Investment Merits

New supply of CCR units will likely remain scarce moving forward underpinned by low land sales activity in CCR. We opine that the shrinking supply of CCR properties will eventually lift the segment’s price. Unsold units in CCR made up 40.7% of total unsold units under CDL’s portfolio of development properties, and CDL is well-positioned to benefit in the scenario of a market turnaround given its large exposure to CCR properties.

CDL has seven development projects which have more than 10% unsold units within the project. Apart from two projects, and assuming a gradual absorption of these unsold units based on transaction history, CDL remains in good stead to clear the inventory of unsold units. Given the Group’s strong balance sheet (net gearing of 20% after including fair value gains on investment properties), it is not pressed for time to clear these units.

Rental Properties segment contributed 21.3% of total profit before taxes (PBT). The segment has provided a certain degree of earnings visibility, and helped to insulate its performance during market slowdowns. Within the Group’s investment properties, office properties formed bulk of the portfolio’s value (72.6%). The Group’s portfolio of offices continues to enjoy healthy occupancy of 97.4% versus the national average of 90.9 % as at 2Q16 despite the softness in demand for office space.

M&C carries most of its hotels at cost, less depreciation and impairment charges on its books. Despite this, M&C currently trades at a deep discount of close to 0.56 times book value, below the 10 year historical mean of 0.7 times.

We believe that CDL will continue its momentum in asset monetisation via M&C, as we note previous monetization strategies by the Group which included the restructuring of Singapore assets by M&C via the initial public offering of CDL Hospitality Trust (CDLHT), as well as the listing of China-focused developer First Sponsor, which reduced CDL’s deemed stake in the company from 46.3% to 35.6% post listing.

Initiating coverage with “ACCUMULATE” rating and target price of S$9.98

We favour CDL for its exposure to CCR inventory and strong balance sheet, and we believe that the market has overly discounted the developer. This is on top of the fact that CDL holds its investment properties based on historical cost. With the successful launch of 3rd tranche of PPS, CDL does not face any impending Qualifying Certificate (QC) charges or claw back of Additional Buyer’s Stamp Duty (ABSD) remission until September 2017.

Company Background

City Development Limited (CDL) was founded in 1963. It started with a development and sales model before branching out into property investments and management. It completed its first residential property in 1965. In 1972, Hong Leong Group(HLG), under the guidance and leadership of founder, Kwek Hong Png, acquired a controlling interest in CDL and embarked on a strategic diversification into investment properties. HLG provided the company with much greater financial resources, and allowed CDL to expand its footprint through numerous acquisitions and development projects. These properties span across numerous subsectors with a focus on residential, office and hospitality. As at 2Q16, the development properties totaled S$5.4bn while its investment properties are valued at S$2.6 billion.

Singapore Property Development

Thinning supply of new CCR properties and low land sales activity in CCR expected to boost prices; CDL to benefit with large portfolio of CCR units

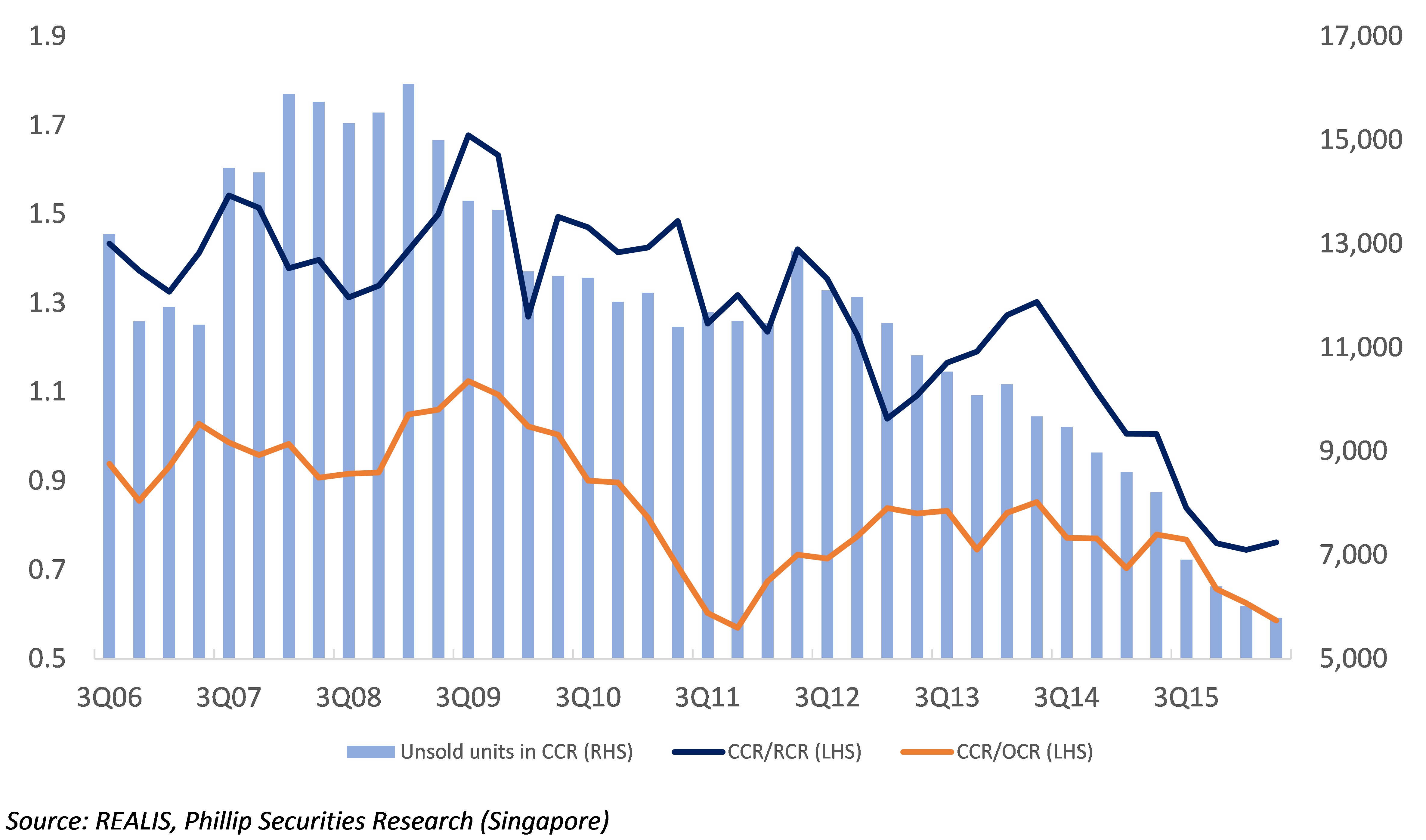

While the absorption rate of CCR properties has been modest for the past few years, we note that the number of unsold units based on the ratio of CCR-to-RCR and CCR-to-OCR units have been declining for the past 10 years, which suggests that the supply of new CCR units is thinning. New supply of CCR units will likely remain scarce moving forward underpinned by low land sales activity in CCR. That is, apart from a CCR land sale at Martin Road in July 2016 which would house an additional 450 units, the prior CCR land sale happened in November 2013, which means that there was close to a 3-year time gap when there were no land sales activities in CCR. We opine that the shrinking supply of CCR properties will eventually lift the segment’s price. Unsold units in CCR made up 40.7% of total unsold units under CDL’s portfolio of development properties. The Group is well-positioned to benefit in the scenario of a market turnaround given its large exposure to CCR properties (Refer to Figure 2).

Figure 1. Ratio of CCR properties to RCR and OCR and remaining unsold units in CCR

