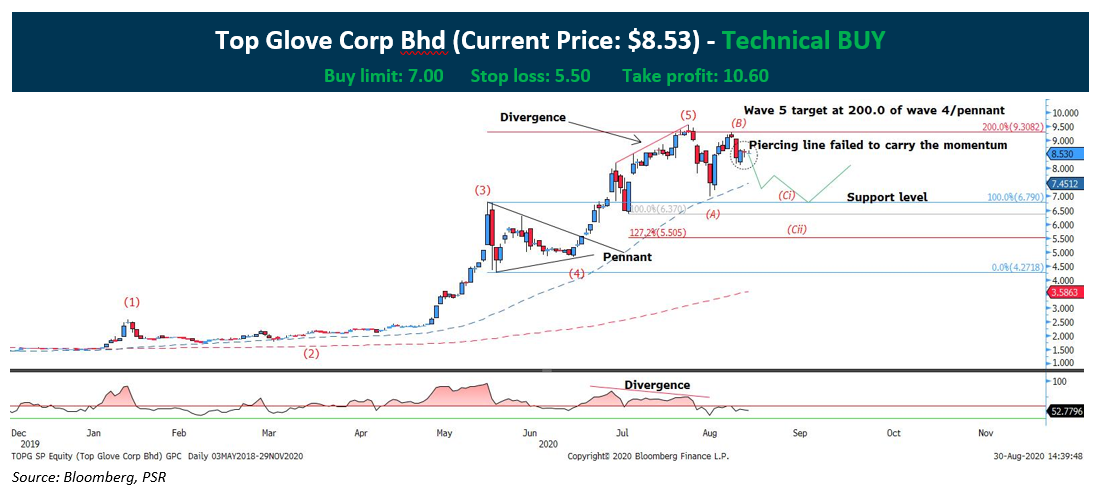

Top Glove Corp Bhd (SGX: BVA) has been the darling of the market since COVID-19 hits the world by storm. The exponential growth is set to continue but based on the technicals, the recent momentum indicate a lack of bullish strength at the sky high prices and as such, a slight correction is unavoidable:

- The stock has completed its impulse 5 wave on the intermediate phase and it is on a potential ABC correction after prices fails to break above $9.50 after a strong bullish candle formation on 18th August 2020.

- Additionally, the 5th wave was confirmed in mid-July after a divergence is observed. Which is an important signals to the end of the 5th Also, the end of 5th wave is observed through the target extension level of 200.00% of wave 4/Pennant.

- The piercing line formation on last Wednesday fails to materialise after the stock fails to close with a newer high or a strong bullish candle.

- The corrective regular flat is on the way to complete wave C and the sub-wave 1 of C has just completed. The potential rebound is at 90% -127.2% of wave A. Which confluence with major support levels indicated in the chart.

*Timeline of the trade is 4 weeks from the date issued.

*Should there be an upside, the stock must clear $9.56 minimally if not we will resume into prolong corrective actions.

*The company has announced a 2 for 1 bonus issue on the company with the ex-date on the 3 September. As such the correction of the stock will more likely happen after the ex-date

CHART LEGENDS

Moving average

Red dotted line = 200 periods Moving average

Blue dotted line = 50 periods Moving average