Maintain BUY at a lower target price of S$29.00 (previously S$33.32). We rolled over our valuation to 2019e and modelled in a more volatile and lower growth environment. We also trimmed our FY18/19 earnings by 3-5%.

The Positives

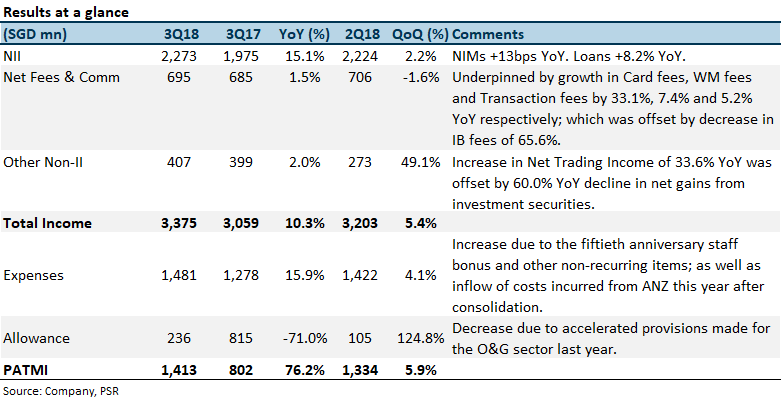

+ NIM at two-year highs. 3Q18’s NIM touched 1.86%, expanding 13bps YoY. The highest in nine quarters. NIM expansion was in line with higher interest rates in Singapore and Hong Kong, which saw loan yield rising faster than deposit costs. Loan yields improved 47bps YoY, interbank yields +41bps YoY and securities yield +32bps YoY; while the cost of funds rose 37bps YoY. Management’s guidance of 1.86-1.87% for 4Q18 NIM seems well within reach with the expectations of further rate hikes and a 60-65% pass-through rate.

+Loan growth maintained its steady pace at 8.2% YoY. Non-trade corporate loans and consumer loans drove loan growth. There was a slowdown in trade loans growth due to unattractive pricing. DBS market share of Singapore housing loan remains strong at 31%. Management guided loan growth for 2019 to be a mid-single digit. Despite the economy still being rather robust, but because of macroeconomic uncertainties, a more moderated growth is in line.

+ Hong Kong’s 9M earnings surged 43% YoY. Hong Kong’s NII grew 27% YoY, driven by rising interest rates which gave a 24 bps increase in NIM to 1.97%. The rise in HIBOR in Hong Kong has become much more significant with a growing CASA base and loans growth was robust at 16% YoY. Hong Kong contributed 20% to total revenue.

+ Normalization of credit costs to 21 bps as compared to 195 bps a year ago. The plunge in allowances of 71.0% YoY was due to substantial accelerated provisions made for the O&G sector last year. Moving forward into 2019, asset quality is expected to remain stable, but the SME portfolio might see a deterioration in loan quality as interest rates rise. However, the SME portfolio is small in comparison to the entire loan portfolio, and the potential delinquencies and provisions made would not be material.

The Negatives

– CIR rose to 43.9% from 3Q17’s 41.8% due to one-off items such as the 50th-anniversary staff bonus, rebranding campaign costs and litigation costs. Excluding these non-recurring items, 3Q18’s CIR stands at 43%, in line with 1H18. Operating expenses increased 15.9% YoY in 3Q18, faster than operating income’s growth of 10.3%; due to more costs than income brought on by ANZ which accounted for 6% of the increase in expenses. More costs could be expected in 2019 as DBS expands into Delhi and Bombay.

Outlook

NIM will continue to improve with rising rates. The management expects 2 -4 rate hikes moving forward with an average of 60-65% pass-through rate. Around half of DBS’s loan book is pegged to SIBOR and the other half pegged to fixed rates. While it generally takes a few months for the SIBOR to reprice, it takes a couple of years for a fixed rate to do so. Hence a large portion of the rise in interest rates has yet to flow into Singapore’s books with more expected to flow through in 2019. We might see a more pronounced lag in NIM expansion as the fed continues to raise its rates.

In regards to the trade war, the management believes that the largest impact will be on market sentiment and not directly on the economy yet. Market sentiments and anxiety have already resulted in a slowdown in equity and bond activities.

DBS has already seen the impact of the property cooling measures on its mortgage loans growth. 3Q18 saw a 50% drop in new mortgage loans and the management had revised its mortgage loan target to S$2.5bn for 2018 as compared to S$4bn at the start of the year. Hence with tighter measures, we expect mortgage loan growth to slow.

The rise in the cost of funds is not an issue yet for DBS. It is inevitable to face higher funding costs, but DBS’s CASA market share remains strong at 53% (despite Singapore’s CASA shrinking and migrating to fixed deposits and bonds). With an ample CASA base, DBS does not need to increase their pricier fixed deposits funding as much as the other banks.

Despite the softer expectation of loans growth due to market headwinds, NIM will still be on a positive trajectory as trade issues will impact trade volumes more significantly than overall margins. The banking sector will enjoy greater pricing power as the US continues to raise its interest rates. Looking forward, asset quality is expected to be healthy, and lower provisions will provide upside to earnings. DBS remains attractive with a dividend yield of 4.5%.

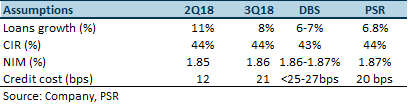

Figure 1: DBS FY18e guidance vs. PSR estimates

The management expects loan growth to slow to mid-single-digit next year. Overall outlook remains positive, and DBS targets an ROE of 13% next year. 2019’s CIR to remain around 43% while asset quality should remain stable despite the expected weakness in SME portfolio due to rising interest rates.

Estimate Changes – Reduce Earnings Estimates

Given the earnings trends for 3Q18 and changes in management guidance for 2019 loan growth, we trim our 2018 – 2019 net profit estimates by 3-5%. NIM expansion and lower allowances should offset lower non-interest income to a certain degree.

Investment Actions

We maintain BUY at a lower target price of S$29.00 (previously S$33.32). As we roll over our valuation to 2019e, we revised our target price lower following adjustments to our beta and terminal growth rate assumption. We are incorporating a more volatile and slower economic growth environment.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Min Ying covers the Banking and Finance sectors. She has experience in external audit and corporate tax roles.

She graduated with a Bachelor of Accountancy with a major in Finance from SMU.