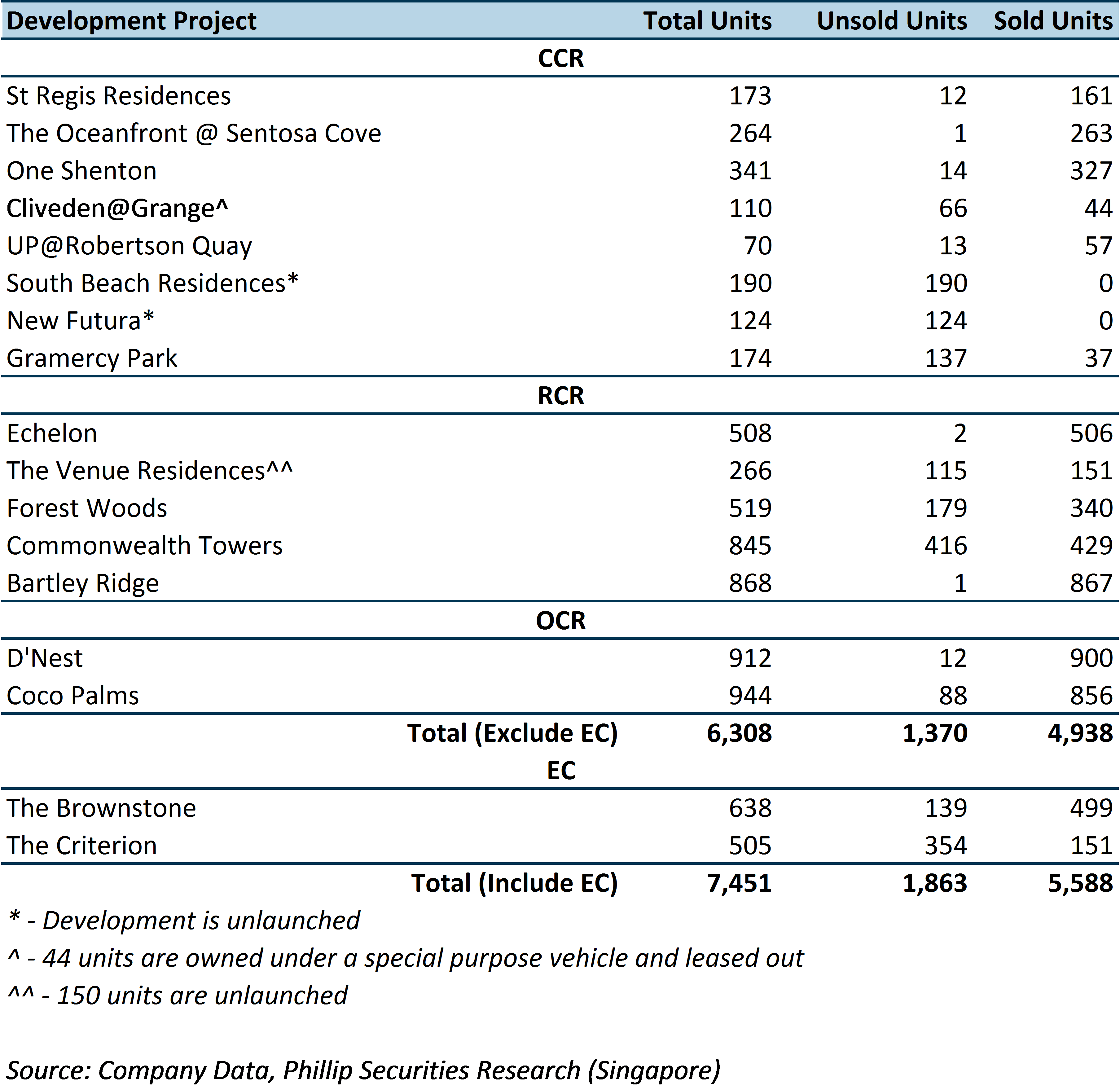

Figure 2. CDL’s portfolio of unsold units as at 2Q16

Near term price pressure expected on CDL’s portfolio of CCR properties, D9 and D10 in focus

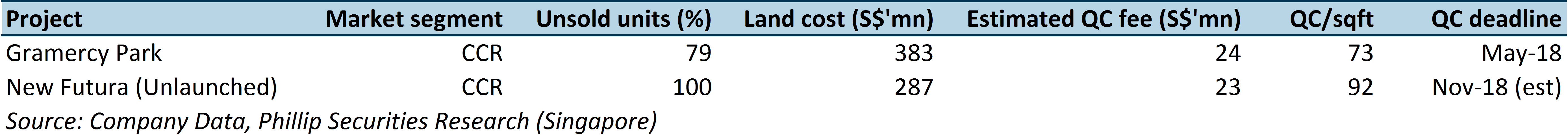

As developers race to clear existing inventory of unsold units in order to avoid the impending QC and claw back of ABSD, they have resorted to cutting average selling price (ASP) of developments. This was in particular to the prices of new developments in District 9, 10 and 11 where ASP fell an average of 20% since the last five years. We believe the higher quantum of these units as well as the ABSD cooling measure would have most likely led to weaker demand. The weakness the demand for CCR units was accentuated when Heeton Holdings resorted to selling iLiv@Grange, a 30-unit luxury condominium project in a bulk sale for a price which translated to S$1,623 per square feet (PSF). Heeton was unable to sell any of the units since its temporary occupancy status (TOP) was granted to the development in October 2013, which subsequently resulted in the Group incurring a QC extension charge amounting to S$5.8 million. We estimate the sale would lead the Group to recognise a loss of c.S$18 million or S$307 PSF. We view that the iLiv@Grange transaction along with the ongoing weak demand for CCR units are among factors that are likely to put near term price pressure on CDL’s projects in the vicinity such as Gramercy Park (22% sold), Cliveden@Grange (37% sold after accounting for units that were leased) and New Futura (yet to be launched).

Profit Participation Security (PPS) investment platform

CDL launched a unique Profit Participation Security (PPS) investment platform in December 2014, which allowed it to monetize its properties through injecting these assets into a partnership for a five-year period with an option to extend for another two. Such a move also allows CDL to avoid any upcoming Qualifying Certificate (QC) extension charges by structuring the PPS entity under Singapore citizens or Singapore-incorporated private companies fully owned by Singaporeans. Besides allowing CDL to recycle capital for possible land bank replenishment, the structure also allows CDL to tide through the current weakness in Singapore’s property market and sell the properties at a more opportune time when prices recover within the five-year duration of the investment vehicle.

3rd Tranche of PPS involving Nouvel 18 unlocks value for shareholders, avoided impending QC charges and grew fund management business

CDL has successfully launched the third tranche of PPS on 21 October 2016 which involved injecting Nouvel 18, a 174-unit luxury condominium development through a sale of the development for S$977.6 million (valuation: S$965.4 million) into the fund management. The proposed transaction will fetch a price of S$2,750 PSF, recognising a c.22% profit before tax margin for CDL which we believe is a fair price considering the current market conditions while matched with the transacted prices of nearby developments such as Ardmore Three (S$2,600 PSF) after factoring in discounts offered at the development). Secondly, the transaction also allowed the Group to avoid an impending QC extension charge of S$37.2 million. Including the latest PPS, CDL has launched three PPS’ between December 2014 and October 2016, the Group currently has c.S$3.5 billion of assets under management, and has met 70% of its S$5 billion target by 2018.

No need to perform fire-sale; Strong balance provides holding power to stash unsold units

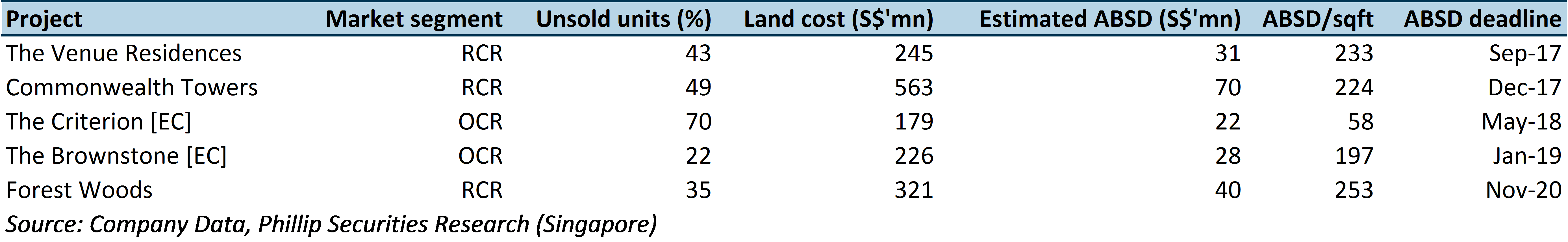

Under CDL’s portfolio of development projects with at least one unsold unit, there are eight out of 17 development projects that are not subjected to either QC conditions or the clawback of ABSD. Given the Group’s strong balance sheet (net gearing of 20% after including fair value gains on investment properties), it is not pressed for time to clear these units. Out of the remaining nine development projects that are subjected to either QC extension charges or the clawback of ABSD, there are seven development projects which have more than 10% unsold units within the project, and may potentially incur the aforementioned penalties. Apart from Commonwealth Towers and The Venue Residences, and assuming a gradual absorption rate for these unsold units based on transaction history, CDL remains in good stead to clear the inventory of unsold units.

Figure 3. CDL’s projects with >10% unsold units, impacted by upcoming QC extension charges

Figure 4. CDL’s projects with >10% unsold units, impacted by upcoming clawback of ABSD

Balance sheet staying strong; net gearing lower than industry average

CDL’s balance sheet as at 2Q16 stayed strong with S$3.3 million in cash with a net gearing of 26% which is significantly below its historical average of 40%. Although some of its peers enjoy greater access to funding, CDL prefers to lower its interest rate risk in a more traditional manner. Since 2009, management has actively lower its reliance on debt funding for its development/investment projects, thereby lowering net debt. On an adjusted basis (including the fair value gain of its investment properties), CDL’s net gearing of 20% is lower than the industry average of 26%. The large availability of cash pile and low gearing provides CDL a war chest to pick up value accretive investments when the opportunities surfaces. In line with the management guidance, they are highly selective and critical of opportunities that arise during weak market conditions.

To read further, please download the PDF file below.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: