Executive Summary

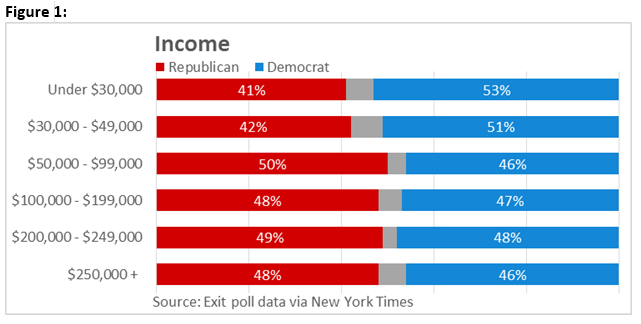

How did Trump win the Presidential Election 2016? Going into the 8 November election, Donald Trump was losing by a huge margin against his main political adversary, Hillary Clinton, in the poll. As the presidential election of the world’s largest economy took place, the world held its breath as the results of the election drew to a close when Donald Trump won the Wisconsin state, bringing him pass the 270 electoral vote required to win the election. Why did some people called this a “freak” results and why is there such an upheaval of emotions around the world and more importantly in the United States of America. This was not an unforeseen major upset which you were led to believe by the mainstream media in US. Majority US media outlets have duped us into believing that Trump’s Campaign is based on hatred for immigrants, racial superiority and plain vanilla disregards to a civilised society. This is all undeniable. However his most important agenda, one which he spent most of his time discussing during his campaign, was conveniently disregarded by the media. His view on international trade was most probably the deciding factor for his victory. No, we are not talking about the “Mexico Wall” that he promised to build. We are talking about the North American Free Trade Agreement (NAFTA) and the Trans-Pacific Partnership (TPP). One thing we know about Trump is that he is not for free-trade. So how did his anti- free-trade view won him the election? By restricting good and services across its borders, it essentially force companies to bring their factories back into the US. This will have a direct impact on jobs creation for the blue-collar workers, and this is also where we see the strongest support for Trump. Grouped by income, his strongest support are the middle income working class Americans. |

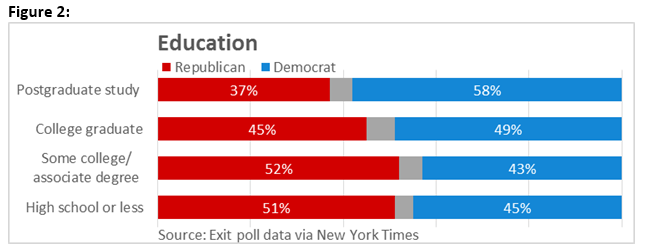

| These are the Americans with a lower education level as well. Thus it is not surprising that Trump won most of the vote of the middle income blue collar Americans. The deciding Wisconsin state which voted for Trump is a state populated with such blue collars American workers. |

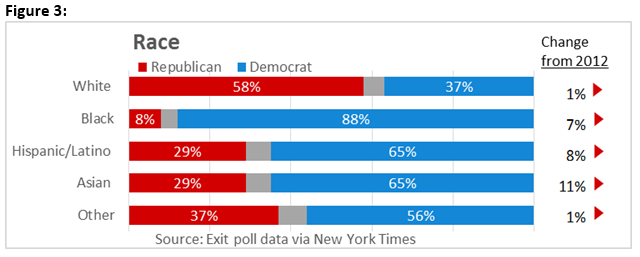

| At certain point of his campaign, many of us were pretty confident that Donald Trump will not get any of the Hispanic or Latino vote due to his perceived racist remarks. For all the attention on him being a racist, the exit polls also showed a different side of the story. Although his supporters from non-white race still lack behind Hillary, he still managed to improve from his Republican predecessor, Mitt Romney. This might also be due to the “Obama-effect” as his renouncement from presidency will impact the support for Democrat from the minority race. |

| This Exit poll by race proved to be pivotal in explaining how Trump was able to win the swing-state of Florida which is traditional populated by Hispanic and Latino. With 29 electoral vote up for grabs, Florida was an important state that both candidates needed to win. Nonetheless, race was less of the deciding factor as people of Florida were more concerned on the economy and voted for a change.

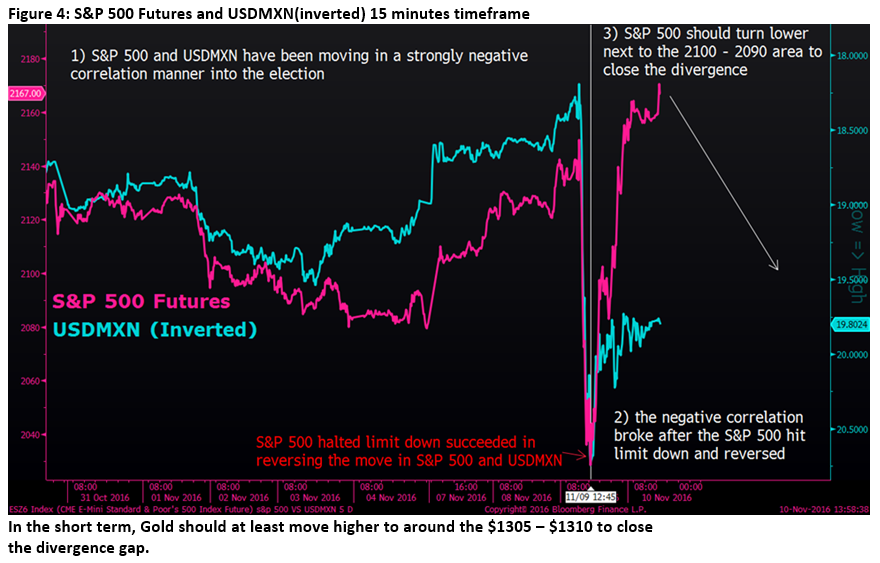

Where will the market head? With the election done and dusted, we shift our focus back to the economy and the financial markets. What does a Trump presidency mean to the market? If we are to take cue from the trading actions in the US equity markets on 9 November (a day after the election), it is signaling that the election was a non-event. Contrary to the dooms day scenario many believed, S&P 500 and NASDAQ were up 1.11%, and Dow Jones Industrial Average was up 1.40%. |

On the longer term basis, things are too vague to call. Given that Donald Trump have a unified Republican Government (Republican wining both House and Senate) for his first 2 years, it will still be hard for him to get his proposal through. After all US is still the leading democratic nation and the US president is not a dictatorship. Having a unified government is one thing, getting his fellow Republicans to support him is quite another. Taking into account the number of congressmen and politicians he has offended during his Republican primaries election, he will first need to make peace within his own party.

| Furthermore policies implementation usually take a long time to pass through and there are always a policy lag time before we see any effect in the economy. That being said, we do see discrepancy in certain market reactions and believe that there will be some volatility in the short run. |

| Post-election overreaction

If one was to look at the closing of the S&P 500 index alone on 9 November 2016, no one would have believed a major event had just occurred in the day where Donald Trump won the presidency race. Everything appeared fine as the S&P 500 index closed higher on the day with a 1.11% gain. However, looking deeper into the different assets that were affected by the election, there was a striking outlier. A Donald Trump presidency would translate into a risk-off environment where Gold should benefit, while Equity markets in general and Mexican Peso would suffer. That was the case initially when news of Trump having a higher probability of winning the election appeared. At one point, Gold was up 5% to a high of $1337, USDMXN was up 13% to a high of $20.77 while S&P 500 Futures was down 4.8% to a low of 2032 point. The correlation between the S&P 500 Futures and USDMXN has been strongly negative until the point where the S&P 500 Futures was halted limit down at the 5% level. The cause of the strong fall in the equity futures and USDMXN was the news of Donald Trump winning one of the early swing state, Florida. Once the dust settled with more certainty of a Trump victory, market rebounded immediately which gave rise to the clear divergence that has been showing up between the S&P 500 Futures and USDMXN. We believe that the rally in the equity market post-election was an overreaction shown by the large divergence between the S&P 500 Futures and USDMXN. |

A short term play on the S&P 500 Futures now would be to trade the closing of the divergence where S&P 500 Futures could fall back to the 2100 – 2090 area.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Sai Teng covers the global macro research. He has more than 6 years investment experience primarily in portfolio construction and asset allocation. He graduated with Bachelor of Science in Banking and Finance from University of London.