Property Development

Transactions at Venue Residences and Commonwealth Towers boosted by price cuts; More price cuts expected to accelerate sales at Commonwealth Towers

CDL moved 26 units out of 112 unsold units in The Venue Residences during 4Q16 at an average selling price (ASP) of S$1,408. Coupled with an additional 23 units which were sold during the first two months in 2017, the development has 23% of units that remained unsold. We noted that the 23 units sold between January 2017 and February 2017 were transacted at an ASP of S$1343 which was 4.6% lower than those that were sold in 4Q16. We expected CDL to slash prices gradually in the development in order to accelerate sales momentum and avoid the potential claw back of additional buyer’s stamp duty (ABSD) which is estimated at c.S$30 million including interest. We are of the view that the developer is in good stead to clear the remaining 62 units before the deadline of the ABSD clawback and maintain our expectations that ASP is likely to continue dipping towards our estimate of S$1,300 PSF point.

CDL sold 32 units out of 416 unsold units in Commonwealth Towers in the same quarter at an ASP of S$1,660. The developer has moved another 19 units between January and February 2017 at about the same price point. The development has 365 unsold units (43%) as at 23 February 2017. Similar to Venue Residences, we are expecting further price cuts at the development to accelerate sales of the remaining unsold units. We opine that the developer is likely to continue reducing prices, and projects ASP should come in at S$1,550 PSF. The deadlines for the clawback of ABSD for Venue Residences and Commonwealth Towers are September 2017 and February 2018 respectively.

Investment Action

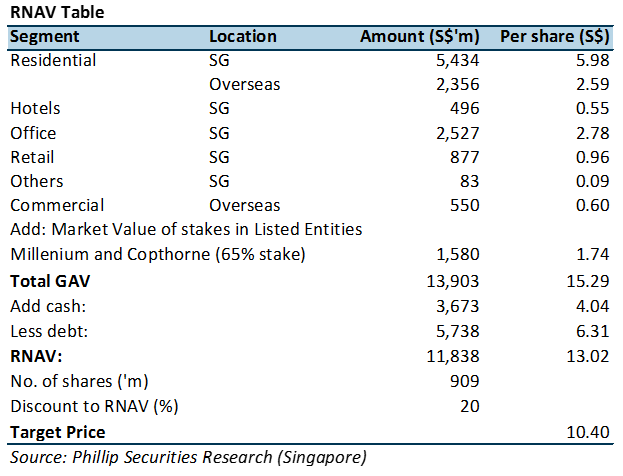

We remain optimistic on CDL’s local and overseas property development segment despite the current challenging markets as unsold units in existing developments continue to be steadily absorbed amid the Group’s solid execution. With a growing cash hoard amounting to S$3.7 billion (Up 13.8% QoQ), we maintain our ‘Accumulate’ rating with an upgraded TP of S$10.40 based on our FY17 RNAV estimates.

Steady take-ups at 1st Phase of launch at Gramercy Park; Holding power gives CDL ample time to clear remaining units

CDL launched and sold 56 out of 87 units at the first phase of launch at Gramercy Park at an ASP of S$2,621 PSF which was better than our expectations. The remaining 87 units in a separate tower of the development is slated for launch by 1H17. We view that CDL still has time on hand to dispose these remaining units before QC extension fees are due in May 2018. Compared to developments which potentially face ABSD clawback, QC extension fees are less severe since fees are computed based on proportion of units that remain unsold. Although unlikely, even if no additional units are sold from here on till the QC deadline, the first year of QC extension fees works out to be c.S$20 million (S$50 PSF). Considering the Group’s strong financial position (S$3.6 billion in cash), CDL has plenty of resources on its balance sheet to utilise which gives the developer the option to hold on to these units without selling them at fire sale prices.

Overseas Residential

Hong Leong City Center Suzhou made a strong maiden contribution to CDL’s profits in 4Q16. As of 31 December 2016, 814 units (78% out of a total 1038 sold) have been handed over and recognised as revenue. To date, 76% (or 1038 units) of Phase 1 (sales value RMB 2.21bn) and 40% of Phase 2 (sales value RMB 502 mn) has been sold. Phase 2 is expected to complete by end 2017.

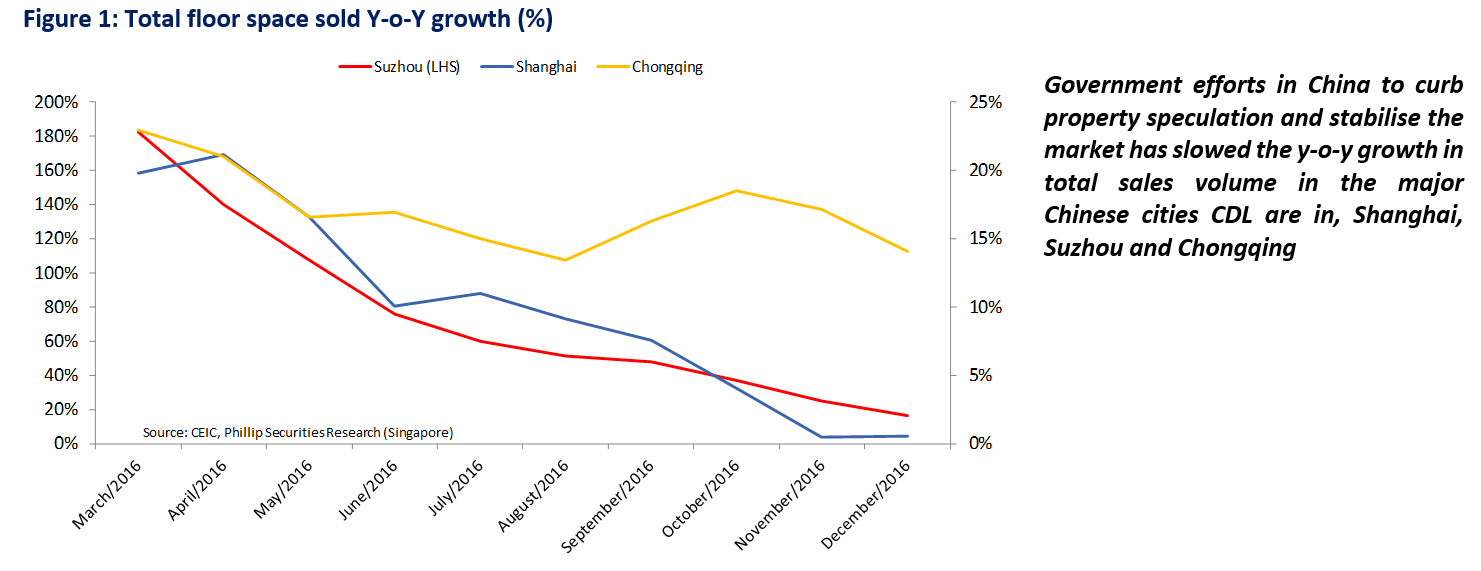

We note that government efforts in China to curb property speculation and stabilise the market has slowed the y-o-y growth in total sales volume in the major Chinese cities CDL are in, Shanghai, Suzhou and Chongqing. Nonetheless, we expect the Group’s China projects to be able to maintain their positive sales momentum due to their favourable locations and we will continue to monitor the pace of sales.

The Group’s biggest projects in UK at Pavilion Road, Knightsbridge, Teddington and Stag Brewery remain longer term projects with first completion at least two years away.

Much as a result of its diversification strategy out of Singapore, 80% of CDL’s land bank is now overseas, with China and UK as its largest markets. We expect sequential strong sales in CDL’s overseas residential developments to contribute more significantly to CDL’s profits in 2017 and 2018 as projects approach completion.

Hospitality business.

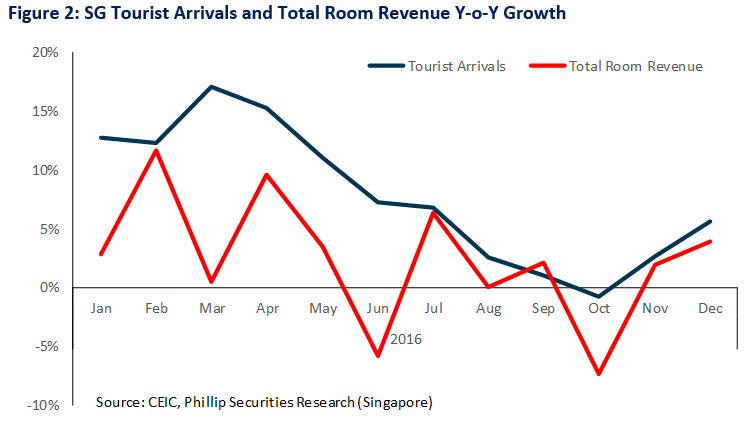

On a constant currency basis, hotel revenue for Millennium and Copthorne came in flat while total Group RevPAR dropped 2.3% led by declines in New York (9.9%) and Singapore (10.1%). We expect Singapore’s hotel portfolio to remain a drag given the anticipated 6.1% increase in hotel room supply in 2017. Most of the supply in 2017 belong to the upscale/luxury sector, which would pose a threat to CDL’s current Singapore hotel portfolio. Despite the general recovery in tourist arrivals in Singapore for 2016, we note that total room revenue growth has lagged, suggesting lower room revenue/tourist and tourists opting for cheaper rooms.

Management expressed optimism in the portfolio global hospitality business for 2017, noting that full year prospects could surprise on the upside on the back of a strong January 2017 global RevPAR performance. London (19.5%), New York (8.9%) and Australasia (12.3) all recorded y-o-y RevPAR growth. Singapore RevPAR though remains a drag with a 5.2% fall.

Made two strategic acquisitions; 24% stake in Co-working space provider, Distrii and 20% stake in online apartment rental platform, Mamahome

CDL acquired a 24% stake in Distrii, a Co-working space provider for RMB72 million which was completed in January 2017. The company is currently operating in 15 locations across China and with another five more locations in China planned to be opened in 1H17. Distrii has committed to lease around 60,000 square feet of space in Republic Plaza where the space was previously occupied by Bank of Tokyo-Mitsubishi, boosting portfolio occupancy rates by 1.9 ppts from the Group’s current office space occupancy rate of 95.9%. CDL also acquired a 20% stake in Mamahome, an online apartment rental platform, which has a business model that is largely similar to AirBnB. The platform is currently listing 150,000 apartment listings over 20 cities in China. Management shared that the acquisition will be synergistic to the Group’s portfolio of investment properties in Shanghai, Suzhou and Chongqing.

Valuations

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: