We recently attended a group discussion with Management, hosted by Managing Director, Ms. Yvonne Lee, who fielded the Question & Answer session.

Company description

Asia Enterprises Holdings Limited (Asia Enterprises) distributes steel products such as plates, angles, beams, bars and pipes to industrial end-users in Singapore and the Asia-Pacific region.

Asia Enterprises was listed on the Main Board of the Singapore Exchange on 1 September 2005 through 5,000,000 Offer Shares at S$0.27 each by way of public offer, and 63,000,000 Placement Shares also at S$0.27 each.

Key takeaways

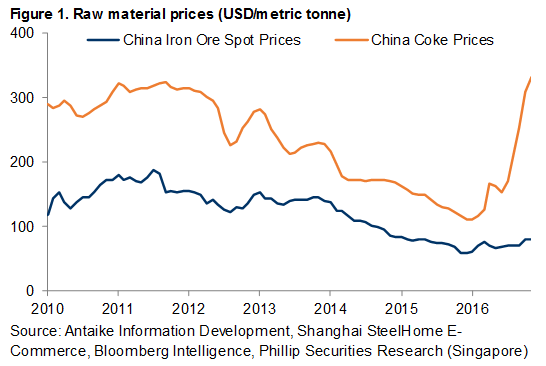

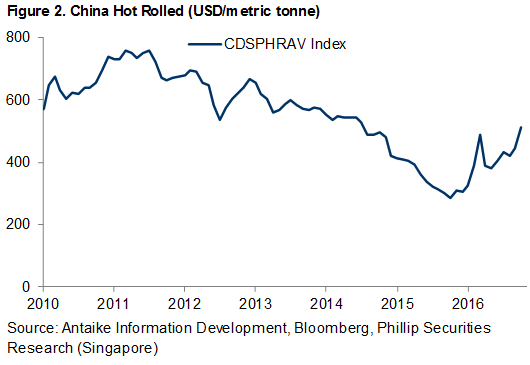

Management shared that the recovery of steel prices has been due to higher cost of the two main raw materials – iron ore and coking coal. Data from Bloomberg (overleaf) show that the cost of iron ore had increased by c.35% during 2016; and the cost of coking coal had increased by c.186% in the same period. We use hot rolled steel from China as a proxy for the mix of steel products and observe that it has recovered c.85% from the low in December 2015. While the higher price of steel has lifted average selling price (ASP) for 9M FY16, Management shared that it is still lower than FY16 average. In terms of product mix sold, hot roll coil is the highest by volume, while plates constitute about half of turnover. (Bear in mind that weighted ASP depends on product mix sold and not just hot rolled steel alone.) Lastly, Management believes demand from Construction to remain stable, while demand from Marine and Offshore has some way to go before a recovery. Overall, demand is not expected to pick up massively in the near term. Management shared that the three biggest customers by revenue contribution are typically not the same every year.

Inventory was written-down by S$9.81 million in 4Q FY15, contributing to the full year net loss of S$12.1 million in FY15. Considering the write-down last year together with rising steel price this year, a write-down again this year in 4Q FY16 is unlikely. As inventory is recorded on an average cost basis, a nuance in relation to inventory is that it is not feasible to forecast with certainty the gross profit margin by tracking the price of steel. The reason is twofold: inventory cost is dependent on when inventory is replenished and quantity of inventory replenished. Moreover, there is a lead time of two to three months before inventory is received.

The warehouse at 36 Penjuru Lane is being redeveloped and expected to be completed by 1Q FY17. When completed, inventory at the other two warehouses (3 Pioneer Sector Walk and 25 Pioneer Sector 2) will be consolidated to this warehouse. Management expects some cost savings with the consolidation of operations. While the additional space increases ability to stock more inventory, Management cautioned against linearly extrapolating potential revenue growth with the increase in storage capacity. The reason is that not all goods sold passes through their warehouse; there are instances where goods are turned around to customers without even entering the warehouse. From a cash flow perspective, we understand that the 9M FY16 Capital Expenditure (CapEx) of S$11.6 million is substantially in relation to the S$18.7 million Capital Commitments disclosed on Page 67 of the FY15 Annual Report. Management shared that the lease for the warehouse at 25 Pioneer Sector 2 will be expiring in four years, and will have to enter into negotiations with JTC to renew the lease or for a replacement site. CapEx is to be expected for redevelopment of a new warehouse, regardless of either outcome.

What do we think?

We show in the last section of this report that current valuation appears undemanding, priced below the estimated liquating values of current-asset value per share of 23.0 cents and realisable current-asset value per share of 20.6 cents. Thus making this a net-net stock. We also show that the current price appears to be irrational, even after assuming that inventory is fully written-off (realisable current-asset value of 18.7 cents per share). Barring any oversupply shock or irrational pricing for steel, we think the worst could be over for steel prices. Catalyst that will move the stock price higher is a recovery in demand from the Marine and Offshore customers and favourable movement in steel prices.

Investment action

No stock rating or price target provided, as we do not have coverage on Asia Enterprises.

Company Background

As disclosed in the FY15 Annual Report, “Asia Enterprises is a major distributor of a comprehensive range of steel products to industrial end-users in Singapore and the Asia-Pacific region.

With 43 years of operating history, Asia Enterprises boasts a wide range of products that is complemented by its value-added services to offer ‘one-stop’ solution and just-in-time delivery to its customers. Today, the Group has a ready inventory consisting of more than 1,200 steel products that it supplies to over 700 active customers involved primarily in marine and offshore, oil and gas, construction, as well as precision metal stamping, manufacturing and engineering/fabrication industries. The Group has forged a strong reputation as a reliable distributor of steel products to the marine and offshore industries.

Asia Enterprises presently operates three facilities in Singapore – two warehouses and a steel processing plant-cum-warehouse with a combined land area of 45,934 square metres. To complement its steel distribution business, the Group also provides precision steel processing services through a joint-venture with Marubeni-Itochu Steel Inc.

As a steel stockist, Asia Enterprises bridges the gap between the steel mills and the end-users. Steel mills only sell their products in large quantities, often with a lead time of around two to three months. End-users on the other hand typically do not meet the minimum order quantity of the mills, need the stock immediately and cannot wait for two to three months. This is where Asia Enterprises acts as a middleman – buying in large quantities from the mills and holding an inventory, ready for sale to the end-users.

Asia Enterprises provides steel processing services through its 60%-owned subsidiary Asia-Beni Steel Industries (Pte) Ltd. The subsidiary is a joint-venture with one of Asia Enterprises’ major suppliers, Marubeni-Itochu Steel Inc. Marubeni-Itochu Steel Inc. is in turn equally-owned by Marubeni Corporation (market capitalisation: JPY 1,175 billion / S$14.7 billion) and ITOCHU Corporation (market capitalisation: JPY 2,744 billion / S$34.2 billion), both of which are listed on the Tokyo Stock Exchange.

The initial public offering (IPO) Prospectus describes the steel processing services as supplying “processed steel materials such as anti-finger print and phosphated electro-galvanised, hot-dipped galvanised, cold-rolled, hot-rolled and stainless steel to our customers that engage mainly in precision metal stamping, manufacturing and engineering/fabrication activities.”

To read the full report, please sign up for premium content.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Richard covers the Transport Sector and Industrial REITs. He graduated with a Master of Science in Applied Finance from the Singapore Management University. He holds the CFTe and FRM certifications and is a CFA charterholder.

He was ranked #2 Top Stock Picker (Asia) for Real Estate Investment Trusts in the 2018 Thomson Reuters Analyst Awards, and ranked #2 Top Stock Picker (Singapore) for Resources & Infrastructure in the 2016 Thomson Reuters Analyst Awards.