While sales volume in 1Q17 represented a 38.9% YoY decline to 2,062 units, we noted that CAPL has launched 1,811 units in the quarter. Although sales volume registered a YoY decline, sales value was down 16.2% which was significantly lower as a result of higher ASPs from fewer sales of township units which command lower ASPs. We opine that the Group may have been able to record a higher sales volume but was constrained from lesser units available for sale during the quarter. While the Group has another c.80% (6,974) of units slated to be launched in CY17, we view that the Group’s sales volume is unlikely to accelerate as the Chinese Government maintains a tighter grip on the property market, in order to curb the rapid gains in home prices in the past year, while maintaining stability in the property market.

In 1Q17, the four operating Raffles City (RC) integrated developments (Shanghai, Beijing, Changning and Ningbo) saw a 3% YoY growth in NPI to RMB272 million (RMB116 million attributable to CAPL). These assets continue to operate at close to full average occupancy rates (retail: 98% and office: 88%). We are of the view that NPI will grow significantly in FY18 as three other retail components (Hangzhou, Changning and Shenzhen) of RC assets become operational in 2Q17, while taking into account of the time required for these assets to stabilise. The three new RC assets’ retail component will boost total NLA of the Group’s existing China RC portfolio by 55.9%. Additionally, the pre-committed leasing rates of these three assets are at least 95% as at 1Q17.

Investment Actions

We are upbeat about the four new retail assets which are slated to be operational in 2Q17 as these assets will be boost CAPL’s recurring income moving forward. A higher recurring income base is much welcomed in China against the backdrop of Chinese Government’s commitment to curb rapid increases in property prices and maintain stability in the market. We maintain an “Accumulate” rating with an unchanged TP of S$4.19.

Retail – Same-mall NPI growth in China up 7.6% Flat in Singapore. One new shopping mall to be opened in China in 2Q17.

CAPL’s same-mall NPI growth in China grew 7.6% YoY to RMB1 billion, mainly driven by a 17.9% YoY NPI yield improvement in malls in Tier 2 cities. We opine the continued strong performance in the Group’s China malls was largely attributable to higher tenant sales where it grew 12.6% YoY in 1Q17 (FY16 YoY growth: 10.2%). This trend is likely to continue as the Chinese Government remains committed to shift the nation’s economy towards a model of consumer spending while being less reliant on exports and investments. The Group intends to open a new shopping mall, CapitaMall Westgate, in Wuhan in 2Q17 which will add 0.25 million sqm of GFA. In Singapore, we expect rental reversions to continue to face pressure due to peak rents signed in 2004/2005 period due for renewal.

Singapore Residential – Victoria Park Villas remain primary concern for ABSD.

In Singapore, CAPL sold 83 residential units worth S$497mn in 1Q17. Total units sold was down 63% y-o-y but total sales value kept up with the S$506mn sold in 1Q16. This was due to the higher average selling price achieved in the quarter through the bulk sale of 45 units in The Nassim. We expect contribution from residential sales in Singapore to come off significantly in the coming quarters due to dwindling inventory as most projects are >90% sold with the exceptions of Sky Habitat (78%), Marine Blue (52%), and Victoria Park Villas (19%).

We maintain our view that Victoria Park Villas remain the primary concern for ABSD charges (S$46mn by June 2018) despite improving buying sentiment on the ground as seen from recent strong launches in the quarter for projects such as Seaside Residences and Park Place Residences. This is due to the large selling price quantum for each unit (>S$4mn) and the restrictions against foreigners for landed home projects. CAPL moved 2 units in the quarter (88 remain unsold). Average selling price was S$1990psf. We feel that price cuts are likely as we move closer to the ABSD due date. Total inventory left for CAPL’s Singapore residential property stands at S$1.3bn (3% of total CAPL assets). This is down from S$1.7bn at end FY16 and S$1.9bn at 3Q16.

Singapore Commercial – Pace of office rent decline slowing, continue to expect bottoming out in 2018.

Weakness in the Raffles City Singapore portfolio (NPI down 5.3% y-o-y as a result of lower hotel turnover rent) was mitigated by higher contributions from CapitaGreen. The pace of decline in office rentals is abating (-1.6% y-o-y in 1Q17 vs -4.8% in 1Q16) and we continue to expect rents to bottom out in 2018 as demand for offices improve and the record supply in 2017 gradually gets absorbed. Minimal leases (5% by monthly gross rental income in CCT portfolio) are due for expiry for the remainder of 2017 and this mitigates the downside risk for the rest of the year.

Serviced Residences – Expect continued revenue pressure in Singapore.

Q1 RevPAU decreased 1% led by 9% drop in Singapore. Although we expect corporate demand to improve y-o-y in 2017, we expect RevPAU pressure on the Singapore portfolio to continue due to the expected 6.6% increase in supply of hotel rooms in 2017 to c.68,587. A good portion of this new supply is in the upscale/luxury segment such as Sofitel Singapore City Centre (Tanjong Pagar Centre) and Andaz Singapore (DUO). We expect other segments in Asia and Europe to remain stable on the back on improving global economic conditions and sentiment.

Nevertheless, we expect a boost to earnings in 2017 come from the 2,600 units expected to be opened in 2017. This represents 8.6% of the total 30,386 operational units currently. Ascott also continued its capital recycling efforts with divestment of properties in Germany and Japan in the quarter.

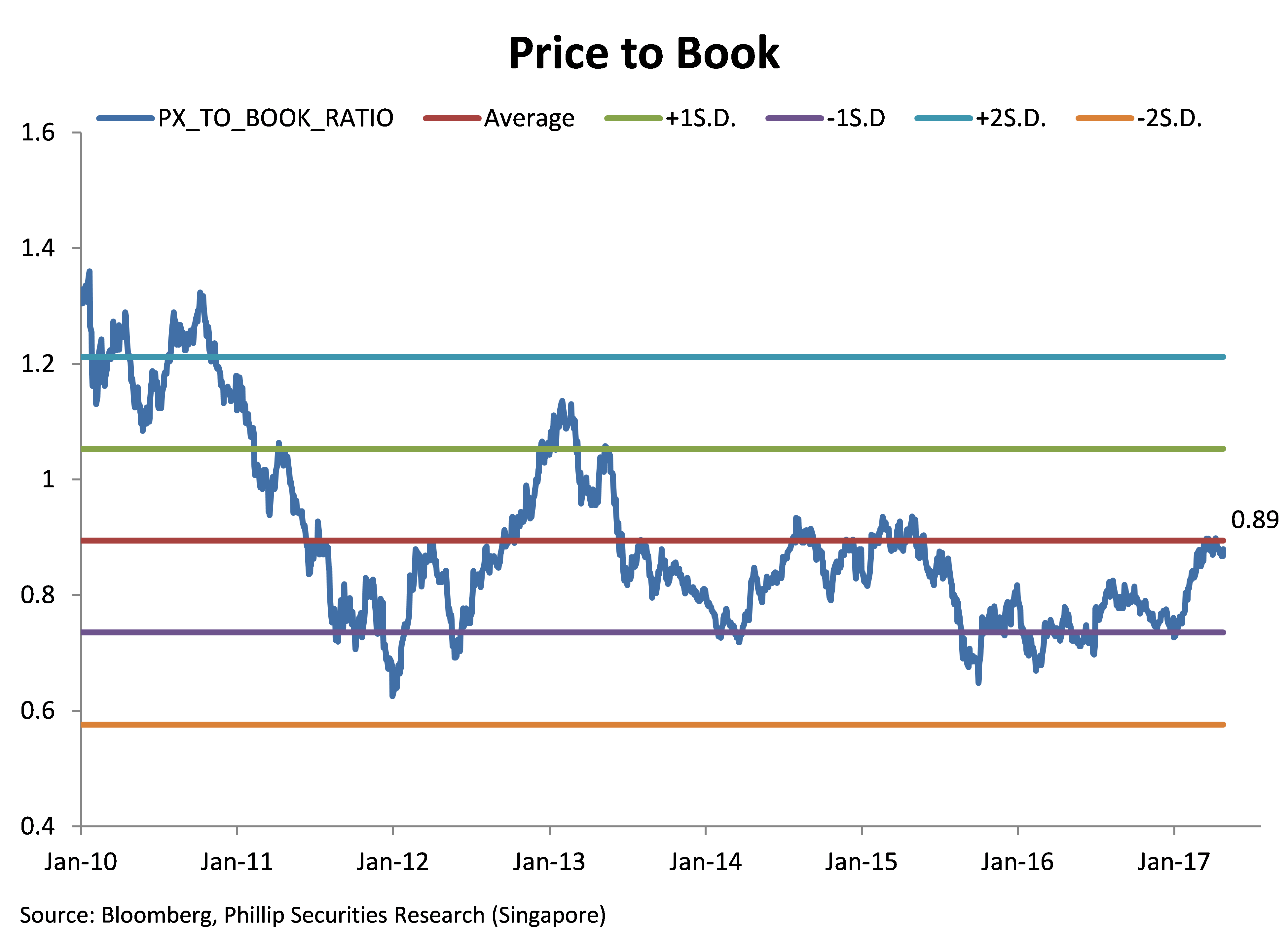

Figure 1: CAPL trades at close to post GFC average Price/NAV of 0.89

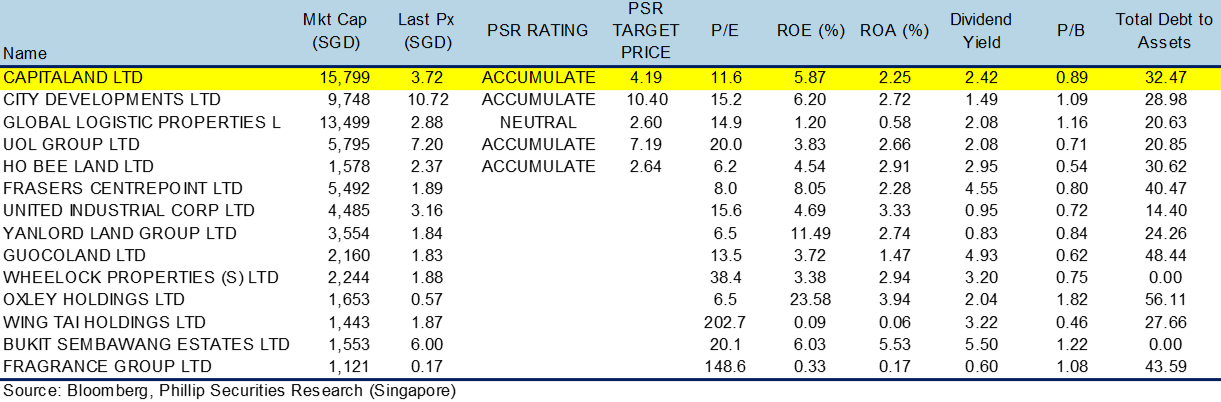

Figure 2: Peer comparison table and PSR calls

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Dehong covers primarily the REITs and property developer sector. He has close to 7 years experience in equities related dealing and research roles.

He graduated with a Masters of Science in Applied Finance from SMU and Bachelors of Accountancy from NTU.