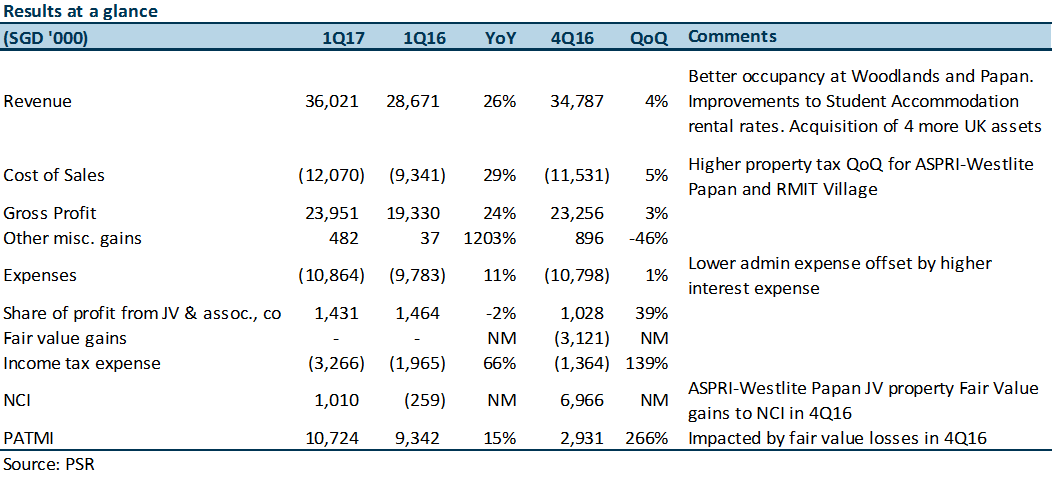

1Q17 revenue grew 26% YoY and 4% QoQ. The YoY growth revenue was mainly due to the addition of four new student accommodation properties in United Kingdom (“UK”), acquired in 3Q16. The QoQ revenue growth was mainly due to higher occupancy for workers’ dormitories at Westlite Woodlands (c.95% in 1Q17 vs. c.90% in 4Q16) and ASPRI-Westlite Papan (89% in 1Q17 vs. 75% in 4Q16). We estimate rental rates increased c.1% QoQ for UK student accommodation business thus providing a boost to the QoQ revenue growth.

1Q17 net profit margin improved to 33% compared to 32% a year ago. The improvements to net profit margin was due to ASPRI-Westlite Papan becoming more profitable in 1Q17 but slightly offset by higher Cost of Goods (“COGs”) and higher interest expense. COGs was higher QoQ owing to more property tax paid on better property valuation for ASPRI-Westlite Papan and RMIT Village. Barring lumpy expenses in COGs, Centurion continues to enjoy a high operating leverage where they will be able to grow revenue faster than costs through positive rental reversions. 1Q17 COGs, distribution and administration expenses margin was c.50%. Based on our estimations, if Centurion is able to maintain this margin through FY17, we can expect c.3% improvement to its operating cash flow compared to FY16.

Singapore Workers’ Dormitory Portfolio have almost hit full occupancy by 1Q17, well ahead of our expectation of hitting full occupancy by end of 2017. We believe that higher occupancy was possible as the foreign worker population in Singapore remained stable while supply of Purpose-Built Workers’ Accommodation remains tight. We expect the supply constraints in workers’ accommodation to continue while the strong pipeline of public sector construction projects which are expected to last till 2020 will keep Centurion’s Singapore workers’ dormitories fully occupied.

Minimal impact from ceasing of operations at Westlite Desa Cemerlang. We estimate Westlite Desa Cemerlang’s quarterly revenue before ceasing operations was c.S$100,000 which was only c.0.3% of Centurion’s average quarterly total revenue over the last 4 quarters of S$31mn.

Maintain Accumulate rating with higher target price of S$0.48, previously S$0.42. We are pleased to see Centurion’s ability to command a price premium for its Singapore workers’ dormitories and yet ramp up its occupancy faster than expected. All these despite competitors slashing prices and weaknesses from the oil and gas industry that we have witnessed in 2016.

Our higher target price is based on the expectation for stronger operating cash flow as a result of Centurion’s continued ability to exercise pricing power in its student and worker accommodation business across markets and on the expectation that favourable supply demand dynamics in its Singapore workers’ accommodation business will continue to support that stronger cash flow. On the cost side, we expect COGs, distribution and administration expenses to be stable at c.50% of total revenue to also support the higher operating cash flow projections.

Jeremy covers primarily the Banking and Finance sector. He has 6 years’ experience in equities related dealing and research roles.

He graduated with Bachelors of Mechanical Engineering from Nanyang Technological University.