We attended an analyst site visit to Regency Specialist Hospital (“Regency”) in Johor and Mahkota Medical Centre (“Mahkota”) in Melaka on 5th to 6th May 2017. The visit provided an opportunity for us to understand how Health Management International (“HMI”) position itself amidst competitive landscape, and how it structures its growth strategies around the diverse operating environment in Johor and Melaka. We also had a brief overview of the performances of new and maturing hospitals.

During the trip, the Group CEO, as well as CEOs, Directors and General Manager of the two hospitals, shared with us some of their market insights and technicalities of the hospital operations.

Site visit key takeaways

Unique partnership model to attract and retain specialist doctors. Malaysia is suffering from specialist shortage. There are There are only about 9,000 specialist doctors nationwide serving the 30.33 million population of Malaysia (equivalent to 0.3 specialist doctor per 1,000 people). The Group offers specialist doctors a chance to start their own medical practise while able to enjoy as the benefit of being part of a hospital ecosystem. The doctors under the Group earn procedure fees and drugs margins, which has a higher earning potential compared to other private hospitals in Malaysia. Management also shared that collaboration with Kaohsiung Medical University could help in terms of medical staff trainings and attracts Malaysian specialists graduated in Taiwan to return and practise in Malaysia.

Mahkota Medical Centre – the Crown Jewel in Melaka

PET-CT Scan: A revolutionary technology with promising prospect

The PET-CT (Positron Emission Tomography-Computed Tomography) scan combines both PET and CT scan images to produce one image, which can detect most cancers in the human body at an earlier stage than most well-known imaging techniques (such as MRI, CT, and Ultrasound scanning), and even blood tests could. Note that cancer treatment is often more successful in early detection cases.

Essentially, the PET-CT scan can be used in diagnostic imaging procedures in oncology, surgical planning, radiation therapy and cancer staging. It helps physicians to diagnose, stage, treat and mange cancer/tumour with more specificity and accuracy, resulting in a better outcome for the patient.

However, PET-CT scan is less common in Malaysia because of resource scarcity – it requires (i) substantial investment in the PET-CT scanner; and (ii) highly trained personnel to operate and manage the radiopharmaceuticals.

Mahkota is the first and the only one in Melaka, to install a PET-CT scanner. Mahkota dominates diagnostic nuclear imaging service in Melaka while offers hospitals in vicinity a nearer solution. The other hospital which offers PET-CT scan service in South Malaysia is KPJ Johor Specialist Hospital (since Nov 2015).

Management is optimistic of a wider usage of PET-CT scan in Malaysia on the back of (i) its growing prominence; and (ii) increasing incidence of cancer.

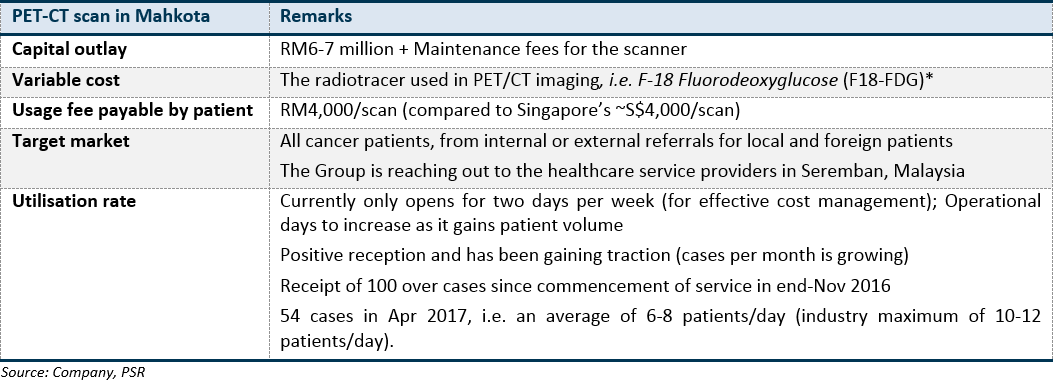

Table 1:

* MMC does not produce the radiotracer, and as the radioactivity of the F-18 FDG reduces by 50% over 110 minutes, it cannot be imported. The F-18 FDG market in Malaysia is controlled by duopoly, i.e. Beacon Hospital and IBA RadioPharma Solutions, which are located near Kuala Lumpur.

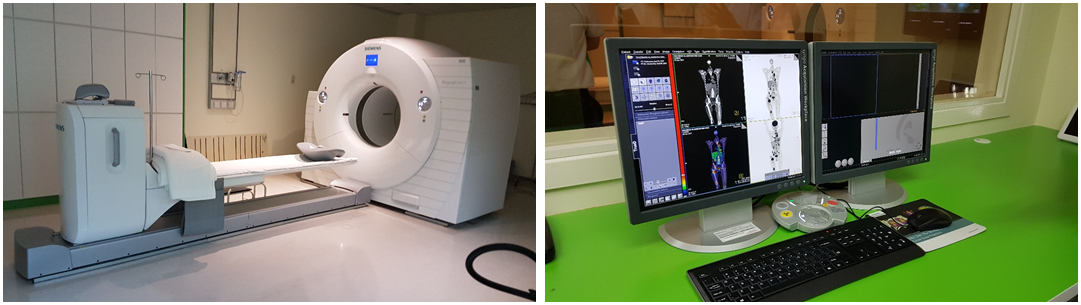

Figure 1 & 2: The newly launched PET-CT scan machine

Preparation work includes pre-injection briefing to patient, preparation of radiotracer for injection, and injection of radiotracer into patient.

The scanning process takes about 20 to 30minutes and patient will be isolated for 2 hours after the scan.

The whole process will take about 4 hours to complete.

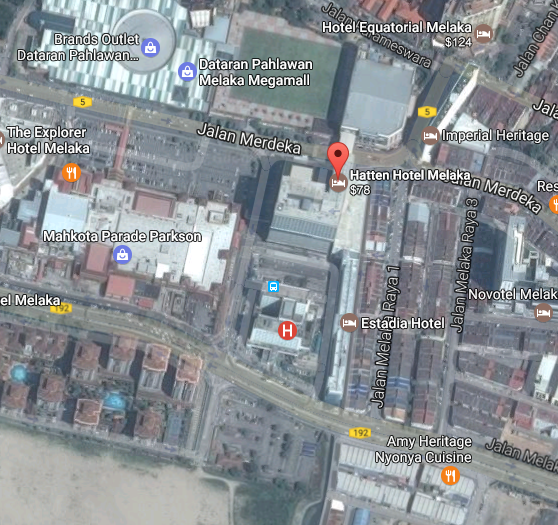

Potential expansion in Mahkota of in existing hospital block, as well as additional parking space, and potentially a new hospital extension block

Mahkota owns two parking lots which would be the plots for its potential expansion plan. Management shared that, in medium to long term plan, Mahkota would build a multi-storey carpark, which we think likely to be at Car Park 2 (see Figure 4).

We also think that it is possible that Mahkota will move its back office to another location – freeing some space in the existing block to add new beds before construction of extension block. We think the extension block could be at Car Park 1 (see Figure 3) as it is closer to Mahkota.

We think that a potentially new hospital extension block in the medium to long term plan would mainly add more clinical service areas and clinic suites, expanding the range of specialty and sub-specialty offered. The additional capacity would be supported by the growing patient base, from both local and foreign, particularly arising from the development in Melaka (such as Melaka Gateway project and several Chinese investments in Melaka).

Figure 3: Car Park 1 (Next to Mahkota; or between Hatten Hotel and Mahkota)

Source: Google Map, Image captured on Dec 2015

Figure 4: Car Park 2: Across the street (Opposite Mahkota)

Source: PSR

Figure 5: Satellite view of Car Park 1 and 2

Source: Google Map, Image captured on 2017

Strategic Positioning and Growth Strategy

RSH, a Regional Solution for Locals; MMC, a Magnet to Medical Tourists

Recall that in our Initiation Report, we mentioned that, healthcare facilities in Johor is under-supplied with bed-to-population ratio* at 1.7, when compared to Malaysia’s at 1.9. On the other hand, Malacca has higher bed density at 2.5.

Hence, the Group’s growth strategy for the two hospitals are very different, with Regency focusing on meeting local demand gap; and Mahkota to tap on foreign market demand amidst saturated scene in the local market. This can be well reflected on the patient mix in Table 2.

Regency’s next initiative would be collaboration with insurance and corporates to grow its corporate account

Nonetheless, management does not discount that there is room for Regency to attract foreign patients. It has recently started its marketing outreach to international patients, in particular from Indonesia and Singapore. Being one of the two hospitals in Johor, Malaysia, approved for Medisave use, offers a stronger value proposition for Singapore patients.

Meanwhile, the strategic location of Mahkota offers a full ecosystem for medical tourists, including food, accommodation, and transportation

It is not surprising when Management shared that Mahkota has the highest foreign patient load in Malaysia. Its main competitor by states within Malaysia would be the private hospitals in Penang. Foreign patients in private hospitals in Kuala Lumpur are mainly expats, and note that the costs of living in Melaka is lower than Kuala Lumpur.

Within the state of Melaka, Mahkota being Indonesian’s top preferred private hospital, despite Pantai Medical Centre Ayer Keroh having an 8 years of head start before the establishment of Mahkota, is a testament of effective marketing of its 17 representative offices in Indonesia.

Please sign in to read the full report in PDF.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Lin Sin has been an investment analyst in Phillip Securities Research since June 2014, where she started as an economist, focusing on China and ASEAN macroeconomics. Currently, she covers primarily the Consumers and Healthcare sectors in Singapore equities market.

She graduated with a Bachelor of Science in Mathematics and Economics from NTU.