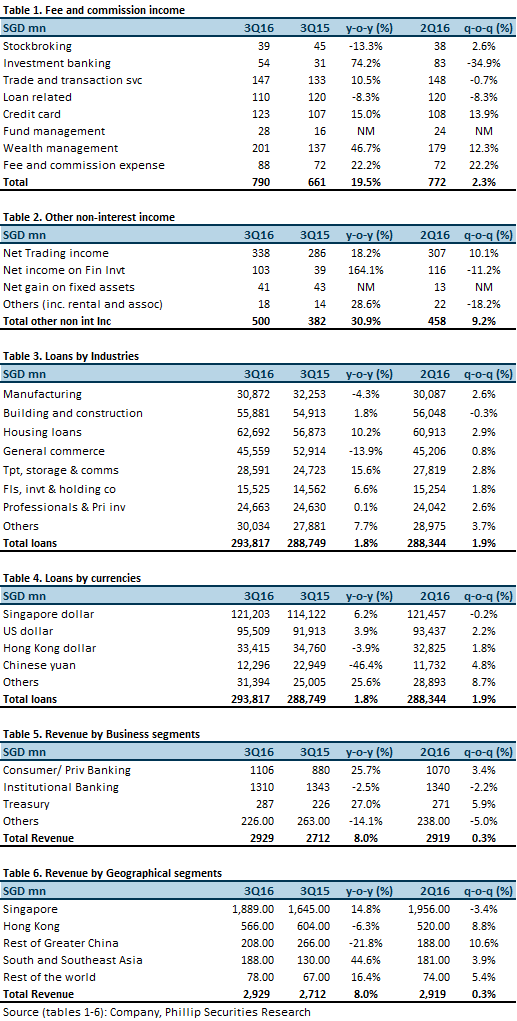

Loans grew 1.8% year-on-year (“y-o-y”). Strong loans growth in Housing loans, up 10.2% y-o-y attributed by higher Singapore mortgage loans. Trade loans remained unchanged quarter-on-quarter (“q-o-q”) at S$37bn but declined 14% y-o-y contributed by declines in Chinese trade loans. On a q-o-q basis, loans growth from Rest of Greater China and South and Southeast Asia regions offset decline in loans from Singapore where SME loans are experiencing weakness from slowing economy.

DBS is vulnerable to NIM weakness in a low rates environment. Average rates on interest earning assets declined 11bps q-o-q, tracking the declines in SOR and SIBOR, while average rates for interest bearing liabilities declined only 1bps q-o-q. We opine that DBS’ Loan-to-Deposit ratio which is pushing to a high of c.90% means it is already maximising the volume of loans it can maintain against its funding from deposits. Now, DBS has less room to optimise NIM further by growing loan volumes faster than deposits. In a low rates environment, DBS would seek to grow the loan volumes to offset the fall in rates on interest earning assets in order to maintain interest income. However, since it is already at a Loan-to-Deposit ratio of c.90% it has less room to grow loans without first taking care of the funding from the liability side. If it tries to grow deposits in tandem, it has to increase rates on deposits but that would run counter to low rates on the interest earning assets and compress NIMs further. Also it may not be able to reduce interest expense simply by cutting rates more aggressively on liability side lest funding drains out and pushes Loan-to-Deposits higher even as loan volumes remain unchanged. We believe the unfavourable rate and volume dynamics is corollary to its current high Loan-to-Deposit ratio and as a result, DBS would have less bandwidth to manage Net Interest Income higher in a low rates environment.

Coverage ratio declined to 100% from 113% in 2Q16 and 161% in 3Q15 as a result of NPLs growing faster than allowance charged. We have alluded to DBS having less bandwidth to manage Net Interest Income higher in a low rates environment, therefore it also implies that it will have to be more cautious in charging higher allowance to the income statement lest it affects the overall profit performance. The situation today is worsened as asset quality is falling and more allowance is expected but the lack of it is leaving the market bamboozled. We believe that DBS had played its cards to drive efficiency too early; only to find itself in a quandary of low rates and falling asset quality happening together.

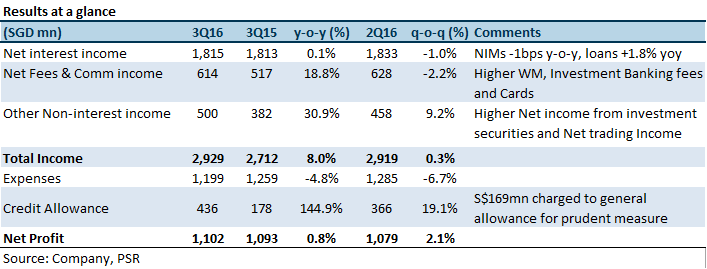

Strong fee and commission income supports performance. Net fee income rose 19% y-o-y to S$614mn led by Wealth Management, up 47% y-o-y from higher bancassurance contributions; by Investment Banking, up 74% y-o-y from higher equity market, fixed income fees and increased advisory activities; by Cards, up 15% y-o-y from growth in credit and debit card transactions. With increased investments into digital and wealth management infrastructure, we believe DBS is seeking to improve the performance of fee income to provide a reliable and consistent boost of offset any potential lacklustre performance from Net interest income segment.

Boost from ANZ acquisition. We believe that the acquisition of ANZ wealth and retail business in five markets (Hong Kong, Singapore, China, Taiwan and Indonesia) is timely because DBS can bolt on the much needed loans and deposits growth. DBS will have access to S$11bn worth of customer loans, representing 3.74% of DBS’ customer loans and S$17bn worth of customer deposits, representing 5.24% of DBS’ customer deposits. DBS can also grow its Cards and Wealth Management franchise across this customer base.

Investment Actions

DBS’ 3Q16 NPAT of S$1.102bn was in line with our expectations of S$1.1bn. The market is focused on the DBS’ asset quality and whether sufficient measures are in place to ensure that. Whereas our view is inasmuch as taking on riskier loans is a concern, the ability to generate higher net interest income is the prerogative to manage higher provisioning to buffer against deteriorating asset quality. We view that the strong Non-interest income segment can help offset the near term weakness in Net interest income and the timely acquisition of ANZ wealth and retail business in five markets will provide the loans and deposit growth support. Maintain to “Accumulate” with a lower target price of S$15.71 (previously S$16.09), pegged at unchanged 0.95x FY16F book value (excluding perpetual capital securities). The lower share price reflects dilution from scrip dividends.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Jeremy covers primarily the Banking and Finance sector. He has 6 years’ experience in equities related dealing and research roles.

He graduated with Bachelors of Mechanical Engineering from Nanyang Technological University.