges, expressways, tunnels, Mass Rapid Transit, port facilities, water and sewage facilities and other infrastructure works (refer to appendix for a list of infrastructure projects completed by the group). The group is founded and helmed by an experienced management team where CEO, Mr. Chua Leong Hai, has more than 40 years of experience in the civil engineering industry. The continuous success in both tendering and completion of civil engineering projects, has allowed HLSH to leverage on its experience and proven track record in order to win further similar contracts. For example, the successful completion of projects awarded by the Port of Singapore Authority and the Civil Aviation Authority of Singapore (CAAS) has allowed HLSH to secure subsequent contracts from the PSA for the construction of port facilities in the 1990s and from the CAAS for the construction of airport facilities in the late 1990s and early 2000s. In addition, the successful completion of taxiways and associated works at Changi Airport Terminal 3 in 2007 has led the group to secure additional projects involving additional taxiway developments at Changi Airport in 2014.

Weaknesses in civil engineering revenue and gross margins to persist as competition intensifies from subcontractors in public project tenders

Subcontractors are likely to tender for projects even more aggressively with lower bids compared to main contractors, since subcontractors typically have a larger pool of active workers to upkeep compared to their main contractor counterparts. Consequently, we expect gross margins from public sector projects to continue faltering. Likewise, for HLSH, the management has ascertained that they are expected to aggressively tender for public civil engineering projects, and subsequently the recognition of lower gross margin in its civil engineering segment.

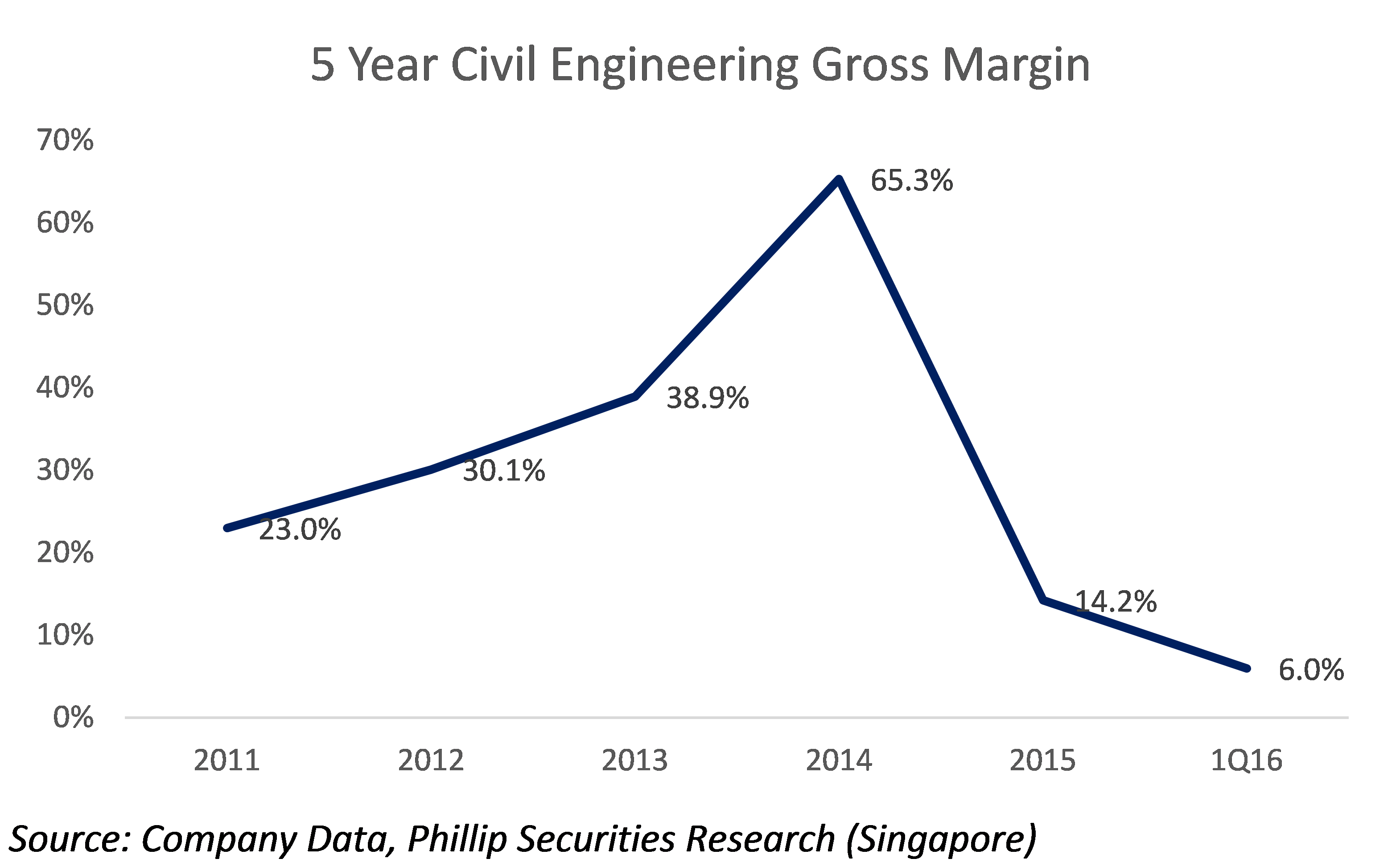

HLSH’s gross margins from the civil engineering segment has been on a decline since 2014. Gross margin in 2015 and 1Q16 came in at 14.2% and 6% respectively, which were below HLSH’s average 5-year historical gross margin is 29.6%.

Performance of civil engineering segment in FY16 is expected to be lacklustre

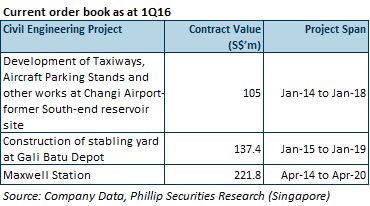

The Group’s net order book which is made up of the three civil engineering projects, currently stands at $382m. We are of the view that the gross margin of 5.9% registered in 1Q16 is likely to sustain around this region with limited upside for the current set of projects on hand despite work intensity having picked up at these projects in the recent quarter. Extrapolating gross profit contribution of $1.4m from civil engineering in 1Q16 for the next three quarters, would lead civil engineering contribution in 2016 to fall short of 2015’s full year contribution of $11m. Even if new civil engineering projects were to be secured, it will take some time before work can meaningfully begin on these projects, and only then would revenue recognition occur.

Sales in new industrial property project expected to be weak amid keen competition and the slower real estate market

The Group’s new industrial property project, Shine@Tuas South, has a planning approval to erect a 6-storey 174-unit multi-user ramp-up B2 industrial building, and is located at 11 Tuas South Avenue 7. The property which is expected to be launched for pre-sales is unlikely to fetch an attractive average selling price due to both keen competition within the vicinity as well as the lower land tender prices since Nov-15. In addition, as demand for industrial properties continues to weaken amid the weaker economic climate and an oversupply of industrial properties from the expanding vacancy rate, it is unlikely for take up volume to be strong at the new property. As a result, we are expecting development margins to be thin when pre-sales begin, however, as the project is slated to be completed in 2018 and revenue could only be recognised after the project completion, there is still plenty amount of time left to sell these units.

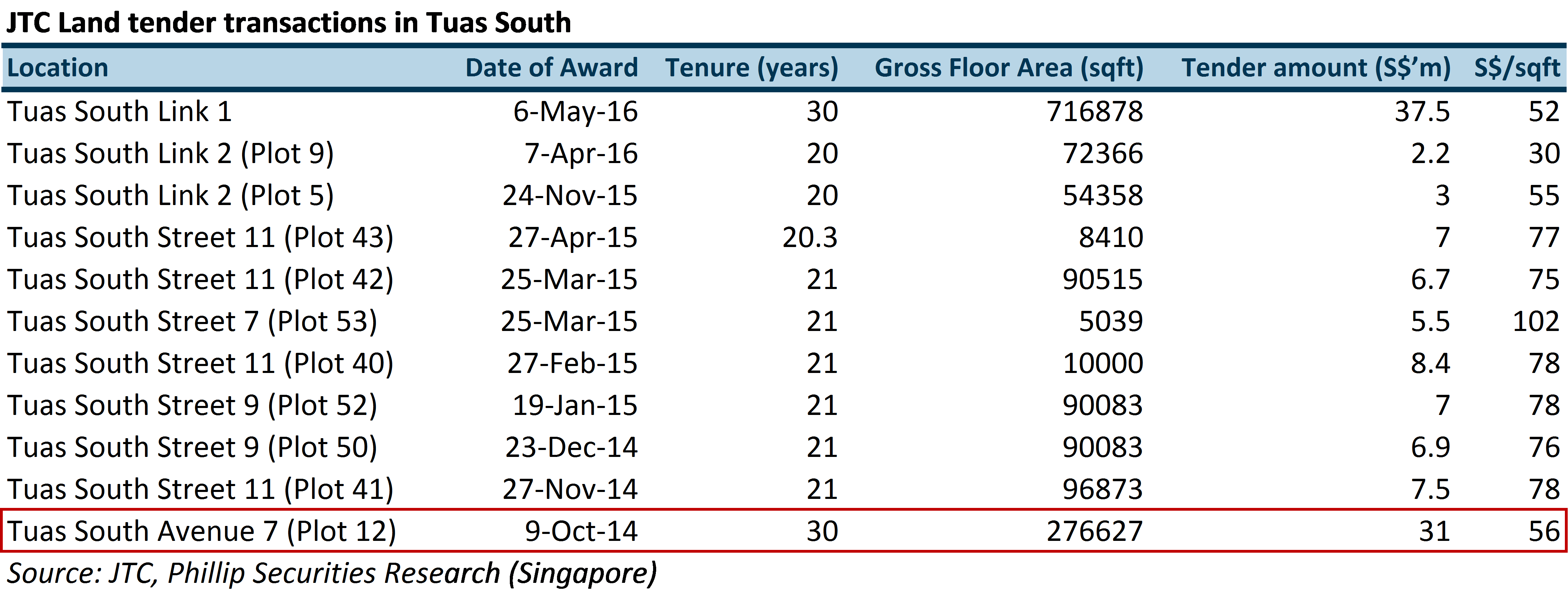

Shine@Tuas South (highlighted in the red bracket) had the advantage of commanding the lowest land tender prices until 24 Nov-15.

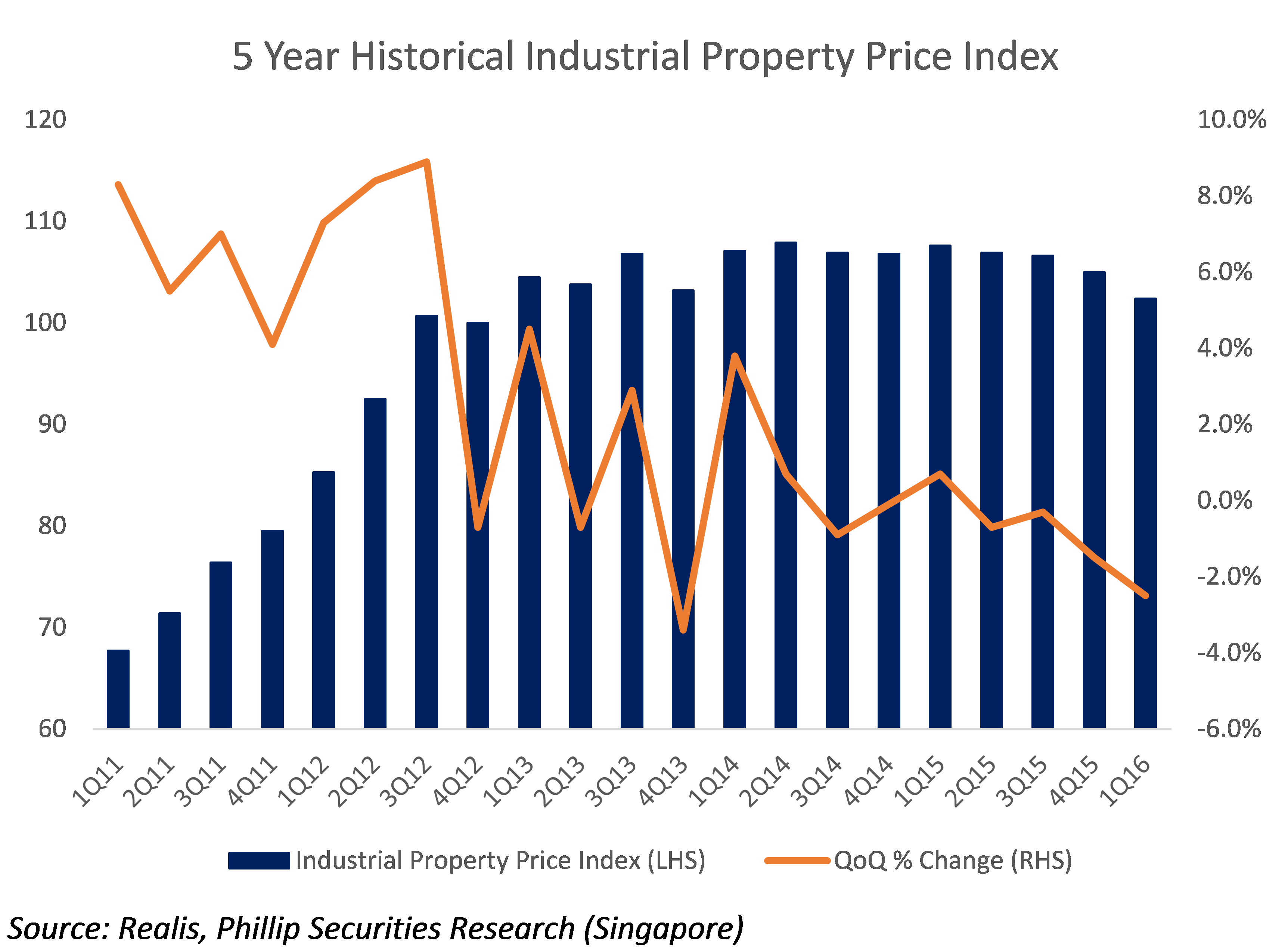

The industrial property price index has declined consecutively for the past 4 quarters and is currently at the 10th quarter low.

Limited impact and growth opportunities in view of the slowing private residential property market decline with the group’s JV residential development project being 99.5% sold

The Group’s only residential development project, The Skywoods, which is jointly developed by a consortium of companies including HLSH (50% owned), has 418 out of 420 units sold or 99.5% sold as at May-16. While our forecasted gross margin (c.8%) from development sale is not as attractive when compared to other similar developments within the area, the ongoing slowdown in the residential property market is unlikely to exert additional pressure on the group’s operations as well as other charges or fines from property cooling measures imposed by the Singapore government. Although not fully disclosed, there is little remaining development profits remaining since a large proportion of which has already been booked previously. With an oversupply and a slow absorption rate of unsold units in the private residential property market, we do not expect the Group to make further investments to pursue growth in the residential property market in the near term.

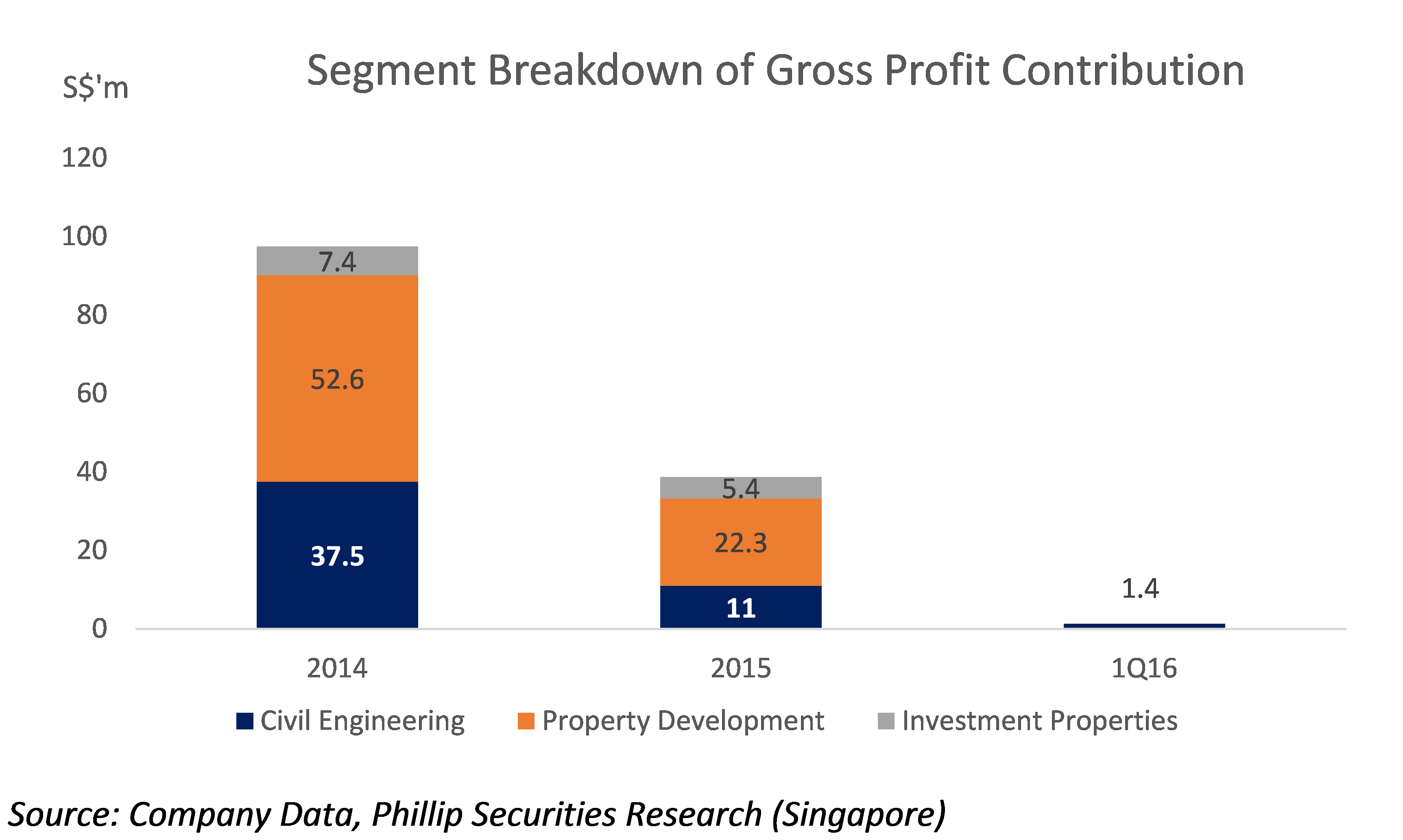

Full year earnings in 2016 expected to be lowest in three years since 2014, mainly due to the absence of revenue contribution from property development and a muted property investment segment

Gross profit contribution from property development has contributed more than 50% of total gross profits in 2014 and 2015. The Group is currently developing one industrial property, Shine@Tuas South, which is slated for completion in 2018. This means that there will be no revenue contribution from this development even if sales are made before completion, as revenue recognition can only occur after the property is completed as a result of the method of revenue recognition for such developments. The Group could see some revenue contribution through the sale of unsold units at its previous development, Ark@Gambas, albeit not significant, considering that it has already been more than 90% sold. Additionally, the lease expiry for a worker’s dormitory investment property has expired in Nov-15, which has led to the ceasing of operations in the property. As the worker’s dormitory is the main contributor of investment property revenue to the group, there was minimal revenue contribution from the group’s investment property segment in 1Q16, and is likely to follow through for the foreseeable future until another investment property is purchased and subsequently begin operations.

Gross profit from property development made up 54% and 58% of total gross profits in 2014 and 2015 respectively. There are no contributions from other business segments apart from civil engineering in 1Q16.

Limited avenues to deploy growing cash reserves as a solid financial position is required to win projects in the public sector

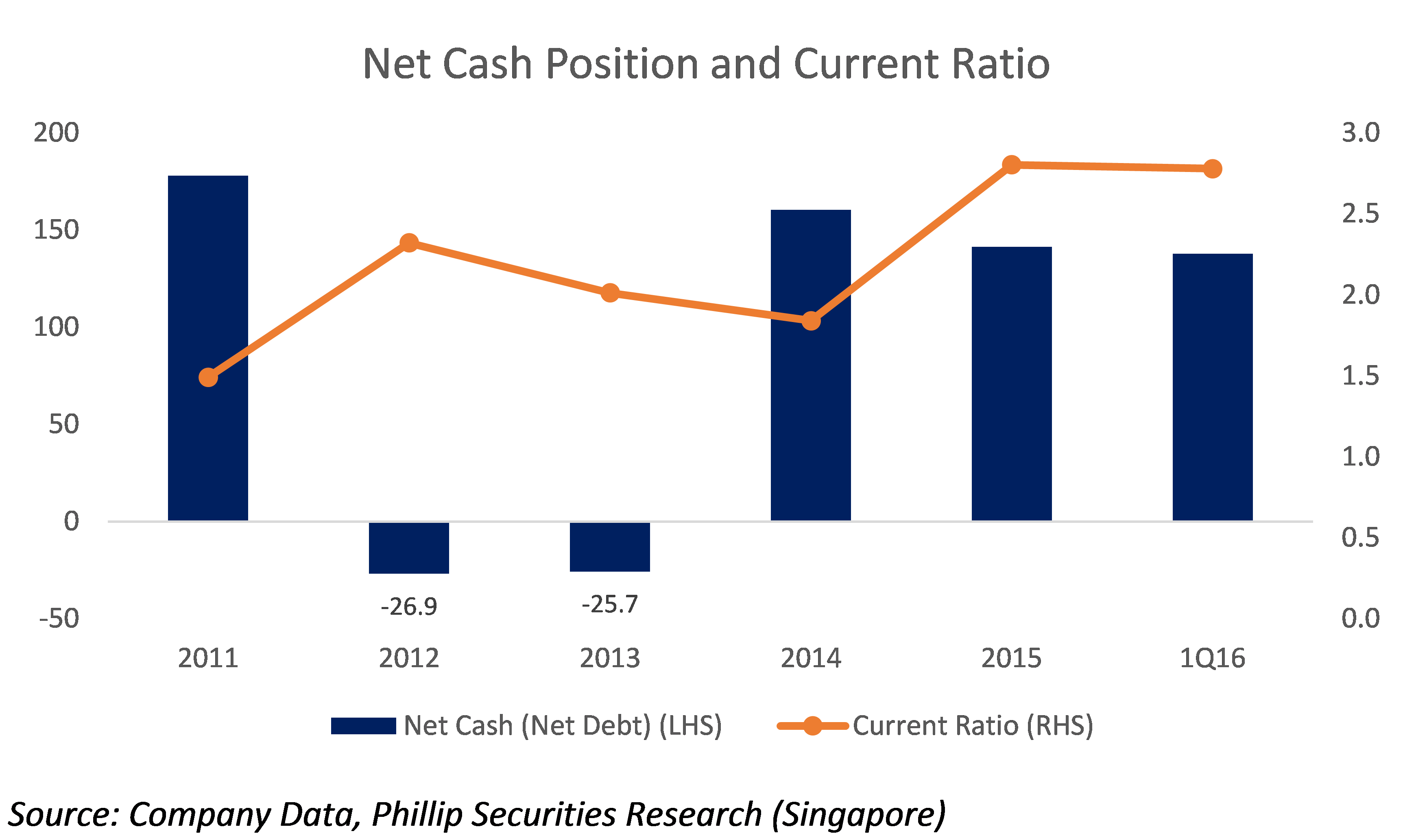

A key consideration in the selection process as a contractor for a tender of Singapore public sector civil engineering works, is whether the selected contractor has a strong financial position to complete the project. This is especially the case for large scale projects in Singapore with contract values that are above $200m. In general, a contractor will set aside 10% of a project’s contract value as working capital alone. HLSH’s balance sheet continues to stay strong where its current ratio and cash balance were 2.8 times and $153.5m respectively as at 1Q16. Cash as a percentage of net assets during the same period was 68.5%. Its cash position is expected to grow further to $215.6m by the end of FY16, after including $62.1m that is due for repayment within a year from a loan to a joint venture partner, where the amount was used to finance the development of The Skywoods residential development project. We view that this amount will be used as development cost for its new industrial property, Shine@Tuas South.

A strong financial standing helps civil engineering companies to secure public sector projects. HLSH’s balance sheet continues to stay strong as current ratio has stayed above 1.5 times, and has been in a net cash position for the last two FYs.

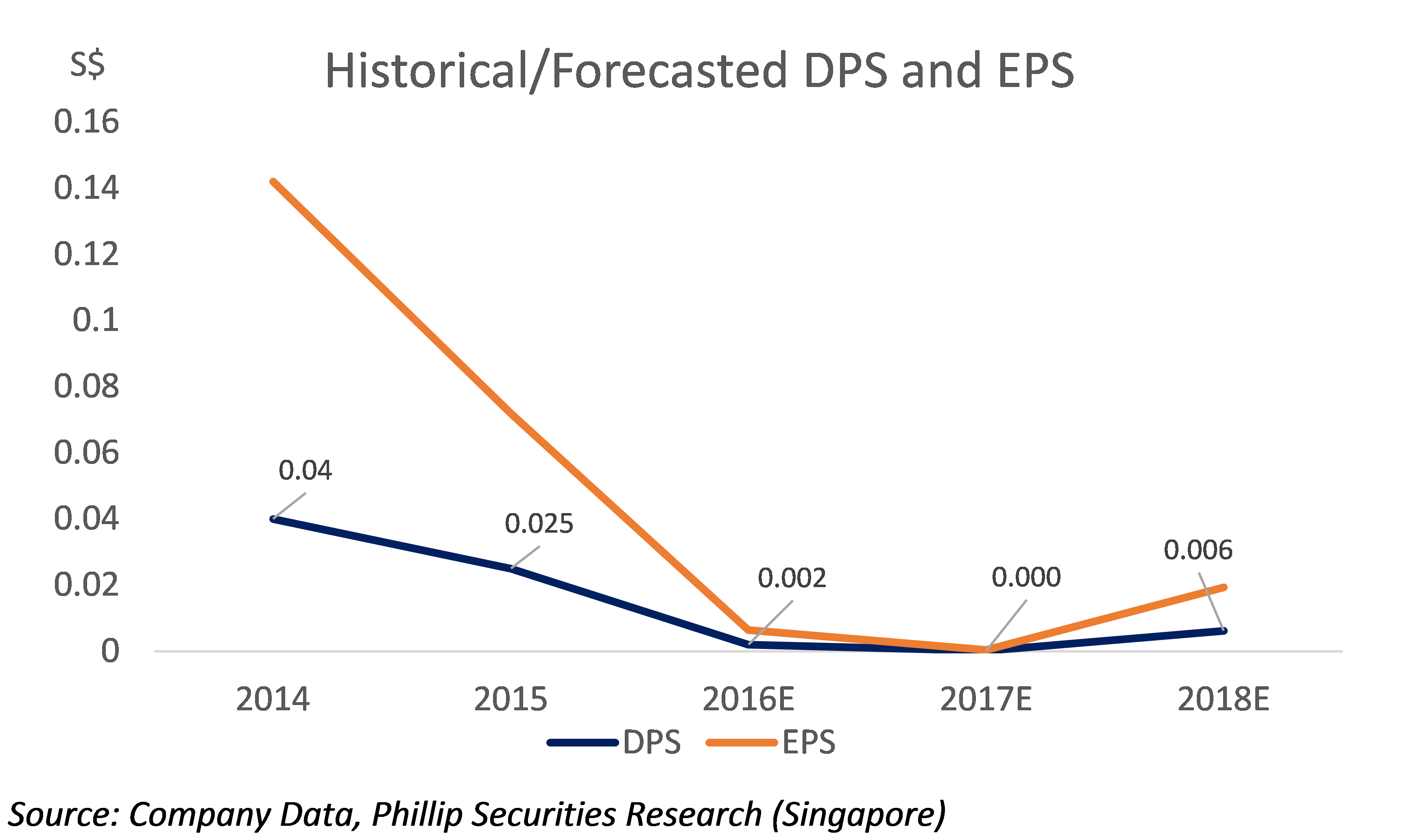

Dividend payments to fall in the next three years as earnings are expected to drop and management is unlikely to maintain dividend payments through the use of cash

It is not an uncommon move for cash-rich companies to pay higher dividends from their cash hoards to make up for the lower earnings generated in a more challenging business environment. However, this cannot be applied for companies like HLSH which require a large proportion of cash reserves in order to maintain a strong financial position on its balance sheet. Hence, we do not expect the management to maintain dividend payments in the face of an earnings decline in both the civil engineering and property development segments. Based on our earnings projection and assuming a five-year average payout ratio of c.30%, we expect dividend payments to decline for the next three years.

Dividend per share (DPS) and earnings per share (EPS) are forecasted to drop moving forward as the group’s margin in civil engineering projects weakens as well as the absence of revenue contribution from property development in 2016 and 2017.

Valuations

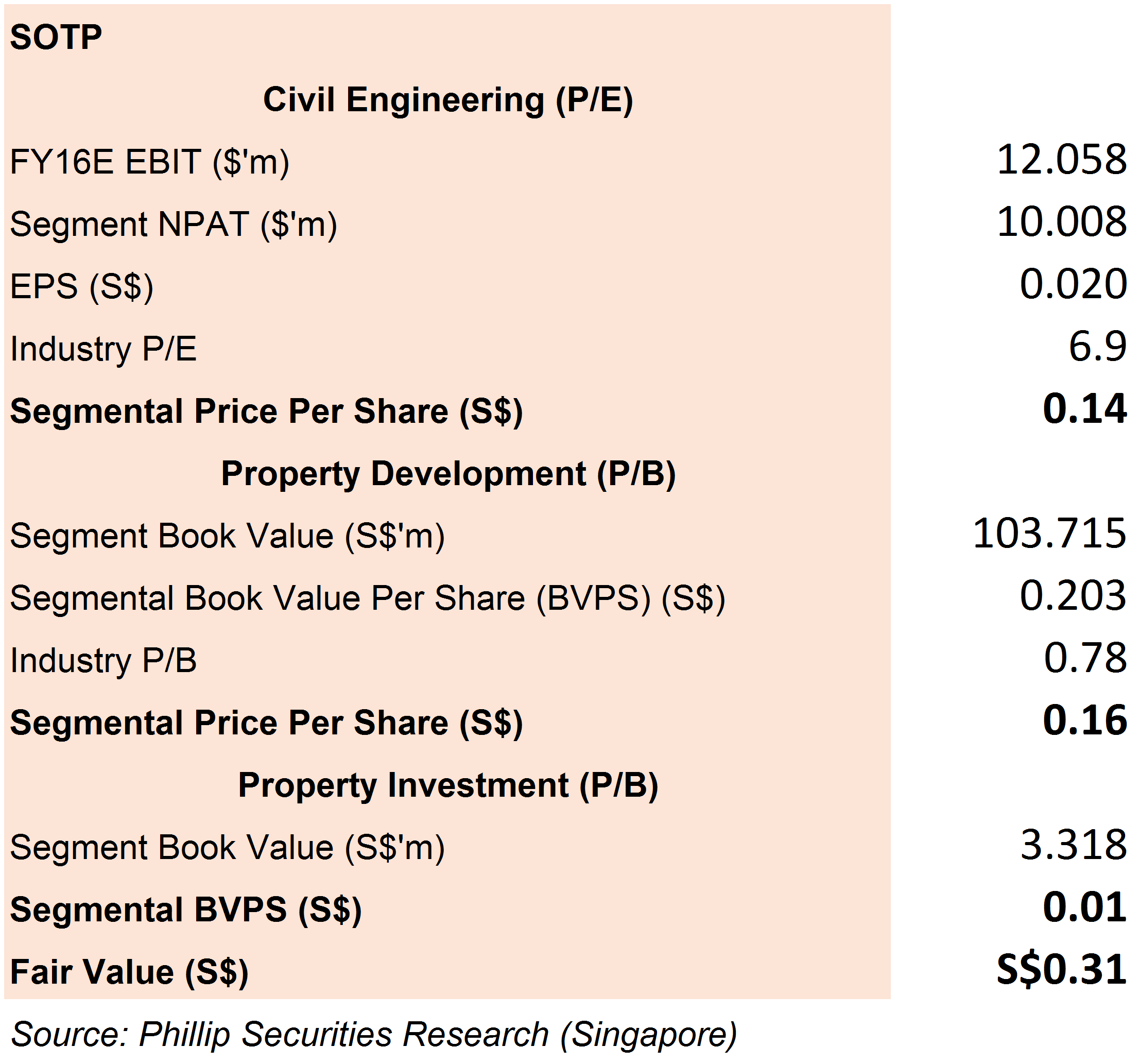

We have adopted a sum-of-the-parts (SOTP) valuation methodology to value the group and its underlying business operations.

Civil Engineering

We have selected the price-to-earnings (P/E) method to value its civil engineering business segment due to the larger degree of visbility in terms of revenue recognition and earnings performance upon the securing of a contract. Additionally, we have valued the civil engineering business according to the current industry P/E of 6.9 times.

Property Development and Investment

Next, we have used the P/B method to value its property development and investment business segments, as well as a 22% discount on the property development segment which is consistent to the current discount on the group’s book value.

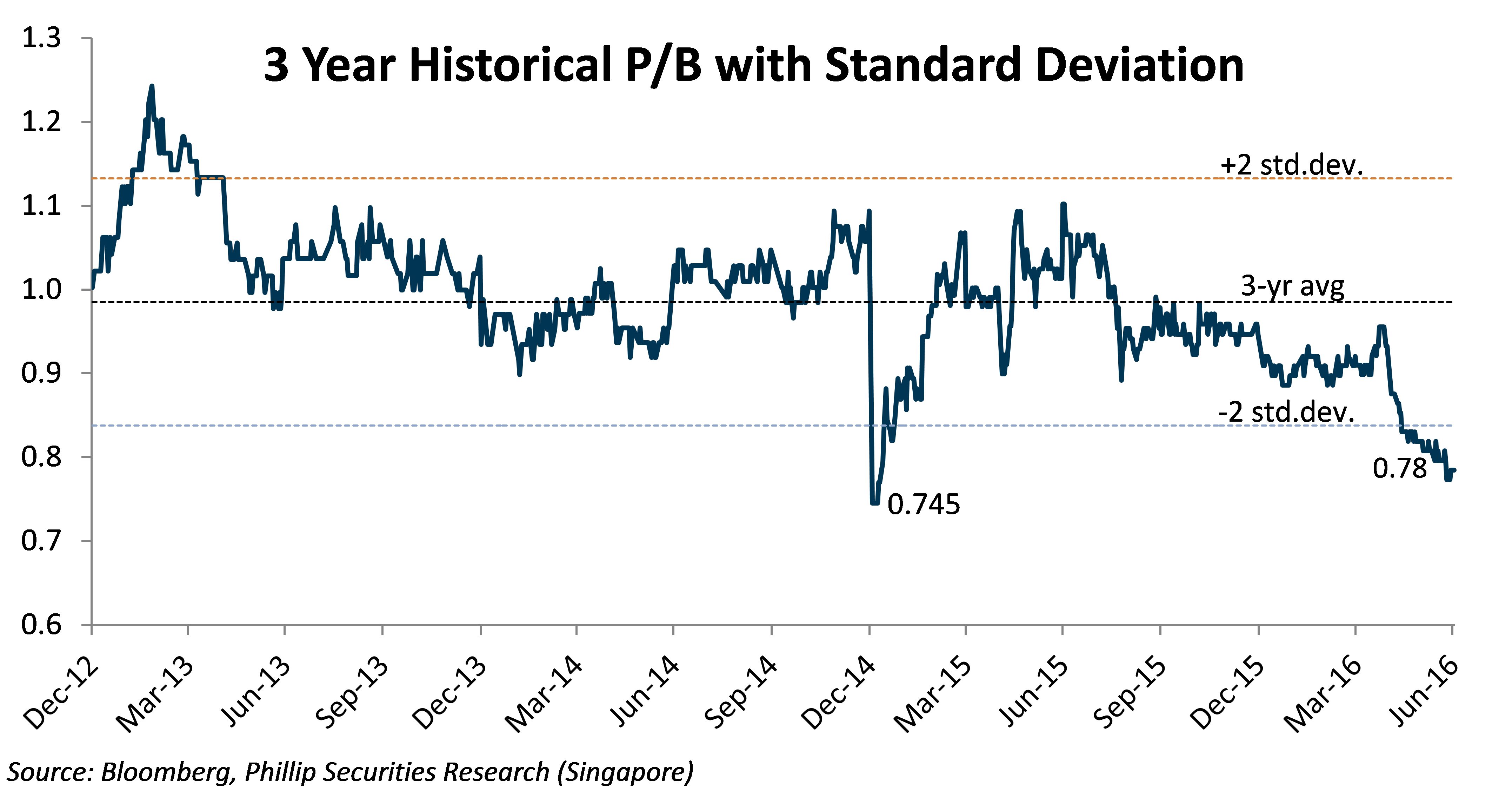

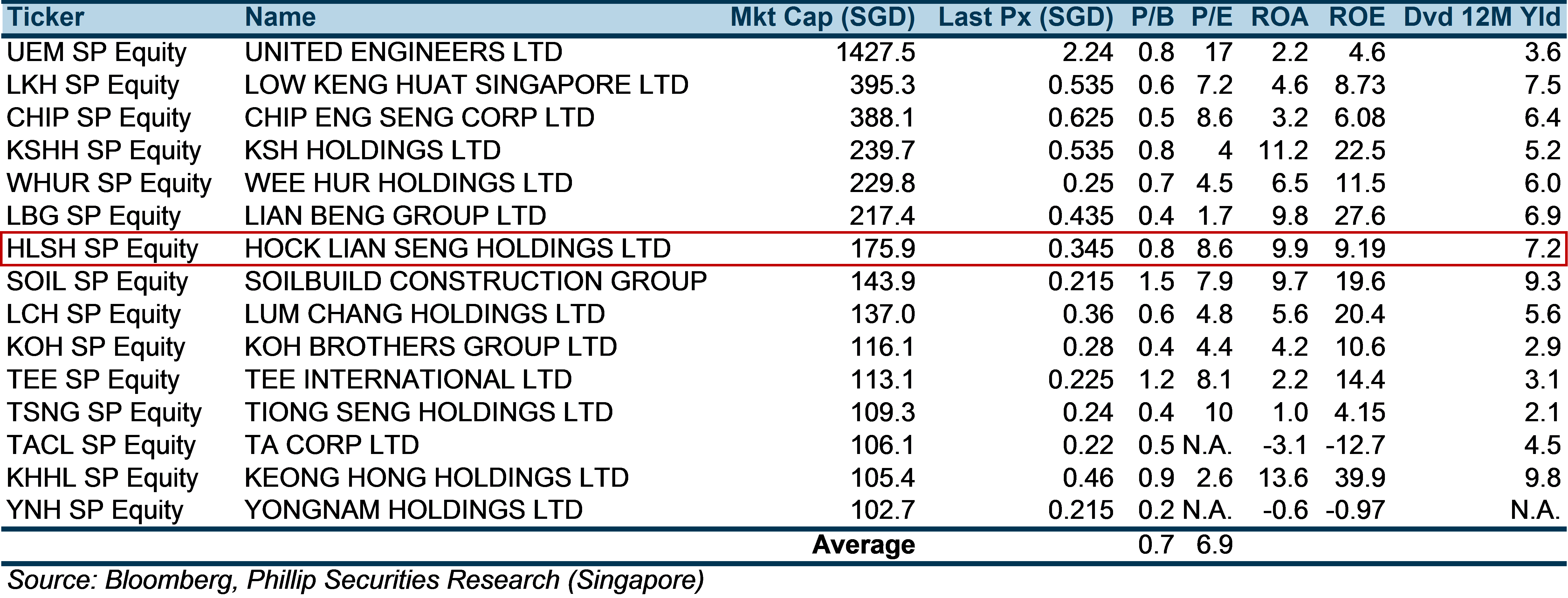

The current P/NAV is not representative of the group’s true value and its higher than the industry’s average

Although the current price-to-book value (P/B) is -2 standard deviations away from the mean of c.1X and seems relatively undervalued, however we note that other comparable companies in the same industry are mostly trading at their historical lows, and therefore is not representative of the Group’s true value. The Group’s current P/B of 0.8 times is higher than the industry’s average of 0.7 times.

Peer Comparison

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: