In Miyuki Nakajima’s masterpiece “Jidai” (Times), she sang that “times go around”. That was a song meant to uplift those who have lose hope and will. Indeed, the current era has been shifting relentlessly. Drone and EV (electric vehicle) development are advancing, and with the advent of IoT, there are high expectations for the next generation 5G communication technology. Sharing-economy is advancing globally, and domestically, besides car-sharing, the younger generation is embracing simple lifestyles such as rental of high-quality clothes and branded handbags through monthly flat-rate payments. They cannot help but feel a generation gap with the generation brought up watching the commercial, “One day I shall own the Toyota Crown”, dreaming of owning a car, getting married and then owning a home, and which had sweated it out through steady savings and the expectation of lifetime employment.

According to a survey released by the Cabinet Office on 8/24, 74.7% of respondents say that they are “satisfied” (including “satisfactory”) with their current lives, the highest rate since the survey began in 1963. This has increased significantly from 58.2% in 2003. Of particular note is that 83.2% of those between the ages of 18-29 years answered that they were “satisfied”, representing the highest proportion with such an answer amongst all age groups. In addition to “Food & Housing”, “Self-development / improvement” and “Leisure / recreation”, “Sense of fulfilment in the current lifestyle” has also garnered the highest response amongst all age-groups.

It seems that the “Around Fifties” generation, to which the writer belongs, may have a misguided thinking that, faced with an uncertain future due to the pension problem, collapse of lifetime employment, declining birth rate and ageing population, the younger generation is placed in a very difficult environment. Perhaps there are many things that we can learn from this younger generation which is not concerned about ownership issues, but is living a comfortable life by making full use of their high IT literacy.

Of late, flying cars have become a hot topic. Recalling the scene in “Back to the Future II” starring Michael J. Fox where the time-machine “DeLorean” developed by Dr. Brown (Doc) flew through the air, I believe many others besides myself were very excited. On 8/29, the Ministry of Land, Infrastructure, Transport and Tourism and the Ministry of Economy, Trade and Industry held the first session of the “Public-Private Conference for Future Air Mobility” in Tokyo where the public and private sectors will join effort to realize the “flying car” dream for Japan. By learning from the younger generation which is not bound by stereotyped ideas, Japan may derive new ideas with global competitiveness. While preaching moderately, we should also listen to the ideas of the younger generation occasionally. This may lead to the discovery of new brands.

In the 9/3 issue, we will be covering ThreePro Group (2375), Wacoal HD (3591), PiPEDO HD (3919), Mitsubishi Chemical HD (4188), Yokogawa Electric (6841) and Ryoro Electro (8068).

Selected Stocks

ThreePro Group Inc (2375)

・Established in 1977. Develops support services centered on IT business for companies that target users of IT environments and IT-related equipment, and individuals / companies that make use of these. Provides services such as sales / sales support, IT infrastructure implementation / installation / exchange, and operator / IT personnel dispatch.

・For 3Q (2017/11-2018/7) of FY2018/10, net sales increased by 19.0% to 11.929 billion yen compared to the same period the previous year, operating income increased by 49.3% to 425 million yen, and net income increased by 84.8% to 313 million yen. Overseas PC manufacturers’ OTC sales and sales support services for home electronics mass merchandisers have performed well due to expansion of orders arising from increased advertisement expenditure by companies.

・For FY2018/10 plan, net sales is expected to increase by 22.6% to 16.5 billion yen compared to the previous year, operating income to increase by 31.1% to 500 million yen, and net income to increase by 33.2% to 287 million yen. In terms of actual progress, net income has already exceeded 100% of forecast, but full year performance has been maintained as per original forecast because of the possibility of expensing costs related to headquarter function expansion. Annual dividend is forecast to increase from 5.00 yen to 7.00 yen.

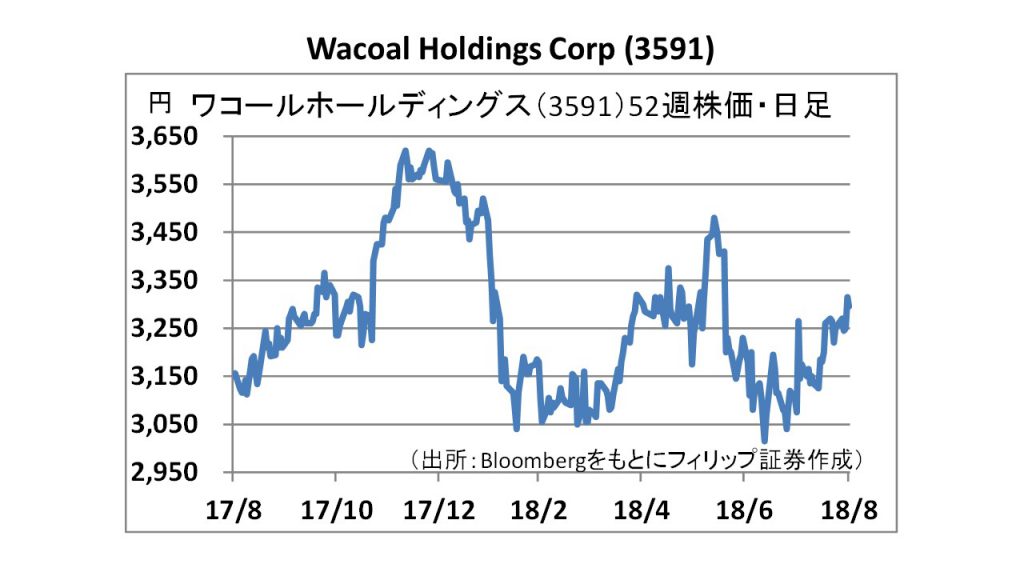

Wacoal Holdings Corp(3591)

・Established in 1946. Mainstay business is manufacture, wholesales and direct sales to consumers of intimate apparel (mainly women’s foundation garments, lingerie, nightwear and children’s underwear), outerwear, sportswear, and other textile products and accessories. Other businesses include food, culture / services and interior furnishing of shops.

・For 1Q (Apr-June) of FY2019/3, net sales increased by 1.4% to 49.373 billion yen compared to the same period the previous year, operating income decreased by 0.7% to 4.397 billion yen, and net income increased by 59.6% to 6.289 billion yen. Overseas business had led the increase in revenue, but operating income declined due to compensation for abandoning land destined for factory usage recorded in the same period of the previous year. Final increase in profit owing to valuation gain of equity securities. ・For FY2019/3 plan, net sales is expected to increase by 2.2% to 200.0 billion yen compared to the previous year, operating income to decrease by 13.0% to 10.0 billion yen, and net income to increase by 2.6% to 10.0 billion yen. Company has announced a comprehensive business tie-up with Descente. Through this, company aims to create new businesses beyond the boundaries of the current business domain, and develop products over and above the strengths of both companies.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note: