Tagged: investing, phillip, phillipcapital, research

Replying to #

Question:

Could you provide some reports on good dividend Stocks, REITS or ETF to advise my client to buy. Kindly advise. Thanks.

Answer:

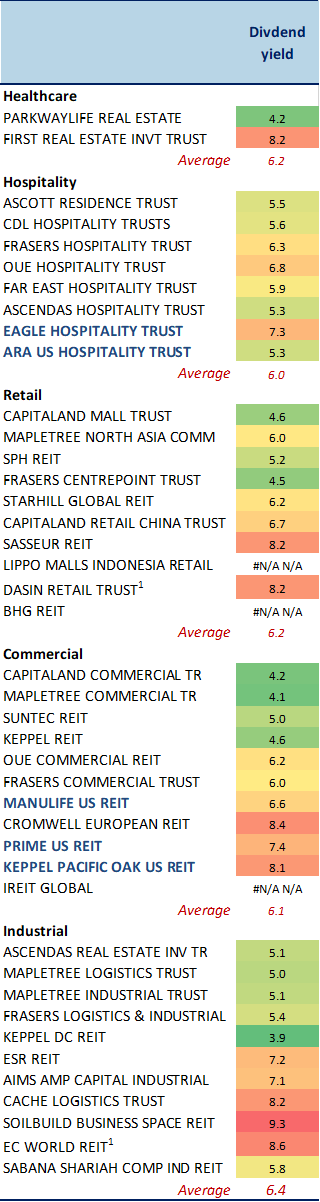

We believe the US REITs listed on SGX offer the most attractive yields.

Overseas REITS generally have higher yields.

The higher yields are to compensate for the risk local investors require when investing in REITs with overseas assets, where the investor may be less familiar with the market as compare to the local market.

China REITs such as Sasseur (8.1%), Dasin (8.2% – Accumulate), CRCT (6.6% – Accumulate) and EC World (8.6% – Buy) still have relatively high DPU yields, however the RMB has taken a beating due to the unresolved trade situation.

We feel particularly positive about the US Office REITs, Manulife (6.6%), Keppel Pacific Oak US REIT (8.1%) and Prime US REIT (7.4%), the US economic outlook is relatively positive, in comparison to other markets and the stronger USD works in favour of these REITs.

However, we do not have coverage on any US REITs at the moment.

Below is the Bloomberg consensus estimate of the dividend yield for SREITs.

Source: Bloomberg

Replying to #

What are the potential in Lendlease Global reit unit trust?

At 95 cents per unit,what are the potential from here?

Over Value ?

You must be logged in to reply to this topic.

About :

李浩然先生(Eric Li) 高級分析師 現任現為輝立証券持牌高級分析師,曾任職股票基金、家族辦公室及證券公司等,擁有多年的證券研究部門從業及投資經驗,並先後於香港最暢銷的財經媒體撰寫投資專欄。畢業於香港理工大學電子計算系。 Eric is currently a licensed research analyst at Phillip Securities. Prior to joining Phillip Securities, he has years of equity research and investment experiences in asset management company, family office and securities company. Meanwhile, he has written investment columns in Hong Kong`s best-selling financial media for years. He holds Bachelor of Arts in Computing from The Hong Kong Polytechnic University.About :

She graduated from the University of New South Wales with a bachelor's degree in accounting and finance and from the University of Hong Kong with a master's degree in finance. He is currently a licensed analyst at Phillip Securities, mainly responsible for research in the TMT and semiconductor sectors, and has worked in securities companies and family offices.About :

陳翹昕小姐 (Chloe Chan) 分析師 陳翹昕小姐持有英國雷丁大學金融與投資銀行一級榮譽學士學位,現為輝立証券持牌分析師,主要負責新股及消費行業研究。 Chloe Chan holds a First-Class Honours degree in Finance and Investment Banking from the University of Reading. She is currently a licensed research analyst at Phillip Securities specializing in IPO and the consumer industry.About :

Darren has over three years of experience on the buy-side as a fund manager. During his time as fund manager, he has managed multiple funds and mandates including dividend income, growth, customised, Singapore focused and regionally focused funds. He graduated from the University of London with a First-Class Honours degree in Banking and Finance.About :

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.About :

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.About :

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.About :

香港恒生大學金融分析一級榮譽畢業,具有股票研究、技術分析和投資經驗。現為輝立証券持牌分析師,主要負責遊戲?娛樂?食品等板塊研究。 Elvis holds a BBA degree with first class honor major in Financial Analysis at the Hang Seng University of Hong Kong. He has experience in equity research, technical analysis and investment experience. He is currently a licensed research analyst at Phillip Securities and mainly covers Gaming, Entertainment and Food sectors.About :

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.About :

Passionate in looking for new ways to use data to tell a story, I enjoy chatting about economics and connecting complex financial data to real-world outcomes. I look forward to conducting quality fundamental research and exchanging insights with you during our in-house seminars and presentations. I graduated from the National University of Singapore with a Bachelor of Engineering (Industrial and Systems Engineering), Honours.About :

I analyze the stock market and conduct technical analysis to provide investment recommendations. I look forward to having a conversation with you in our in-house seminars and presentations to identify good risk-reward trading strategies together. I graduated from Nanyang Technological University with a Bachelor of Accountancy (Honours).Login here if you are our existing user.

SIGN UP FOR FREE NOWNot a Premium Content Subscriber yet? Sign up here!