| Recap on the first quarter of 2017

Events

Markets

Looking Ahead

Geo-political risk remains high with the nuclear threat from North Korea unresolved. In addition, the bombing of Syria will have a negative impact on the already strained relationship between U.S. and Russia. The dismissal of Head of FBI, James Comey, will add to the complication of the U.S.-Russia relationship.

A bipartisan agreement was negotiated to prevent a U.S. government shutdown. With the approval of House of Representatives and Senate on the new budget, the U.S. government have kick the can down the road till September when they have to revisit the fiscal deficit problem. Fed will most probably raise their benchmark rate to from 1 percent to 1.25 percent during their FOMC meeting in June. Market has priced in the probability at 100%. |

In Europe, the election fever continue with the upcoming French General Election. Macron, whom won the French Presidential Election, is a candidate outside the establishment parties. We foresee he will face political headwind when he has to form his government. His En Marche! Party has no seat in the parliament currently. Theresa May has also call for an early general election to be on 8 June 2017. She believe that a snap election should help her Conservative Party maintain its majority status in the lower house of Parliament.

Organization of the Petroleum Exporting Countries (“OPEC”) and other major oil producers are meeting on 25 May 2017 to extend their agreement to hold oil production at 1.8 million barrels a day. 1. No sign of fear in the markets |

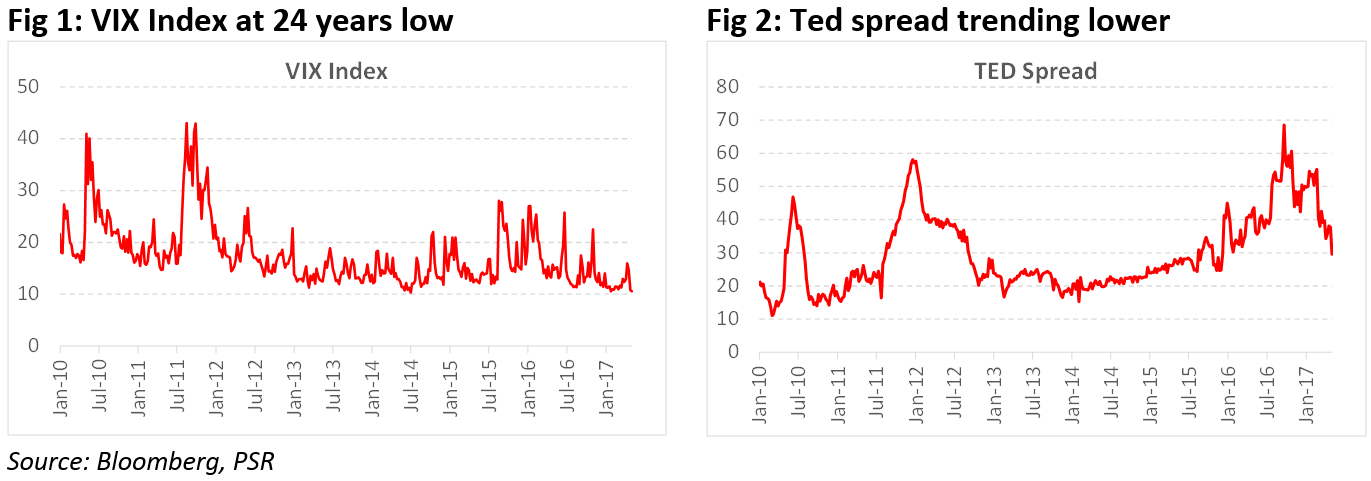

Equity markets have been heading higher and are not pricing any form of geo-political risk. Indicators tracking fear in the markets are at their extreme low or have been trending downwards. This is a clear signal that risk aversion is low and markets are very much in a risk-on environment. Looking at two of the most common fear gauges, we see both the VIX Index and the TED spread trending lower with the former closing below 10 for the first time in the past 24 years.

VIX Index measures the Volatility of the S&P 500 equity Index.

Ted Spread is the difference in rates between the 3-month LIBOR minus 3-month Treasury yield. This measure the interbank liquidity and a higher spread indicates an increase in market risk.

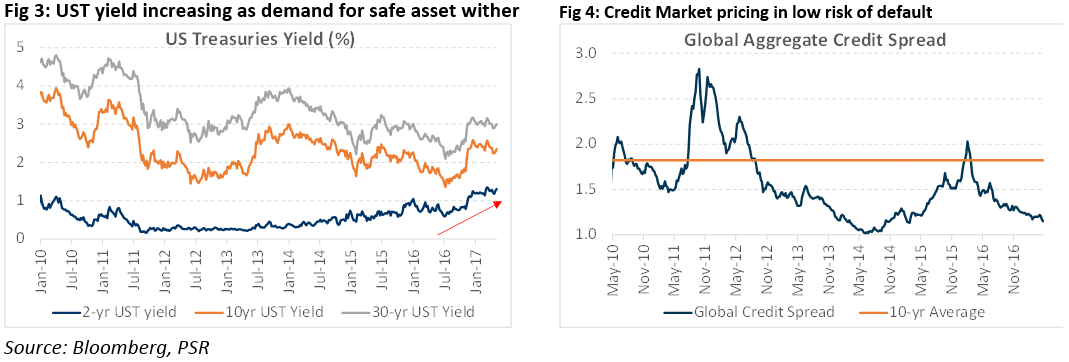

| Fixed-income is not pricing in any risk

The traditional way of sensing the risk appetite of the markets is to look at the level of interest for safe haven asset, such as that of the U.S. Treasuries. Treasuries yields have increase throughout all tenors which points to a lower demand for the safe asset Treasuries. This disinterest in safe haven asset may indicates that investors seek higher return in riskier assets. |

Credit markets are also showing similar signs as credit spread continues to tighten, an indication that markets are not pricing in any default risk.

| 2. Fundamental remains supportive of the optimism in the market

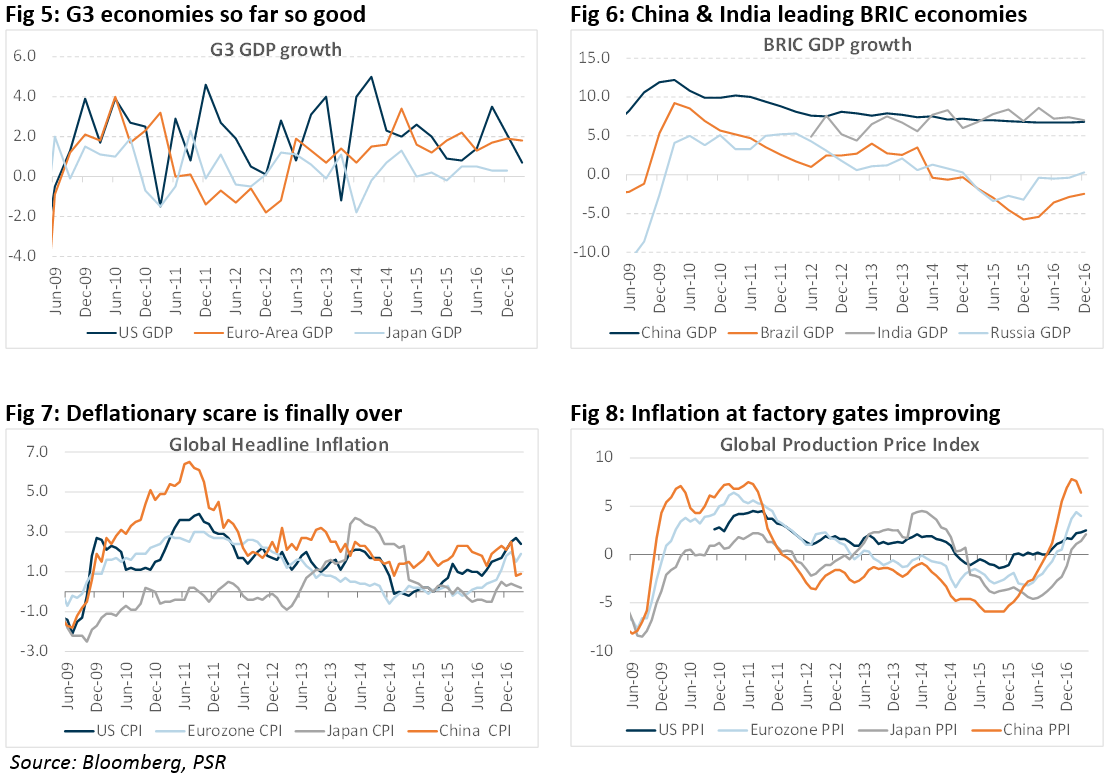

Corporate earnings recovering Earnings results for the S&P companies have been very positive. 323 out of 421 companies that have reported results in the first quarter of 2017 have beaten estimates with an overall average of 9% surprise above estimates. Currently, the average EPS growth is at 33% YoY. Economic condition providing tailwind for the market Although the U.S GDP results for Q1 2017 fell short of expectation, it marks the 31st quarter of expansion since the U.S. experience a recession (defined as 2 consecutive quarters of negative growth). UK and China have also reported expansionary GDP growth in the first quarter of 2017. Inflation is creeping back into the major economies as deflationary risk subsides. U.S. maintained an average of 2.5 percent inflation rate in the first quarter while Japan overturn a disinflationary pressure to maintain 6 months of price inflation. |

This depict a sanguine economic growth environment which is positive for equity markets.

Global growth has maintained on an expansionary mode and talks of a secular stagnation has faded away.

Beside Russia and Brazil that are recovering from a recession, other major economies have posted economic growth albeit modest growth compared to period prior to the GFC.

Most of the inflation was due to a base effect of oil prices.

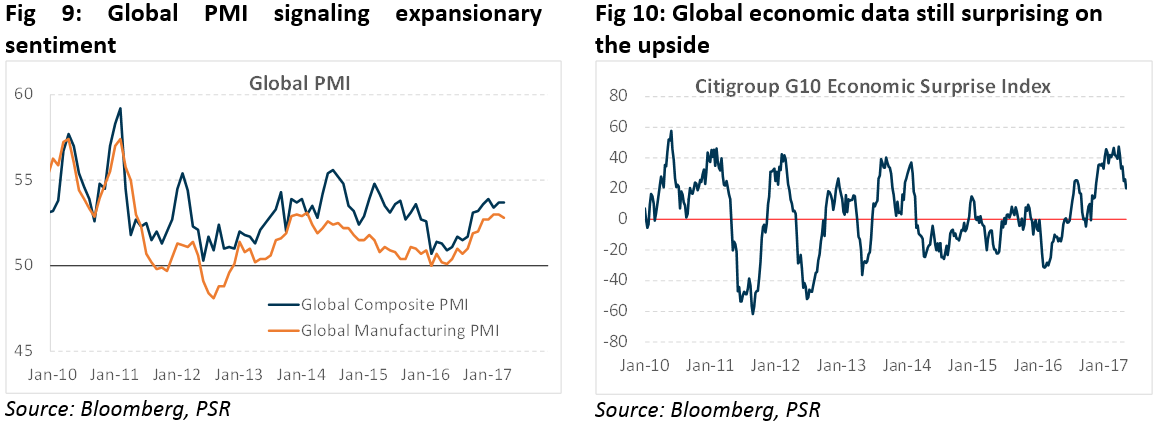

| Soft data indicates better time ahead |

Aside from historical data, soft data such as the Purchasing Manager Index (PMI), consumer confidence and business confidence index can give us an insight to future economic activities. So far, global PMI survey has been indicating expansionary sentiment while economic data is still surprising on the upside against estimates.

Survey from businesses are showing a healthy dose of optimism as global PMI remains above 50, indicating an expansionary environment.

Economic data is still exceeding economists consensus estimates as surprise remain positive.

| Global monetary policies remain accommodative

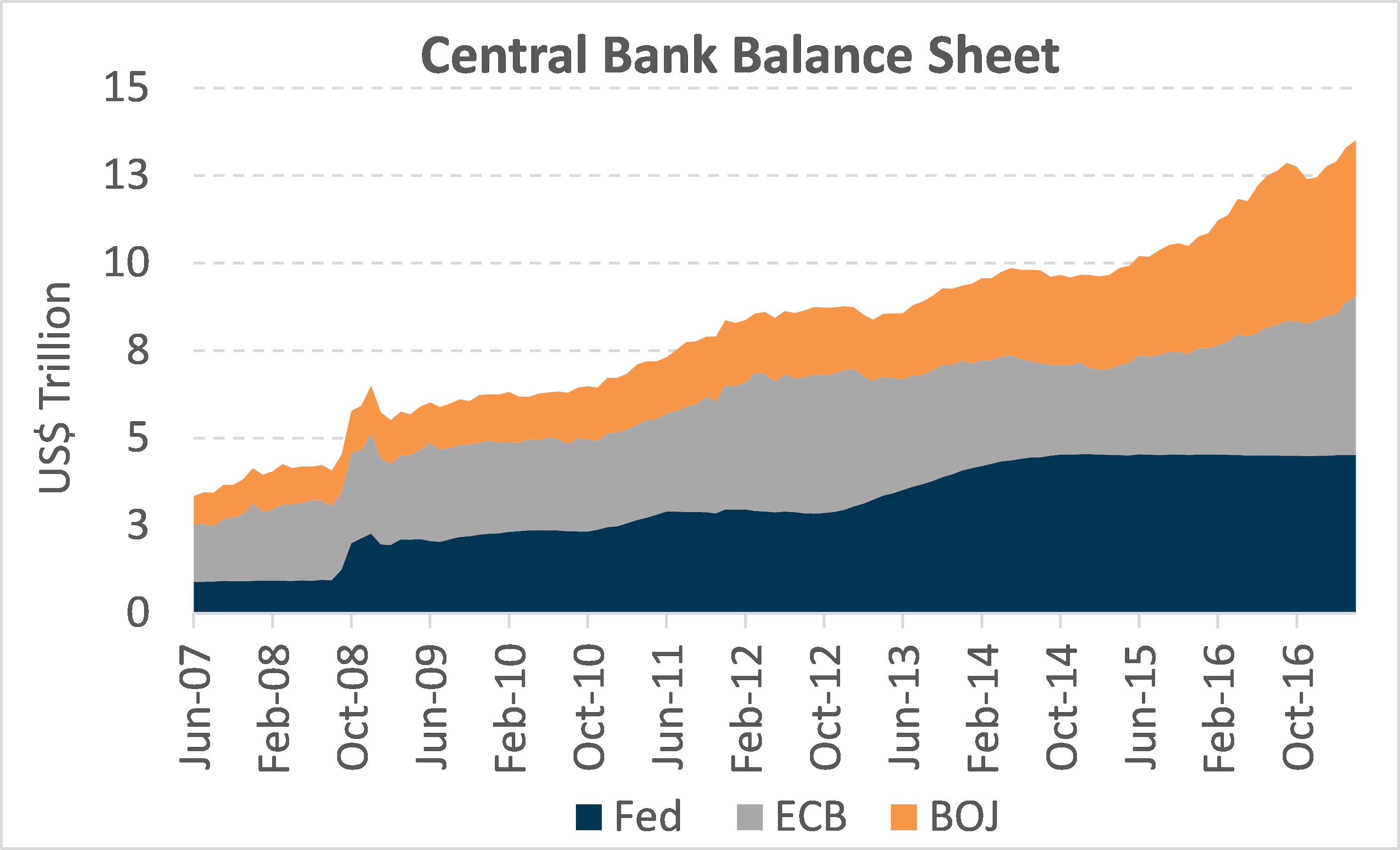

Even as The Federal Reserve (the “Fed”) embarks on a tightening monetary cycle, they have yet to unwind their balance sheet. Adding together with the quantitative easing from European Central Bank (“ECB”) and Bank of Japan (“BOJ”), overall monetary policy from the 3 largest central banks has remained accommodative. There is still a combined total of US$13.5 trillion of liquidity supporting the markets. |

Fig 11: Combined balance sheet of the 3 major Central Banks

| 3. Our Investment Strategy

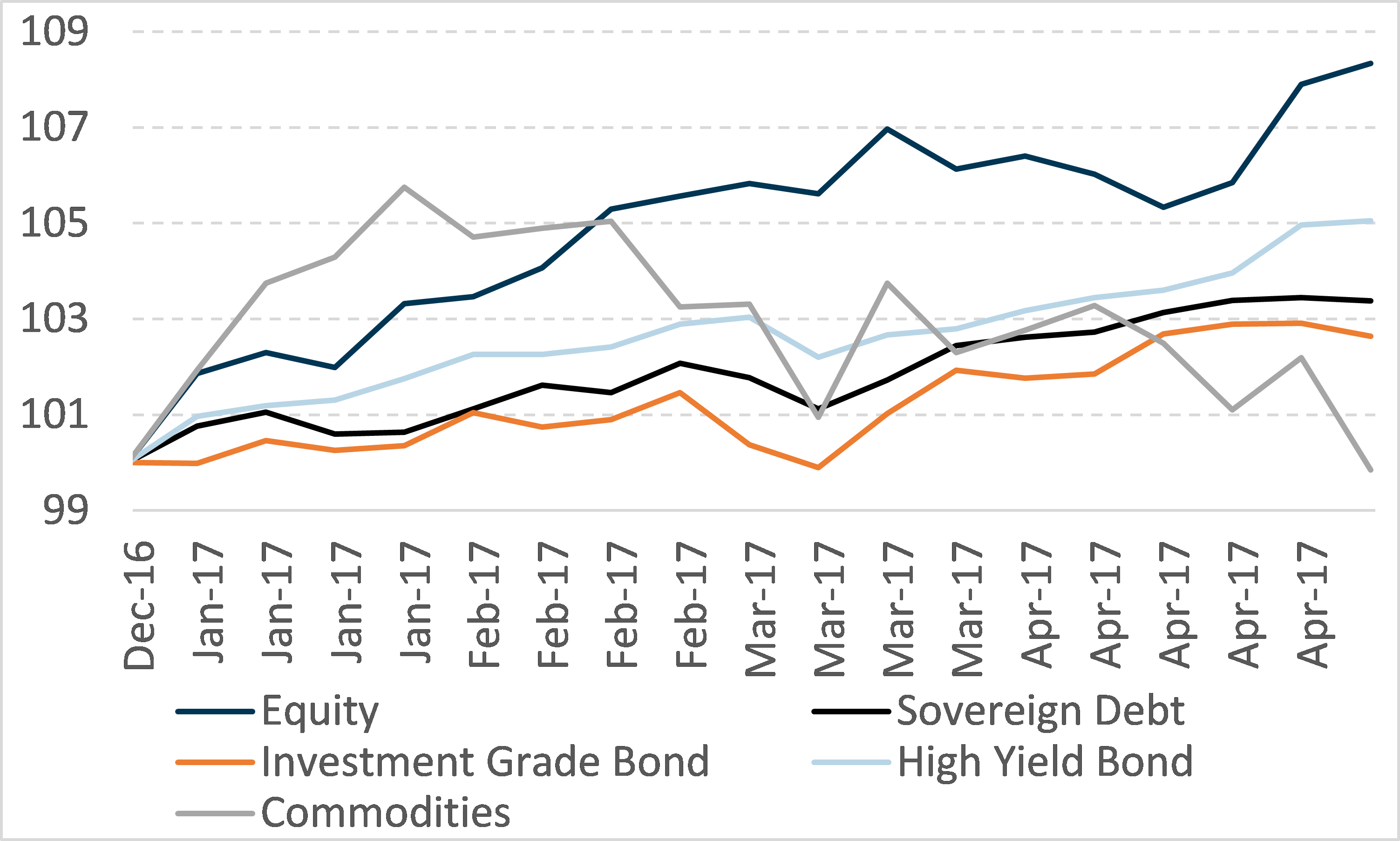

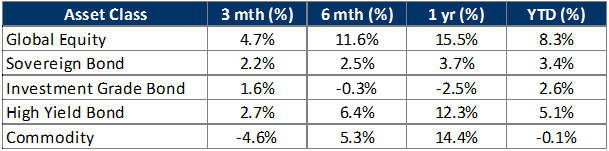

Buying into risky assets As U.S. economy continue to experience reflation and the euro-skeptical movement facing a strong push back after the French election, there is a renewed optimism in the equity markets. Markets have also priced in the news of China tightening regulation on the shadow banking sector. Markets sentiments are turning positive on the “One Belt One road” infrastructure spending project initialed by the Chines government. With the improving economic tailwind, it is not hard to understand why equity has outperformed all other asset class. Year-to-date (YTD) equity performance has supported our investment thesis as global equity returned 8.3%, the best performing asset class this year. |

Fig 12: Equity the major outperformer

Source: Bloomberg, PSR

Please login to read the full report in PDF.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Sai Teng covers the global macro research. He has more than 6 years investment experience primarily in portfolio construction and asset allocation. He graduated with Bachelor of Science in Banking and Finance from University of London.