Investment Summary

The Group is an established and diverse integrated services provider offering workforce solutions and services in Singapore through its three business segments of Employment Services Business, Cleaning and Stewarding Business and Security Services Business. The Group provides a range of solutions and services, from sourcing and training of foreign labour, to providing specialised solutions and services for facilities management services, in accordance with the requirements of its customers.

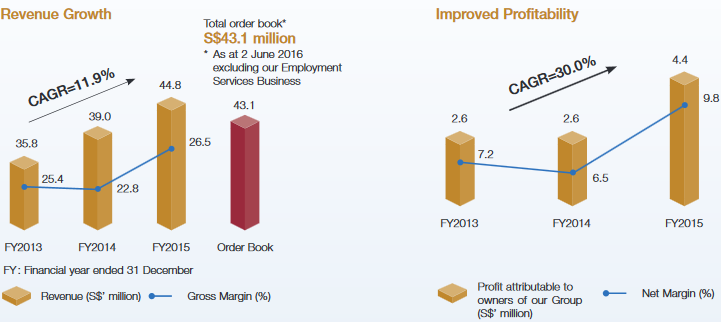

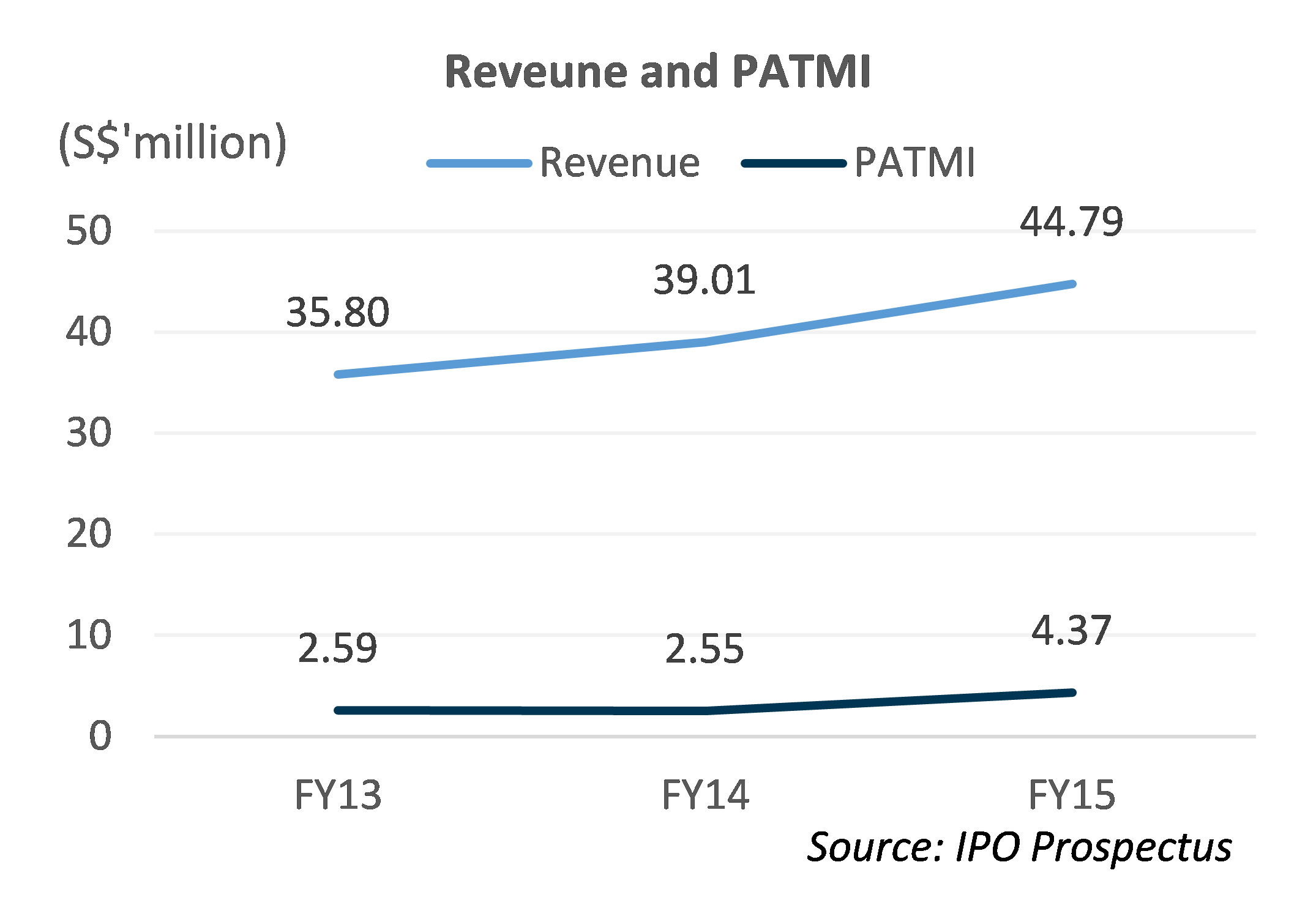

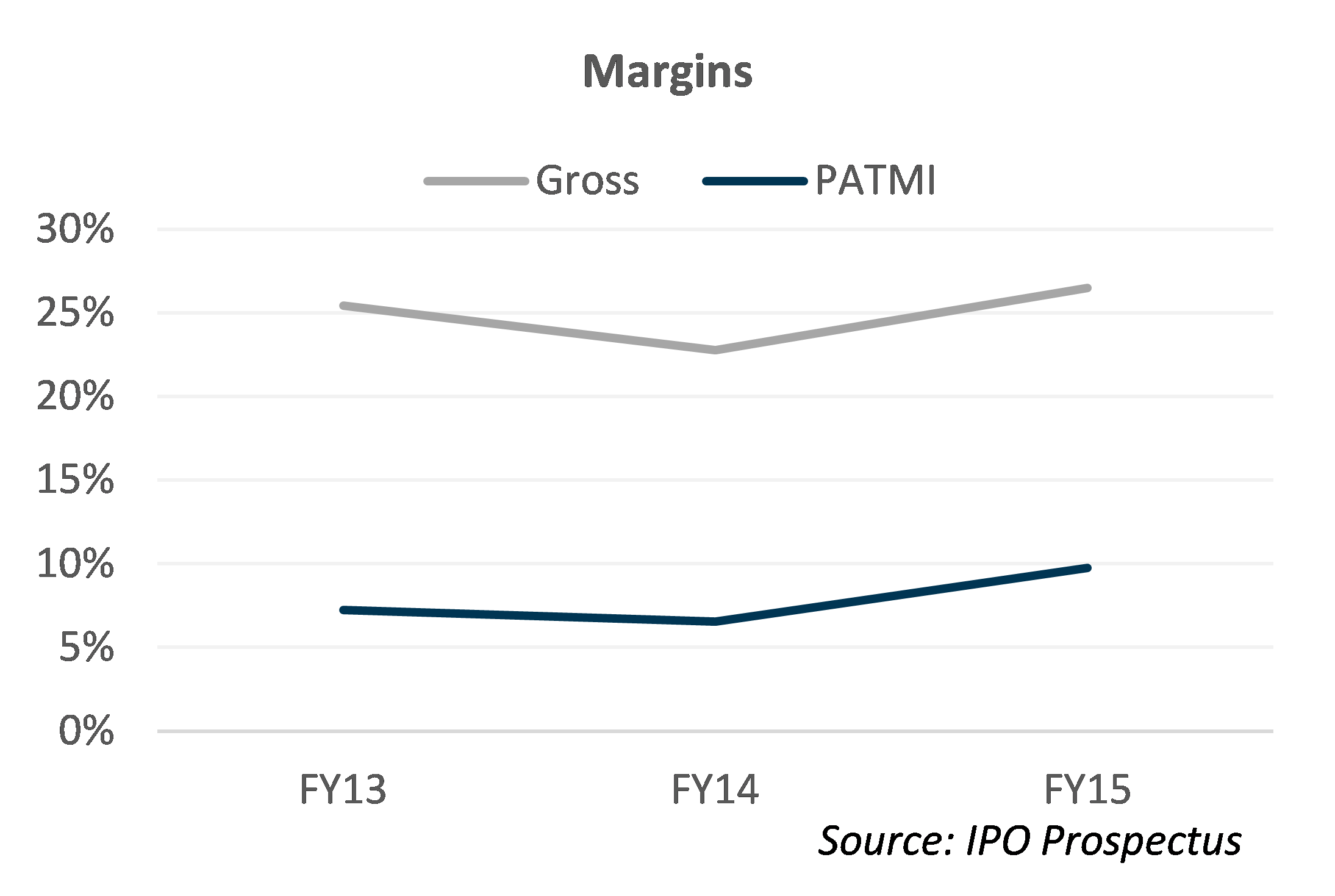

Financial Highlights

Source: IPO Prospectus

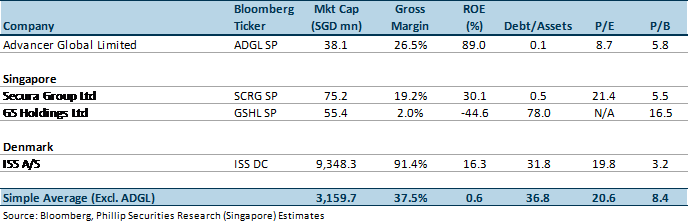

Peer comparison

Source: Bloomberg, Phillip Securities Research (Singapore) (PSR)

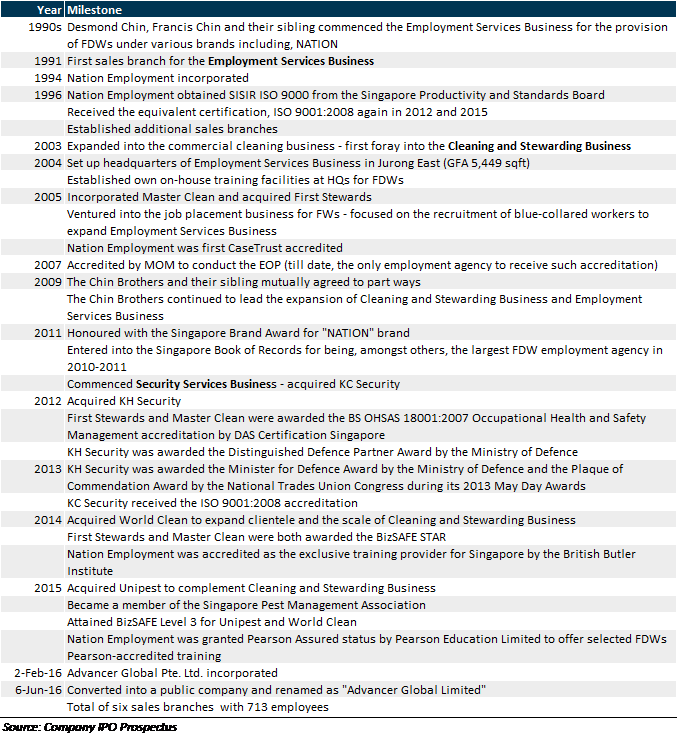

COMPANY BACKGROUND AND HISTORY

Business Segments

a. Provide one-stop shop services for the sourcing, employment and training of foreign domestic workers (“FDWs”) to households

b. Sourcing and employment of foreign workers (“FWs”) to, amongst others, corporations and organisations

2. Cleaning and Stewarding Business

a. Provide integrated cleaning and stewarding solutions and services

b. Provide pest control services for the remediation and prevention infestations through wholly-owned subsidiary Unipest

3. Security Services Business

a. Provide manpower for security solutions and services to, amongst others, commercial, industrial and residential properties, as well as security escort services

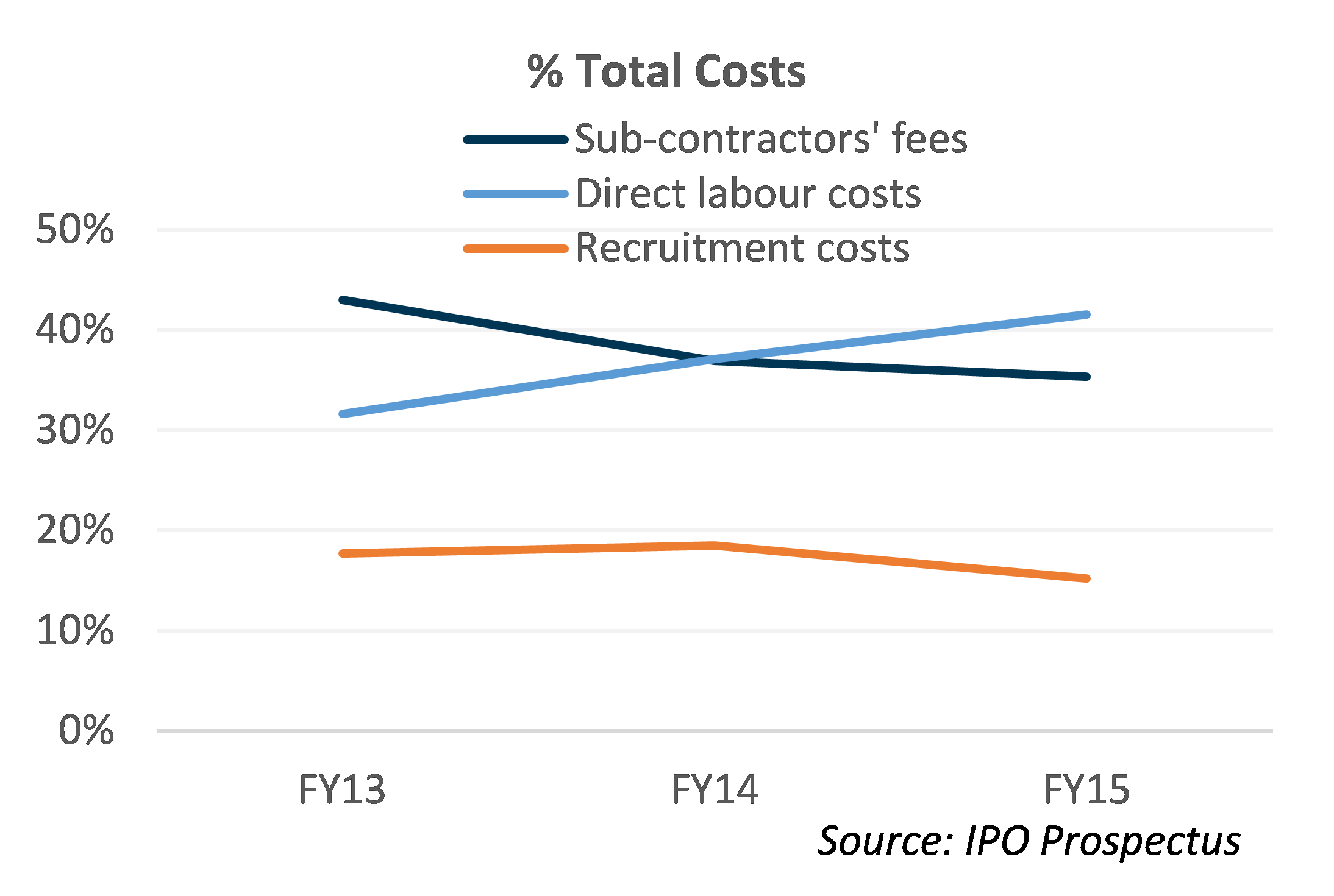

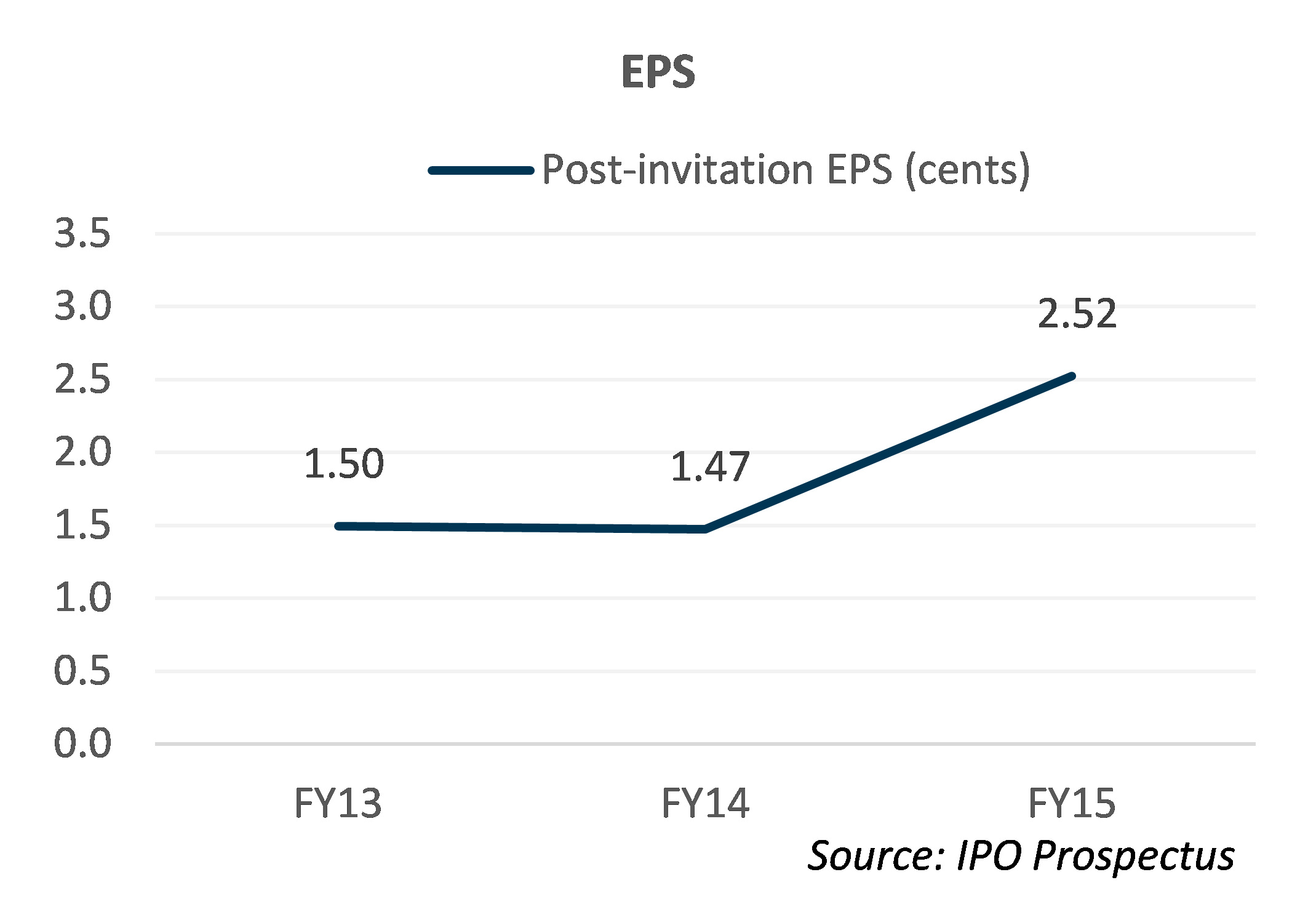

Financial Highlights

Good Track Record

Corporate Milestones

Awards and Accreditations evidencing quality solutions and services

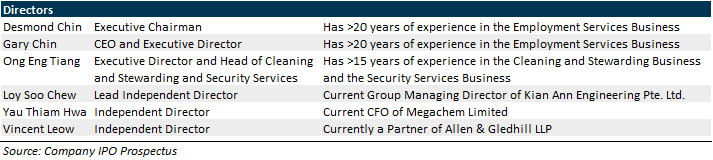

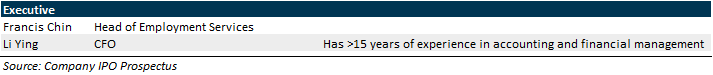

Strong and dedicated management team and employees

Household brand, supporting its recurring income

Sole Singapore Player as a one-stop solutions and services provider

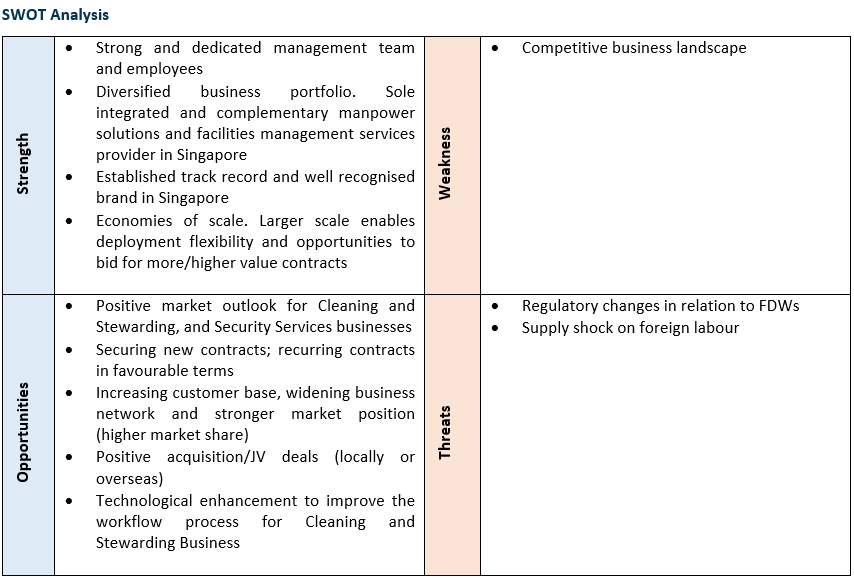

The Group’s unique multidisciplinary business model and structure has no direct competitors. However, it believes that its main competitors for each of its business segments, are:

Source: IPO Prospectus

Prospects and Opportunities

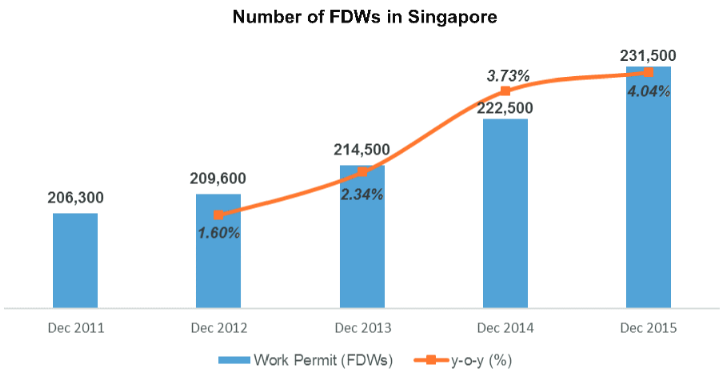

Increasing demand for FDWs – underpins growth in Employment Services Business

a) Ageing Singapore population increases the need for FDWs to provide caregiving support to families with elderly persons and children. The number of elderly persons aged 65 years and above is estimated to increase from 340,000 in 2011 to 900,000 in 2030. Families with children will increasingly rely on FDWs to assist with caregiving duties so that both parents can remain in the workforce.

The numbers of FDWs living in Singapore has been increasing steadily over the past five years. Demand for FDWs is estimated to increase from 231,500 in December to about 300,000 by 2030.

b) Favourable government policies e.g. concessions in relation to FDW levies for Singapore families caring for an elderly person or children below the age of 16, and potential increase in the source countries which FDWs can be recruited, could benefit the Employment Services Business by increasing both demand and supply.

Facilities Management Businesses to see a boost from the increased supply of Singapore’s residential and commercial property market

As at 31 March 2016, the URA sees the pipeline supply of

a) a total of c. 2,314k sqft of retail space to be completed for the remainder of 2016;

b) a total of c.27,996 units (including executive condominiums and private residential units) to be completed in the 2016.

Increase in supply in the property sector will raise the demand for all kinds of facilities services.

M&A opportunities amid consolidation of players in the facilities management market

Implementation of new licensing system by the National Environmental Agency and the progressive wage introduced by the Police Licensing and Regulatory Department would raise the bar for new entrants and existing market players. These also pose opportunities for the Group to expand by merging or acquiring smaller players that are squeezed out.

Management also shared that its economies of scale enables the Group to meet these rising expectations of service standards.

USE OF PROCEEDS

Management intends to expand into new complementary business that will create synergistic value with its Facilities Management Businesses, through organic and inorganic growth. These include venturing into services it has yet to be able to offer as well as expanding the size of its team of cleaners and security officers. Hence, management has earmarked bulk of its IPO proceeds for business operations expansion.

The Group also considers exploring opportunities to expand its Employment Services Business organically in Singapore or overseas.

Brand awareness is crucial for the Group in gaining market share for its Employment Services Business. Management intends to increase “NATION”’s branding and marketing activities through a wide range of media platforms, engaging celebrities to act as spokespersons, as well as refurbishing its existing sales branches.

SHAREHOLDING STRUCTURE

The Chin Brothers (Mr Desmond Chin, Mr Gary Chin and Mr Francis Chin), and Mr Ong Eng Tiang) will collectively own 71.56% (from 100%) of enlarged share capital after IPO, and Mr Teo Sau Keong, will hold an aggregate of 3.61% of enlarged share capital after IPO. In demonstration of their commitment to the Group, they have agreed to a lock up period of 6 months for 100% of their interests and a further 6 months thereafter, for 50% of their interests, from the date of listing.

The other 24.83% consists of 10.68mn new shares which will be offered at S$0.22 each (7.68mn placement shares and 3mn public offer).

KEY RISKS

Key personnel risks. The Group depends on the contributions of its Directors and Senior Management, in particular, the Chin Brothers and Mr Ong Eng Tiang, who have been instrumental in spearheading the Group’s growth, corporate development and overall business strategies.

Requirement to obtain licenses, permits, approvals and/or certifications to ensure the continuity of its business and operations. Most of its licences, permits, approvals and/or certifications are renewable on a periodic basis. Renewal under unfavourable terms and conditions or failure to renew could results in failure or delays in providing solutions and services to its customers, hence adversely affecting the Group’s prospects, reputations and financial performance.

Changes to the existing rules and regulations could increase the risk of not able to obtain or renew its licences, permits, approvals and/or certifications. It may also require the Group to obtain additional licences, permits, approvals and/or certifications to continue its operations. Additional expenses may adversely impact its financial performance.

Supply of foreign labour affected by (i) both local or foreign laws, regulations and policies; and (ii) reliance on its sub-contractors. Subjected to these requirements, the Group may not be able to obtain sufficient supply of foreign labour to meet its business demand.

What do we think?

Established player in the field of integrated manpower solutions and services with favourable prospects. Its diversified portfolio and extensive scale enable it to offer clients complementary services at a better rate. Its quality service helps to build long-standing relationships with its customers which could translate into recurring incomes. The Group could leverage on its track record and strong brand recognition, to ride on the favourable trends in providing Employment Service Business and Facilities Management Businesses.

Ability to pass on costs to customers, thus sustainable margins despite higher manpower costs. Management shared that the contracts are renewed in staggered terms, where there would be 4%-6% upward adjustments in total contract value. This would help to cushion the inflationary pressure due to manpower crunch and regulatory changes on minimum wage.

Prudent management on acquisition deals. The Group has various acquisitions experience where the acquired companies have bode well with the Group’s business model and has been performing since acquisition. Management shared that historically, its acquisitions were internally funded by cash and were made in staggered payments with profit guarantee conditions. Therefore, these acquisition deals would not hit the Group’s cash flows as it is partially self-funded (i.e. profit from the acquisition target would be used to pay off the acquisition costs). Management noted that some of the assessment criteria for potential acquisition target are: accreditation and awards, terms of the company’s existing contracts, profitability of the company, and reputability.

IPO price at a discount to peers. With all three business segments are profitable and provide recurring income, stable margins, positive operating cash flows, and a high return on equity (FY15 ROE at 89%, pre-invitation), Advancer Global trades at a post-IPO historical P/E of 8.73x, lower than the industry average of 20.6x.

Decent dividend yield. No fixed dividend policy but the Group intends to declare and distribute dividends of at least 50.0% of PATMI for each FY2016, FY2017 and FY2018 to its shareholders. Taking the secured order book of S$43.1mn as at 2 June 2016 as a conservative gauge of FY16 top line, FY15 PATMI margin of 9.8% (which the management guided that it should be sustainable), and 50% payout ratio, this implies a dividend yield of 5.5% at the offering price of S$0.22.

Investment Actions

Application for IPO shares closes at Thursday 7 July and trading commences 11 July 9am.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Lin Sin has been an investment analyst in Phillip Securities Research since June 2014, where she started as an economist, focusing on China and ASEAN macroeconomics. Currently, she covers primarily the Consumers and Healthcare sectors in Singapore equities market.

She graduated with a Bachelor of Science in Mathematics and Economics from NTU.