Capitaland’s upside from November has come to a halt and the stock is likely to make another 3-wave downside. First, prices today has broken below the support of the descending triangle. Ichimoku has shown “3 bearish death cross” signal. However, $2.95-$3.10 support zone is worthy to take a look and notice. Otherwise, support zone 2 is worthy to take a look at as well.

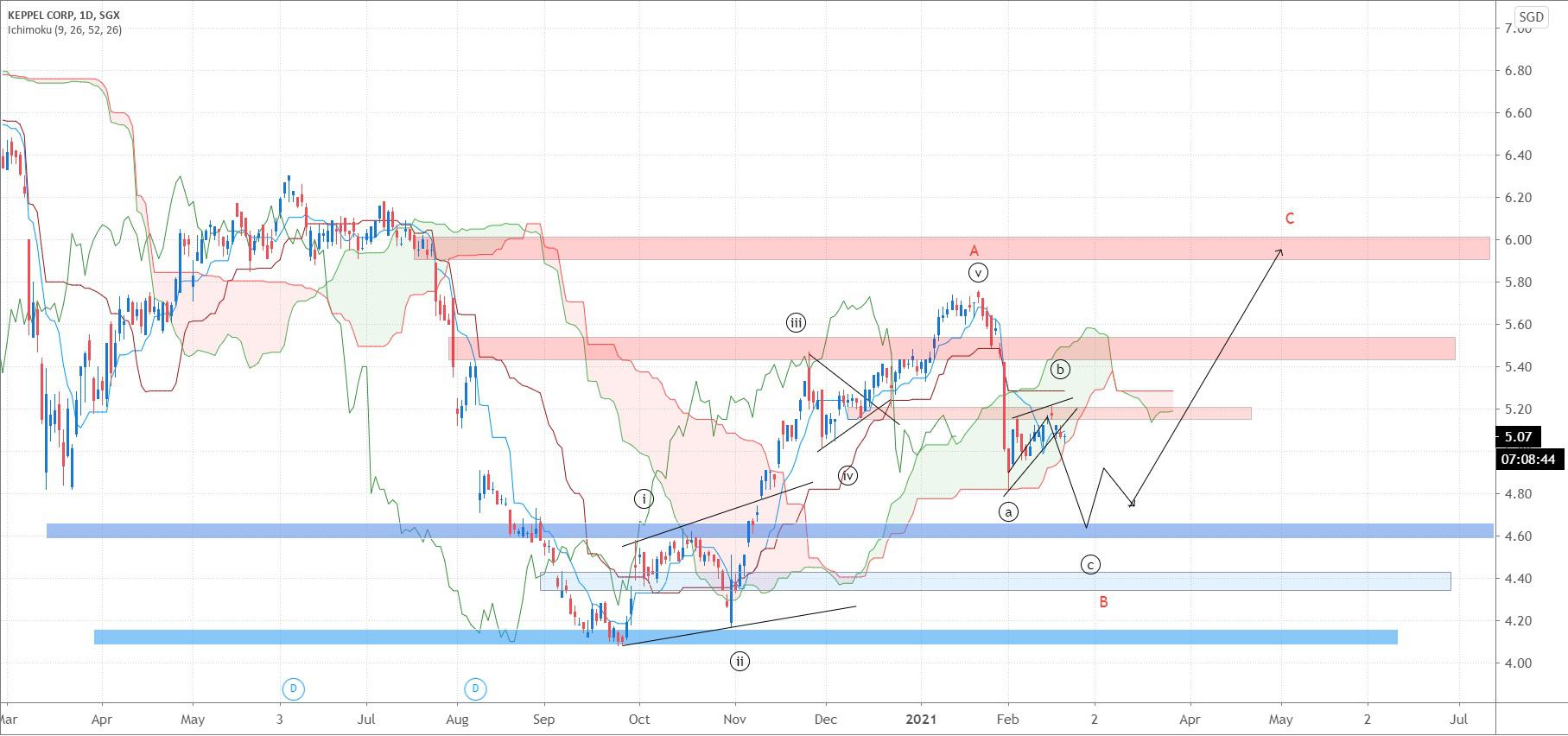

Keppel Corp has broken out of the sub-corrective rising wedge and we expect prices to continue to slide further into $4.60 support region. Overall, the corrective ABC wave structure has yet to complete and should $4.60 holds, prices are expected to rally to $6.14.

Potential head and shoulder are coming close to confirmation after prices fail to close above key resistance at $26.00. As DBS has just completed the double zig-zag formation within the larger ascending channel resemble the flag, we are more caution for now. Next support target to observe is at $23.56-$23.00.

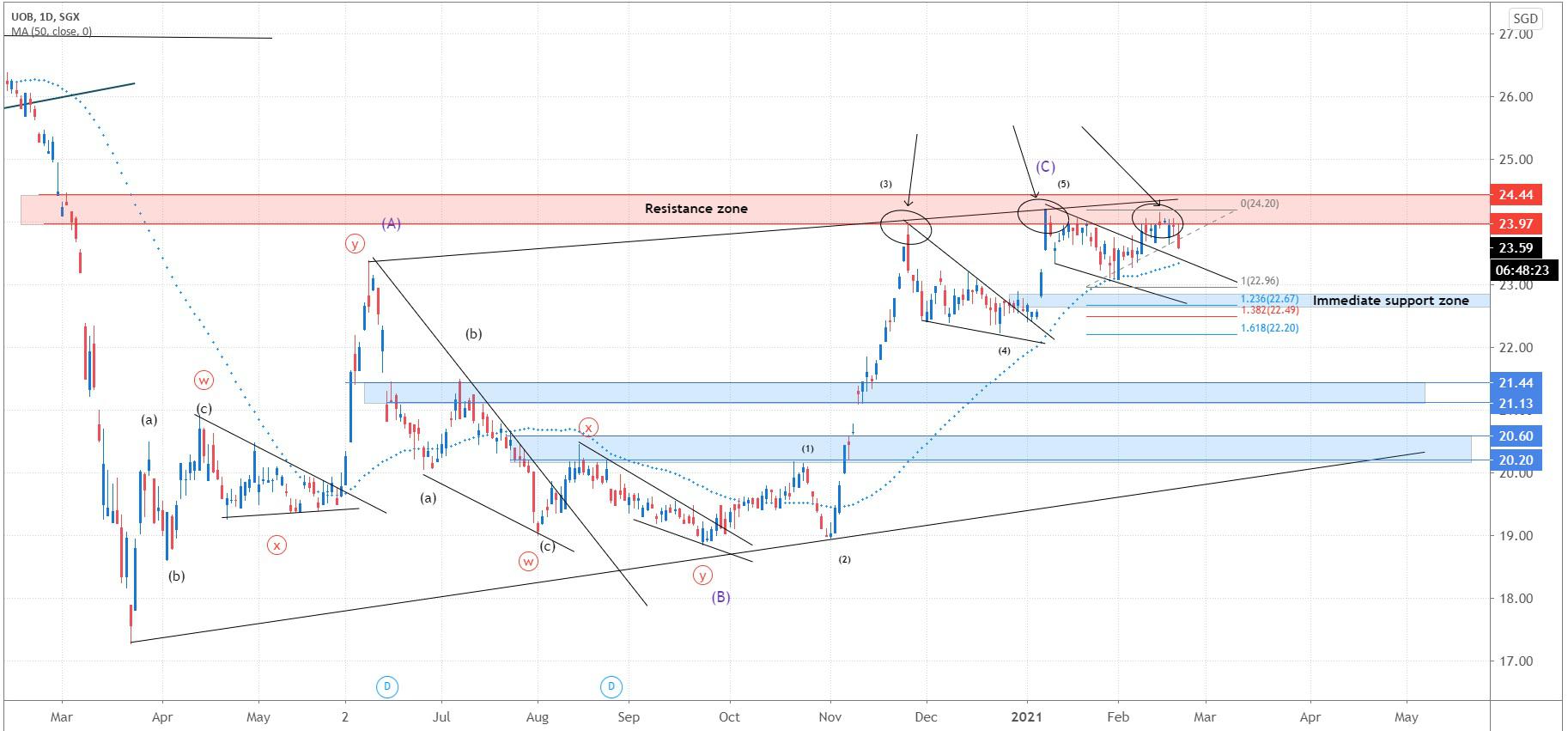

Like DBS, UOB is facing tough resistance at $23.97-$24.44. expect further sliding to 22.67 minimum.

As for OCBC, it has similar attributes and structure as both DBS and UOB.

Capland seems like supported at 308

Hi Wei Ren, SPH broke 200EMA, seems like this is a good sign for this sleeping beauty?

You must be logged in to reply to this topic.

About :

李浩然先生(Eric Li) 高級分析師 現任現為輝立証券持牌高級分析師,曾任職股票基金、家族辦公室及證券公司等,擁有多年的證券研究部門從業及投資經驗,並先後於香港最暢銷的財經媒體撰寫投資專欄。畢業於香港理工大學電子計算系。 Eric is currently a licensed research analyst at Phillip Securities. Prior to joining Phillip Securities, he has years of equity research and investment experiences in asset management company, family office and securities company. Meanwhile, he has written investment columns in Hong Kong`s best-selling financial media for years. He holds Bachelor of Arts in Computing from The Hong Kong Polytechnic University.About :

陳翹昕小姐 (Chloe Chan) 分析師 陳翹昕小姐持有英國雷丁大學金融與投資銀行一級榮譽學士學位,現為輝立証券持牌分析師,主要負責新股及消費行業研究。 Chloe Chan holds a First-Class Honours degree in Finance and Investment Banking from the University of Reading. She is currently a licensed research analyst at Phillip Securities specializing in IPO and the consumer industry.About :

Darren has over three years of experience on the buy-side as a fund manager. During his time as fund manager, he has managed multiple funds and mandates including dividend income, growth, customised, Singapore focused and regionally focused funds. He graduated from the University of London with a First-Class Honours degree in Banking and Finance.About :

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.About :

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.About :

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.About :

香港恒生大學金融分析一級榮譽畢業,具有股票研究、技術分析和投資經驗。現為輝立証券持牌分析師,主要負責遊戲?娛樂?食品等板塊研究。 Elvis holds a BBA degree with first class honor major in Financial Analysis at the Hang Seng University of Hong Kong. He has experience in equity research, technical analysis and investment experience. He is currently a licensed research analyst at Phillip Securities and mainly covers Gaming, Entertainment and Food sectors.About :

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.About :

I analyze the stock market and conduct technical analysis to provide investment recommendations. I look forward to having a conversation with you in our in-house seminars and presentations to identify good risk-reward trading strategies together. I graduated from Nanyang Technological University with a Bachelor of Accountancy (Honours).Login here if you are our existing user.

SIGN UP FOR FREE NOWNot a Premium Content Subscriber yet? Sign up here!