Company Background

Ascott Residence Trust (ART) is an owner-operator of serviced residences (SRs) with 79 properties totalling 11,430 keys spanning 14 countries. c.85% of gross profit is derived from its eight key markets – namely, the US, Japan, UK, France, Vietnam, Singapore, China and Australia. ART’s SRs, excluding its US properties, are operated under three core brands – Ascott, Citadines and Somerset. Ascott Limited, ART’s sponsor, is a wholly-owned subsidiary and the hospitality arm of Mainboard-listed CapitaLand Limited (market cap S$15.3bn).

Investment Merits

41% of gross profit is stable, derived from master leases (ML) and management contracts with minimum guaranteed income (MCMGI) while the remaining 59% is derived from management contracts (MC), thus providing upside potential. 70% of the room stock is for long-term stays and the remaining 30% for higher-yielding short-term stays. 75% of EBIT is sourced from five core developed markets.

ART’s Sponsor, Ascott Limited, has grown its presence at a CAGR of 36.5% over the past three years to 100,000 keys over 172 cities across 33 countries as at 21 January 2019. Ascott Limited is targeting 160,000 keys by 2023. ART is poised to benefit from Ascott’s brand awareness and economies of scale. ART currently has a right-of-first-refusal (ROFR) pipeline of 20 properties. Following the divestment of Ascott Raffles Place, ART’s gearing is expected to fall 2.2pp from 36.7% to 34.5%. Given ART’s significant asset base of S$5.3bn, this translates to a debt headroom of c.S$880mn (assuming a 45% gearing level).

With 70% of room stock used for long-term stays, less wear and tear is observed in comparison with hotels as there are less frequent turnovers. In addition, SRs only offer limited services, unlike hotels which offer a full range of services, which translates into lower CAPEX and manpower requirements.

Key risks

Initiating coverage with BUY rating and target price of S$1.36

We initiate coverage on ART with a BUY rating and a DDM-derived target price of S$1.36. This implies a 21.5% upside and a FY19e P/NAV of 0.80.

Revenue models

ART’s assets are leased out on three different types of leases – master lease (ML), management contract with minimum guaranteed income (MCMGI) and management contracts (MC).

Figure 1: Characteristics of different leases under ART

Figure 2: Gross profit by revenue model

Master Lease

Under a triple-net lease, master lessors are responsible for the property taxes, insurance and maintenance, resulting in high gross profit margins. Due to the longer lease terms, the master leases in France, Germany and Australia are subject to annual rental reversions pegged to the consumer-price index (CPI). Ascott Orchard’s lease includes an additional variable component.

Management contract

Operating income from management contracts are dependent on the RevPAU of each asset. RevPAU is a function of the occupancy rate and the average daily rate (ADR). Income is tied to the profitability of the SR and ART is responsible for the day-to-day cost of operations as well as CAPEX outlays. Hence, profit margins for this revenue model have a wider range and are thinner compared to MLs.

Management contract with minimum guaranteed income (MCMGI)

Similar to management contracts, MCMGIs are driven by RevPAU and profitability of the SR. However it is downside protected as the operator guarantees to pay the shortfall should income be lower than the pre-agreed minimum income level. MCMGIs allow ART to participate in the upside of the SRs. All of ART’s MCMGI assets are currently contributing more than the minimum guaranteed income.

With the divestment of Ascott Raffles Place (previously under master lease) and acquisition of Citadines Connect Sydney Airport and Lyf One-north (to be operated under management contract), a higher portion of gross profit will be derived from management contracts which have lower profit margins associated with them. Corresponding, we expect gross profit margins to deteriorate 1pp from 46.5% in FY18 to 45.5% in FY20.

Figure 3: Gradual shift towards revenue derived from management contracts

Demand drivers for SRs

Corporates

ART’s longer stays are driven by the corporate segment which clock in stays ranging from a month to two years. Some business travellers are MICE organisers or expats on overseas project group assignments that last between 3 to 6 months. PwC’s talent mobility study show that overseas assignee levels have increased by 25% over the past decade and it is estimated that there will be a 50% increase in overseas assignments in 2020 driven by short-term and commuter assignments.

