On track to clear off remaining units at Commonwealth Towers and The Venue Residences before ABSD deadline

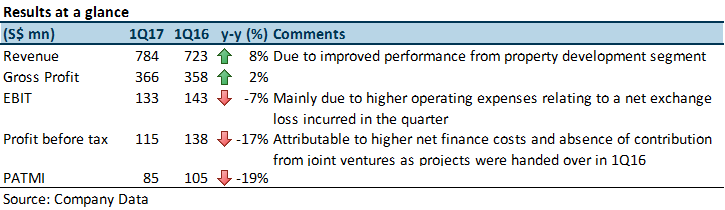

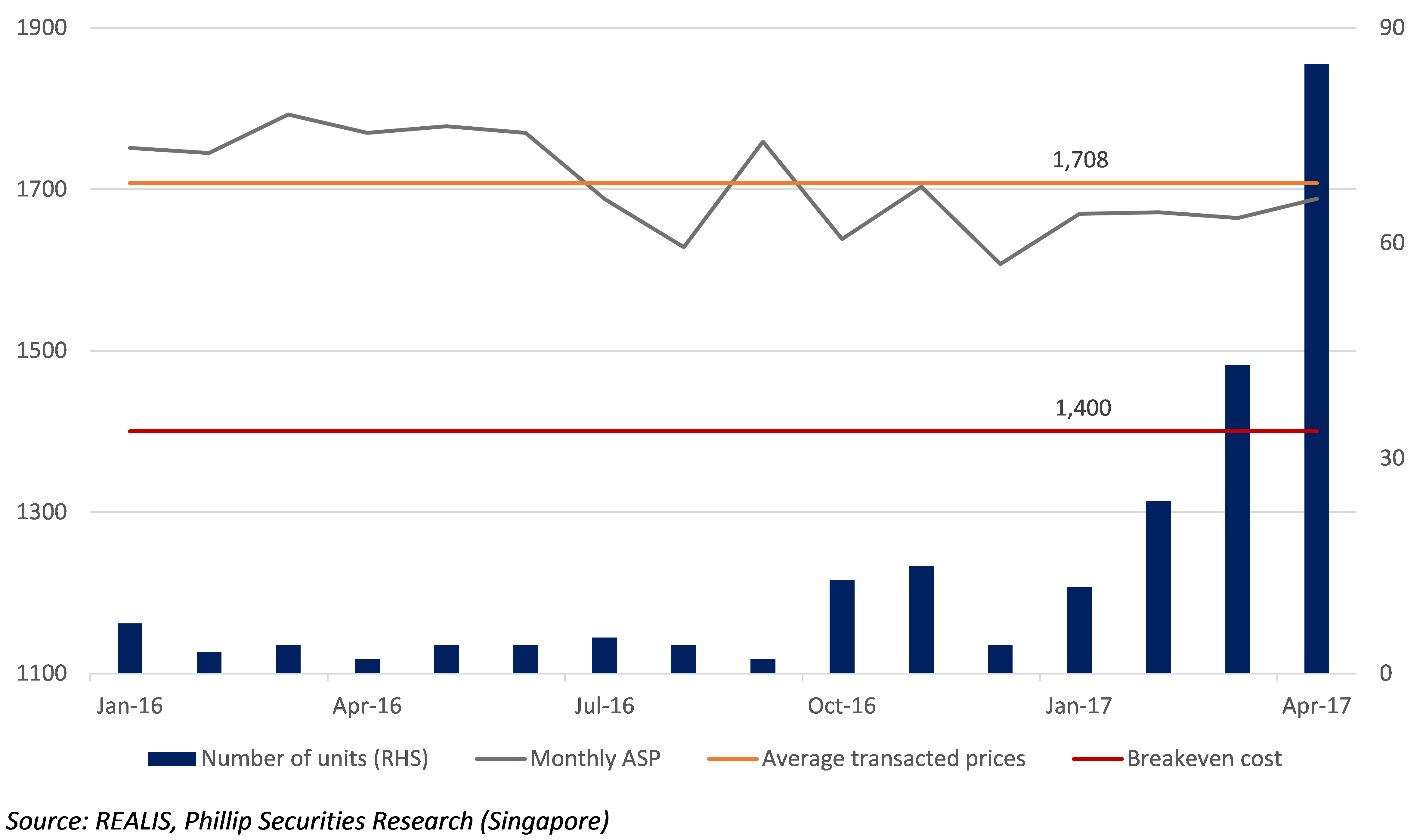

CDL sold a total of 131 units in Commonwealth Towers and The Venue Residences in 1Q17, bringing the sales status of the two developments (8% of our RNAV estimates) to be 64% and 88% sold respectively. We noted that there was a pickup in transactions since the start of 2017 amid improving sentiments, and are of the view that the Group will be able to clear the remaining units in the developments before the ABSD deadline which are September 2017 and April 2018 for The Venue Residences and Commonwealth Towers respectively. We have initially expected an ASP reduction in Commonwealth Towers towards S$1,500 PSF in order to move units in the development, but instead saw that ASP maintained at S$1,600 region and is moving upwards into S$1,700. The Group continues to cut prices in The Venue Residences in a bid to accelerate sales volume but was within our expectations. We expect further price cuts towards the S$1,300 PSF region for The Venue Residences as the development is near its tail-end.

Strong take up rate at Gramercy Park suggests recovery in CCR market segment

CDL sold a total of 90 units in the 174-unit high end freehold condominium development, Gramercy Park (5% of our RNAV estimates), as at 1Q17. In March 2017, the Group has soft launched and sold 16 out of 20 units in the second tower where ASP has increased to S$2,800 PSF from S$2,600 PSF. The strong take up rate in Gramercy Park and ASP gains suggest that prices could be a prelude that prices have more or less bottomed out in the CCR segment, providing an opportunity for the Group to launch two new developments, New Futura and South Beach Residences. Additionally, with more than 66% of its Singapore development projects’ RNAV located in the CCR market segment, we expect CDL to benefit significantly as the CCR segment recovers.

Investment Action

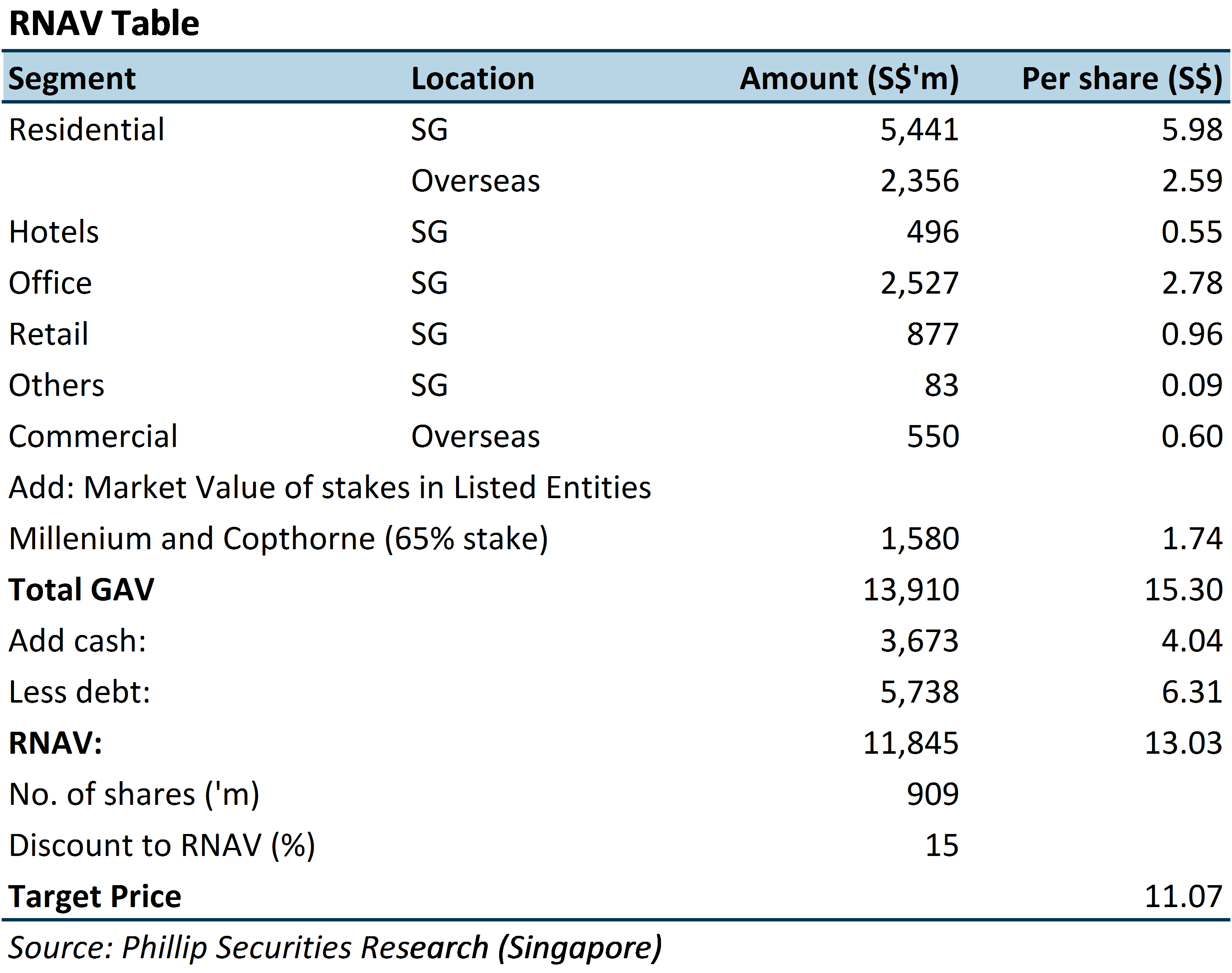

We remain optimistic that a recovery in the CCR market segment is in sight which CDL will be a beneficiary of given its large exposure in the market segment. Consequently, we have reduced our discount to CDL’s RNAV estimates to 15% (20% previously). We maintain our ‘Accumulate’ rating with an upgraded TP of S$11.07 based on our FY17 RNAV estimates.

Lack of new launches in CCR will benefit New Futura’s Launch

There are two development projects in the Core Central Region (CCR) market segment that are slated to be launched in 2H17. We view that the lack of new launches in the CCR market segment in 2017 will bode well for CDL, as the Group intends to launch New Futura, a 124-unit freehold development project, in District Ten this year. Given the scarcity of freehold new launches in the CCR segment, we are expecting ASP in New Futura to be in the range of S$2,600 PSF – S$2,800 PSF, which will potentially add S$0.10 – S$0.11 to our RNAV estimates when completely sold. The other development is a 450-unit project located on Martin Road which is expected to be launched in 2H17.

Recent residential land site tender at Tampines Avenue 10

CDL submitted a winning bid of S$370.1 million for a land plot located in Tampines Avenue 10 with a maximum GFA of 60,810 sqm, translating into a land price of S$565 PSF PPR. The site is expected to be developed into a 15-storey residential project with 800 units and a child care centre. We estimate that the breakeven cost for the project to be S$940 PSF and expect ASP to be S$1,100, adding S$0.10 to our RNAV estimates when completely sold. We expect take up to be at least decently strong considering that the remaining units in The Santorini and The Alps Residences are likely to be substantially sold by the time CDL’s units are ready to be rolled out for sale sometime in 2018.

Figure 1: Volume and price transactions at Commonwealth Towers ($’psf)

Figure 2: Volume and price transactions at The Venue Residences ($’psf)

Overseas Residential – Positive on China long term, cautious on UK pending General Elections

Revenue continued to be boosted by progressive handover of units in Phase 1 of Suzhou Hong Leong City Center (HLCC). To-date, 1062 units (or 77% of total 1374) of Phase 1 have been sold vs 1038 as at end FY16. Total sales value of Phase 1 units sold thus far amount to RMB 2.27bn.

Despite multiple rounds of cooling measures, developers in Shanghai and Chongqing (where CDL is present in) continue to show sustained appetite for land acquisition, with 1Q17 land purchases up 98% and 16% y-o-y respectively. (Source: CEIC). CDL continues to hold a positive long term view of the property market and growth opportunities in China and we think developers’ shared optimism on the saleability of projects going forward judging from the increased land purchases bode well for CDL’s China projects.

In the UK, the Group has delayed the launch for some of its ready-to-market projects until after the General Election after which the Group opines the outlook for the London residential market will be clearer.

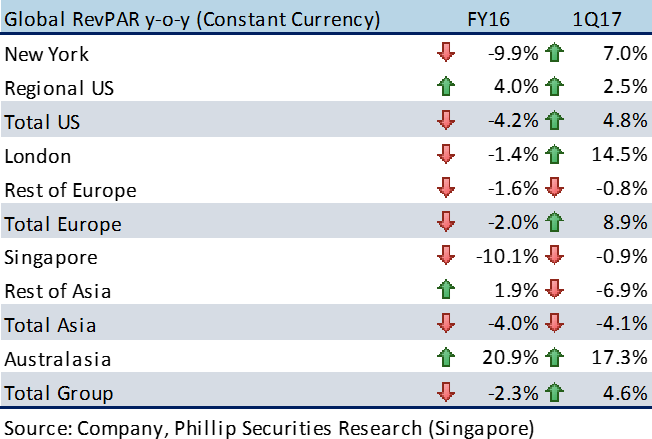

Hospitality Business – One-off foreign exchange loss dragged on performance

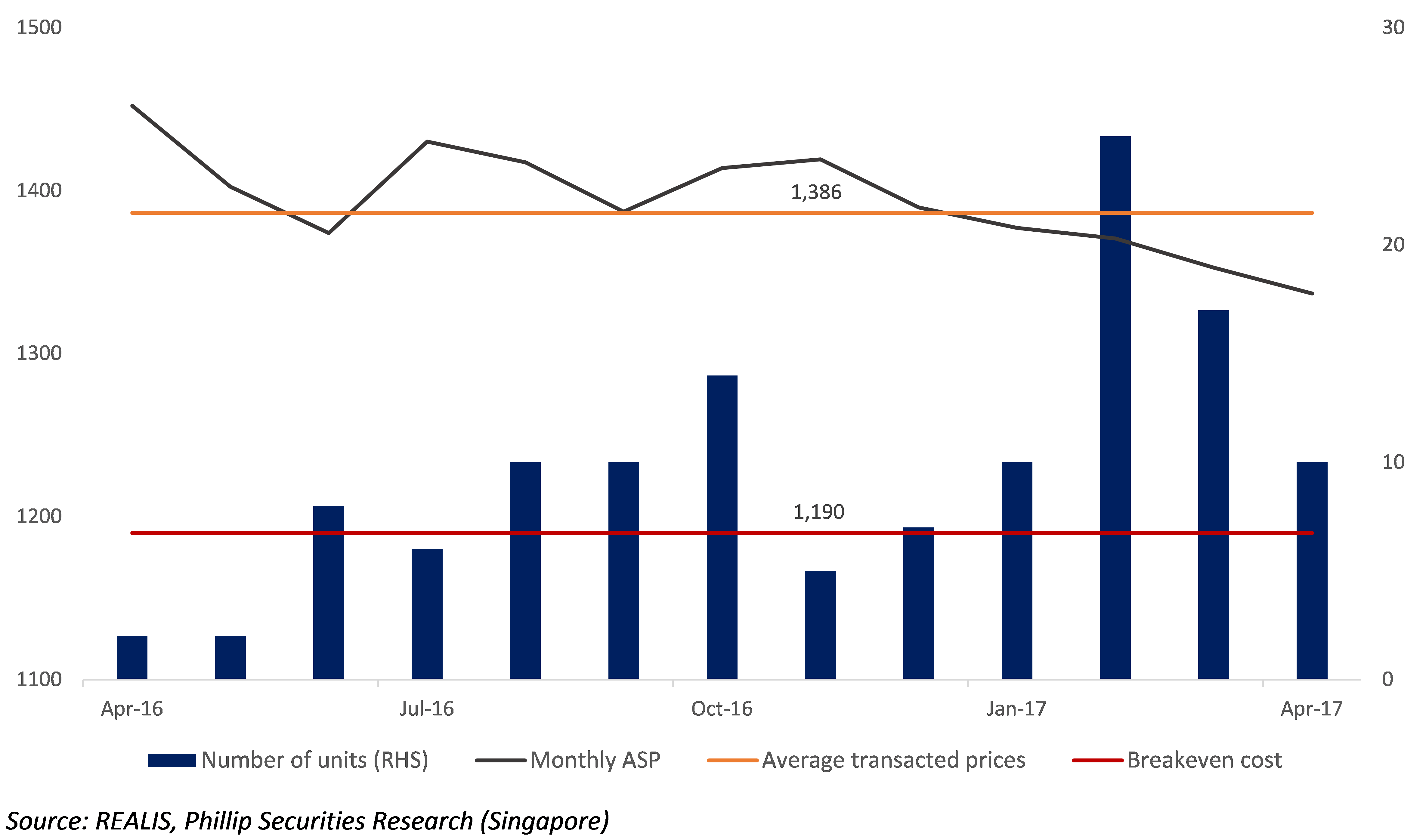

The Group’s 65% owned Millennium and Copthorne (M&C) recorded a 50% drop in PATMI to £3mn in 1Q17. This was primarily due to a S$6.5mn exchange loss at M&C’s REIT associate CDLHT, without which M&C Group pre-tax profit for the period would have dropped 5.6% to £17mn. Global RevPAR however, showed an encouraging increase of 4.6% y-o-y (vs down 2.3% in FY16) driven by increases in US, Europe and Australasia on a constant currency basis. RevPAR weakness was persistent in Asia, this time led by Taipei and Seoul with the lower number of Chinese tourists.

We expect the Singapore weakness to persist due to the anticipated 6.1% increase in hotel supply in 2017 (mostly in upscale/luxury sector), notwithstanding improved corporate demand that we anticipate in 2H17. We however expect weakness in the Seoul and Taipei markets (which was due to political tensions between China and the two countries) to be passing and Asia RevPAR to improve in 2H17. Overall, we expect global RevPARs to continue to show improvements as improved global sentiment and economic conditions continue to boost tourism.

Figure 3: Global RevPARs showing improvement (with exception of Asia)

Valuations

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: