Challenges to the Singapore Securities Market

The Singapore public equities market has been facing headwinds owing to slowdown in economy and dismal trading volumes. This has led to privatisation of firms such as Tiger Airways, Osim and Eu Yan Sang while supply of IPO remains weak.

We set out to expound the cause behind rising privatisation and the dearth of IPOs:

Both of these challenges pose risks to the potential supply of IPOs and to the maintenance of the number of public listed firms on SGX. But we are confident that the Derivatives market will continue to drive growth for SGX and to offset weakness in the Securities market.

Investment Actions

Maintain “Accumulate” rating on SGX with unchanged TP of S$7.99.

Rise of Privatisation Deals

In the Global PrivateEquity Report 2016 by Bain&Company describes the successive years of strong cash distributions supported Limited Partners (“LPs”) to reinvest capital back into PE across every region in the world. The increased demand and expectations from LPs is building up global PE dry powder that the PE firms are pressured to be put into new deals. The total capital targeted for buyouts alone reached $460bn in 2015, the highest level since 2009.

The announced value of global corporate M&A transactions topped $4tn in 2015, surpassing 2007 peak. We surmise that the cost of debt will remain exceptionally low for corporates as ECB and BOJ continue to participate in corporate bond purchases. Our conjecture is corporate M&A is a more attractive way to expand because the benefits of the acquisition can accrue to the acquirer quickly, given successful integration. Especially when global competition is moving at a fast pace, corporates would need quick access to established networks and connections to be ahead. And we also believe this is the reason that corporate acquisition became a dominant exit strategy for SEA start-ups which we will discuss later.

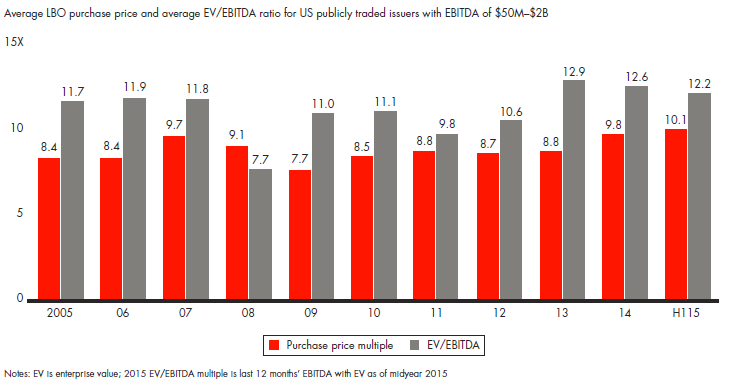

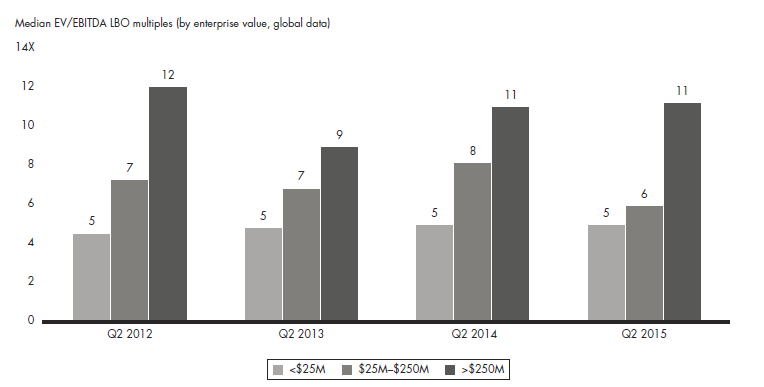

The crowding of PE firms and corporations into the same space has resulted in PE buyout funds paying more in terms of a multiple to EBITDA for a buyout acquisition, while the cooling public equity markets lowers Enterprise Value (“EV”) of public listed firms (see Figure 1). The convergence of how much PE firms are willing to pay for a buyout and the declining EV of public listed firms make public-to-private deals more attractive than previously perceived. So the public-to-private deals offer an avenue for PE funds to deploy the dry powder to work based on “cheaper valuations”. Smaller enterprises valued at $250mn or less are also attractive to PE firms, but at lower EV/EBITDA multiple relative to those valued more than $250mn (see Figure 2).

Figure 1. Public-to-private deals have become more common as valuations of public and private companies converge

Source: S&P Capital IQ LCD; S&P Capital IQ, Bain & Company

Figure 2. Smaller middle-market deals are available at more reasonable purchase price

Source: Pitchbook, Bain & Company

We put all that material into context of stocks in Singapore and tally the numbers that may be considered attractive by recent Q2 2015 EV/EBITDA LBO (Leveraged Buyouts) multiples as shown in figure 2. Our list of Singapore 715 stocks, excluding the three Singapore banks and other trade suspended stocks.

Figure 3.

Source: PSR, Bloomberg estimates |

Clearly the Singapore stock market offers a fertile ground for buyout funds to cherry pick based on valuations alone. For example, PE firms looking out for a turnaround story may find the beaten down offshore oil services companies attractive. EVs of offshore oil services companies are declining rapidly as their market capitalisation collapse and as they go through rounds of equity raising to pare off debt and raise cash. All these ravaging of value for equity owners leaves the door of opportunity wide open for PE firms and corporations to snap up deals.

The goals for PE firms and corporations in a buyout may somewhat differ – PE firms seek a return on investment on a cheaply valued buyout while corporations seek synergy from the buyout. But as pointed out in the Global Private Equity Report 2016, private equity firms can pursue buy-and-build strategies where they can assemble several low-multiple companies into a larger entity that can command a premium on exit. Corporations who are undecided on potential synergies from a buyout should be mindful of PE firms snapping out cheap deals and selling it back to the corporations at a premium when the synergies become clearer. Inevitably, competition for buyout deals would start early. The recent deal by Salim’s Marvellous Glory Holdings to acquire the rest of the shares in China Minzhong Food that it does not already own is emphatic of how corporations can become more aggressive in defending territory. China Minzhong despite experiencing declining profits and high Price Earnings valuation of 29x, has a market capitalisation of S$757mn and an EV/EBITDA ratio of 3. This is way cheaper than the EV/EBITDA LBO multiple of 11 for companies worth more than $250mn.

Nonetheless, valuations should not be the sole indicator that lift the likelihood of a privatisation bid. Some other factors would include: Forecast of EBITDA growth and percentage of public floats.

Dearth of IPOs

We opine that the dearth of IPOs in Singapore is partly due to start-ups circumventing the need to raise funds via the public markets and even to eschew IPO as a means to exit. This had resulted in SGX not being able to benefit meaningfully from the huge growth in funding and exit strategies of start-ups.

Considering the smaller number of firms in Singapore’s cottage industry compared to China, Australia and Indonesia coupled with stalled expansion plans owing to the slowdown in economy, the potential contribution by start-up funding within the IPO space could have significantly boosted public market listings. According to IE Singapore, by 1Q2016, Singapore start-up funding reached US$275mn in 37 deals. While by 1H2016, the Singapore IPO market raised S$1.6bn from 8 IPOs. Funding from start-ups already make up close to a quarter of fund raising from IPOs and this does not include possibility of listing unicorns like Garena which raised US$170mn in Series D funding (31 March 2016) but has continued to remain private. Even with initiatives from SGX to help tech start-ups list more easily, the ample funding from Venture Capital (“VCs”) is enough to keep start-ups away from IPOs.

The other way for SGX to latch onto the start-up ecosystem is to list start-ups that have rich valuations and are ripe for exit. However this has also proven to be elusive as M&A deals have become the dominant exit strategy for start-ups in South East Asia. In a report by Golden Gate Ventures titled “Southeast Asia Offers Big Exits”, it sets out to explain that despite attractive growth story in the ASEAN countries, foreign companies face difficulty expanding into South East Asia owing to protectionist legislation in all ASEAN countries except Singapore. By acquiring local start-ups, companies can “plug-and-play” and gain quick access to the SEA markets. This enhances the attractiveness of start-ups that have established networks and local business knowledge in SEA as acquisition targets. Evidently, 43% of M&As in SEA have been made by foreign (non-SEA) companies. The dominance for M&A deals as an exit strategy will continue to incentivise start-ups to remain private and less IPO ready.

Conclusion

The discussion on the challenges to the IPO market and risk of privatisation share a common theme – corporates, PE funds and VCs are bankrolling deals and these investments do not require the role of an exchange to provide a venue for pricing transparency and liquidity. However we think that the following developments may help alleviate the problems

Private IPOs. Owing to more start-ups staying private even as valuation of these start-ups reach a billion dollars, pressure has also been mounting on workers, founders and early-stage investors who hold shares and need cash but have few avenues to sell them. We believe that exchanges can benefit by creating a secondary trading platform where formal arrangement is made with private start-ups that allow the start-up employees to sell shares. Nasdaq had established Nasdaq Private Market to facilitate secondary offerings through company-approved tender programs.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Jeremy covers primarily the Banking and Finance sector. He has 6 years’ experience in equities related dealing and research roles.

He graduated with Bachelors of Mechanical Engineering from Nanyang Technological University.