Leisure

SRs are priced slightly higher than hotels but units are generally 30-50% larger compared to hotels, hence more competitive on a per square foot level. They are also amenitised with cooking facilities which are favoured by some guests. An Association of Serviced Apartment Providers’ survey on SR operators in the UK reported that across the board, members saw their Chinese-sourced business increase by 5 to 50% YoY in 2018, with majority of the guests from China being leisure travellers.

Figure 4: Gross profit by geographical breakdown

Costs

Direct costs comprise staff cost, depreciation and amortisation, property tax and insurance which mostly accrue from the management contract revenue model. Staff costs and depreciation and amortisation account for 20% and 13% of direct costs respectively.

Finance costs include the cost of forex hedging and interest rate swaps. 80% of debt is on fixed terms with 96% of total debt expiring after 2020.

Figure 5: Manager’s management fees

Our valuations have factored the acquisition of Citadines Connect Sydney Airport which was announced on 28 March 2019. Figure 6 below summarises notable transactions that have occurred in the last two years.

Figure 6: Summary of corporate actions

Investment Merits

41% of ART’s gross profit is derived from stable streams (master leases and MCMGI) while 59% derived from management contracts provide upside from variability. 70% of room stock is used for long-term stays, with the remaining 30% room stock for higher-yielding short-term stays. The average length of stay in most properties ranges 1 month to 2 years which affords income visibility and cushions transient vacancies or scheduled AEIs.

Figure 7: Length of stay in each MCMGI and MC asset

Additionally, 75% of EBIT sourced from developed markets which further speak to the stability of income. Long term stays are driven by the corporate segment’s business travels, meetings, incentive travel, conventions and exhibitions (BTMICE) needs as well as out stationed executives working in project groups. As such, there is less cyclicality compared with hotel operations, which is primarily tourism driven.

In Singapore, there is a distinction between the licenses meant for long term stays and short term stays. Other countries do not have this distinction. Serviced residence licenses mandate a minimum stay of one week while hotel licenses have no minimum length of stay requirement. Of their four SRs located in Singapore, Ascott Orchard and Ascott RP (divested), which is located along the prime shopping district and CBD respectively, hold the hotel license, allowing them to benefit from the tourist influx in Singapore. These two assets are operated under master lease with a participating variable component. ART has benefitted from this pre-emptive of applying for the hotel license as the average length of stay at Ascott Orchard is currently less than one week.

S$800mn debt headroom for inorganic growth

Post (Ascott RP) divestment gearing expected to fall 2.2pp from 36.7% to 34.5%. Given ART’s significant asset base of S$5.3bn, this translates to a debt headroom of c.S$880mn. This is sweetened by ART’s ability to borrow at a low cost of debt of 2.3%, giving them an advantage over REITs with higher borrowing costs, which means that more projects would be yield accretive to ART.

Riding on Ascott’s brand name and rapid growth

Over the last 3 years, the number of keys under Sponsor Ascott Limited has been growing at a CAGR of 36.5%. from 39,000 to 100,000 keys. The signing of 28 management contracts (totalling 26,000 keys) in China in January 2019 enabled Ascott Limited to achieve their 2020 target of 100,000 keys ahead of schedule. Ascott is targeting to operate 160,000 keys by 2023. In 2018, the global construction pipeline for the hospitality sector reached a high with hospitality heavyweights such as Marriot, Hilton, InterContinental and Accor accounting for 55% of the 13,571 projects/2.3mn rooms in the global pipeline. Developer-operators like Banyan Tree have also refined their strategy, choosing the asset light approach and ramping up the number of keys through management contracts. The strategy of increasing the number of keys globally enables operators to build brand prominence as well as take advantage of economies of scale. With most of ART’s assets operated under the Ascott, Citadines and Somerset brands, ART is poised to benefit from the brand and reputation that Ascott has built.

Figure 8: Ascott Limited’s rapid growth in number of keys

Expanding income base though expansion into new co-living segment

Lyf One-north is ART’s maiden development project and first co-living asset. It is located in Singapore and holds a SR license and will be managed by Ascott. The co-living concept is targeted at executive millennials and expatriates who prefer a more social and experiential environment. One-north is dubbed Singapore’s research and innovation hub, where numerous young entrepreneurs and start-ups congregate. Co-living accommodations have shared common spaces such as living rooms, kitchens, and working spaces. It gives tenants the luxury of typical amenities in a home without having to incur the cost of additional space and investment in furniture and appliances. The sharing economy has enabled co-living operators to reduce individual unit spaces but still provide these amenities without the cost of duplication.

Figure 9: Ascott Limited’s Lyf pipeline

Hmlet, one of the first movers in the co-living space in Singapore, started operations in 2016 and currently has 18 properties totalling 1,000 beds. Hmlet rents and renovates properties to eventually sublet them. Apart from expatriates, their clients include couples that require transitional housing while awaiting the completion of their flats.

Sponsor Ascott Limited has four co-living properties in the pipeline totalling 784 units and intends to increase the number of keys from this segment to 10,000 by 2020. Including ART’s Lyf One-north, there will be 1,080 Lyf units. ART’s Lyf One-north will stand to benefit from the scale and presence of the Lyf brand.

Right of First Refusal (ROFR) Pipeline

Ascott Limited has granted ART the ROFR for its properties – regardless of the developmental or operational stage – that are used as serviced residences or rental housing properties in Europe and Pan-Asian region. Currently, there are currently 20 properties at various developmental and operational stages in ART’s ROFR pipeline.

With 70% of room inventory used for long-term accommodation, less wear and tear is observed in comparison with hotels, which experiences more frequent turnovers. CAPEX is generally broken into two categories, maintenance and improvement CAPEX. Improvement AEIs are undertaken to refresh the property or upgrade the PPE which will translate into higher RevPAU from the improved asset. Maintenance CAPEX is incurred to replace existing PPE and furniture and fittings with similar (or newer model of) equipment to serve the same function, and as such will not increase RevPAU significantly, but rather help to maintain the current RevPAU. We expect less maintenance related CAPEX spending due to less wear and tear, which will provide better profit margins and less disruption to the business from closure of rooms for renovation.

Unlike hotels which offer full range of services, SRs only offer a limited selection of services, which translates into lower CAPEX and OPEX requirement. As master leases are triple-net and only receive a fixed fee (except Ascott Orchard), only properties under MCMGI and management contract will stand to benefit from the CAPEX and OPEX efficiency of SRs. The 11 rental housing properties in Japan are also minimally furnished. Some SRs have F&B outlets on the premise or shared, self-service, pay-per-use amenities such as washing machines. The limited selection of services also corresponds to lower manpower requirements.

Outlook

CapitaLand-Ascendas Singbridge transaction and overlapping mandates with Sponsor’s parent’s affiliate, Ascendas Hospitality Trust

CapitaLand announced the acquisition of Ascendas-Singbridge on January that is subject to shareholder vote on 12 April 2019. Ascott Limited, ART’s sponsor, is 100% owned by CapitaLand. If the acquisition of Ascendas-Singbridge is approved, CapitaLand will own 27.72% of Ascendas Hospitality Trust (AHT). AHT has 14 assets which are located in Singapore (1), Australia (6), Japan (5) and Korea (2). CapitaLand’s Management commented it would be more likely to merge ART and AHT or divest its stake in either ART/AHT, than to modify the investment mandates of the two REITs.

Key risks

Substantial room supply hitting several markets that ART is operating in – namely, Japan, China, Germany, UK, Vietnam and Australia – will put downward pressure on RevPAU. There is also risk of unfavourable foreign currency movements in the countries which ART operate. These factors are mitigated by ART’s diversified portfolio which no geography accounts for more than 15% of gross profit. Historically, ART’s forex hedging strategy of hedging distributable income in EUR, GBP, JPY and USD has limited the impact of FX movements on gross profit, keeping it in the range of +/- 1.4% in the last 5 years (impact of FY2017/18 FX fluctuations on gross profit was 0%).

Valuation

We initiate coverage on ART with a BUY rating and a DDM-derived target price of S$1.36. With a DPU yield of 6.3%, this implies a 21.5% upside. At a discount to P/NAV of 0.80, we find ART to be attractive.

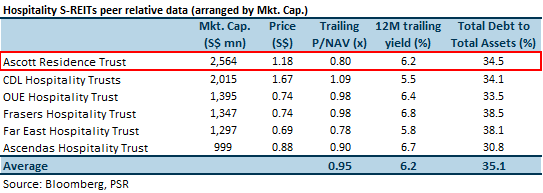

Figure 10: Peer comparison table

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: