Chance for Japanese companies even in the midst of US-China friction?

The “fourth round” of additional sanctions tariff (up to 25% tariff on about 300 billion USD worth of Chinese products) levied on China announced by the Trump administration on 13/5 has shaken the Japanese stock market badly. Unlike the first to third rounds launched last year, this round involves consumer goods which are highly-dependent upon imports from China and which covers 40% of total imports from that country. There are therefore concerns that these high tariffs will directly lead to rising import costs, thereby inducing price hikes in the US, as well as a slowing down of the global economy due to a decline in China’s growth rate. For the Japanese stock market during the 13-17/5 period, the Nikkei average consolidated at around 21,000 points, after falling from the 10/5 closing of 21,344 points, and reaching 20,750 points on 14/5. As stated in the “1st April, 2019 Investment Strategy Weekly Report”, the level of 21,000 points for the Nikkei average is an important turning point for the market in the medium to long term.

In the “fourth round”, mobile phones and laptops accounted for a huge percentage of the value of imports from China in 2018. However, “TV game consoles”, “umbrellas / walking sticks”, “PC monitors” and “toys” each has high dependency on China of more than 80%. As a result, US companies are expected to rush to secure alternative import sources. Japanese companies should have the ability to look out for business opportunities in the midst of such a conflict. In such a situation, it does not suffice to just simply wholesale Chinese products. Rather, companies should import raw materials and other materials from China, process and assemble them in Japan, and finally export as Japanese products.

On 14/5, Walt Disney announced that it had attained full management control of “Hulu”, a video distribution service provider. The company is also planning to launch “Disney Plus”, a new video distribution service, this December. With Disney having exclusive distribution of good contents such as “Disney”, “Marvel”, “Star Wars”, etc, Netflix, the leading video distribution provider, and Amazon and Apple etc, which have video distribution services, should become more vigilant and proactive in sourcing rights to good content. In such a situation, Japanese animation companies are likely to surface as potential candidates. Currently, Marvel’s movie, “Avengers: Endgame”, is a big hit. At the same time,

Comcast’s subsidiary, “NBCUniversal”, which has transferred Hulu’s shares to Walt Disney, is also making a hit with

“Pokémon Detective Pikachu” produced by its subsidiary, “Legendary Entertainment”.

While there are concerns about the global economy and financial markets as the US-China trade war intensifies, we also

should not forget that US companies could be keenly eyeing Japanese companies.

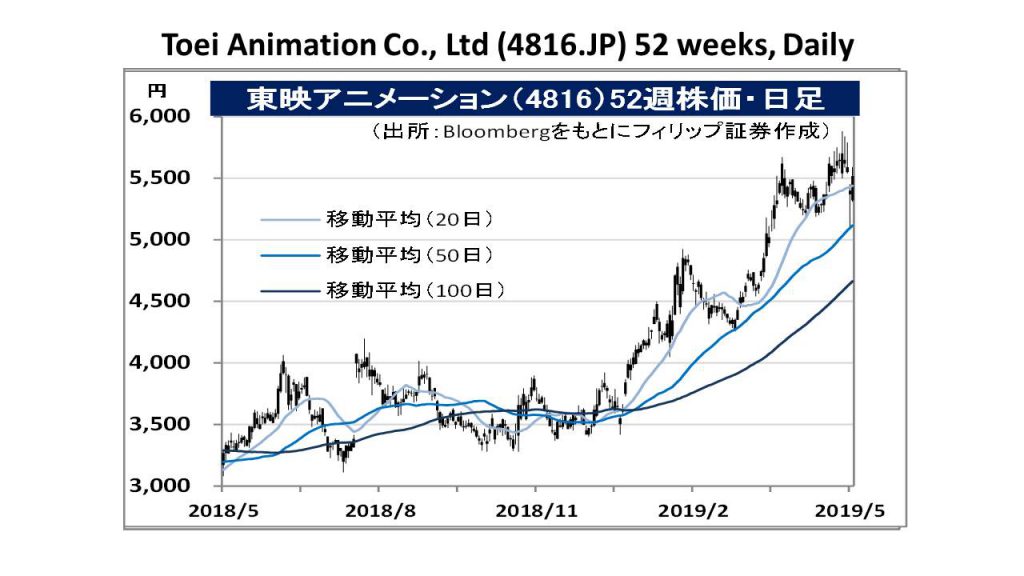

In the 20/5 issue, we will be covering Toei Animation (4816), Yokogawa Bridge Holdings (5911), Moonbat (8115),

Marui Group (8252), Sony Financial Holdings (8729) and Sumitomo Realty & Development (8830).

・Established in 1948. Comprises mainly video production and sales business involving planning, production, broadcast rights sales of various animation productions, licensing business that licenses animation characters and receives royalty, and product sales business of animation characters.

・For FY2019/3 results announced on 14/5, net sales increased by 21.1% to 55.701 billion yen compared to the same period the previous year, operating income increased by 39.6% to 15.741 billion yen, and current income increased by 44.9% to 11.375 billion yen. In terms of business segment profits, that for video production and sales business increased by 71.2%, licensing business increased by 25.5% and product sales business increased by 4.8% over the same period. Overseas video sales and licensing had been particularly good.

・For FY2020/3 plan, net sales is expected to decrease by 17.1% to 46.2 billion yen compared to the previous year, and operating income to decrease by 23.8% to 12.0 billion yen. In terms of company plan, production work for TV will be reduced, licensing revenue will also be reduced as a reaction to the major contracts for game machines of the previous year, and SG&A expenses for the medium-term will be increased. However, the global trend of expanding video distribution and game apps via smartphone diffusion will remain unchanged. We should also take note of the company being a model for animation production companies appearing in popular dramas currently being broadcast.

・Established in 1918. Besides the mainstay Bridge business, also comprises the Engineering-related business that designs and produces engineered structures and civil engineering works, the Advanced Technology business that manufactures precision equipment using CAD technology, etc, and the Real Estate business.

・For FY2019/3 results announced on 15/5, net sales increased by 8.3% to 141.924 billion yen compared to the same period the previous year, and operating income decreased by 23.5% to 10.509 billion yen. In terms of business segment operating income, that for the mainstay Bridge business fell 29.0% to 6.03 billion yen in response to a reduction in large-scale projects in the previous term. That for the Engineering-related business fell 1.1%, the Advanced Technology business fell 12.2% while the Real Estate business increased 16.7% over the same period.

・For FY2020/3 plan, net sales is expected to increase by 7.8% to 153.0 billion yen compared to the previous year, and operating income to increase by 6.6% to 11.2 billion yen. Expected future demands include large-scale renewal and repair of expressways, emergency measures for national resilience, and the western extension of the Osaka Bay Expressway. Supported by the Linear Chuo Shinkansen and large-scale civil engineering / building-related projects in metropolitan redevelopment areas, the record orders (153.24 billion yen) received at the end of FY2019/3 are expected to continue to grow strongly going forward.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: